Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 15 September 2017 00:00 - - {{hitsCtrl.values.hits}}

Chinese investment in Sri Lanka has grown significantly in the last five years but it continues to remain low as a share of GDP and in comparison to other countries in the region. In this article, N.P. Ravindra Deyshappriya analyses China’s spending, and discusses how policymakers in Sri Lanka could expand FDI inflows from its East Asian neighbour

Chinese investment in Sri Lanka has grown significantly in the last five years but it continues to remain low as a share of GDP and in comparison to other countries in the region. In this article, N.P. Ravindra Deyshappriya analyses China’s spending, and discusses how policymakers in Sri Lanka could expand FDI inflows from its East Asian neighbour

By N.P. Ravindra Deyshappriya

http://blogs.lse.ac.uk: Sri Lanka is strategically located at the midpoint of shipping lanes that connect China and the Middle East. This favourable location helps explain why China has made significant and increasing foreign direct investment (FDI) in Sri Lanka, and has been the top source of FDI to Sri Lanka since 2013.

Despite this increasing investment, however, Chinese investment in Sri Lanka is negligible compared to its FDI in other Asian countries, particularly when considered as a percentage of Sri Lanka’s GDP. This article explains this comparative deficiency and highlights policy priorities towards further development of investment relations.

Non-governmental entities and governmental schemes have provided practical assistance in realising current  levels of FDI. For example, the Sri Lanka-Chinese Business Cooperation Council (SLCBCC) has played an active role in directing Chinese investment to Sri Lanka, by providing information to both parties through the arrangement of events such as the Kunming Trade Fair in 2011 and 2013, and ‘How to do Business in China’ seminars. Additionally, the Sri Lankan government provided passports to Chinese investors who invested more than $25 million on the basis of the second home passport scheme.

levels of FDI. For example, the Sri Lanka-Chinese Business Cooperation Council (SLCBCC) has played an active role in directing Chinese investment to Sri Lanka, by providing information to both parties through the arrangement of events such as the Kunming Trade Fair in 2011 and 2013, and ‘How to do Business in China’ seminars. Additionally, the Sri Lankan government provided passports to Chinese investors who invested more than $25 million on the basis of the second home passport scheme.

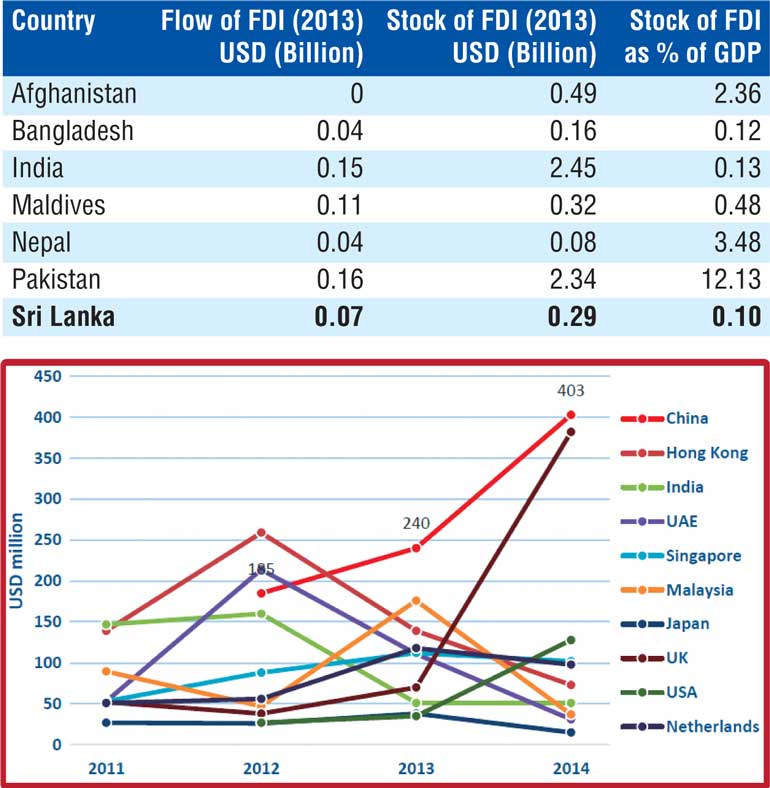

Figure 1 shows the FDI inflows from China and other selected countries to Sri Lanka between 2011 and 2014. It highlights that China was the third largest FDI donor to Sri Lanka in 2012 and become the largest FDI donor country in 2014, increasing across the time period from $185 million to $403 million. China’s position is followed closely by the UK, while most other donor countries saw a decline in their FDI to Sri Lanka over this period.

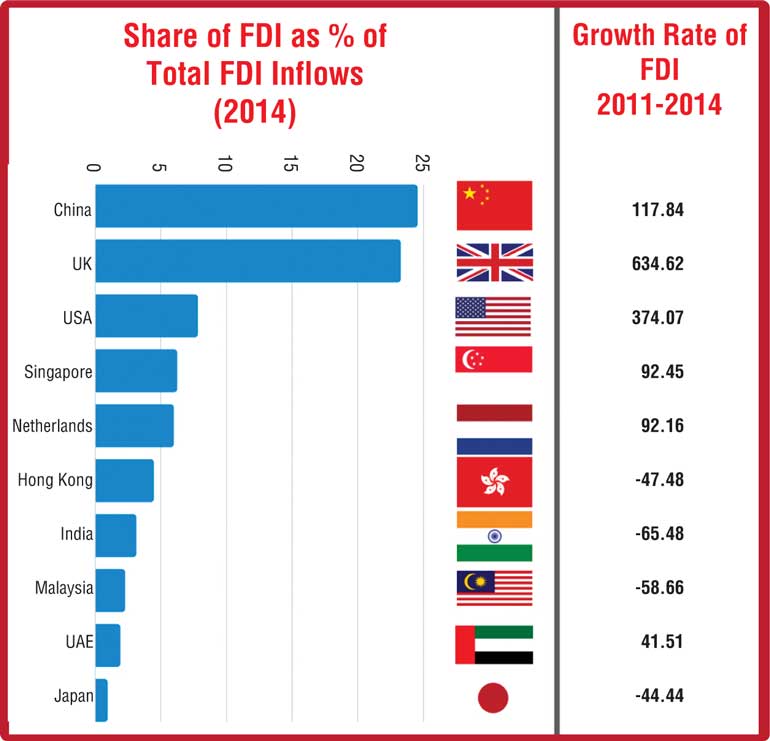

Figure 2 illustrates that China accounted for the largest share (24.53%) of total FDI inflows to Sri Lanka in 2014, growing at a rate of 117.84% in sharp contrast to the negative growth rate of FDI inflows from many other Asian countries. It must be noted that the UK and US have recorded first and second highest FDI growth rates during the period of 2011-2014, yet the volume of FDI from those countries remained significantly lower than that from China.

Chinese FDI was directed mostly towards infrastructure development including transportation and power and energy. The largest such project was the Norochcholai coal power plant, which was financed by a concessionary loan of $450 million. Another important project was the Exclusive Economic Zone in Mirigama (in Sri Lanka’s Western Province, near Colombo), which has further plans of expansion to the Southern and Eastern Provinces.

A major development project in the transport sector was the Colombo-Katunayake Expressway, funded by $248.2 million of Chinese investment while the Hambantota seaport ($461 million) and Mattala airport ($210 million) were built to advance the maritime and aviation sectors. Future infrastructure projects include an International Financial City in Colombo, which is being built to realise Sri Lanka’s ambition of becoming a financial and logistics hub in the Indian Ocean Region.

China has become the third largest foreign direct investor in the world, accounting $107 billion FDI outflows in 2013. Due to China’s geographical proximity to Asian countries, a large proportion of FDI is directed to other countries in Asia, amounting FDI stock worth $447.41 billion which accounted for 68% of global Chinese FDI stock by 2013. Table 01 compares the Chinese FDI to South Asian countries in 2013 As the table highlights India and Pakistan have the largest stock of Chinese FDI as of 2013. In the same year, Afghanistan and the Maldives had stocks worth 2.36% and 0.48% of GDP respectively. These are all higher than Sri Lanka, whose FDI stock amounted to $0.29 billion by 2013, at 0.10% of GDP, only above that of Nepal ($ 0.08 billion) and Bangladesh ($ 0.16 billion) in terms of FDI sock. It is apparent, therefore, that notwithstanding the increasing trend of Chinese FDI in Sri Lanka, Chinese FDI remains low compared to other South Asian countries, both nominally and as a percentage of GDP.

Although China is the largest FDI donor to Sri Lanka, the analysis highlights that investment from China is relatively low as a percentage of GDP. It is therefore crucial to rethink appropriate priorities to attract more Chinese investment.

Economic and political stability, alongside a transparent legal system, are important to improve the confidence of all foreign investors. The Sri Lankan Government thus needs to prioritise policy stability and legal transparency in Sri Lanka, while also considering the speed of the judicial process, representation by foreign law firms, and a functioning international arbitration system. Similarly, Sri Lanka should work resolutely and steadfastly to improve its rankings in international indices such as Ease of Doing Business Index.

The recently established Asian Infrastructure Investment Bank (AIIB), led by China, is an alternative development body to traditional development organisations such as the World Bank and IMF. Sri Lanka is a founding member of AIIB, which is expected to provide infrastructure-oriented loans and aid with fewer pre-conditions than the Bretton Woods counterparts. Hence, it is essential to strengthen Sri Lanka’s relationship with the AIIB to secure more infrastructure-oriented assistance in the longer term, which in turn will maintain an investor-friendly atmosphere through modern infrastructure facilities.

Sri Lanka’s Board of Investment (BOI) and other investor-oriented websites should be fully translated into traditional and simplified Chinese, to ease the process of investing in Sri Lanka. Similarly, it is equally important to invite Chinese business journalists and bloggers to Sri Lanka, who could discover and write about Sri Lankan investment opportunities in traditional and social media in China.

As a practical matter, the Chinese Government could simplify the process for Sri Lanka’s business community to obtain Chinese visas, to make the attendance of investment-related conferences and trade exhibitions more convenient.

Similarly, there is significant potential to engage the increasing numbers of Sri Lankan students in China to expand investment opportunities. Sri Lanka’s diplomatic missions in China could assist these students to obtain internships in fast-growing or influential Chinese companies, as people-to-people connections can pay long-term dividends in expanding economic relations. The Embassy of Sri Lanka in Beijing could also identify the best or suitable students to develop as potential recruits, who could be headhunted into the Foreign Service after graduation, given that these students would have acquired a valuable familiarity with Chinese language, culture and business.

In conclusion, China has been the largest FDI donor to Sri Lanka since 2012 and vastly invested in the fields of road and transportation and power and energy. However, Chinese FDI inflows to Sri Lanka is significantly low compared those to other Asian counterparts. Consequently, appropriate policy measures are crucial to attract more Chinese FDI in order to support wider economic growth.

(The author would like to thank colleagues at LKI for their ideas and assistance with this article. The opinions expressed in this article are the author’s own and do not necessarily represent or reflect the position of any other institution or individual with which he is affiliated.)

[N.P. Ravindra Deyshappriya is a doctoral candidate at the School of Economics, Finance & Marketing of RMIT University, a Research Consultant at Centre for Poverty Analysis, Sri Lanka and former Research Director at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI) in Sri Lanka.]