Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 12 March 2024 00:00 - - {{hitsCtrl.values.hits}}

The Central Bank of Sri Lanka (CBSL) salary hike ranging from approx. 29.53% to 79.97% has taken the Nation by storm! This article intends to show the worthy citizenry of Sri Lanka that the attempts of the Governor/CBSL to cover up this faux pax and unconscionable abuse of powers is utterly fallacious and designed to deceive the people and Parliament of Sri Lanka.

The Central Bank of Sri Lanka (CBSL) salary hike ranging from approx. 29.53% to 79.97% has taken the Nation by storm! This article intends to show the worthy citizenry of Sri Lanka that the attempts of the Governor/CBSL to cover up this faux pax and unconscionable abuse of powers is utterly fallacious and designed to deceive the people and Parliament of Sri Lanka.

The Governor of the Central Bank has declared the country financially bankrupt, insolvent, unable to pay its debts on 12th April 2022. In this context the Ministry of Finance has issued instructions not to increase any salaries of employees in the Government sector. However, CBSL employees’ salaries have been increased as per Collective Agreement entered into with their Trade Unions.

It has been observed that the so-called Collective Agreement signed by the CBSL is not in accordance with the Industrial Disputes Act No:43 of 1950. It is invalid since it has not been sent to the Commissioner General of Labour and it has not been gazetted by the Commissioner as required by Section 6 and 7 of the Act under reference. According to the Governor CBSL, he has followed this practice since it has been done for the past several years. Is it correct to blindly follow illegal practices of the past? Is he aware that wrong procedures and practises in the past do not become correct or valid simply because they continue to be used in the present? There is a Supreme Court decision also to the effect that wrong decisions should not be taken as precedents.

On the other hand, as per Section 49 of the Industrial Disputes Act, “Nothing in this Act shall apply to or in relation to the State or the Government in its capacity as employer, or to or in relation to a workman in the employment of the State the Collective Agreements of the State or the Government.” In this case, the CBSL as a Government entity has no powers to enter into Collective Agreements as its employer is the Government of Sri Lanka.

Next it is the contention of the CBSL that it is “autonomous” and independent so as to formulate its own remuneration and conduct its budget for its staff without relying on the Consolidated Fund of the Government of Sri Lanka. This is misleading the public giving the general impression that it is tantamount to being a private limited company. On the contrary, the identity or definition of the CBSL as in CBSL Act No: 16 of 2023 shows that it is very much a Government entity. As defined in the said Act (page 93) a “public corporation” means “any corporation, board, or other body which is or was established by or under any written law other than the Companies Act No: 07 of 2007, with funds or capital wholly or partly provided by the Government, by way of grant, loan or otherwise.” Since the CBSL is established by an Act of Parliament viz Monetary Law Act (MLA) No:58 of 1949 and not under the Companies Act No:07 of 2007, its Governmental status is implicit if not apparent.

Moreover it is the “Fiscal Agent and Banker” of the Government; Official Depository of Government. The functions of the CBSL as set out in the Act under reference show innumerable instances of its standing as a Government institution viz. In the enumeration of CBSL functions: “ (7) (a) determine and implement monetary policy, (b) determine and implement exchange rate policy (c) “to hold and ensure the prudent and effective management of the Official International Reserves of Sri Lanka etc. etc.

It may be noted further that as per the CBSL Act 16 of 2023 (Chapter VII Article 120 its “officers and servants to be deemed public servants for purpose of Chapter IX of the Penal Code.” The point that the CBSL is very much a Government organisation is reinforced by the fact that its Governor and members of the Monetary Board are appointed by the President of Sri Lanka with the approval of the Constitutional Council (CBSL Act 16 Section 15 of 2023). Therefore the accountability of the CBSL to the Government and the people of Sri Lanka is paramount.

The CBSL claims that its staff are of such high calibre and standard that paying them a wage that is over and above all other parallel grades in the country is justifiable to retain such excellent services. I would like to ask the question whether the current salary increase is a just reward or bonus to the CBSL staff for the exemplary manner in which they have discharged their duties. I like to point out the following few cases for the general public to judge their efficiency.

One of the key functions i.e. “to register, licence and regulate and supervise financial institutions”? (7 (f) CBSL Act 16 2023. The wide spread collapse and destitution of account holders of fraudulent, inefficient financial institutions who were given free reign and not monitored adequately by the CBSL are legion e.g. Golden Key, The Finance Company, TKS, etc. If the CBSL supervised the activities of these institutions properly, could they have collapsed? In addition there are the antics of Perpetual Treasuries and Bond Scams. What of the key functions of the CBSL in this regard like “regulation of the reserve of Commercial Banks and Prescribed Financial Institutions”: With what efficiency have these been discharged?!

The mismanagement of the Employees Provident Fund to date by the CBSL can be further evidenced by the Report of the Salaries and Cadres Commission to the Cabinet of Ministers dated 31/05/2018 No: NSCP/2/33/CM. As per this report, as at 2017 there were 2.6 Million employees registered with the Employees Provident Fund. But the CBSL has maintained 17.3 million accounts in the EPF Department of the Central Bank when the total population of Sri Lanka was 21 million. Surely it should have been obvious for them to realise the anomaly that at any given time 17 million out of a population of 21 million could not have been in employment coming under EFP. They have not been able to implement the recommendations of the Salaries and Cadres Commission to date which was to link EPF accounts to National Identity Card Number to avoid duplication and consolidate multiple accounts maintained by CBSL. To date the non-consolidation of this important EPF fund where accounts are erroneously tallied with actual number of EPF employees remains without rectification, despite the recommendations of the Salaries and Cadres Commission which the Cabinet of Ministers approved.

The Employees Provident Fund Act established under the Act 15 of 1958 (43) (1) states that the “income from the investment of any monies of the Fund shall be exempt from income tax chargeable under any written law relating to the imposition of the income.” However the EPF investment funds income is taxed. This is a double standard in respect of the Central Bank where according to their most recent CBSL Act No:16, 2023,116 “(a) The Central Bank shall be exempt from the payment of income tax.” We understand that the CBSL EPF fund investment is not taxed.

Just consider how CBSL has discharged some of its key functions viz: Management of the Public Debt, Advise on Government Credit Operations, Monetary Policy and Fiscal Policy, when today this insolvent country is reeling under successive debt burdens hanging on the heads of its unborn children, that it cannot find ways of paying back. Surely the Economic Research Department of this prestigious CBSL could have at least put out some forecasting on the nation’s dire predicament and forestalled the collapse and bankruptcy of this debt riddled economy. It cannot pass the buck on to the Ministry of Finance solely since many of its illustrious “economists” have been contracted to the post of Secretary to the Treasury from time to time and CBSL maintains a close working relationship with that Ministry.

The Supreme Court of Sri Lanka has found some former Governors of the Central Bank and a few senior officers seconded to the Ministry of Finance, responsible for the financial and economic crisis that led the country to bankruptcy last year.

The CBSL supposes that salary peaks for their “high calibre” personnel who enter the portals of this esteemed Institution are essential to retain their services in the country. The CBSL is treading on extremely thin ice when it claims its professional expertise to be worthy of higher pay due to their enormous high calibre. An analysis of its recent Recruitment Notice 2023 for executive grade Class I Management Trainees reads like what is common to most executive recruitment in Sri Lanka’s Scientific Service, Administrative Service, Technical Services etc. Consider the medical profession for example, where countrywide G.C.E. Advanced Level examination will determine candidates with the highest result to enter the Medical Colleges. Thereafter their progress through MBBS to MD, FRCS, or higher Consultant status is a long rigorous training and examination trial of 13 long years. Consider the life and death responsibilities they undertake, the equally onerous and crucial posts as Chief Justice, Judges, Magistrates, in the legal profession and other Government Executive and Senior Executive grades whose salaries are miniscule compared to the CBSL category. As in the CBSL, the entry into all professional levels of the Public Service requires a University Degree often with a First or Second Class, island wide competitive examination, interview. In order to reach certain levels of Executive and Senior Executive grades of the Public Service, officers have to possess a Postgraduate Degree at a Masters or PhD level. In the CBSL as well as in other services, such postgraduate studies are financed by the Government of Sri Lanka.

The CBSL Governor has stated that there is an exodus of officers from its qualified staff and it is necessary to incentivise them with higher emoluments. An examination of the web site of the CBSL shows that there are 29 Departments of the CBSL and that there are no vacancies shown in the higher echelons of this organisation at the level of Senior Executives. There are 10 Assistant Governors with all the other 29 Divisions intact with Directors, Additional Directors, with only two officers on leave.

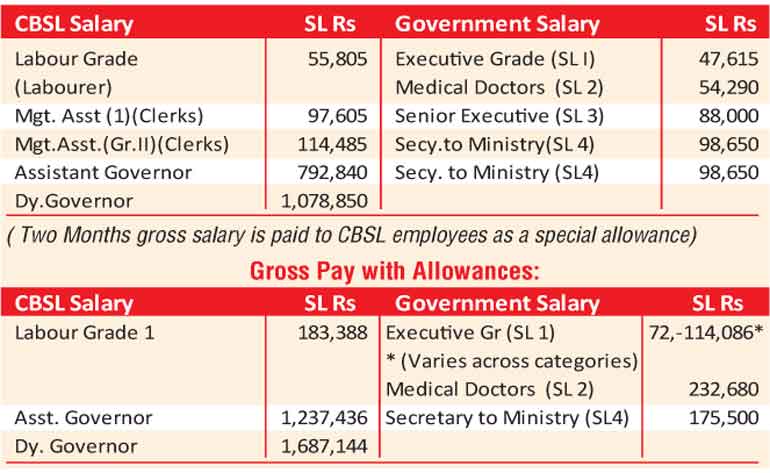

Can the Governor explain on what criteria and basis he has deemed colossal increases in the salaries of the CBSL whereas even a CBSL labour grade is getting more than an Executive Officer of the Public Service at the initial recruitment level.

The Table I below shows a few examples of these ridiculous anomalies at initial of the salary scales

In contrast it is a fact that in Singapore during the 2008 -2009 recession, the State Investor Temasek Holdings introduced across the board pay cuts. The Government Salaries Committee of Singapore recommended cuts in the emoluments of Cabinet Ministers. It was only after they were able to get over the recession, that Singapore allowed salary increases and reimbursed pay cuts. Instead CBSL has recommended high taxes for citizens, and increased the remuneration of their employees.

In conclusion, it is the right of the citizens to know what other privileges these employees of the CBSL are enjoying. According to a recent web site in the last quarter of 2023 inviting Management Trainees to Staff Posts Class Grade 1, it is stated that CBSL Staff Class Gr. 1, are entitled to “attractive salary, special payment equal to two months gross salary per annum, benefits of EPF, ETF, medical benefit scheme, staff loan facilities, pension benefits and training opportunities.

We the People of Sri Lanka have a right to ask how does the CBSL which is certainly NOT a private sector profit making company, justify any salary increase that is not on par with important service oriented organisations in the Public Service which are vital and directly connected to day to day life of the people.

(The writer is a former Chairman National Salaries and Cadres Commission of Sri Lanka.)