Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 18 December 2017 00:10 - - {{hitsCtrl.values.hits}}

The need for demystifying economic policies

Economic policies have always been mysteries to laymen. They have become mysteries because top economists often present them in a language not comprehendible by ordinary people. Policymakers design policies after much labour and thought. Yet, they fail to explain their rationale to people, leaving them in a state of confusion.

This leads to the creation of a trust deficit between the policymakers, on one side, and those who are to benefit from policies in the long run, on the other. It also gives opportunities for those who feel threatened by new policies to put pressure on governments not to go for them by mobilising people and other forces to serve their cause.

As a result, even the policies which are essential and carry high economic costs if they are not implemented are abandoned mid-course due to prolonged public protests. Sri Lanka’s past is full of such instances. It also explains why Sri Lanka’s economic growth has been low – about 4.4% on average annually in the whole post-independence period – and why it had been a laggard compared to its peers.

Central Bank Governor Dr. Indrajit Coomaraswamy

The present Government, which has experienced a declining economic growth rate – 4.8% in 2015 and 4.4% in 2016 - has been particularly vulnerable to this ominous development. As the latest economic data suggests, the performance of the economy in 2017 would be most disappointing for the Government with the growth rate estimated to be slipping even below 4%. This makes the realisation of the ambitious targets pronounced in Vision 2025 of the Government – an increase in the average income of a Sri Lankan, known as the per capita income, from $ 4,000 in 2017 to $ 5,000 by 2020 – extremely challenging.

SLEA’s attempt at disseminating economic information

In this background, the Sri Lanka Economic Association or SLEA, the topmost body of economists in the country, had ventured into the task of generating an open and free discussion of the policy package being proposed by the present Government.

It did this by hosting a public forum on the direction of future economic policies in Colombo last week. In fact, such a discussion would have been generated by the Government itself before SLEA ventured into it. Yet, as the Government had done on previous occasions, it appeared to have thought that its job was over after the documents containing the policy had been released either in Parliament or at a gala event hosted luxuriously at a public venue.

Government’s lukewarm approach

This writer in a number of articles published in this series attempted to analyse those policies for the benefit of the public and Government policymakers (available at: http://www.ft.lk/columns/Vision-2025--Part-1--Need-for-moving-from-a-wish-list-to-a-concrete-plan/4-639757 ; http://www.ft.lk/w-a-wijewardena-columns/It-is-an-uphill-task-for-the-Govt--to-attain-the-envisaged-targets/885-640237 ; http://www.ft.lk/columns/Budgetary-consolidation-and-resolving-the-country-s-debt-crisis-permanently/4-640685 and http://www.ft.lk/columns/Vision-2025-Part-4--PM-s-alleged-instructions-to-remove-direct-placements-are-against-the-Vision/4-641107).

However, the response received from the Government was stark silence, probably because an open discussion or a critical evaluation of its policies by the public would have been considered not to its liking.

The tense situation in the public forum

At the SLEA forum under reference, from the Government side, Dr. Harsha de Silva, the Deputy Minister of National Policies and Economic Affairs, took to the podium. Harsha had come to prominence by being the firebrand critic of the economic management of the previous administration and, therefore, was the person best-qualified to represent the Government in the forum arranged by SLEA.

The private sector had been represented by the Chairman of the Sri Lankan brand Nature’s Secrets, Samantha Kumarasinghe, known for being critical of the present Government’s policies, especially its trade policies.

In between Harsha and Samantha was Central Bank Governor Dr. Indrajit Coomaraswamy, who was faced with the difficult task of presenting a balanced view, compared to the pro-view of Harsha and the counterview of Samantha.

The audience had been treated to a tension-filled evening with the exchange of arguments followed by counterarguments. This is a healthy sign since economic policies should be debated freely before a final agreement is reached. It should always be remembered that dialogue, although sometimes fiery, is always better than enforced consensus from the nation’s point of view.

A detailed report of the tense discussion has been presented by Daily FT (available at: http://www.ft.lk/opinion/Tensions-mount-at-economic-policy-discussion/14-645263).

High-flown economics needs to be simplified

Governor Coomaraswamy’s presentation at the forum on economic policy (available at: https://www.youtube.com/watch?v=tmbD_82XReY) deserves further elaboration. That is because what Coomaraswamy had presented in high-flown technical terms was totally appropriate for the audience at hand consisting of the country’s top economists.

However, if it is to be conveyed to the public at large, it needs to be converted into the ordinary man’s language to facilitate a proper understanding of the presented information. Such an exercise is necessary since, as this writer had encountered during the weekend, even the final year undergraduates or the MBA students of a well known state university could not properly explain the rationale of the policy package described by Coomaraswamy. Hence, this article aims at taking ordinary folks through the policy package, as pronounced by Coomaraswamy, to be implemented by the Government in the next few years.

Relishing small gains

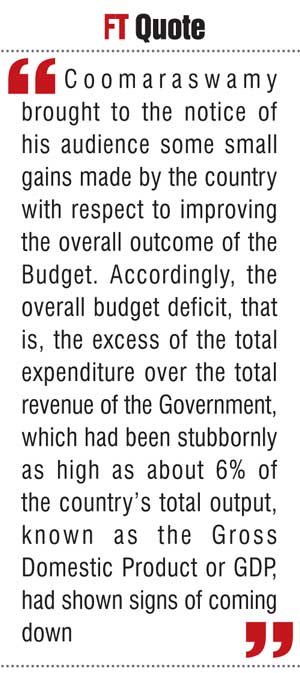

At the outset, Coomaraswamy brought to the notice of his audience some small gains made by the country with respect to improving the overall outcome of the Budget. Accordingly, the overall budget deficit, that is, the excess of the total expenditure over the total revenue of the Government, which had been stubbornly as high as about 6% of the country’s total output, known as the Gross Domestic Product or GDP, had shown signs of coming down. This has been made possible by an increase in the total revenue of the Government, from around 12% of GDP a few years back to around 14% of GDP in the most recent year.

A surplus in the primary account

At the same time, Sri Lanka is to record a surplus in the primary account of the Budget after many years of having a deficit in that account. The primary account is simply one component of the Budget generally used by economists to assess its health.

In that account, the total consumption expenditure of the Government, also known as the current expenditure or recurrent expenditure, without interest payments is compared with the total revenue of the Government.

If revenue is higher than current expenditure without interest payments, the primary account generates a surplus. If revenue is less than such expenditure, then, the primary account records a deficit. A deficit is a situation where the Government has failed to control even its day-to-day normal expenditure programs.

It is like a person who spends more than he earns on a day-to-day living. The result of such lavishness in spending is that a person or a Government will have to live continuously on borrowed money. But, sooner or later, things will reach the stage where it would not be able to borrow any further. At that stage, it will have to abandon all its plans for the future for lack of resources.

Desirable fiscal developments

Thus, a surplus in the primary account is considered a desirable achievement. It is not only a sign of self-discipline but also a mechanism to at least part finance the interest payments out of taxpayers’ money.

If the surplus in the primary account is more than the interest payments then the Budget is considered to have generated a surplus in its current account. It will not only help the Government to part finance its capital expenditure programs but also to keep the overall budget deficit in check. A sound fiscal policy seeks to achieve this status and according to Coomaraswamy, Sri Lanka is now moving along this path.

Its success has even been vouched for by the IMF, he noted, when it decided to release the fourth instalment of the Extended Fund Facility Programme which Sri Lanka entered into with the fund in 2016.

Complacence is the worst enemy

These are of course small gains over which the country could be happy. Yet, Coomaraswamy opined that it is not a reason to be complacent. In fact, complacence is the worst enemy of any Government since it elevates the Government to a false sense of success.

What has already been achieved on the fiscal front has to be continued with consistency, dedication and commitment. By announcing that the country should not be complacent about its past achievements, he has indirectly warned the Government that it should not even for a moment relax its grip on reforming the Budget. This warning should be seriously taken by the Government in general and the Minister of Finance, Mangala Samaraweera, in particular. Any laxity in these endeavours will amount to sacrificing the hard-earned gains by the country in the recent past. It is not a risk which Sri Lanka should take at the moment.

Liability management to the rescue

Coomaraswamy drew the attention of the audience to the specific problem faced by the country with respect to repayment of debt and payment of interest, known as debt servicing, in the next few years. In fact, the total debt servicing during 2018 through 2020 will be much more than the estimated revenue of the Government due to an undesirable bunching of these debt payments.

A solution available to the Government is to elongate the debt service payments by going for specific borrowings that are not used for financing the Budget but for reissuing the debt repayable in lax years in the future. This is known as liability management since it amounts to changing the structure and the time schedule of debt liabilities of the government.

However, at present, there is no possibility for the Government to do so since the entirety of the borrowings to be made under the Appropriation Act has to be used for financing the approved expenditure programs.

Hence, to give this additional supporting power, Coomaraswamy announced that the Government will introduce a special Liability Management Act. This Act will permit the Central Bank to raise funds on behalf of the Government and outside the borrowing limits prescribed in the Appropriation Act to even out the debt repayment liabilities by shredding the high spikes in debt repayment due to bunching.

It will, therefore, improve the cash flow of the Government but it will not be a mechanism to reduce the overall public debt over the long run. This latter is a must for the Government to enforce discipline on its revenue as well as expenditure programs.

Monetary fallout of Hambantota Harbour leasing

Coomaraswamy also outlined the special procedure being adopted to handle the extraordinary windfall the Government would get from leasing the Hambantota Harbour to China’s Merchant Ports Holding Company. The lease money, amounting to about $ 1 billion, will be some extraordinary revenue being earned by the Government by selling an asset, known as asset management.

The normal procedure for handling such foreign exchange receipts is that the Central Bank would buy the dollars by providing the rupee equivalent to the Treasury, a process commonly known as the printing of money.

The Treasury will in turn record it as an income in the Budget and spend the rupee proceeds in its normal expenditure programs. It will not only boost Government expenditure but will also increase the total expenditure in the economy, known as the aggregate demand or AD directly. If the supply does not increase, this will overheat the economy causing the inflation to raise its ugly head.

Since Sri Lanka has a free import policy, the new money will move out of the country to meet import demand. There is another side effect of this operation. That is, when the Central Bank buys dollars and issues rupees, it increases its net foreign exchange holdings leading to an increase in the monetary base – the seed money created by the Central Bank and made available to commercial banks to create further money – by an equal amount.

Given the large size of the transaction in question, the total monetary base will increase by a huge amount, estimated to be at around Rs. 155 billion. Each rupee issued by way of the monetary base will help commercial banks to create additional money in the region of about Rs. 6.50 over a period of about 18-24 months.

Thus, the foreign exchange receipt on account of the leasing of the Hambantota Harbour will create extraordinary inflation pressures in the economy in the next two-year period. To counter this, the Central Bank will have to increase interest rates and cut credit levels. Such a policy measure, known as a contractionary monetary policy measure, will tame inflation but at the same time cut down economic growth. This latter outcome is not something which Sri Lanka can afford at the moment since it has already begun to experience a declining trend in its growth rates.

Neutralising the leasing proceeds

To mitigate these adverse effects, Coomaraswamy revealed that the funds to be received by the Government on account of this transaction will be neutralised in the Central Bank through the adoption of a special procedure. Accordingly, two special accounts will be created in the Central Bank, with the Government’s approval, to make the entire transaction just a book entry.

The dollar component, which is in foreign exchange, will be debited to one account; the rupee component will be credited to the other account.

This will prevent the Government from using the proceeds for local expenses directly. At the same time, it will be neutral on the monetary base since no money will be released by the Central Bank to the public or the commercial banks. Thus, there will be no additional creation of new money by commercial banks. Coomaraswamy said that when the debt servicing on account of the loan raised to construct the Hambantota Harbour becomes due, the moneys in both the dollar account and the rupee account will be used for that purpose.

Accordingly, it will guarantee the debt repayment by the Government without affecting its annual revenue flows. This is similar to creating a sinking fund to facilitate specific foreign debt repayments. It is indeed a victory for the Central Bank to get the Government’s consent to forego the right to use the leasing proceeds for its ordinary expenditure programs, specifically at a time when the Government is faced with the problem of raising sufficient revenue to meet its expanding expenditure programs.

These are sound policies which the Central Bank is planning to adopt. They will deliver good results to the public in the long run. Hence, public support should be extended to the Central Bank to successfully implement these policies.

[W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected]]