Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 4 May 2021 00:00 - - {{hitsCtrl.values.hits}}

Unless fiscal consolidation is achieved in combination with prudent monetary policy, the CBSL’s interventions such as forward market restrictions intensify official speculation worsening market volatility

In view of the need to avoid volatility in the foreign exchange market and the impact on banks’ risk management, the Central Bank of Sri Lanka (CBSL) has directed licensed commercial banks to refrain from entering into forward contracts of foreign exchange except for a few specified purposes effective from 25 April 2021. Previously, the CBSL had prohibited commercial banks to enter into forward contracts of foreign exchange for a period of three months effective from 25 January 2021.

In view of the need to avoid volatility in the foreign exchange market and the impact on banks’ risk management, the Central Bank of Sri Lanka (CBSL) has directed licensed commercial banks to refrain from entering into forward contracts of foreign exchange except for a few specified purposes effective from 25 April 2021. Previously, the CBSL had prohibited commercial banks to enter into forward contracts of foreign exchange for a period of three months effective from 25 January 2021.

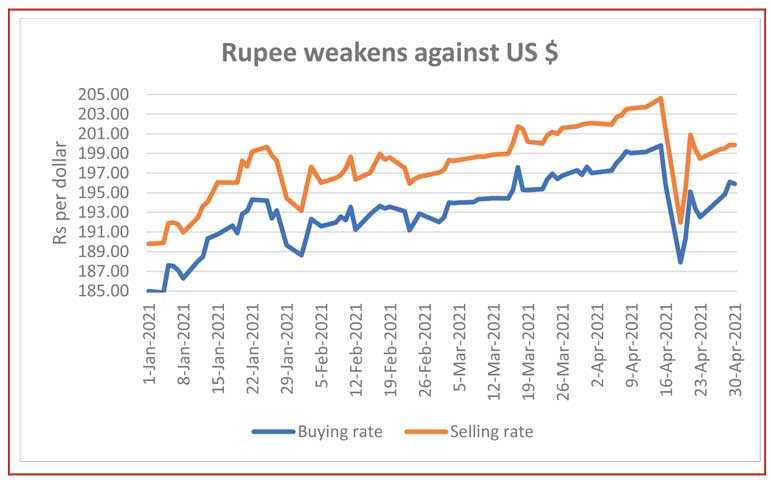

In spite of the forward market restrictions effected in January, the exchange rate dipped to Rs. 195.91/199.87 against the dollar by the end of last month, compared with Rs. 184.98/189.90 at the beginning of the year, as shown in the Chart. Given the uncertainties arising from exchange rate fluctuations, the market players including individuals, businessmen and investors are exposed to what is known as the exchange rate risk.

Forward market is a remedy for forex volatility rather than a cause

In order to hedge against future exchange rate fluctuations, entrepreneurs engaged in foreign currency transactions adopt different derivatives, which are financial instruments derived from other financial instruments or real assets. There are different types of derivatives in well-developed currency and commodity markets in advanced countries.

The single most important derivative instrument available in Sri Lanka is the forward foreign exchange contract which enables exporters and importers to lock in their foreign transactions at an agreed exchange rate.

A main advantage of the forward market is that it helps to reduce market uncertainties arising from exchange rate fluctuations, and thereby to improve investor confidence. Thus, forward market is a remedial measure rather than the cause of foreign exchange volatility.

Effectiveness of restrictions questionable

It is doubtful whether the forward market restrictions imposed by the CBSL are effective in mitigating foreign exchange volatility since forwards are not the origin of such volatility.

The severe shortage of foreign reserves in the backdrop of weak balance of payments (BOP) and rising debt service commitments is a key factor that has led to propel foreign exchange volatility in recent months.

The widening fiscal deficit requires more and more Government borrowings aggravating the debt burden. Interest payments on foreign loans alone absorb 50% of tax revenue, which fell to mere 8% of GDP in 2020.

These are the problems that need to be tackled by the authorities rather than restricting the forward market which is not responsible at all for market volatility.

Exchange rate volatility

Frequent fluctuations of the value of domestic currency against foreign currencies are known as exchange rate volatility which captures the dispersion of the value of the domestic currency against foreign currencies. A company is exposed to exchange rate risk arising from such volatility when it engages in business transactions denominated in foreign currency. Exchange rate volatility has adverse effects on the cost structure of companies doing business internationally.

The main causes of exchange rate volatility currently evident in Sri Lanka include high fiscal deficit, rising debt commitments, rapid money supply growth, balance of payments deficit and dwindling foreign reserves.

Official reserve assets are down to $ 4,005 million as against $ 6,930 million of foreign debt commitments to be settled within the next 12 months; $ 157 million (up to 1 month), $ 1,598 million (more than 1 and up to 3 months) and $ 5,175 million (more than 3 and up to 12 months).

More and more foreign loans have to be raised continuously to rollover the debt. Recently, the CBSL entered into a bilateral swap agreement with the People’s Bank of China to obtain Chinese currency equivalent to $ 1.5 billion. Subsequently, a loan of $ 500 million was also obtained from China. These are only temporary solutions to overcome the BOP difficulties.

The recently issued Sri Lanka Development Bond of $ 750 million went undersubscribed by 12%. The yield rates of this bond are higher, compared with the lower Treasury bill yield rates implying that foreign loans cannot be raised at the suppressed yields offered for domestic securities.

Forward market reduces foreign exchange exposure

As mentioned earlier, forward contracts are the main derivative instrument used in Sri Lanka to minimise the risk of exchange rate volatility. Forward trading is in a rudimentary stage in Sri Lanka.

In the forward market, two parties enter into a forward contract to buy or sell a specified amount of currency at an agreed exchange rate (called the delivery price) at an agreed future date. These forward dates are usually between two days and 24 months from the current date.

The agreement is between the two parties involved, and the trade does not take place in a regular exchange.

The price of the forward is based on the existing exchange rate on the spot market at the time the deal is agreed, plus an adjustment factor, which represents the interest rate differential between the two currencies. The forward contracts are generally used to hedge foreign exchange exposure risks, and to stabilise future cash flows based on the current exchange rate.

Forward contracts enable companies trading internationally to lock in foreign currency transactions for a future date at an exchange rate agreed upon now, and thereby to hedge against foreign exchange exposure risk.

Other hedging strategies

Other hedging strategies

A futures contract, which is another form of derivative instrument, is essentially the same as a forward, except that the deal is made through an organised and regulated exchange rather than being negotiated directly between two parties. Forwards and futures are known as derivative products whose value depends on an underlying asset such as a foreign currency, a bond, a share or a commodity.

In addition to forwards and futures, well-developed financial centres such as New York, London and Tokyo offer other derivatives like foreign exchange options which give the purchaser the right to buy or sell an asset at a future date, but there is no obligation to complete the future transaction if the buyer finds it in her interest to not exercise the option.

Currency swaps have also been increasingly used in global financial centres in recent times to protect continuous cash flows in different currencies from unexpected foreign exchange fluctuations. A currency swap is a formal agreement to exchange the currencies at predetermined exchange rates on a series of future dates.

CBSL’s direct interventions create “official speculation”

An excess demand for foreign currency usually reflects an excess supply of domestic currency. When a central bank intervenes in the foreign exchange market without eliminating the excess money supply, the official interventions itself may be deemed “official speculation”, as pointed out by Ronald McKinnon in his book (1979), ‘Money in International Exchange: The Convertible Currency System’.

The current situation in Sri Lanka can be interpreted in terms of McKinnon’s assertion. The money supply rose by 22% during the last 12 months mainly due to 55% increase in net bank credit to the Government. The CBSL’s credit to the Government increased by as much as 131% while commercial banks’ credit by 42%.

Instead of adopting a contractionary monetary policy stance to reduce the rapid money supply growth, the CBSL intervenes in the foreign exchange market with measures such as forward market restrictions to protect the rupee. Hence, these interventions fuel official speculation, as per McKinnon’s thesis.

The root cause of the rupee depreciation in recent months is the excess supply of domestic currency as against the excess demand for foreign currency. The CBSL does not have the policy space to restrict money supply growth, given the huge borrowing requirements of the Government. This provides idle breeding grounds for official speculation.

BOP deficit is a monetary phenomenon

Excess supply of money results in higher demand for imports, and widens the trade deficit, as per the ‘Monetary Approach to Balance of Payments’. To maintain the exchange rate, the monetary authority will have to sell foreign currency in exchange for domestic currency.

As the CBSL is currently not in a position to sell foreign currency to the market, it has resorted to interventions such as forward market restrictions.

Market sensitivity to interventions

In its directive issued on 25 April, the CBSL uses the term “excess volatility” in the foreign exchange market, thus officially admitting that volatility prevails in the market. The rational market players react to such speculative declarations, and eventually the effect of the policy measure anticipated by the authorities is getting defeated.

Some of the directives issued by the CBSL were withdrawn or revised in double quick time, magnifying market uncertainty. The mandatory export earnings conversion, which was revised many a times, is a good example.

Counter-speculation by traders

In the absence of the forward trading due to restrictions imposed by CBSL, exporters and importers are likely to adopt alternative strategies to reduce their foreign exchange exposure.

As exporters do not have forward cover, they may try to defer the dollar payments from their foreign customers so as to take advantage of future rupee depreciation. Although such efforts may be restrained to a certain extent by recent forex conversion rules imposed by CBSL, market actors will continue to search for alternative paths to hedge against rupee fluctuations.

Anticipating rupee depreciation in time to come, importers may try to advance the date for making dollar payments.

Such counter-speculative behaviour of exporters and importers aggravates dollar shortage in the market and intensifies foreign exchange volatility.

Policy imperatives

In the final analysis, foreign exchange volatility is the result of the “twin deficits” – fiscal deficit and balance of payments deficit. In fact, the balance of payments deficit can be considered as the mirror image of the fiscal deficit.

The budget deficit which reached 11.1% of GDP last year is most likely to be even higher this year with impending tax shortfalls and expenditure hikes amidst the sequential waves of the pandemic. The haphazard tax cuts implemented in 2019 without considering their adverse economic consequences have worsened the fiscal situation pushing up the borrowing requirements.

Recently, the Government has decided to relax the Fiscal Management (Responsibility) Act of 2003 to raise the fiscal deficit target to 8.9% of GDP in 2021, and to reduce it to 4% of GDP by 2025. These appear to be too optimistic, given the deteriorating fiscal situation.

When the Act was initially approved in 2003, the budget deficit was targeted at 5% of GDP. The situation has worsened after 17 years aggravating macroeconomic instability as reflected in the volatile foreign exchange market.

Unless fiscal consolidation is achieved in combination with prudent monetary policy, the CBSL’s interventions such as forward market restrictions intensify official speculation worsening market volatility.

If at all, forward trading needs to be promoted to enable market participants to hedge against currency exposures, and thereby to reduce market uncertainty.

(Prof. Sirimevan Colombage is Emeritus Professor in Economics at the Open University of Sri Lanka and Senior Visiting Fellow of the Advocata Institute. He is former Director of Statistics, Central Bank of Sri Lanka and reachable through [email protected])