Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 1 June 2021 01:11 - - {{hitsCtrl.values.hits}}

Manning Market demolished

By The Prince of Kandy

Though the media and financial players in Sri Lanka will not openly admit it, we are in the middle of a property crisis. The benchmark of commercial property in Sri Lanka the World Trade Centre (Overseas Realty PLC) has dropped to about 80% occupancy levels from levels nearing 90% in 2019 and at about 97% in 2015.

To quote the Overseas Realty annual report; The revenue from leasing spaces at WTC decreased by 6% to Rs. 2,292 million (2019 – Rs. 2,409 m), due mainly to concession given to tenants and lower occupancy levels during the year.

Now, this given COVID-19 is expected and overseas realty remains the furthest thing from financially distressed. The crisis that this article speaks of exists in the highly leveraged inner-city developments where due to the leverage even stagnant prices should lead to insolvency and bankruptcy of many prominent developments.

Context

Over the recent period, the state has taken over the likes of Altair and Destiny. These are two prominent developments in proximity to other developments that are also facing difficulties selling. The state through captive funds has long been in the possession of the failed Ceylinco investments in the Hyatt Regency (Ceylinco Celestial Towers).

The state has also directed the banking institutions to take a lax approach to collection from major property developments. This is further compounded by the ridiculous system of valuation that the accounting standard and state have both endorsed.

Though returns from property (rent) are low yielding this should not be conflated for them being safe assets. State backing only works as a reinforcement mechanism if the state is financially strong and this is far from the case.

Not safe assets?

Property in Sri Lanka may not have yet witnessed depreciation but as seen in more advanced economies like Japan and the United States this is a possibility. Regardless there are many asset classes like fixed income that possess this property of not going down in nominal value.

Property also cannot be liquidated quickly and/or does it ensure a steady stream of payments. Tenants are in short supply and the renting market is fraught with concerns like non-payment and squatting with no solutions in sight.

As this article focuses on ‘Colombo proper’ this issue is further compounded by the large disparity in property prices over a few kilometres in radius.

Difficulty in ranking the best parts

The centre of Colombo is Colombo 01. The simplicity and genius of our naming system should be appreciated. It is the heart of the city and goes for about Rs. 18 million per perch. This in relation to the rest of the city outside Port City will not change.

The problem comes about when valuing adjacent plots of land. Colombo 03, 02, 10, and 11 go for Rs. 16 million, Rs. 12 million, Rs. 4 million, and Rs. 10 million respectively. Port City is expected to be above Rs. 13 million per perch.

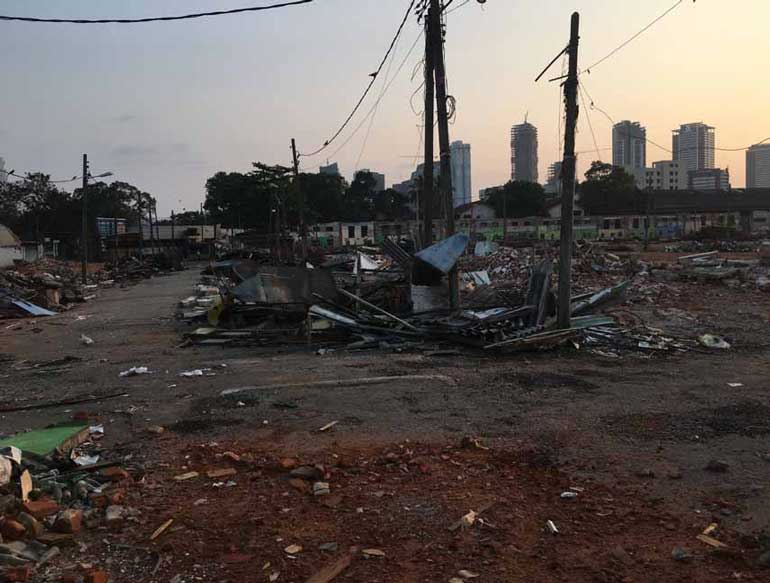

There is a large buildable area in the hands of the state around the Lotus Tower (Colombo 10). The Chalmers Granaries land (Colombo 11) has been on sale for a long period of time and the Manning Market was just demolished. There are still defence establishments that occupy land in Colombo 03.

All of these areas have underserved housing and underserved commercial space. Colombo’s population would have to increase by 32.8% to even touch a million residents. The majority of people in Colombo are poor.

The rich live in houses

Yes, the only real density of rich people in Sri Lanka is in Colombo proper. Sadly, for real estate agents though is that they tend to already have homes. A large portion of their wealth also stems from the fact that they have land in the city.

Townhouses with proximity to leading schools and gardens will always be more sought-after than high-rise apartments. In London, New York, Singapore, and even the upcoming Colombo Port City, townhouses will be the most sought-after real estate.

We are not in short supply of townhouses. Most townhouses are either on rent to some embassy or are being used as makeshift office space. There are many that are dilapidated with very rude signage to deter property brokers.

Property woes

To be reductive ‘Colombo proper’ apartments are overvalued. There isn’t a shortage of buildable space, yes much of it is brownfield but it is easily demolished. There isn’t a large growth in population. Most apartments are sold to people that don’t need them who either intend to rent them out or occupy them on their short visits from overseas.

Though Colombo is the largest urban centre the majority of people in the Western Province live outside Colombo. Housing, land, and apartments in those regions offer a much better return on investment.

There isn’t a shortage of apartments either. Many completed projects remain unsold and are incredibly small. Given the rental yield, people actually looking to live in the city would be better off renting and buying in the suburbs.

Property owners in Battaramulla, Rajagiriya, Moratuwa, Negombo and Wattala have done very well for themselves.

To put it concisely; the housing stock that the private sector decided to construct was at odds with the demographic trends in the city.

Demographic trends

There is no Sri Lankan person willing to spend Rs. 24+ million and Rs. 20,000 on maintenance fees for a 650 square foot apartment in Colombo 02. That wealth bracket would buy a home/apartment in the suburbs with space for children. The foreigner looking to rent that apartment is currently spoilt for choice.

The wealth distribution increases exponentially in the upper-income brackets. There is a large gap even between the highest-paid CEOs to the people who own the enterprises.

To quote Head of John Keells Properties Nayana Mawilmada in a recent interview, “Affordability though is a problem. A lot of what is being built in and around the city is quite expensive. The reason for that is construction costs in the region are higher than those for the region. A lot of construction materials are taxed. Regulations tend to be difficult. Our cost of delivering something is higher than Malaysia.”

Luxury apartments in inner-city areas

This is where the crisis is concentrated. When Liberty Plaza was built it was thought to be highly sought-after. It was very well-located. Over time it became a bit of a dump. Residents now have to deal with a noisy environment while being in very close proximity to the vice industries.

Marina Square by Access Residencies is not in a sought-after area. It is being sold on the basis that it will become a sought-after area. The timeline over which it can be completed would be similar to the time it would take to build an LRT to Malabe.

The development will likely end up in the same state as Liberty Plaza is today with the sad exception that it even for a brief period of time was not a sought-after area.

Last I checked though there is disagreement on the value of an LRT system there is bipartisan agreement that the broader Western Province shall have elevated highways. Regions like Wattala are well-placed to both access the Port City and decent places to raise a family.

World of haves and have nots

Statistically, you are probably either in the very small class of people that can own multiple luxury properties or the very large group of people that can’t even own one. Anyone with experience in the lobbies of Colombo high-rise buildings would realise that there are a lot of foreign tenants and many of them do not own cars.

Proportionate to the purchase price of these apartments the rental yield is very low. If you are just looking to profit from these purchases, would you not be better off buying multiple smaller properties in the suburbs?

Inner-city areas world-over offer poor capital returns to property holders. Given Port City and the existing developments in Colombo 01 won’t Colombo 03, 02, 10, and 11 quickly become more inner-city than they already are?

Inner-city amenities

Globally in certain very wealthy regions of the world, there has been urban regeneration and gentrification of inner-city areas. As mentioned before Colombo because of the lack of population growth and the availability of fiscal space that is not going to happen.

Colombo 03, 02, 10, and 11 do not have many parks or communal space. The schools where the wealthy send their kids, the three set up by Elizabeth Moir and the Overseas School of Colombo are located in proximity to where the wealthy live which is well south of the inner city.

Trying to tell a bunch of people who as previously mentioned already have accommodation that they need to buy space in the inner city is a tall order. Developments in the suburbs of Colombo and all over Sri Lanka sell out within weeks while these high-end developments remain on the market till even after completion. In the suburbs, there are multiple generic developers and a deep need for accommodation at affordable prices.

Why they developed the inner city?

The inner city was historically used for industrial production. Think of the warehouses of the John Keells Tea Broking arm in Colombo 02 to the Old Train Service Yards in Maradana. With the BOI zones and the outer circular road industrial production moved outside of the Western Province and even those within the Western Province to outside Colombo.

The land also was buildable, unlike suburban greenfield land. The companies owning the land were well connected and have access to cheap finance. They will be the major beneficiaries of the gentrification of the inner city.

Cost factor

The inability to sell and thereby obtain financing for construction makes these mega-development projects more expensive than they need be. It’s not like a building begins when all apartments have been presold. For new developers, without historical title to the land, there are also considerable costs in obtaining land and getting approvals.

As previously mentioned, the quantum and cost of construction in Sri Lanka is too high for our small economy. In no other industry do we see foreign blue-collar workers in such quantity? Almost one in two workers is a foreigner.

Developments in the inner city will have to compete with developments in Port City while the developer will have to pay high import taxes and taxes on profits. This is on top of being just outside the financial centre and sought-after outskirts of the city. Why buy into something that won’t be price competitive in the long run?

Port City will be amazing

The Port City legal framework is amazing. After all the Government had to pull out, we won the war card to get it through. It will be meticulously planned and everything will be within walking distance.

The building regulation will make sense and every new construction will complement the existing space. All the people will be slim. By virtue of the need to purchase the property need to have disposable income. This will come in stark contrast to some of the layabouts who have inherited property in Colombo 07 who can barely afford to paint the place.

Status quo

Now, most of this piece represents the status quo as understood by society. Interest rates, especially when compounded with the withdrawal of WHT and imposition of income tax on fixed deposits, offer very poor returns.

Even with this these apartments in the inner city remain unsold. Apartments that have been constructed remain empty and those nearing completion are almost immediately put on the market. Even old apartment complexes in amazing locations are on the market trying to cash in on the inflated prices.

Central Bank

In the interests of the financial system, the Central Bank should step in and create a mechanism for valuation. Firms are taking advantage of the current weak mechanism and creating perverse allocations of credit as can be seen from the empty apartments.

The Central Bank is further delaying the inevitable by offering guaranteed low credit to the sector through various interest rate-capping schemes. As can be seen by their public statements though the Central Bank is pro-Sirimaesque-austerity it does not feel that property developers should feel any pain.

The Central Bank could also help the municipalities set countervailing taxation to create stable property prices. Excess taxation could be used to create a property fund that invests in housing stock for rental purposes.

In theory not practice

The Central Bank could do all of this in theory but in practice, we have seen that they would be unable to do the simplest of tasks. Take for instance the payments to ETI depositors where they have failed so greatly. It is truly comical how they try to paint this as a triumph.

After having taken forever to disburse funds from the deposit guarantee mechanism they choose physical means of disbursement during a pandemic.

ETI and Swarnamahal had accepted deposits in an ad-hoc manner creating considerable administrative difficulties in selecting genuine claims. Even with this the Central Bank has in no way considered placing industry-wide standards for the issuance and maintenance of deposit certification and databases.

Conclusion

We all know that our capital markets are infiltrated by crooks. As people may accuse this article of fear-mongering let us take a historical case to illustrate the point.

Ceylon Foreign Trades PLC and related companies purchased warehouse land. They almost immediately then revalued the land and took in the surplus into their set of accounts. The banks turned a blind eye and that company went on a massive CSE investment spree on margin.

The people conducting the valuation, the accountants who signed off on the books, and the directors all remain from a legal standpoint capable of moving into property development in the inner city. It doesn’t have to be the same people as that type of person is widespread around Colombo.