Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 1 November 2022 00:00 - - {{hitsCtrl.values.hits}}

Eradicating corruption alone would be adequate for Sri Lanka to overcome the current economic crisis

‘Corruption’ has been a subject of global presence, particularly during the last 40 years. Although corruption existed at various scales throughout the world, it was insignificant before the 1980s, after which it became a pandemic that even led some countries to develop social and political unrest to the extent of their collapse. The significance of mitigating corruption lies in developing investor confidence and creating enabling global business environment.

Unfortunately, Sri Lanka has been earning a bad reputation for corruption. “Sri Lanka Brief”, quoting the reports of “Global Financial Integrity”, records that “Sri Lanka’s illicit money outflows are worse than that of notorious drug haven Colombia at $ 14.74 billion, and several million less than that of Panama, data show”. It is not surprising that there exists a direct positive relationship between the level of development and corruption.

The corruption perception index of Transparency International 2015 records that “If there was one common challenge to unite the Asia Pacific region, it would be corruption. From campaign pledges to media coverage to civil society forums, corruption dominates discussion”.

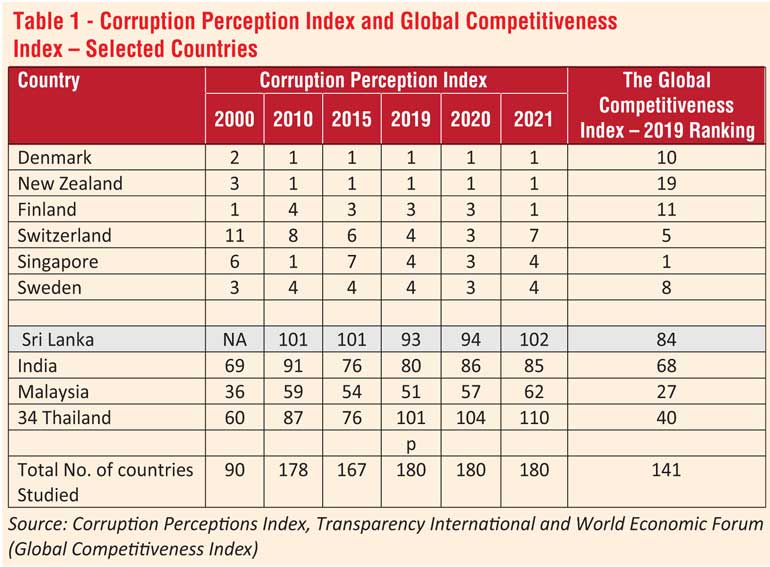

The least corrupt nations in the world are primarily small countries (Table 1), and they are some of the richest, illustrating a positive and robust relationship between the level of corruption and the development status. Further, a direct and positive relationship exists between the level of corruption and competitiveness. The least corrupt countries are the most competitive, and vice versa (Table 1). In Asia, the wealthiest countries (i.e., Singapore, Japan, South Korea, Australia, and New Zealand) record the least corruption levels and high competitive indexes. Sri Lanka has been at higher levels of corruption. There was a significant drop in 2019. However, it rose again from 2020 to 2021, recording a change of -1. Regarding competitiveness, India, Malaysia, and Thailand are comparable countries in Asia to Sri Lanka. Although the corruption levels in India and Malaysia are lower than in Sri Lanka, they have also been rising continuously.

A discussion on “Global Trade” on YouTube on 30 August 2022 by “Advocata” (Source: https://www.youtube.com/watch?v=80QGnzTL2QA) disclosed some alarming information on corruption. During the program, Professor Premachandra Athukorala of the Australian National University, referring to one of his studies in 2013 for the World Bank, revealed that 260 BOI-registered export-oriented companies left Sri Lanka due to corruption-related issues.

The publication on “Trade-related illicit financial flows in 134 developing countries 2009 – 2018” by Global Financial Integrity reveals that due to mis-invoicing the total value gap Sri Lanka experienced from 2009-2017 as a percentage of total trade was 20.3% in 2009, 21.2% in 2010, 19.4% in 2011, 20.0% in 2012, 16.0% in 2013, 18.5% in 2014, 19.1% in 2015, 18.5% in 2016, and 19.5% in 2017 (Average 19.2%). The report related to Sri Lanka records the sums of the value gaps identified in trade between 134 developing countries and all of their global trading partners from 2009-2018 in USD millions as in Table 2.

Thus, from 2009 to 2017, the total amount of illicit financial outflow from Sri Lanka was $ 36,833 million (36.833 billion). The total external debt of Sri Lanka as of the end of 2021 was $ 50,724.21 million ($ 50.72 billion) – (Source: Central Bank of Sri Lanka). Thus, the total outflow of USD from 2009 to 2017 due to mis-invoicing was approximately 73% of the total external debts. Hence, it appears that curtailing illicit outflow of foreign exchange through mis-invoicing itself would be adequate to resolve Sri Lanka’s current forex issue.

The report proposes the following measures to curtail the forex losses due to mis-invoicing:

At the national level:

(i) Make trade mis-invoicing illegal (adopt legislation that clearly criminalises trade mis-invoicing and ensure that the associated penalties are substantial enough to serve as an effective deterrent)

(ii) Strengthen law enforcement capacities of customs authorities (establish specialised asset forfeiture and recovery units at the national level)

(iii) Establish multi-agency teams to address customs fraud, tax evasion and other financial crimes

(iv) Implement trade mis-invoicing risk assessment tools (Governments should invest in equipping customs authorities with strengthened IT and data technologies to build capacity

(v) Strengthen customs oversight of Free Trade Zones (FTZs)

(vi) Establish National Trade Facilitation Committees

At the international level:

(i) Expand information-sharing between importing and exporting countries

(ii) Explore the use of distributed ledger technology to identify trade mis-invoicing

The level of corruption is a significant indicator of creating enabling business environment. Corruption in Sri Lanka is interwoven among the politicians, public, and private sectors and thus requires a comprehensive and long-term strategy to eradicate it. Sri Lanka needs to work out effective anti-corruption systems as a primary requirement of rising from the ash. Corruption can be reduced to a significant level by introducing virtual systems. In addition to commissions and bribes, the primary sources of illegal money, it should also address sealing loopholes in tax leakages, a key source of black money in the country. Introducing an advanced automated tax collection system, keeping the human intervention minimal, similar to the USA, would be an efficient way. Achieving a low corruption perception index will increase the competitiveness in the doing business index attracting high-level foreign investors. According to the statistics provided by Global Financial Integrity, eradicating corruption alone would be adequate for Sri Lanka to overcome the current economic crisis.

When a country is corrupt and is globally known, it creates chain effects in expediting the collapse of the economy. While high-end investors refrain from investing, the country becomes a breeding ground for black money laundering.

(The writer is Fellow, the Institute of Town Planners Sri Lanka (FITPSL), Honorary Fellow, Planning Institute of Australia (HFPIA), and Past President, Institute of Town Planners, Sri Lanka. He could be reached via email at [email protected].)