Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 26 November 2022 00:00 - - {{hitsCtrl.values.hits}}

Following article is based on the presentation made by the writer at the 4th International Research Symposium titled ‘Sri Lanka in crisis: Search for a way out’ organised by the National Centre for Advanced Studies in Humanities and Social Sciences.

Let me begin by providing a brief critique of the neoclassical explanations on the crisis. So the neoclassical view or the neoliberal view tries to frame Government’s policy failure as the primary cause for the crisis. So they highlight that the high budget deficits reaching about 12.3% due to tax cuts and debt monetisation ultimately led to the deficit in the balance of payments and eruption of the foreign exchange crisis or what we call a large fiscal deficit transforming into a balance of payments crisis. So this is how they are trying to understand this problem. Academics like Professor Rohan Samarajiva, Professor Premachandra Athukorala, Dr. W.A. Wijewardena and institutes like Advocata and Verite basically subscribe to this view.

However, we need to highlight the fact that Sri Lanka has experienced budget deficits well over 10% consecutively after 1977 liberalisation. But of course we did not witness a crisis of this magnitude and a crisis of this magnitude cannot be reduced merely to large fiscal deficits and it cannot be explained by fiscal deficits reaching about 12% or about 11% of the GDP. Similarly, I can also point out the fact that countries like Mexico and Argentina have in fact reduced their budget deficit to around 5% or even at times their budgets were in surplus, but at the same time the countries were facing acute balance of payment crises.

So this means to show that the leakage is happening through the private sector itself, while the neoclassical view is trying to frame the issue as a problem of government policy and as a problem of fiscal deficit. And that the leakage of funds is happening through the fiscal deficit, while in these countries the fiscal deficit has been quite low even say around 5% and at times they were in surplus. Even during these periods, they have defaulted on their foreign debt and face massive foreign exchange crises which are still ongoing.

So we have to see where the leakage is happening. There are two sectors in the economy, government and private sector. If the government sector is not in a deficit and still we are facing massive foreign exchange shortages, that means to say that there is an equally massive leakage of funds or capital through the private sector itself. So when it comes to the Sri Lankan case, despite the fact that our fiscal deficit is quite large, over 10%, we have experienced that range even before, but it was clearly not sufficient to trigger a crisis of this magnitude. So what we are trying to point out here is even if Sri Lanka manages to phase off its fiscal deficit, the currency shortage, foreign exchange shortage and the balance of payment crisis will still persist like what Argentina, Venezuela and Mexico is currently facing. I will explain the reasoning behind this conclusion later in the discussion.

And before moving on to that, the neoclassical view also holds that Sri Lanka’s real exchange rate was appreciating because of incorrect policy measures and therefore it has also led to a drain of foreign exchange and emptying of foreign reserves of the Central Bank. That is the Central Bank arbitrarily fixing the exchange rate and interest rate in the face of debt monetisation leading to appreciation of the real effective exchange rate, making imports cheaper and exports uncompetitive. This was because the domestic rate of inflation was higher than our trading partners. But however, IMF highlights in their assessment of the Sri Lankan economy that the real appreciation was around 17% by March 2022.

At that time the real appreciation was about 17%. So their recommendation was that currency should depreciate by this rate. So that should be sufficient to correct the imbalance in the balance of payments through the exchange rate mechanism. However, when the currency was floated, we saw that it depreciated about five times what the free market rate suggested by the IMF would basically settle on.

For instance, now, before the depreciation, before the floating of the currency, the kerb market rate in fact reflected the IMF currency value, which is around 240 to 250 rupees a US dollar. But however, when it was floated, the rate of depreciation was about five times what the free market competitive equilibrium rate would demand. Please bear in mind that the free market competitive rate calculated by the IMF took into account debt monetisation or money printing, budget deficits, inflation that actually led to the real appreciation of the currency. So the actual rate of depreciation far exceeds what the free market competitive equilibrium rate would demand. This is the point which I would also like to highlight here.

That means to say that there is a greater outflow of capital through the private sector than what was generated by the fiscal deficit and money printing which we need to probe, which we will do right now. But before we move on to that, I would also like to point out the fact that foreign borrowing of the Government is criticised as unproductive. There is a general consensus in the fact that unproductive foreign borrowings led to this foreign exchange crisis in Sri Lanka. However, what we need to also point out is the composition of foreign borrowings compared to well, the infrastructure projects financed through foreign borrowings only account for around 20% of the $ 51 billion that we defaulted in around April this year.

So we cannot entirely attribute Government’s wasteful infrastructure projects as the main instigator of the crisis because a large volume of that debt has been borrowed to support the balance of payments and boost foreign reserves. So this foreign exchange is released to the market through the banking system which is also used by the private sector.

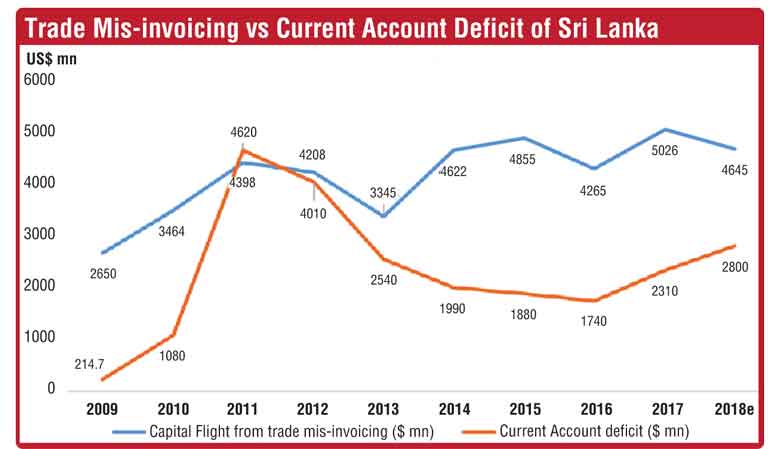

So let me now highlight the issue of capital flight through the trade account, which is happening through the private sector, which has been documented by Global Financial Integrity based on UN trade data, a global think tank on illicit capital flows. According to this, around $ 40 billion has been flowing out of the country between 2009 and 2018 through a mechanism called trade mis-invoicing. Startlingly the report highlights that the amount is a gross underestimation because it only looks into trade based on open accounts and has not analysed letters of credit and services trade. Outflow estimated is double the current account deficit of the country during this period (See graph). If we take the annual average figure of the current account deficit and the annual average of this outflow, that outflow is roughly twice as much as the current account deficit during the period.

So we can now pinpoint where the outflow is actually happening and how this foreign exchange crisis was brewing over the last 10 to 20 years. We have to also point out the fact that this outflow is about 80% of the debt that we have defaulted on. We can see compared to the reasons the neoclassicists have highlighted the centre of gravity of the crisis is elsewhere and it lies right at the heart of the private sector: more precisely within the import/export corporate sector and the Central Bank has so far failed to take any legal action against the perpetrators and reveal it to the public whose lives have been destroyed by the activities of the corporates.

The Chamber of Commerce, the agent of Sri Lanka’s corporate class is silent about it and are maliciously accusing the protesters of destabilising the economy, who took to streets demanding justice. The corporates are more inclined to transfer out their incomes, and more importantly, transfer out even foreign exchange that flows in as remittances and foreign debt, in the form of convertible currencies through mis-invoicing. Not only this led to a tremendous drain of foreign exchange and balance of payments crisis but also it is leading to a loss of government tax revenue further increasing indebtedness of the government.

Now we have to also highlight the growing concentration of incomes of the export sector which is also intensifying this problem. As Joseph Stiglitz has shown us, monopolistic concentration within the external sector of an economy would basically discourage these economic agents from responding to interest rate and exchange rate mechanisms in a way that would achieve equilibrium in the economy by adjusting these parameters in a moderate way. I hope that’s clear.

So we have a liquidity trap in the foreign exchange market which is also aggravated by the oligopolistic market structure in the export sector where export incomes are highly concentrated within few firms. Central Bank for instance stated that 60% of export incomes are generated by 7 firms in the country and BOI states that 70% of the merchandise exports are generated by BOI firms. So this is leading to a foreign exchange liquidity trap characterised by capital flows not responding to changes in the interest rate and the exchange rate, rendering the monetary policy mechanism powerless in influencing capital flows. This means to say demand for foreign exchange has become infinitely elastic with respect to the interest rate and the exchange rate.

For instance, Sri Lanka now is recording consecutive trade surpluses on a monthly basis and highest ever export incomes but experiencing the most acute foreign exchange shortage in its post-independence history leading to shortage of all forms of essentials from food to medicine. This is because exporters are refusing to repatriate the residual export incomes creating a gap between incomes and cash inflows. So even if there is say a revival of tourism Sri Lanka may not get out of the foreign exchange crisis. It is a classic example of a liquidity trap in the foreign exchange market. So to correct this mechanism there needs to be strict and greater state intervention into the economy and not the other way around. Because right now we are witnessing a market failure in the external sector.