Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 17 May 2022 02:46 - - {{hitsCtrl.values.hits}}

Aseni, student of economics, and her grandpa Sarath Mahatthaya, an ex-officer of the Finance Ministry, are in conversation on currency board systems. They have talked about why colonial Ceylon had established a currency board in 1884 when the country had faced its first monetary and banking crisis. They have noted that the currency board which had issued currency backed by a 100% reserve of foreign exchange, namely, Indian silver rupees and investments in securities, had been up to its expectations. The independent Ceylon had replaced the currency board with a central bank. Today, they are planning to discuss why Ceylon did so and why Singapore, another independent country, chose to retain its currency board.

The previous discussions can be accessed here:

https://www.ft.lk/columns/A-child-s-guide-to-currency-board-systems-Part-I-How-colonial-Ceylon-did-it/4-734214.

The discussion continues.

Aseni: I am puzzled, Grandpa. If the currency board system had functioned well, why did the independent Ceylon choose to replace it?

Sarath: Aseni, it is a long story. Its root can be traced to a young Ceylonese politician called J.R. Jayewardene who had been a member of the political movement called Ceylon National Congress. In 1939 he submitted a comprehensive policy package which Ceylon should adopt after it gets independence. This policy package which was nationalistic in nature bore the evidence of his wish to use expansive fiscal policy even at that early stage. If you look at what he proposed you will observe that a government with normal tax potential cannot meet those targets.

Aseni: What were his proposals, Grandpa?

Sarath: First, he suggested that the independent Ceylon should give priority to local businesses and not to foreign owned ones. Since foreigners will bring in foreign exchange, if you close doors for them, you close the door for future non-debt forex flows as well. Second, he suggested that the foreigners should be prohibited from getting local jobs. In other words, all jobs should be given to local people. Third, he suggested that Ceylon should ensure food security by producing more through both intensive and extensive farming. Farmers should be supported, he said, by giving them inputs at subsidised rates, high tariffs and banning the importation of all foods that can be cultivated locally. Fourth, he said that the distribution of food products should be a government monopoly.

Fifth, land fragmentation should be prevented by government buying lands that have been placed for sale. Sixth, main and base industries should be a government monopoly. Seventh, importation of essential commodities should also be a government monopoly. Eighth, the public transport should be run by the government. Ninth, primary, vocational, adult, and technical education should be provided by the government. Tenth, students should receive their education in mother language and English should be taught in schools as a second language.

Aseni: OMG! He cannot blame Bandaranaikes for implementing that program after 1956. It seems they have copied JR when they implemented a purely nationalistic state-run economic development policy. But how does it relate to discontinuance of the currency board in favour of a central bank?

Sarath: It will become clear if we look at his first few budgets and how he openly advocated for the active role which the central bank should play in the economy. Even in the first budget he presented in 1947 before Ceylon formally got its independence, he said that the government sector should be expanded. He had said that the government should control prices, interest rates, and investments which an independent central bank would not do without proper assessment. Upholding the need for having deficit budgets, he had expanded the government expenditure.

During 1939 to 1946, the colonial government on average spent Rs. 237 million as recurrent expenditure. JR increased it to Rs. 742 million. Regarding the total expenditure of the government, he increased it to Rs. 1,223 million by 1952. To finance the deficit, he borrowed heavily from the market. The total was Rs. 698 million. Out of that, Rs. 312 million was from the newly established Central Bank. Naturally, he could not have done it had the Currency Board continued in Ceylon.

Aseni: But the establishment of a central bank in place of the currency board was recommended to him by an expert he had got from the Federal Reserve Bank of USA. So, he was not to be blamed, though he was a beneficiary. Isn’t it the case, Grandpa?

Aseni: But the establishment of a central bank in place of the currency board was recommended to him by an expert he had got from the Federal Reserve Bank of USA. So, he was not to be blamed, though he was a beneficiary. Isn’t it the case, Grandpa?

Sarath: You are correct, Aseni. However, according to his biographers, K.M. de Siva and Howard Wriggins, he had deliberately not invited the Bank of England to send an expert from the UK. Probably, he had the fear that an expert from the Bank of England would recommend the continuation of the currency board. So, he invited the Federal Reserve Bank to send an expert and the expert who was fielded was John Exter who already had experience in setting up a central bank in the Philippines. If one compares the Monetary Law Act which he had recommended and the Central Bank of the Philippines Act, one will find that both are almost identical. Hence, Exter had come to Ceylon with a format of the central bank he will be recommending.

So, the continuation of the currency board had already been ruled out. Exter, in his report, had argued that Ceylon needed a central bank at that time. Critics say that he did so to please his Master. But to his credit, he had said in his report to JR that Ceylon should not follow Keynesian policies blindly. Therefore, it was up to the leaders of the country to refrain themselves from following those policies. But that was not what was followed by Sri Lankan leaders. They ran budget deficits and used the Central Bank money to fill the gap.

In the opening ceremony of the Central Bank on 28 August 1950, the Prime Minister D.S. Senanayake had observed that in many countries the central bank power to issue money had been abused. He said that the excessive use of the central bank credit had reduced the real value of money held by people. It also has resulted in the dissipation of the foreign exchange reserves. He was referring to the domestic inflation and the depreciation of the exchange rate. He had warned the new central bank not to make the country bankrupt by a loose currency policy like the post-war China and Greece.

But JR in his address countered DS subtly. He said that money is there for the benefit of man and man is not there for the benefit of money. What he meant was that the central bank should not adhere to strict money rules but make available the needed money for the benefit of the people. He was not worried that excessive money will lead to inflation and currency depreciation as opined by DS. He wanted the central bank to contribute to the economic and social development of Ceylon.

This was in line with his embracing the Keynesian ideology for economic stabilisation after reading John Maynard Keynes’ 1936 book General Theory of Employment, Interest, and Money. You will recall that Keynes recommended in that book that the government should increase the total demand of the economy by increasing its expenditure through deficit financing. The central bank was the main source of such financing.

These were JR’s plans. A currency board would have been an obstacle for the realisation of these plans. So, independent Ceylon discontinued the currency board system. Instead, it went for a central bank. All finance ministers since independence found the Central Bank to be a cash cow which could be milked at will to fund their profligate expenditure programs.

Aseni: The truth in the warning given by the first PM of Sri Lanka can be found today more than any other time, though this PM was said to have been schooled only up to the Seventh Standard. This is the beauty of a leader having common sense that is much more valuable than a ton of university degrees. The critics say that today’s Central Bank has caused an explosion in money supply to the extent of Rs. 4 trillion or 52% during the 27-month period from December 2019.

The result has been inflation is rising at 30% with food inflation at 47% according to official sources. The usable foreign reserves have fallen below $ 50 million according to the finance minister Ali Sabry. But analysts say that this is also not correct because the Central Bank’s foreign reserves are negative to the extent of $ 4 billion with foreign borrowings amounting to $ 6 billion. I find that it is a pathetic situation, Grandpa. But I have read that Singapore which also had a currency board inherited from the British decided to continue with it in 1965 when it became fully independent. Why did they do it, Grandpa?

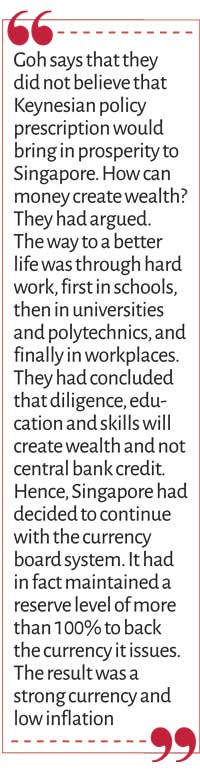

Sarath: The policy strategy adopted by the Singaporean leaders was in contrast with that adopted by Ceylonese leaders. The independent Singapore, instead of abolishing the currency board it had inherited from the British, decided to continue with it. The reasons for arriving at this decision have been explained by its first Finance Minister and first Chairman of the Currency Board, Dr. Goh Keng Swee, in an article he had contributed to the silver Jubilee Publication of the Currency Board titled ‘Prudence at the Helm’. In this publication released in 1992, Goh has explained in an article titled ‘Why a Currency Board?’ why the Singapore’s old guard chose the currency board system in preference to the establishment of a central bank which was the popular vogue of almost all the newly independent countries.

Singapore set up a currency board to issue currency backed by 100% foreign reserves and a monetary authority to perform the functions of a central bank without power to issue currency. According to Goh, this was decided by the Cabinet of Ministers reaching at his own decision independently. Therefore, Goh has explained his decision.

As a student, Goh had read Keynes’ General Theory not once but several times. He says that he found it to be a very badly written text. He could not understand why Keynes had measured all aggregates like GDP or money supply in wage units. That was to measure the value of a coconut not in terms of money say Rs. 100, but in terms of the wages paid to produce that unit. Keynes’ recommendation was to increase money supply to raise the aggregate demand and it will certainly increase the prices.

Keynes knew this, according to Goh, and he wanted to hide the price factor from the system that is to be set up. That is, when the prices go up, you will measure the value of a coconut not in terms increased prices but increased wage units. Thereby he was able to hide the price factor. But many nations which had adopted the Keynesian prescription had come to face with the reality of inflation setting in the system and destroying what was expected of Keynesian policy. This had been predicted by the Singaporean old guard even at that early stage.

Goh says that they did not believe that Keynesian policy prescription would bring in prosperity to Singapore. How can money create wealth? They had argued. The way to a better life was through hard work, first in schools, then in universities and polytechnics, and finally in workplaces. They had concluded that diligence, education and skills will create wealth and not central bank credit. Hence, Singapore had decided to continue with the currency board system. It had in fact maintained a reserve level of more than 100% to back the currency it issues. The result was a strong currency and low inflation. You will note, Aseni, that both are luxuries in Sri Lanka which had gone for a central bank in 1950.

Goh says that they wanted to convey three messages through this bold policy. One was to the international community that Singapore wanted to maintain a strong currency which is the only hedging against inflation in a country which depends on imports. The second was to their citizens. If they wanted better public services, they should be prepared to pay because there is no such thing as a free lunch. Third, the academics in Singapore should realise that what is fashionable in other countries should not be relevant to Singapore.

So, you will realise that leaders in Ceylon did not have this foresight. They still do not have.

Aseni: Well-revealing. But how is the track record? Has Singapore been successful in attaining its objective?

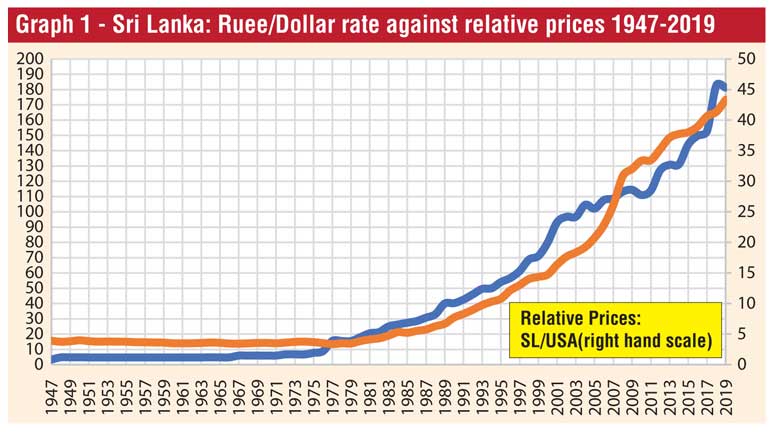

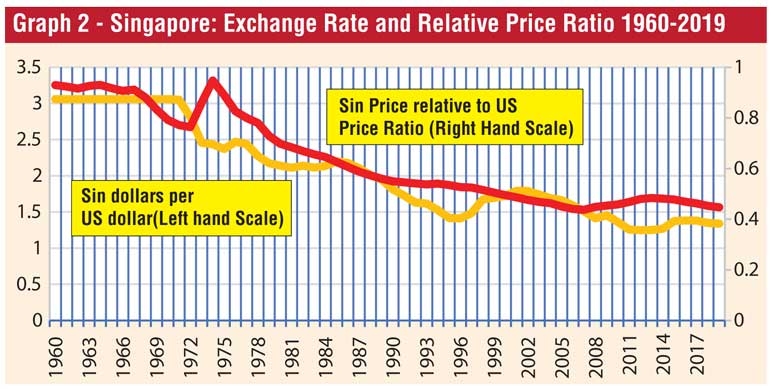

Sarath: I will show you two graphs, one relating to Sri Lanka’s experience, and the other relating to Singapore.

The first graph shows that Sri Lanka’s inflation rate has been higher than the inflation in the benchmark country, USA. Hence, Sri Lanka rupee has depreciated along with that development. The second graph shows that Singapore had kept its inflation below the US inflation. As a result, the Singapore dollar has appreciated against the US dollar.

There is no better evidence to appraise the success or failure of central banks as against currency boards.

Aseni: Thanks, Grandpa. We now see where we are and why we are there.

(To be continued.)

Part I of this article was published in the Daily FT on 2 May and can be seen at https://www.ft.lk/columns/A-child-s-guide-to-currency-board-systems-Part-I-How-colonial-Ceylon-did-it/4-734214

Part II was published on 9 May and can be seen at

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)