Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 8 October 2021 00:04 - - {{hitsCtrl.values.hits}}

|

|

| CB Governor Ajith Nivard Cabraal has urged importers to act responsibly and only import what is absolutely necessary |

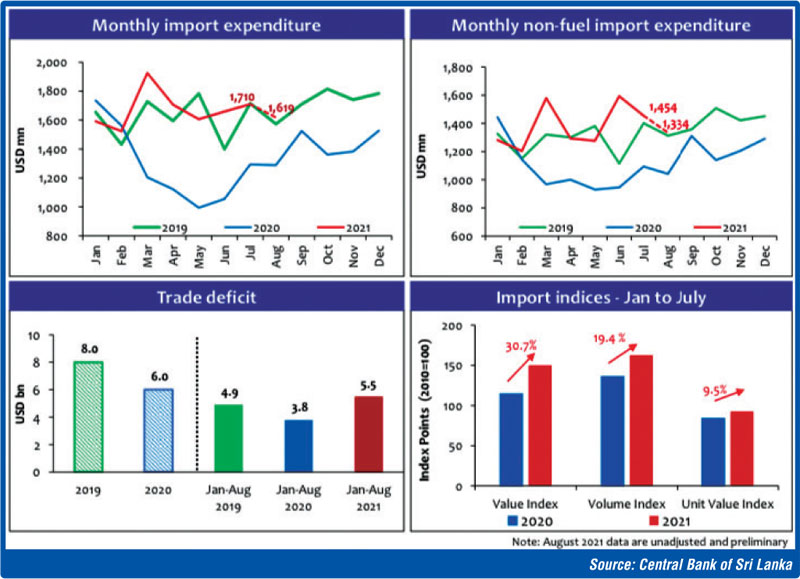

According to CBSL data, Sri Lanka’s imports rose to $ 1,710 million in July 2021, a 17-month high, despite the severe import restrictions. In spite of this, to spur economic revival and for business to play a constructive role in the country’s economic growth, the Central Bank of Sri Lanka removed the cash margins imposed on the importation of non-essential items with immediate effect.

CB Governor Ajith Nivard Cabraal speaking at the launch of the six-month Road Map for Ensuring Macroeconomic and Financial System Stability by the Central Bank of Sri Lanka, requested and invited the importers to act responsibly and only import what is absolutely necessary, and appealed to importers not to stockpile additional inventory.

He further said: “We want to assure the importers that there will be sufficient foreign exchange and reserves available for them and we would like to ensure that their imports are done in such a way that they do not need to stockpile unnecessarily.”

Exports on the rise

Sri Lanka’s exports, fortunately according to CBSL data, have been on the rise. In July 2021, exports were $ 1,104 million, up from $ 1,007 million in June. Furthermore, according to CBSL data, Export income recorded the highest since $ 1,137 million recorded in March 2019.

With the relaxation, banks and companies have been directed by CBSL to exercise prudence and refrain as far as possible from investing in non-essential expenditure. The restrictions specify certain areas such as advertising, business promotions and business travelling, etc. However some of these expenditure items for the private sector serve a very different purpose, because they can help to boost export income and generate new business opportunities.

CBSL must not however make the same mistake some of the Latin American countries made by believing that

more exports will automatically reduce the trade deficit and open up, believing simply that the recipients of export income will invest their receipts to export more and more.

Exercise prudence

Exercise prudence

Sri Lanka’s debt to GDP ratio is 110% of GDP and the budget deficit is likely to be over 13% of GDP this year. Also, according to Central Bank data, loan settlements due in the next 12 months amount to $ 7.3 billion. Of this total, domestically raised foreign loans amounting to around $ 3 billion could be rolled over with great stress to the banking system leaving around $ 4 billion for immediate settlement.

Given the current challenges in raising foreign $ borrowings in international capital markets and our repeated sovereign rating downgrades, the Government needs to be extra vigilant when relaxing forex outflow rules and regulations and also given that there has been a surge in private credit fuelled by money printing and low interest rates.

For example, because car imports have been banned, vehicle imports have fallen from $ 300 million in 2019 to 6.7 million in 2021. Generally, Sri Lanka’s import bill for vehicles and parts and accessories is around $ 1 billion. However, machinery and equipment imports which were $ 1.42 billion in 2019 had risen to $ 1.59 billion in 2021, which is a good thing.

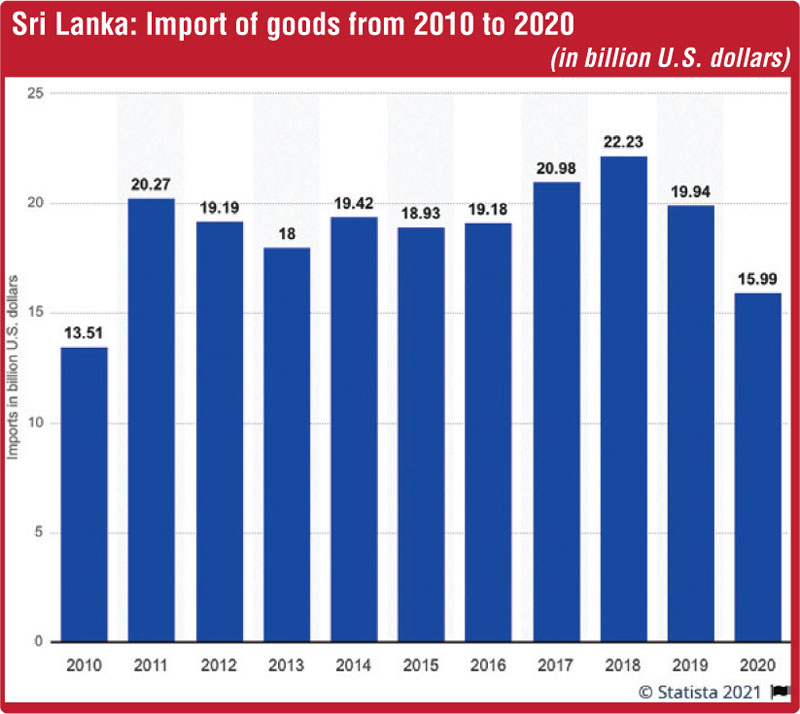

Sri Lanka’s total imports in 2018 was $ 22 billion, in 2019 at $ 20 billion and in 2020 at $ 16 billion (see graph). Our export income for 2021 is expected to be around $ 12 billion and imports over $ 21 billion.

Overly cautious

According to EconomyNext, the Central Bank of Sri Lanka has been pumping record volumes of rupee reserves into the banking system mainly through failed bill auctions, triggering cascading credit.

Also, despite an artificial peg, the rupee peg is under pressure and exporters will continue to hoard dollars using cheap rupee credit for day-to-day expenses. That makes perfect business sense for them because it will drive up margins for exporters.

Therefore exporters despite any tax breaks will be motivated to keep forex earned abroad without repatriating and surrendering, thereby aggravating the forex problem. As a result, to maintain the peg, the Central Bank will have to sell USD. Hence, the Central Bank will be under pressure for a start to hike policy rates to get bond auctions to work.

Given Sri Lanka’s unenviable balance of payment history and a recorded deficit of $ 832.2 million by March 2021, the CBSL must certainly be cautious when taking the pressure off the forex pedal in the next six months.