Friday Feb 13, 2026

Friday Feb 13, 2026

Tuesday, 12 March 2024 00:01 - - {{hitsCtrl.values.hits}}

The importance of the services trade of Sri Lanka with the rest of the world has increased significantly over the last few decades. Despite the merchandise export sector recording a modest growth in the past decade, Sri Lanka’s services industry, which provides cross border services to non-residents, has shown tremendous potential. Sectors such as tourism, IT-BPO and computer services, and port and airport services are at the forefront of this growth. The tourism sector, the country’s main source of services income, has already recovered after several difficult years. The IT-BPO and computer services sector has grown with its skilled workforce. Port services have benefitted from the emergence of several new port terminals, both in Hambantota and Colombo, with further expansions already underway. Airport services have also benefitted with the growth in the tourism industry over the last decade and the increasing number of Sri Lankans travelling abroad for work and leisure. Further, there are many other services provided by residents to non-residents, such as construction services, insurance services, telecommunication services, management and consultant services, research and development, and other technical services, among others. These services, despite their smaller volumes at present, have tremendous potential to grow in the coming years.

The importance of the services trade of Sri Lanka with the rest of the world has increased significantly over the last few decades. Despite the merchandise export sector recording a modest growth in the past decade, Sri Lanka’s services industry, which provides cross border services to non-residents, has shown tremendous potential. Sectors such as tourism, IT-BPO and computer services, and port and airport services are at the forefront of this growth. The tourism sector, the country’s main source of services income, has already recovered after several difficult years. The IT-BPO and computer services sector has grown with its skilled workforce. Port services have benefitted from the emergence of several new port terminals, both in Hambantota and Colombo, with further expansions already underway. Airport services have also benefitted with the growth in the tourism industry over the last decade and the increasing number of Sri Lankans travelling abroad for work and leisure. Further, there are many other services provided by residents to non-residents, such as construction services, insurance services, telecommunication services, management and consultant services, research and development, and other technical services, among others. These services, despite their smaller volumes at present, have tremendous potential to grow in the coming years.

However, capturing actual cross border data on the services sector has remained a perennial problem. Capturing this requires reporting of individual transactional level data provided by different service providers through the banking system. Unlike merchandise trade, which physically occurs through ports and airports of Sri Lanka and captured by Sri Lanka Customs, capturing ‘invisibles’ requires full amalgamation of the country’s entire banking system with the Central Bank in terms of data collection efforts. In order to separately identify services sector cross-border transactions, a system was needed to properly identify the purpose of each transaction and a coding system to classify similar transactions to be aggregated for statistical reporting. With this as one of the key objectives, the Central Bank started development of the International Transactions Reporting System (ITRS) in 2019. After 4 years of dedicated effort by the Central Bank and the banking sector, the ITRS started receiving data from January 2023.

A new output: monthly cross border services sector data

The Central Bank issues a monthly press release on key external sector statistics termed ‘External Sector Performance’. With a lag of four weeks, this press release is the fastest mode of external data dissemination on pre-announced days of each month based on an ‘advanced release calendar’ (https://www.cbsl.gov.lk/advance-release-calendar-2024)’. Data released traditionally has included monthly merchandise imports and exports, workers’ remittances, earnings from tourism, foreign investments to the government securities market, foreign investments to the Colombo Stock Exchange, the latest gross official reserve position, and exchange rate movements. This data can be considered as the ‘pulse of Sri Lanka’s external sector’ whereby the media and the public gauge the health of the country’s external sector. One of the key statistics of national importance that was missing from this publication was monthly services sector statistics, which were estimated on a quarterly basis for Balance of Payments compilation purposes.

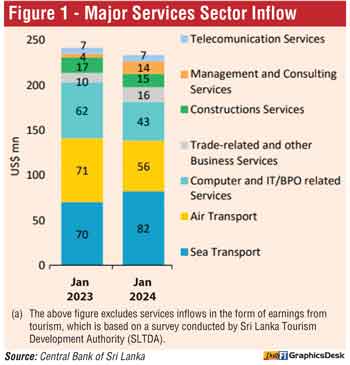

After a full year of data gathering under the ITRS, accuracy checking, coverage improvements and data cleansing since January 2023, the Central Bank published monthly services sector data in the ‘External Sector Performance – January 2024’ press release. Figure 1, reproduced from the January 2024 monthly press release, illustrates the newly compiled monthly services sector data by the Central Bank, adding further value to its external sector data dissemination process.

Figure 1: Major Services Sector Inflow (add graph)

The above figure excludes services inflows in the form of earnings from tourism, which is based on a survey conducted by Sri Lanka Tourism Development Authority (SLTDA).

Readers are invited to visit the Central Bank’s website to peruse the above press release to familiarise themselves with the new set of services sector data compiled by the Central Bank. A detailed list of services sectors, alongside their cross-border inflows, outflows and net flows are given in the Annexures of the press release.

Setting up the ITRS project amidst unprecedented obstacles

Setting up the ITRS project amidst unprecedented obstacles

As the Secretary to the ITRS Steering Committee, the author would like to take this opportunity to document some of the challenges faced by the Central Bank ITRS team and our banking sector participants in setting up the ITRS implementation project over the last four years. The project commenced in late 2019, as one of the key Strategic Priorities of the bank for 2020-2023. However, the magnitude of the project was such that there was a need for significant changes to all banks’ core banking system and other peripheral systems requiring sizeable monetary and human resource investments. These requirements were budgeted by each bank, while the Central Bank developed the reporting requirements and the associated information technology infrastructure internally. From 2020 to early 2022, the country was hit by the COVID-19 pandemic followed by the economic crisis, severely constricting the abilities of the Central Bank and reporting banks to divert all required resources to such a large-scale project. With physical meetings being nonexistent, the project was completed with hundreds of hours of online collaborations between the Central Bank and reporting banks. The situation was also aggravated by the significant staff turnover, mainly IT specialists that were integral to the project.

Getting everyone on-board, a team effort by the Central Bank and the banking sector

The success of implementing the ITRS project required full collaboration of all banks. Even if one of the major banks that deals with cross-border transactions had not been able to adequately change their core banking systems on time, the whole reporting would have been futile in generating comprehensive statistics with the full coverage to represent the entire country. The banks understood this precondition, and the fact that, despite the required changes requiring at least a couple of years to implement, the timelines cannot be compromised. In this context, the Central Bank is extremely grateful for the noteworthy role played by the banks amidst the numerous obstacles faced by the sector at the time.

Capturing data per international standards

The reporting requirement of the ITRS was to capture cross-border transactional data at an individual transactional level. However, this data is to be used as aggregate data for statistical compilation, ensuring the confidentiality of individual transactional level data. In order to aggregate these transactional level data, coding systems were introduced to classify different data fields. For example, the main ITRS report for an individual transaction consists of 40 different fields. Out of this, 11 fields are mandatory for all types of transactions, which include basic customer level data that are common for all transactions. Further, there are fields that should be mandatorily reported based on the type of transaction. For example, for service sector transactions such as a payment abroad for education purposes, the ‘name of the education institute’ and ‘the country of the education institute’ become mandatory. For merchandise imports, the ‘Import Subcategory Code’, customer ‘Tax Identification Number (TIN)’, and ‘payment terms’ of the transaction become mandatory fields. Most fields are based on a coding system given by the Central Bank that banks must adhere to in reporting each individual transaction. In this context, the ‘ITRS code’, which describes the purpose of the transaction, is based on international standards that enable the aggregation of data to international statistical standards.

The prowess of the Central Bank in-house software development

The entire IT infrastructure of the ITRS was developed in-house by the Central Bank Information Technology Department. The ITRS involves the ITRS Tool, ITRS Web, SFTP Server, an Application Program Interface (API), and associated databases. The ITRS files in the .txt format are uploaded typically from the ITRS Tool (with the exception of some foreign banks), and the uploaded files are verified by the ITRS Web. Communication between the ITRS Tool and the Central Bank database is done by an API. All files are transferred to the Central Bank servers using a Secure File Transfer Protocol (SFTP) and are transferred to the Central Bank database after approval by the user using the ITRS Web. Finally, the Central Bank database is connected to a data visualisation software to generate graphical and tabular analytical reports. These in-house development capabilities of the Central Bank are highly valuable, considering the need for continuous development to accommodate new system changes and the need for ensuring the security of data reported via the ITRS.

The hard truth: not all things can be automated

One of the key elements of the ITRS is the identification of the purpose of each cross-border transaction by the reporting banks. However, this task is easier said than done, as there was no prior practice by banks to identify the purpose of each transaction out of thousands of cross-border transactions occurring in the banking system daily. In addition, most cross-border inflows directly come to a customer account, which is called Straight Through Processing. There was no practice in Sri Lanka’s banking system to identify the purpose of these transactions, which became a requirement under the ITRS. It was clear in the design stages of the system that assigning ITRS code to capture the purpose of the transaction cannot be fully automated. The banks had to set up a system where a manual intervention is required to find out the purpose of the transaction, either by looking at the underlying documentation, customer’s history with the counterparty involved or if these are inadequate, to find it out by contacting the customer. Hence, the complexity of the ITRS was such that not all things can be automated fully, despite all the technology available.

Accuracy, accuracy, accuracy: the importance of data quality

Despite having a very sophisticated data reporting system, the reported data is useless if data reported through such a system has a high level of erroneous entries. Hence the key communication from the Central Bank to banks was to prioritise accuracy in the first place, second place, and third place. The software developed by the Central Bank also utilises special rules to capture logical errors reported at a transactional level. However, there could be many reported transactions that are logically correct, but not accurate. For example, if a bank reports the currency of transaction as Japanese Yen, when the actual reported amount is in US dollars, there is no logical reasoning that can flag such a transaction, but the error in reporting could be considerably large. Hence, banks were instructed to ensure accuracy of all reported transactions as their number one priority.

Data cleaning: the daily grind

The ITRS records more than 100,000 individual transactions daily. Hence, despite every effort, there are always non-logical errors in transactions reported by banks that require manual inspection and scrutiny. This process is done by the Central Bank ITRS Team and is termed the ‘daily data cleaning process’. Daily data cleaning is done manually by the ITRS Team on high value cross border transactions above a certain threshold. Mostly, the daily cleaning is done on the ITRS code where it can be obviously identified that the ITRS code is erroneous looking at historical transactions of the same transactor. Such errors are communicated to the banks via the ITRS for further feedback. Banks also go through a manual verification process of such transactions, ultimately requiring a daily grind both from the Central Bank and reporting banks.

A national need delivered: a Unique Identification Number to all transactors

Sri Lanka’s ITRS introduced the concept of a ‘Unique Identification Number (UIN)’ to ensure that each transactor in the ITRS can be uniquely identified from ITRS transactions reported throughout the banking system. For each type of transactor in the ITRS, a particular identification becomes a valid UIN for ITRS reporting. In most situations, the transactor has an already issued unique registration number from a Sri Lankan government authority. For example, for all Sri Lankan Citizens, the UIN must always be the National Identification Card (NIC) number for the purpose of reporting to the ITRS. For a Private Limited Liability Company, a Partnership registered in Sri Lanka, a Sole Proprietorship Registered in Sri Lanka, and a Public Listed Company, the UIN must always be the relevant Business Registration Number. Further, the Foreign Passport Number is the UIN code for all non-citizens.

However, if a uniquely identifiable UIN of a particular transactor from an official registration is not available, banks must request a UIN through the ITRS. For example, any club, society, non-governmental organisation (that does not have an official registration number), state institution, sports body, diplomatic mission, international organisation, foreign company incorporated outside Sri Lanka, and similar entities that do not have an official identity issued by a Sri Lankan government authority must register once in a lifetime of the entity in the Central Bank ITRS. After a UIN is obtained by such an entity, the same UIN must be used by the entity when opening an account in any bank within Sri Lanka, ensuring that all banks use the same UIN for a particular entity. This UIN system goes beyond the scope of the ITRS and is expected to support many Central Bank and government identification purposes of such entities, fulfilling a national requirement.

Big data, big problems: Big data solutions through data analytics

Handling big data volumes on a real time basis has resulted in some unique problems in the ITRS. Many of the data visualisations were significantly time-consuming on a real time basis when handling such heavy loads. Hence, innovative solutions were adopted by the Central Bank to find a compromise between real time monitoring and data visualisation convenience. Many creative solutions were adopted by the Central Bank throughout the project implementation stage to ensure the practicality of data analytics when big data processing is involved.

Data driven policy making in the services sector using the ITRS

The importance of data collected through the ITRS could be explained by a single example. It has been questioned whether the country needs local branches of foreign universities or more generally, greater higher education opportunities locally. However, policymakers from different governments have always taken a side in this debate without much data to back their decisions. Simply put, there were no answers to questions, such as “How much money is going out of the country on account of Sri Lankan students to study abroad?”, “Which countries are receiving such funds?” and so on. ITRS data will be able to bridge this data gap in future so that policymakers can make better informed, data driven policy decisions. Similarly, services sector data could also be the foundation for negotiations in future international trade agreements that typically involve both merchandise trade and services components. Such data driven policymaking will be a major use of ITRS data in the future.

Way forward: Regional collaboration and supporting data for policymaking

The successful initiation of Sri Lanka’s ITRS has been acknowledged by regional central banks, with the Maldives Monetary Authority also initiating dialogues with the Central Bank of Sri Lanka on technical collaborations on implementing the Maldives International Transactions Reporting System.

The Central Bank plans to initiate the next phase of the ITRS project to obtain more granular level data reporting of other forms of cross border transactions that are not captured in current reporting. The Central Bank will continue to consistently work with reporting banks to improve the timeliness, accuracy, and coverage to further enhance the data collected from the ITRS.

(The author is a Senior Economist and Head of the International Finance Division of the Economic Research Department of the Central Bank of Sri Lanka and a short-term expert on external sector statistics of the International Monetary Fund.)