Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 3 March 2023 00:25 - - {{hitsCtrl.values.hits}}

Experts say Sri Lanka has been the target or victim if you may, of predatory lending over the years, both foreign and domestic and sauce for the goose is sauce for the gander

Lending to Sri Lanka between 2007 and 2022 was often marked by an absence of due diligence, opaque conditions and aggressive lobbying with politicians and bureaucrats. A top banker called it, predatory or quasi-predatory lending practices by those who lent to Sri Lanka.

Lending to Sri Lanka between 2007 and 2022 was often marked by an absence of due diligence, opaque conditions and aggressive lobbying with politicians and bureaucrats. A top banker called it, predatory or quasi-predatory lending practices by those who lent to Sri Lanka.

Interest rates charged which were in the range of 6.3% were “exorbitant” given that the effective LIBOR (London Inter-Bank Offered Rate) was much lower (just 2% in 2009 and even lower in 2018) and could be construed as predatory lending. This is when commercial banks were borrowing at much less.

Generally, predatory lending is lending with “severe conditions” and can be some or all of the following:

Critically, Sri Lanka’s capacity to repay was also not factored in. Herein lies our problem and current financial crisis. These borrowings must be investigated to prevent a future catastrophe. The findings must be discussed at the highest levels of government to prevent a repetition 20 years from now. Those responsible for irresponsible borrowing must be investigated and asked to declare their assets.

Criticism

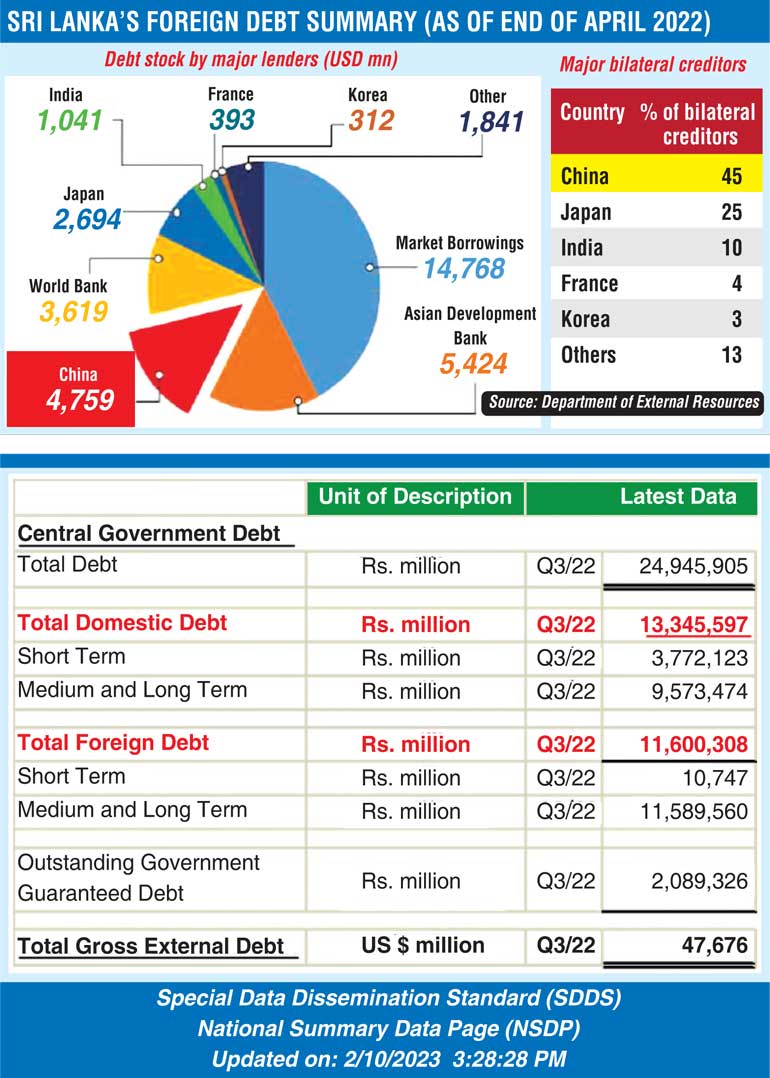

The high pitched sound bites, particularly in the Western press and that too in relation to the debt owed to China masks the true nature of the rest of the debt, both foreign and local. Of the former, the multilateral debt is not labelled as predatory as it does not meet the definition above. Governance structures are also very high.

The bilateral debt restructuring has largely come on board with haircuts and moratoriums, particularly the Paris Club and India. China is in the political dimension at present and will hopefully be negotiated to a satisfactory conclusion to all parties concerned, given their willingness according to the newspapers.

Commercial borrowings

The commercial foreign debt, aka ISBs have signalled their willingness to come on board with haircuts and moratoriums. Most holders for the time being have acquired them in the secondary markets at deep discounts and have room for negotiating such concessions.

Sri Lanka’s domestic debt too has almost all the characteristics of “predatory” lending to the GOSL over the years, principal among which are:

Stable future

Experts say Sri Lanka has been the target or victim if you may, of predatory lending over the years, both foreign and domestic and sauce for the goose is sauce for the gander. Our domestic public debt too must therefore be subject to significant restructuring, haircuts and interest discounts. Here too, most holders for the time being have either acquired them in the secondary markets at deep discounts and have room for negotiating such concessions and/or have recognised significant capital gains and even realised such gains.

The earlier the holders for the time being abandon holding out, the less pain for them and the smoother the overall debt restructuring, unlocking Sri Lanka’s trajectory to the next level of recovery and normalcy.

Moreover, given that in today’s extraordinary conditions of a sovereign debt default and sovereign rating downgrades most or all of the lender risks of predatory lending have either crystallised or will soon. The banking regulator should proactively stop distribution of such unrealised gains and manage these elevated expectations for the greater good of the nation.

The banks and holders of treasuries for the time being will most likely cry foul and lean on the lobbyists to negate this and we can expect an increase in the protestations, threats and whining of their apologists among the ranks of their tax and financial advisors and their shareholder lobbies.

Some licensed deposit holding financial institutions have, in the recent past in relation to this measure, audaciously even hinted at enforced haircuts on the FDs they hold, in the expectation that this uncorroborated notion will derail the entire debt restructuring and the consequent recovery to a semblance of normalcy.

The nation’s savers are not to blame for the recklessness of the financial institutions and some HNIs in their mission to increase shareholder distributions.

Here again the regulatory authorities should not countenance such moves on savers, let alone approve them (as only they can) and manage all expectations firmly, for the greater good of the nation. Offering a few credible options to the creditors may go a long way in closing the debt restructure without delay.

References:

https://www.outlookindia.com/business/lessons-from-sri-lanka-over-borrowing-a-trap-you-must-avoid-in-personal-finance-news-208466/amp

https://www.orfonline.org/expert-speak/sri-lankan-crisis-the-perils-of-inherited-fallacies-and-economic-mismanagement/