Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 2 July 2024 00:02 - - {{hitsCtrl.values.hits}}

President Ranil Wickremesinghe

Treasury Secretary Mahinda Siriwardana

The Treasury is aware that the country is in a difficult place. But that difficulty is not visible on the surface. Fuel is available, electricity is available and public and private transportation is in place. It’s the mirage that seems to matter to most rather than reality

“At the Treasury we are aware that the country is in a difficult place. But that difficulty is not visible on the surface. Fuel is available, electricity is available and public and private transportation is in place. As public servants, we got our salaries because the government didn’t impose pay cuts like in Greece during the bailout program of the International Monetary Fund. That’s a good thing. But we still pay the salaries with difficulty” – Mahinda Siriwardana, Secretary to the Treasury and the Ministry of Finance (https://island.lk/treasury-secretary-urges-public-to-have-a-pragmatic-view-of-economy-and-fiscal-discipline/)

“At the Treasury we are aware that the country is in a difficult place. But that difficulty is not visible on the surface. Fuel is available, electricity is available and public and private transportation is in place. As public servants, we got our salaries because the government didn’t impose pay cuts like in Greece during the bailout program of the International Monetary Fund. That’s a good thing. But we still pay the salaries with difficulty” – Mahinda Siriwardana, Secretary to the Treasury and the Ministry of Finance (https://island.lk/treasury-secretary-urges-public-to-have-a-pragmatic-view-of-economy-and-fiscal-discipline/)

The Secretary to the Treasury and the Ministry of Finance has, in a nutshell, given a picture of the overriding ethos in the country when it comes to its economy. While there are signs of some economic stability as noted in the two reports mentioned below (EconomyNext and the Central Bank of Sri Lanka), it’s the mirage rather than the reality that seems to be what matters for most. There is hardly any discussion about the debt level of the country at a public level although the high level of debt did not happen overnight. Besides this, there is no discussion about how this debt is to be paid and there seems to be a pervading indifference about this and an expectation that fuel has to be available, electricity has to be available and public and private transportation has to be in place irrespective of whether such provisions are funded with debt or with the country’s own funds.

To be fair by the public, their attitude has a direct connection with their lack of confidence as to how governments manage expenditure although perversely, this also has a connection with the public attitude that governments are there to provide all what they need and also want, irrespective of the cost of such provisions. This catch 22 situation is a major challenge facing the country as the means to economic growth and stability, which necessarily must be strategic and long term, are not viewed as such by the public. Political parties that promise overnight short term benefits from political platforms win elections.

Currently, there is data that shows the country has achieved some economic stability in the last two years under the stewardship of President Ranil Wickremasinghe. The following two reports, no doubt among many others, provide some evidence to this effect.

EconomyNext (https://economynext.com/sri-lanka-central-govt-debt-to-gdp-at-100-pct-by-march-2024-168424/) in an assessment of the economy says that Sri Lanka’s central government debt has fallen to 100.56% of gross domestic product by March 2024, down from 105.49%, amid an economic recovery and exchange rate stability. Sri Lanka’s economy grew 8.4% nominally in the March 2024 quarter, taking the rolling GDP up to Rs. 28,249 billion from 27,629 as the Central Bank provided monetary stability through deflationary policy, for economic agents to work and generate value.

The Central Bank also allowed the rupee to appreciate to 301 by March from 323 in December amid deflationary policy. It is suggested that this report by EconomyNext and also the Central Bank’s Annual Economic Review 2023 (https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-economic-review/annual-economic-review-2023) are examined by discerning readers as they present the economy of the country as heading towards a healthier situation.

This is important as the pessimism and doom and gloom felt by many and promoted by some for political purposes, may not all be true and as there is room for some degree of optimism. However, unless the current trajectory is maintained and long term and strategic thinking takes over from short term quick fixes, the economy is bound to run into quicksand sooner rather than later.

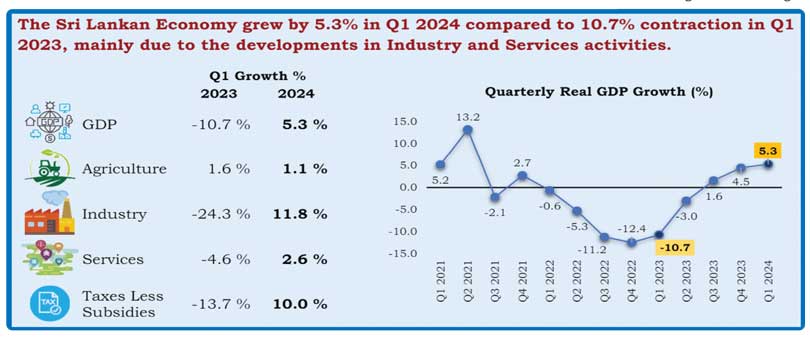

The given Central Bank table for Q1 2024 also supports the annual review for 2023 that a degree of economic stabilisation has indeed occurred (https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/national_accounts_estimates_2024_q1.pdf).

These data sets need to be recognised and given publicity, the contents discussed and debated, as it is important to provide some degree of confidence to the people of the country and possible investors who otherwise will only hear the doom and gloom political platform speeches by Opposition leaders. The fact that no alternative plans, leave alone strategic plans, but even one-year plans, are yet to be presented to the public by them, makes it all the more important to examine the long-term policies and plans of the current Government.

However, despite these somewhat optimistic reports, the World Bank in its biannual update for 2024 titled Bridge to Recovery says, “Sri Lanka’s economy is projected to see moderate growth of 2.2% in 2024, showing signs of stabilisation, following the severe economic downturn of 2022. But, the country still faces elevated poverty levels, income inequality, and labour market concerns. The poverty rates continued to rise for the fourth year in a row, with an estimated 25.9% of Sri Lankans living below the poverty line in 2023. Labour force participation has also seen a decline, particularly among women and in urban areas, exacerbated by the closure of micro, small, and medium-sized enterprises (MSMEs). Households are grappling with multiple pressures from high prices, income losses, and under employment. This has led to households taking on debt to meet food requirements and maintain spending on health and education.” (https://www.worldbank.org/en/news/press-release/2024/04/01/sri-lanka-s-economy-shows-signs-of-stabilization-but-poverty-to-remain-eleva

ted#:~:text=COLOMBO%2C%20April%202%2C%202024%E2%80%94,severe%20economic%20downturn%20of%202022)

The World Bank update possibly shows the reality in the country and the need for serious discussions by all responsible persons as to the need for long term strategic thinking and economic planning. So far, even the Presidential aspirants from the major opposition political combines, who regularly criticise the President and the Government about failures and shortcomings, are yet to offer their alternatives to the Government’s trajectory.

In regard to the debt to GDP ratio, Investopedia, a leading global financial media website headquartered in New York City, founded in 1999, and providing investment dictionaries, advice, reviews, ratings, and comparisons of financial products, such as securities accounts, says that the debt-to-GDP ratio is the metric comparing a country’s public debt to its gross domestic product (GDP). By comparing what a country owes with what it produces, the debt-to-GDP ratio reliably indicates that particular country’s ability to pay back its debts. Often expressed as a percentage, this ratio can also be interpreted as the number of years needed to pay back debt if GDP is dedicated entirely to debt repayment. The higher the debt-to-GDP ratio, the less likely the country will pay back its debt and the higher its risk of default, which could cause a financial panic in the domestic and international markets.

Investopedia further states that a study by the World Bank had found that countries whose debt-to-GDP ratios exceed 77% for prolonged periods experience significant slowdowns in economic growth (https://www.investopedia.com/terms/d/debtgdpratio.asp).

Challenges for sustainable economic management

Challenges for sustainable economic management

Whilst appreciating the efforts of the President, the Central Bank, the Ministry of Finance, who have no doubt made a significant effort to stabilise the economy over the last two years, sustainability and growth of the economy is still on shaky grounds as expressed by the Secretary to the Ministry of Finance.

Surmounting challenges ahead are even beyond the scope and ability of the Central Bank and the Ministry of Finance who are compelled to follow the path taken by their political masters and unfortunately, experience shows that the political masters of all hues have generally failed the country. This failure is about the lack of or absence of long-term strategic thinking and planning on the part of political leaders. The tragedy of bankruptcy that befell Sri Lanka was not the fault of bodies like the Central Bank or the Ministry of Finance but the ignorance and lack of economic knowledge and common sense on the part of politicians and the general attitude of most of the public in the country.

It is customary to blame only politicians for the country’s economic woes while not admitting that the public, through their short term expectations and focus solely on short term gains, have contributed to these woes. The country has been living beyond its means, but the public, even the more economically literate individuals, have not attempted to change their own thinking, let alone the thinking of politicians. The population has shown a high degree of ignorance and selfishness and politicians have taken advantage of that, making promises to the public with the only goal of being elected to office.

The strategic thinking and planning that is badly needed, and which has eluded the country, should have focused on two key areas. Firstly, its Debt to GDP ratio. As mentioned earlier, the Debt-to-GDP ratio is the measure comparing a country’s public debt to its gross domestic product (GDP). By comparing what a country owes with what it produces, the Debt-to-GDP ratio reliably indicates that particular country’s ability to pay back its debts. A high ratio and low foreign reserves translate to a country’s inability to pay its debts, and in turn lowers investor confidence. Sri Lanka has had this unfortunate experience on both fronts as all are fully aware.

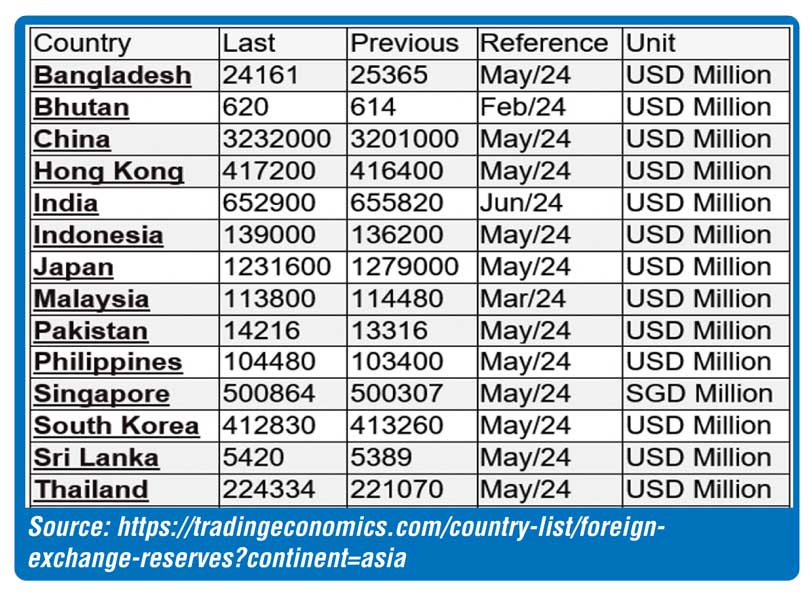

The second key economic measure is the country’s foreign reserves. Even where the debt to GDP ratio in a country is high, it could still attract investors if it has high foreign currency reserves. Unfortunately, Sri Lanka has failed to have a low debt to GDP ratio and its foreign currency reserves have been abysmally low. The table below shows the foreign reserves of some countries in the Asian region, and in comparison, how low Sri Lanka’s reserves are.

Sri Lanka will have to ensure it does not borrow more than an agreed maximum percentage of its GDP. The World Bank recommendation of 75% of the GDP as the maximum is a measure that all political leaders should agree on. Secondly, it will have to increase its foreign reserves in net terms, after deducting borrowings, and have a target to build up foreign reserves that will be able to fund imports at least for 12 months if not more. Following Singapore’s very successful management of foreign reserves by the (GIC), the Government of Singapore Investment Corporation which now boasts of a portfolio of $ 770 billion, Sri Lanka should seriously consider setting up a similar body and assign its management to GIC for an agreed period of say 10 years.