Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 13 December 2022 00:40 - - {{hitsCtrl.values.hits}}

The Government’s initiative on organic agriculture, under former President Gotabaya Rajapaksa, came under severe criticism due to its failure. The failure is attributed to the sudden decision to convert from chemical fertilisers to organic fertilisers without following the directions in the Sri Lanka National Agriculture Policy.

The policy, under the sub-theme “Fertilisers”, states, “Promote production and utilisation of organic and bio-fertilisers and gradually reduce the use of chemical fertilisers through Integrated Plant Nutrition System (IPNS)”. Under the sub-theme “Pesticides”, it states, “Minimise the use of synthetic pesticides through promoting bio-pesticides and Integrated Pest Management (IPM)”.

Thus, it is clear that the crisis is due to the wrong way of implementing the national policy directives – instead of following a gradual transformation, implementing an abrupt change. Another reason for the failure is converting all kinds of crops into organic agriculture (i.e., Agricultural Scientists note that floriculture and crops grown in the hydroponic system need chemical fertiliser, at least to a certain extent).

However, the intellectuals, farmers, and general public are now divided primarily into groups for and against organic agriculture. On the other hand, some farmers, and companies, particularly start-ups, are involved in organic agriculture mainly for the export market. Let me first discuss the global market for organic food and beverages that we can access as a good source of foreign exchange.

Allied Market Research records that “the global organic food and beverages market size was valued at $ 187,485.6 million in 2020 and is estimated to reach $ 860,625.7 million by 2031, registering a CAGR of 14.9% from 2022 to 2031. The rise in awareness regarding the health among consumers and the various health benefits of organic food and beverages intake has encouraged the growth of the global organic food and beverages market.”

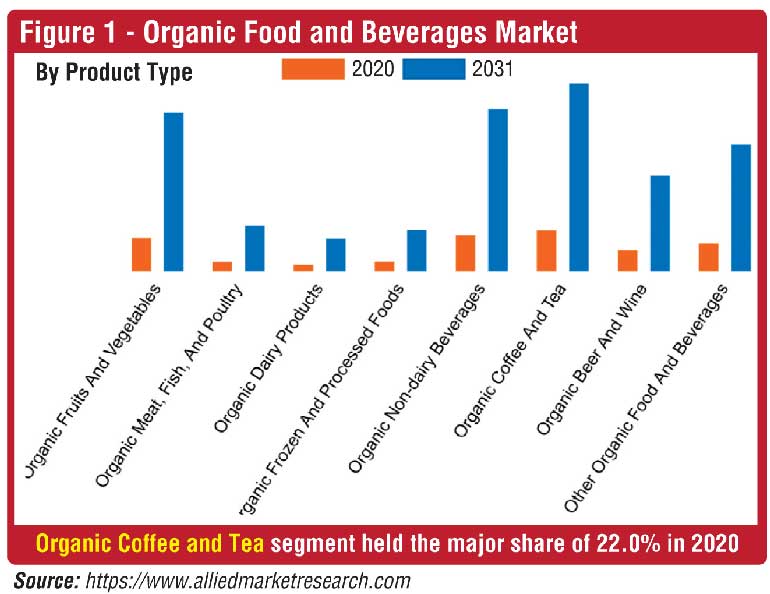

Figure 1 illustrates that the organic coffee and tea segment records the highest share (22% in 2020), and the estimated increase for 2031 is about four times the 2022 demand. So isn’t it time for Sri Lanka to think of capturing the global organic team market? The other two highly demanded segments are organic fruits and vegetables and organic non-dairy beverages.

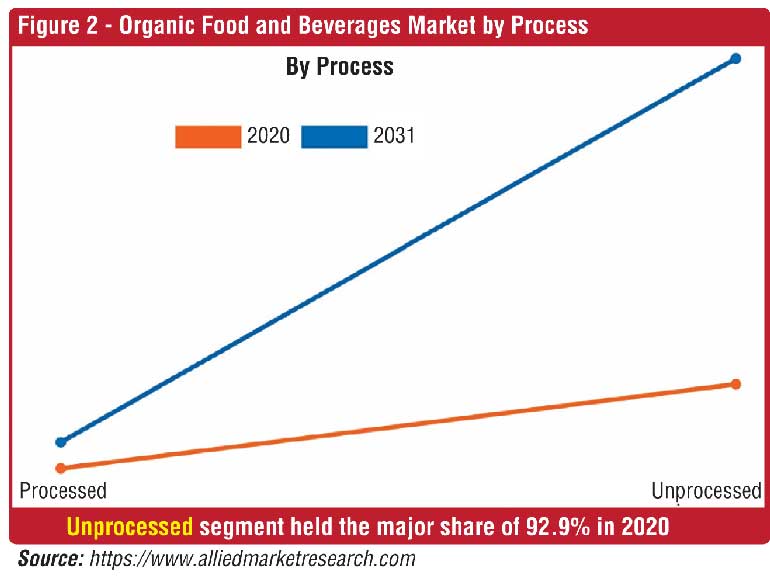

Further, Allied Market Research indicates that the share of the demand for unprocessed organic food and beverages in 2020 was 92.9% and continues to grow (Figure 2), illustrating the less capital investment needed for processing. North America holds the highest percentage of 47.0% of the total market share.

The Business Research Company records that “the global organic food market size is expected to grow from $ 227.19 billion in 2021 to $ 259.06 billion in 2022 at a compound annual growth rate (CAGR) of 14.0%. Furthermore, the global organic foods market is expected to grow to $ 437.36 billion in 2026 at a CAGR of 14.0% (https://www.thebusinessresearchcompany.com).

There are slight differences in the estimation of different research companies. However, they are talking about a market size of approximately $ 400 billion in 2026 and over $ 800 billion in 2030.

Having understood the global market situation for organic food, several private sector Sri Lankan companies have initiated exporting organic food and beverages, mostly Virgin Coconut Oil, Organic Coconut Flour, Natural Coconut Chips, Coconut Milk, Coconut-Kithul Spreads, Infused Virgin Coconut Oil, Coconut Water, Coconut Snacks, Desiccated Coconut, Tea, Spices, Fruits, Nuts, and Vegetables. As a result, the number of startups has been growing.

A research study published by the Hector Kobbekaduwa Agrarian Research and Training Institute in 2018 on “the Export Market for Organic Food: Present Status, Constraints and Future Scope” lists 38 companies involved in the export of organic food and beverages. The report indicates that the extent of land under organic agriculture in Sri Lanka in 2011 was 19,469 hectares, which was only 0.5% of the country’s total land area.

The report further indicates that organic tea experiences a 30-50% lower yield than conventional tea. However, it fetches a minimum of 2-3-fold higher prices in the global market.

To access the global organic food market significantly, the study recommends the Government take measures such as (i) improving the quality of research for the development of value-added products, (ii) training programmes for producers, (iii) promoting certification programmes, (iv) developing national policies for organic food production and promoting Sri Lanka’s organic products at international fairs, (v) Providing a substantial subsidy for organic growers, (vi) promoting organic exporters to join forces to promote and market their products (vii) tax concessions to the organic food processors and exporters, (viii) subsidies for organic inputs, (ix) establishment of the third country registration unit under the Ministry of Export Development as the control authority in Sri Lanka.

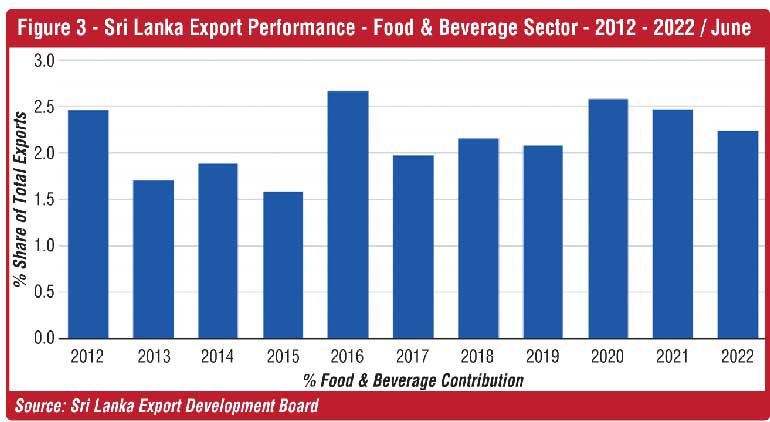

As a whole, Sri Lanka’s export earnings from goods continuously performed well. The value of total merchandise exports increased from $ 7,444.90 million in January-September 2020 to $ 9996.19 million in January-September 2022. The export earnings from Food and Beverages, Vegetables, and Fruits and Nuts increased from $ 323.21 to 366.92 million during the same period (Source: Sri Lanka Export Development Board - https://www.srilankabusiness.com).

Thus, Sri Lankan exporters are mature and experienced in dealing with international markets. As proposed above, Government support at the policy level can make the exporters and growers of organic food and beverages increase the export volumes and capture the ever-growing global market.

In 2021 our food and beverages export earnings from the US was $ 28.32 million (Source: Export Development Board - https://www.srilankabusiness.com), while USA’s organic food and beverages market size alone stood at $ 23,733.7 in the same year (source: https://globalorganictrade.com). Regarding overall food and beverages exports, we have concentrated more on our traditional markets – India ($ 67.22 in 2021) and Maldives ($ 30.03 in 2021) – Source: Export Development Board.

Although we have gradually expanded to the USA, Singapore, the Middle East, and Japan, the organic food and beverages market exploitation, particularly in North America, Europe, and Japan, is still insignificant.

Sri Lanka has passed $ 300 million annually from the export of food and beverages. However, we have not concentrated significantly on supplying organic food and beverages to high-end markets. If we can exploit just 2% of the $ 800 billion global organic food and beverages market, it will generate $ 16 billion in export earnings per annum.

About 40 years ago, only one agricultural B.Sc. degree course was offered at Peradeniya University. However, over the next 40 years, agricultural degree programs were diversified to cater to the growing demand in specialised subject areas and introduced to 10 universities.

(i) Perdadeniya University - B.Sc in Agricultural Technology and Management, B.Sc. in Food Science and Technology, B.Sc. in Animal Science and Fisheries

(ii) Ruhuna University - B.Sc. in Agricultural Resource Management and Technology, B.Sc. in Agri-Business Management, B.Sc. in Green Technology

(iii) Wayamba University - B.Sc. in Agri-Business Management, B.Sc. in Biosystems Engineering, B.Sc. in Biotechnology, B.Sc. in Horticulture and Landscape Gardening, B.Sc. in Plantation Management

(iv) Uva Wellassa University - B.Sc. in Animal Science, B.Sc. in Aquatic Resource Technology, B.Sc. in Export Agriculture, B.Sc. in Tea Technology and Value Addition

(v) Sabaragamuwa University - B.Sc. Agricultural Sciences and Management, Commercial Horticulture, Plantation Management and Livestock Production

(vi) Jaffna University – several specialised courses through six departments, namely Department of Agronomy, Department of Animal Science, Department of Agri Biology, Department of Agricultura Chemistry, Department of Agricultural Economics, Department of Agricultural Engineering

(vii) Eastern University - B.Sc. in Agriculture

(viii) Rajarata University – B.SC. in Agriculture

(ix) Open University - Bachelor of Technology (BTech) Honours in Agriculture and Plantation Engineering, Bachelor of Industrial Studies Honours – Agriculture

(x) Colombo University - Bachelor of Biosystems Technology Honours in Agriculture. In addition, there are a large number of diverse diploma and certificate-level courses offered by Technical Colleges

Thus, academically Sri Lanka produces adequate high-quality graduates and diploma holders to transform Sri Lanka’s agricultural sector to be competitive with any other country. However, it appears that after completing the studies, they fall into the “Job seekers” category rather than getting into “Agri-Business”. Therefore, to get the optimum accessibility to $ 800 billion worth Global Organic Food and Beverage Market, it is necessary to:

Establish “Incubators” to provide the graduates/diploma holders and entrepreneurs with information and global opportunities, connections

Establish a land management system to optimise the productivity of state lands and to lease them to start-ups on concessionary rates for export-oriented agriculture

Develop a payment system for everybody in the supply chain (i.e., growers, processors, exporters) in Foreign Currency (This will significantly reduce the forex losses through mis invoicing and encourage newcomers into export-oriented agriculture)

Provide a concessionary financing system for start-ups

Develop business plans for the Institutions under the Ministry of Agriculture to capture the global food and beverages market

Financial and Business support for R&D activities of the agricultural institutions, particularly that of endemic crops (i.e., I understand that the Department of Agriculture has improved local tangerine (Heen Naran) to fit into the global market). Such Research and Development Activities need to be taken forward for practical implementation.

(The writer is a Fellow of the Institute of Town Planners Sri Lanka (FITPSL), an Honorary Fellow of the Planning Institute of Australia (HFPIA), and a Past President of the Institute of Town Planners, Sri Lanka. He could be reached via email at [email protected].)