Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 9 October 2023 00:25 - - {{hitsCtrl.values.hits}}

We can achieve debt sustainability in the medium to long run without vandalising the pension funds and the living conditions of the general public by expediting the legal trials against tax evasion

|

The Central Bank of Sri Lanka (CBSL), and the unmandated Ranil-Rajapaksa regime have plundered half of the future incomes of the Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF) through the Domestic Debt Restructuring (DDR) program, enforced from September 2023 until 15 February 2038. This article shows how CBSL performed this act of financial terrorism; how the catastrophic impact of DDR on pension funds is demonstrable through calculation; and proposes ways of reversing this damage.

The Central Bank of Sri Lanka (CBSL), and the unmandated Ranil-Rajapaksa regime have plundered half of the future incomes of the Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF) through the Domestic Debt Restructuring (DDR) program, enforced from September 2023 until 15 February 2038. This article shows how CBSL performed this act of financial terrorism; how the catastrophic impact of DDR on pension funds is demonstrable through calculation; and proposes ways of reversing this damage.

The anatomy of plunder

The custodian of the EPF, the CBSL Governor, states shockingly that plundering pension funds and excluding private bondholders from the DDR is in the best interests of the fund. In response to the criticism raised by Dr. Nishan De Mel at Verité Research that no country apart from Sri Lanka has exclusively subjected pension funds to DDR, the Governor claims that it’s a “unique solution” to the debt crisis “discovered” by local experts and that Sri Lanka does not need local experts to implement the same procedures practiced elsewhere in the world! (see Keynote speech by Governor at the Inauguration of CMA National Management Accounting Conference 2023 on the CBSL YouTube channel). As outrageous and delusional as this statement sounds, the CBSL Governor must be reminded that no other country has exclusively targeted pension funds in DDR because no civilised administration would plunder the only means of survival of their workers after their retirement.

During the same keynote speech and at the discussion with trade union representatives on 5 September, the Governor made a ridiculous argument to reduce the four-fold process of trade mis-invoicing to under-invoicing of imports. He categorically stated that there is no outflow of foreign exchange through trade mis-invoicing. It is a great “discovery” he made to save the business elite in the import and export sector from facing legal trials on illicit capital flows and tax evasion that destabilise the economy. We would not waste words in refuting his delusions as it should be clear that the Governor was trying to fraudulently establish that there is no other alternative than slashing the EPF/ETF funds to reduce the Government’s debt financing costs.

Furthermore, Dr. W.A. Wijewardena and Chandra Jayaratne have shown that 14% gross tax paid by all members of the EPF, regardless of their annual incomes, is a steeper burden than the net tax of around 48% paid by the commercial banks, 30% profit tax paid by corporates on net income and income tax paid by individuals on a progressive basis. The latter excludes income less than Rs. 1.2 million per annum and imposes a 6% tax up to a maximum of 36% on income brackets increasing by Rs. 500,000 per annum. Therefore, increasing the gross tax imposed on pension funds refusing to participate in the DDR from 14% to 30% is an act of coercion and financial terrorism, forcing the members of the pension funds to decide which limb they prefer to dismember.

It is patently unfair to exclude private bondholders from DDR, allowing them to reap super profits in the financial markets both in the form of capital gains and interest yields. From Rs. 1,754.1 billion worth of high-yielding treasury bonds issued last year, private bondholders including banks purchased 75.7% (Rs. 1.33 trillion) while superannuation funds purchased only 21% (Rs. 369.9 billion) (calculated using Table 107 of CBSL Annual Report, Statistical Appendix 2022. See Table 1 below), indicating that DDR has excluded the highest cost bonds. (This fact was maliciously refuted by the CBSL Governor at the 5 September meeting with trade unions. We have produced the CBSL Annual Report data below). Capital gains of private bondholders exceed 100% now that the market interest rates have fallen to around 15%. This is reflected by a 500% to 1,000% increase in profits of primary dealers and over 400% increase in profits of the commercial banks in the second quarter of this year (see Colombo Stock Exchange financial reports) while credit growth to the private sector is negative 7.6% up to July this year (CBSL), and the GDP contracted over 11% and 3% in the first two quarters (Census and Statistics).

On the other hand, contrary to the claims of the CBSL Governor, reducing yields of privately held bonds would have no adverse impact on the banking system if high interest yielding fixed deposits issued last year and early this year are renegotiated to current market levels. The impact on the net liquidity position of the banks will then be zero. Furthermore, it would boost future lending capacities of the banking system and hence enable the sector to return to their normal banking business of lending, from speculating on Government debt.

On the other hand, contrary to the claims of the CBSL Governor, reducing yields of privately held bonds would have no adverse impact on the banking system if high interest yielding fixed deposits issued last year and early this year are renegotiated to current market levels. The impact on the net liquidity position of the banks will then be zero. Furthermore, it would boost future lending capacities of the banking system and hence enable the sector to return to their normal banking business of lending, from speculating on Government debt.

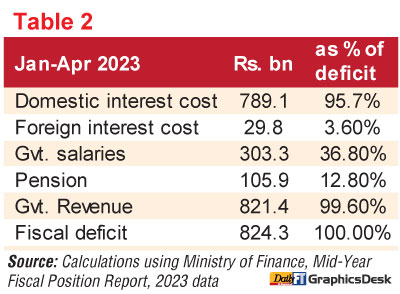

Therefore, DDR is absolutely necessary to reduce the exceedingly high Gross Financing Needs of the Government. For instance, the Government spent Rs. 789.1 billion on servicing the domestic interest cost and only 29.8 billion on foreign debt interest payments totalling Rs. 819 billion, which is almost equal to the total Government revenue of Rs. 821.4 billion in Jan-Apr 2023. The domestic interest payments cost is 95.7% of the fiscal deficit of Rs. 824.3 billion and foreign debt interest payments were only 3.6% of the deficit during the period (see Ministry of Finance, Mid-Year Fiscal Position Report, 2023, p. 14-26). Expenditure on Government salaries (Rs. 303.3 billion) and pension (Rs. 105.9 billion) on the other hand, totalled only Rs. 409.2 billion, or nearly half of the interest cost on domestic debt during the period (see Table 2). Despite this, the public sector salaries cost is framed as the major cause for the gaping hole in Government finance by neoliberals.

The burden of foreign debt interest payment is insignificant because interest rates and therefore, interest payment on multilateral loans, which the Sri Lankan Government is still financing, is low. Foreign debt interest payment is insignificant in 2023 also because the Government defaulted on bilateral and commercial debt in April 2022. On the other hand, interest payments on domestic debt increased by Rs. 447.2 billion in Jan-Apr 2023 compared to the same period the previous year, indicating that 56.7% of the payments were absorbed by the borrowings made in 2022. This shows that those who own the domestic debt, of which the highest interest yielding bonds are with the private sector, as shown before, are absorbing a greater share of Government resources, which would have been available for providing relief to the broken livelihoods of the people, restoring the collapsing public services and transforming the productive sector of the economy.

However, an unproductive rentier elite is absorbing Government resources in the form of interest payments with no productive contribution to the economy, by purchasing the lion’s share of the highest yielding bonds last year, benefiting from an economic collapse that erupted due to the specific mode of their surplus appropriation, among other reasons. High interest rates are not proof of their entrepreneurial skill it indicates the opposite, or the domination of interest, rent and capital gains in the distribution of national income as opposed to productive sector profits and wages. Hence, DDR should be enforced on the bonds they hold, and not on those held by workers under the EPF and the ETF.

Refusing to address odious debt

The decision to exclusively target pension funds satisfies the whims and fancy of the tax evading, trade mis-invoicing counterproductive business elite holding the highest yielding treasury bonds. They work hand in hand with the political establishment, responsible for over Rs. 5.5 trillion in assets excluded from Government accounts borrowed for financing public investments between 2006 and 2021 (see Table 12 of Auditor General’s Annual Report 2021, p. 114). It means to say that only Rs. 2.7 trillion in assets remain in possession of the State appropriated through Rs. 8.2 trillion in borrowed funds; i.e., 67.5% of the total borrowings financing Government projects during the period are unaccounted. The US dollar value of this amounts to a staggering 41.1 billion. It is over 87% of the total outstanding foreign debt of Sri Lanka at the end of 2022. Therefore, over two-thirds of the debt that financed public investments since 2006 can be declared as odious debt in international courts. International law and US law both hold that the public should not be burdened and punished by repaying debt that did not benefit them. Nevertheless, the Government and the CBSL refuse to address the issue and undertake legal proceedings internationally.

The Government also borrowed extensively to finance a genocidal war, killing thousands of civilians and inflicting unspeakable suffering on the people of the North and East. International investigations such as those of the United Nations and the Government’s own Paranagama Commission documented these atrocities, which amount to war crimes. Now, the Sinhalese Government is demanding the people of the North and East to repay the debt which financed the slaughter of their own people. The British colonialists followed the same brutal principle; they taxed the populations they subjugated and murdered to recover the costs of their own murderous invasions. The ethnic dimension of the debt crisis must be a central question in seeking justice, accountability and an equitable solution.

Tax evasion exceeding cuts to EPF/ETF

Tax evasion exceeding cuts to EPF/ETF

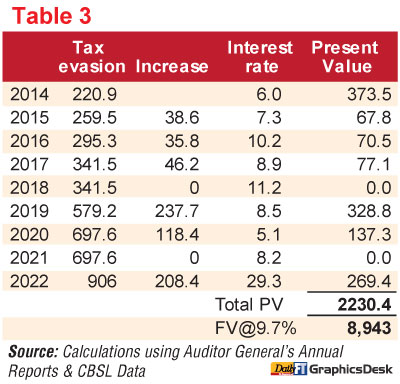

The present value of evaded taxes between 2014 and 2022 amounts to approximately Rs. 2,230.4 billion. Its future value by 2037, compounded by 9.7% per annum, amounts to Rs. 8,943 billion – as much as three times greater than the highest impact estimated on the pension funds due to DDR (see Table 3 and Method 1). In this light, it is clear that the business elite and the political establishment are entirely responsible for the ongoing collapse and the humanitarian crisis facing Sri Lanka. They criminally reap super profits with complete impunity, while workers who keep the economy alive must pay for the consequences. The regime’s message to the public through DDR is crystal clear: ‘We’ll extract your labour until you can no longer serve. Whether you survive afterwards is not our concern’.

A recent survey by the Centre for Policy Alternatives revealed that as much as 69.5% of the public is unaware of the DDR process, and 62.2% did not approve it, making it clear that the current despotic regime is serving the interests of a criminal elite while holding the public at gunpoint. The CBSL and its Governor did not reveal the exact details of slashing EPF/ETF returns before enforcing it on the members through parliamentary approval. The CBSL exchanged 49 bonds amounting to Rs. 3.2 trillion, of which 11 bonds yielded an average of 24.6%, with 12 bonds yielding only 9.7%. The CBSL did not reveal this information to the members until they enforced the DDR on 11 September. It is a pillage of workers’ retirement funds and a ruthless violation of the fundamental rights of the members of the funds and the constitution by the custodian of the EPF; it’s an act of financial terrorism by the US-backed Government.

The Governor concealed the damage to the EPF in his empty rhetoric at a recent Public Finance Committee meeting. He stated that the loss to the fund by the end of 2037 is only 4% due to DDR. Committee Chairman MP Dr. Harsha de Silva disingenuously supported it without assessing the difference in weighted average yields of the pre-DDR and DDR Treasury bond portfolios, demonstrating the loss of compounded cash flows and the Terminal Value loss to the fund from the slashed return.

The CBSL refused and failed to use the DDR to address key factors which led to the economic fallout and destitution. In the following account, we intend to demonstrate the colossal damage inflicted on pension funds through DDR. We demand the implementation of alternatives presented below to reverse the damage while at the same time remaining close to achieving the intended reduction of annual Gross Financing Needs of the Government by 0.5% of the GDP, as proposed by the CBSL in their initial presentation to the parliamentarians on DDR in July this year.

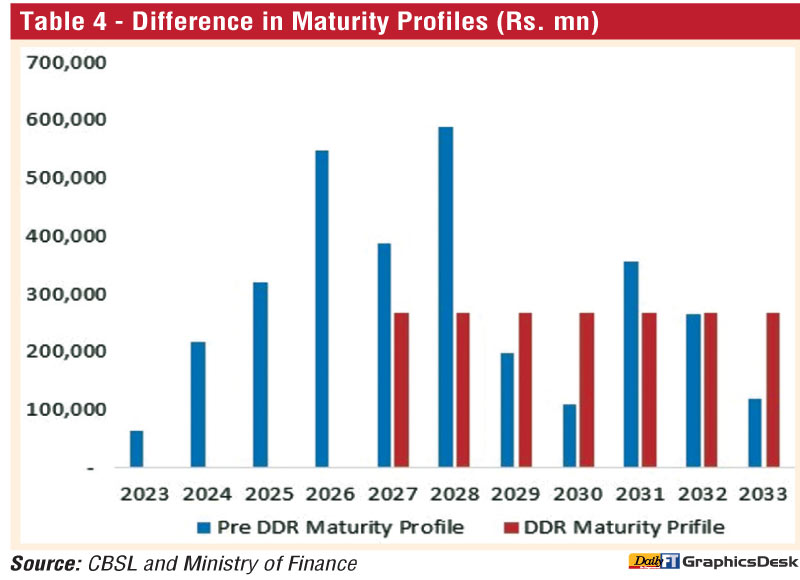

We have two methods at our disposal to calculate the impact of DDR. By applying the difference in the weighted average yields of pre-DDR and DDR Treasury bond portfolios to either of the portfolios, we can calculate the total of lost cash flows, which gives two final results. Given that the maturity profiles of the two portfolios are incompatible, the total cash flows of the two methods will be unequal. The portfolio consisting of a long-term maturity period without bunching up of maturities early in the timeline will yield a higher cash flow and vice versa. Table 4 demonstrates that two-thirds of the principal value of the pre-DDR portfolio, or approximately Rs. 2.1 trillion out of the Rs. 3.2 trillion, would have matured by 2028, whereas two-thirds of the DDR portfolio of 12 bonds mature only by 2034. Given that the maturity profiles of the two portfolios are significantly different, we have to use them separately to calculate the loss in cash flows, which yields two distinct results. Nevertheless, the percentage loss to the portfolio will not differ significantly, which remains the key in our assessment.

Let’s simplify this idea in a more comprehensible example. For instance, if we extend the maturity of a five-year bond yielding 10% per annum to ten years and slash the interest rate to 5%, it is incorrect to say that cash flow loss after restructuring is zero. We compare the difference in returns of two bond portfolios, especially when their maturity profile is different, by comparing the difference in their weighted average yields and not by assessing the difference in total cash flows. However, this is the opposite of what the apologists of DDR want the public to believe. In the above example, both cash flows are equal. But the bond yielding 10% stopped generating income after maturing in five years, while the 10-year bond will continue generating cash flows at half the rate. This example demonstrates the error committed by those who say that the loss to the pension funds due to DDR is merely 4% to 6%. Among them are the CBSL Governor, Dr. Harsha de Silva MP and Murtaza Jafferjee of Advocata Institute.

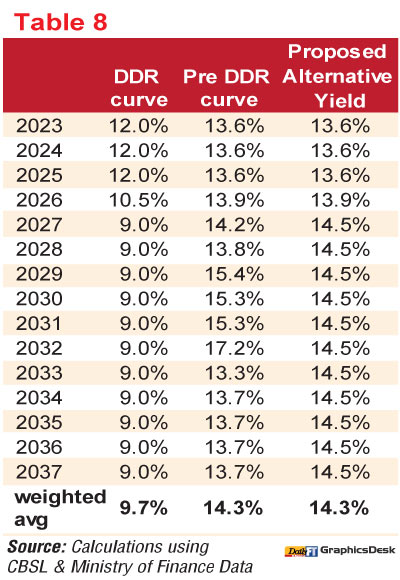

Let’s now dive straight into our calculations. We will first assess the compounded cash flow loss by applying the difference in weighted average yields of the two portfolios to the newly issued DDR portfolio consisting of 12 bonds, each with a principal value of Rs. 267,038.5 million and weighted average annual return of 9.7% before tax and management costs. How was the weighted average return calculated? Each DDR bond pays an annual return of 12% in semi-annual coupon payments until 2025. Which means it will yield only one coupon payment in 2023. In 2026, the first and second semi-annual coupons pay 12% and 9%, providing an annual yield of 10.5% (see CBSL announcement on 14 September 2023). The portfolio’s annual return falls to 9% through step-down coupon rates from 2007 to 2037. The weighted average return of this portfolio is 9.7% per annum, which declines to 7.6% after deducting 14% gross tax and management costs.

Similarly, we follow the same steps to calculate the weighted average return of the pre-DDR bonds portfolio. How do we do this? The weighted average yield of the pre-DDR portfolio was 13.6% in October 2023, calculated using the pre-DDR treasury bonds portfolio data of pension funds released by the Ministry of Finance on 14 September and data published by the CBSL on the Government’s outstanding treasury bonds portfolio. After deducting 14% gross tax and 0.7% management costs, the net return falls to 10.99%, equal to the rate announced by the Superintendent of the EPF at the Public Finance Committee meeting on 7 September 2023.

Weighted average yield changes when bonds mature and exit the portfolio. To be comparable, we need to calculate it for the pre-DDR portfolio annually, up to 2037, by excluding the maturing bonds. The annual average of this is 14.3% before taxes and expenses. Even without calculating the compounded cash flow losses and the Terminal Value loss on the difference in yields, we can immediately see that the 9.7% average yield of DDR portfolio is 32.2% below 14.3% return of pre-DDR portfolio. This loss ratio is over five to eight times greater than what the CBSL and other apologists of DDR want the public to believe.

Now, we can calculate the lost cash flows from slashed interest rates and compound it to arrive at the total nominal cash flow loss due to DDR and the loss ratio. We will first apply the difference in weighted returns to DDR portfolio of 12 bonds before tax and expenses, which we may call Method 1. The latter should be the preferred method, given that the DDR portfolio is currently active and the proposed alternatives demand adjustments to the coupon rates of the DDR bond profile while retaining its new maturity profile.

Method 1 shows a total cash flow loss of Rs. 1,266.4 billion before compounding up to 2037. When compounded by 9.7% annually (the DDR yield which CBSL agreed to pay), the total nominal cash flow loss increases to Rs. 2,933.8 billion, deriving a loss ratio of 50.01% before the Terminal Value loss of Rs. 2.1 trillion is added (see Method 1 Table). The Terminal Value loss estimates the return lost till perpetuity by permanently losing income from interest rate reduction on the new portfolio. (In calculating the Terminal Value loss, we applied the Central Bank’s long-term expected inflation rate of 4.5% as the growth rate, the rate of return is 9.7% before tax and expenses, and the annual average of the compounded cash flow loss as the cash flow at the final period of calculation in applying the Perpetuity Growth Method or Gordon Growth Model).

Tables 5 and 6 show that up to 2025, loss to the fund is minimal at 2.6% due to a higher coupon rate payment of 12% in the DDR portfolio and the weighted return of the pre-DDR portfolio remaining below 14%. However, from 2027 onwards, loss to the fund accelerates with stepdown coupon rates of DDR and the increase in weighted yields of the pre-DDR portfolio.

In Method 2, we apply the same procedure to the pre-DDR portfolio of bonds. It yields a loss ratio of 48.2% with a total cash flow loss of Rs. 634.4 billion and a compounded cash flow loss of Rs. 1,711 billion (see Method 2 Table below). As discussed earlier, given that over 65% of the pre-DDR portfolio matures by 2028, the total loss of compounded cash flow is lower in Method 2 than in Method 1. However, more importantly, the loss ratio is 48.2%, significantly close to 50.01% derived in Method 1.

Alternative yield curve to reverse the loss

Alternative yield curve to reverse the loss

In this light, it is clear that the damage to the fund due to DDR is colossal, contrary to the assessment of the CBSL and other apologists of DDR. Note that the yield curve of the DDR bond portfolio is inverted and downward sloping, which means that the custodian of the EPF completely disregarded the time value of future cash flows of the pension funds (see Figure below). From our discussion thus far, it is clear that the Government hopes to delay the debt repayments by extending the maturity profile of the pre-DDR bonds, of which Rs. 2.1 trillion would have matured by 2028.

To reverse the damage inflicted on the fund by the DDR and at the same time remain close to the Gross Financing Needs target set by the IMF, we propose to:

The proposed revision to the coupon rates will only reverse the 0.1% reduction of GDP from Gross Financing Needs (GFN), which the CBSL aimed to achieve by slashing the interest yield of treasury bonds held by pension funds. It will retain the 0.4% of GDP saved through maturity extension and entirely reverse the damage to the fund while enabling the CBSL to reach 0.4% of the targeted reduction of 0.5% of the GDP of GFN.

We can achieve debt sustainability in the medium to long run without vandalising the pension funds and the living conditions of the general public by expediting the legal trials against tax evasion, starting from the largest frauds, and declaring the misappropriated Government borrowings as odious debt and bringing the perpetrators to justice. These demands are realistic and are only impossible to reach within a reality shaped by the interests of criminals. Hence, let us demand a different reality, which does not imperil the futures of ordinary Sri Lankans.

(The writer is an economic analyst.)