Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 2 January 2023 00:20 - - {{hitsCtrl.values.hits}}

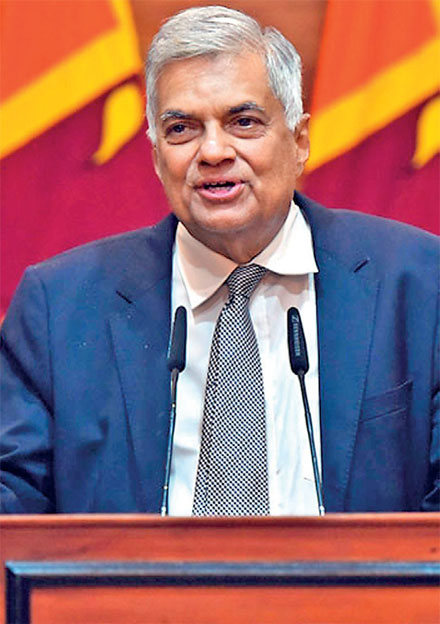

President Ranil Wickremesinghe

Central Bank Governor Dr. Nandalal Weerasinghe

|

Challenge of President Wickremesinghe

Challenge of President Wickremesinghe

According to media reports, the Cabinet headed by President Ranil Wickremesinghe has approved the proposed new central bank law (available at: https://www.centralbanking.com/central-banks/governance/organisation/7954060/sri-lanka-cabinet-approves-draft-of-new-central-bank-law). This is the third time a Cabinet headed by Wickremesinghe has approved a new central banking act. The first was in 2004 and the second in 2019. In both these instances, it was proposed by the Ranil Wickremesinghe administration but aborted by the subsequent regime that came to power ousting his government. On this third occasion, it hangs on a very fragile thread.

That is because he will have to convince the political party that supports him in Parliament, namely Sri Lanka Podujana Peramuna or SLPP of the need for enacting this law. Historically, that party had been opposed to a new central bank law. However, this time, enacting a new central bank law giving it more independence is one of the pre-conditions for the proposed bailout package from IMF (available at: https://www.imf.org/en/News/Articles/2022/09/01/pr22295-imf-reaches-staff-level-agreement-on-an-extended-fund-facility-arrangement-with-sri-lanka).

Prior to this statement, the US Senate Committee on Foreign Relations too had emphasised on the need for making the Central Bank of Sri Lanka an independent institution as a pre-condition for any IMF assistance to Sri Lanka (See: https://twitter.com/SFRCdems/status/1542979994892357633?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1542979994892357633%7Ctwgr%5E421cd3367d0d1bb56193a351ca6cc3f78eef58ab%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fd-11067494233692288552.ampproject.net%2F2211302304002%2Fframe.html). Hence, the options available to SLPP is also limited and the successful passage of this law in Parliament may pave way for the SLPP government headed by Wickremesinghe to obtain the much-needed bailout package.

CB independence a must for coordinating fiscal and monetary policies

A publication by IMF in 1995 titled Policies for Growth highlighting the Latin American experiences (available at: https://www.elibrary.imf.org/display/book/9781557755179/ch05.xml) has argued cogently that central bank independence is a must for the proper coordination of both fiscal policy and monetary policy. Analysing the literature on central bank independence, the publication has noted the role of “various attributes of central bank independence, such as financial independence and political independence”.

CB should have budget and policy independence

The publication further elaborates on this point as follows: “The former has been measured by indicators such as the central bank’s ability to set salaries for its staff, to control its budget, and its degree of discretion regarding distribution of its profits. Financial independence, particularly in many developing countries, should also include the freedom for the central bank not to undertake operations that will lead to central bank losses. For instance, in the 1980s in several Latin American countries (such as Argentina, Chile, and Uruguay), central banks had to bail out commercial banks and provide exchange rate guarantees that proved to be costly.”

These two types of independence refer to the traditionally known budget independence and policy independence. The Central Bank of Sri Lanka presently enjoys the first and therefore it should be retained without any dilution to the spirit of the law. However, policy independence is only partly enjoyed by the bank and it is this aspect which should be strengthened and improved.

Past abortive attempts at making CB independent

I have been arguing for greater independence of the Central Bank of Sri Lanka in this series as well as in public lectures. I was also directly involved in drafting a new central banking law during 2002-4 when I headed the Steering Committee on Central Bank Modernisation under the direction of the then Governor, the late A.S. Jayawardena. We were supported by the World Bank in this exercise. The draft law which ensured greater independence for the Bank was presented to the Prime Minister Ranil Wickremesinghe and his Cabinet carried it for enactment. However, the government changed in 2004 and the new government headed by Prime Minister Mahinda Rajapaksa who later became President in 2005 shelved the law.

After that, the need for enacting a new central banking law giving it greater independence came to the fore during the previous Yahapalana government headed by Prime Minister Ranil Wickremesinghe. A new central banking law drafted by a committee headed by the present Central Bank Governor Dr. Nandalal Weerasinghe under the direction of Governor Indrajit Coomaraswamy was accepted by the Government for enactment and it was even gazette as a bill prior to presentation in Parliament.

Meanwhile, Gotabaya Rajapaksa was elected as President in November 2019 and his administration decided to shelve it again allowing the draft bill to have a natural death. Now this renewed interest in giving greater independence to the central bank has arisen due to the pressure from IMF and US Senate Committee on Foreign Relations as a pre-condition for the much-needed bailout package from IMF. That should not be the case because the central bank should be given greater independence not in compliance of outside pressure but in recognition of the need for protecting the money held in the hands of people.

Importance of CB independence

In delivering the 68th Anniversary Oration of the Central Bank in 2018 (available at: https://www.youtube.com/watch?v=2DWd4LdcJrw&t=51s) and a public lecture at the Bank’s Centre for Banking Studies in 2019 (available at: https://www.youtube.com/watch?v=IIO6UWkqrZw&t=2907s), I argued why central bank independence is for the people and not for the staff or political authorities. The following are excerpts from these lectures.

Both CB and the government are two arms of sovereign state

There is an argument, mostly by those in power, that there cannot be an independent central bank in a sovereign government. If the central bank is totally independent, they argue, that it will lead to an unworkable situation. If the government wants to introduce certain policies for the benefit of the people and if the central bank does not lend its hand for their successful implementation, it is the people who will suffer. But this argument is based on the erroneous perception that the sovereign state and the government are one and the same. It is not the government in power which is sovereign but the state which is made up of all the people living within a given territory. In the case of Sri Lanka, it is the Democratic Socialist Republic of Sri Lanka which is sovereign and not the Government headed by President Ranil Wickremesinghe.

That Government is simply an arm of the state set up for providing certain services for the benefit of the people. They cover areas such as the maintenance of law and order, observance of rule of law, conflict resolution, protection of property rights, and economic prosperity. To do all these services, the Government, on behalf of the state, is empowered to extract a part of the resources and incomes of people through taxation and spend that tax money by observing prudence and maintaining accountability. Similarly, the central bank, another arm of the state, is empowered to supply liquidity to people by issuing legal tender money and maintain its value over time.

Money is just a mental thought without real value

There has been a misconception about the role of money in society. That is to treat money as a real good that delivers prosperity to people. Real goods are those that people can consume for their pleasure or use as an input to produce another real good. Money is simply a go-between two real goods. It facilitates people to exchange one real good for another. For instance, if I have labour services to offer, a real good that I have, I can sell it to an employer who will use my labour service as an input for producing another real good which can be used by him or sold in the market. To make the transaction easier, in modern economies, I will be compensated by a certain agreed quantum of money. I will use that money to buy a real good, say rice, that I need. Therefore, what is being exchanged is one real good for another and money is simply an agent facilitating that transaction. In this sense, it is only an imagination in the mind.

We accept money in compensation for a real good because of its ability to help us get another real good. Politicians and a section of economists who call themselves as followers of a variant of monetary theory called modern monetary theory believe that money is also a real good. Hence, they believe that money can be produced at will to deliver prosperity to people. This misconception has forced them to produce more money than necessary by society in the belief that they are doing a service to the people. But what happens is the increase in the price level at which two real goods are exchanged reducing the real value of money that we produce. To prevent this, the state has created another arm within it, like the government, a central bank to produce money without causing inflation and preserve its value. To do this job properly, the central bank should be independent from the politicians in power, lobbying groups within the private sector, and its own employees.

Exter’s MLA

The present central banking law in Sri Lanka, called the Monetary Law Act or MLA, was drafted in 1949 by John Exter having the need for preventing this dangerous tendency in mind. It has granted the budget independence to the central bank but the policy independence that has been given to it is questionable. There are certain provisions in MLA that compromises the independence of the Monetary Board which is charged with responsibility for preserving the value of money which it has issued. In the new law to be enacted by Ranil Wickremesinghe administration, these compromising provisions which are explained below need be removed.

|

Finance Secretary should be an observer and not a vote carrying member

The first is the provision permitting the Secretary to Ministry of Finance to sit on the Monetary Board as a vote carrying member. John Exter justified it on the ground that in that period, the Secretaries were permanent secretaries who could function as a conduit of communication between the Monetary Board and the Minister of Finance. But after the introduction of the Republic Constitution in 1972, Secretaries are just voices of ministers and hence, the two-way communication model of Exter ceased to exist. This led to the fiscal dominance of monetary policy forcing the monetary board to lend the government in excessive amounts that finally led to the escalation of prices. As a result, people who held on to money issued by the central bank trusting its prudence have been betrayed. In the new law, it is necessary to make this officer an observer and not a vote-carrying member.

Provisional advances have no meaning today

The second is the provisional advances which the central bank is required to provide to the government. This is an overdraft facility which had a meaning in 1950s when the central bank was the sole banker to the government and there were no developed commercial banks. This facility requires the central bank to extend an advance up to 10% of the estimated revenue of the government for the forthcoming year. Hence, it always incentivises the Ministry of Finance to overestimate the revenue to get a bigger provisional advance. It is an abuse of power and hence, in the new central banking law, provisions should be made for extending this facility on the average of actual revenue over several past years at the prevailing one-year Treasury bill rate.

CB’s funding of the budget should be limited

The third is the central bank’s obligation to provide funding to the Treasury by buying Treasury bills in the primary market without a limit. Of course, the central bank should have a sufficient stock of Treasury bills to conduct open market operations as a monetary policy instrument. But what has happened is that the central bank has been called to buy Treasury bills over and above this legitimate requirement. All these moneys are newly printed moneys adding to the reserve money base that leads to subsequent monetary expansion. After buying these Treasury bills from the government, the central bank is required to neutralise their effect by selling them back to banks by offering a higher interest rate. It frustrates the government’s effort of keeping interest rates down to keep the budgets in proper shape. This section need be removed from the new central banking law permitting the bank to buy Treasury bills only for conducting its monetary policy.

The proposed law need be publicly debated

Since the central bank independence is for the people, the new law need be vetted by them before it is presented to Parliament. Both the politicians and bureaucrats have a vested interest to protect their privileges and as a result, there is the danger that strong provisions in the new law could be diluted to meet their interests. This happened in the Right to Information Act as I had argued earlier (available at: https://www.ft.lk/columns/right-to-information-bill-a-defeat-of-public-aspirations-for-transparency-in-the-central-bank/4-533260). Hence, passing a new central banking law is too precious to be left only in the hands of the politicians. I, therefore, urge the Government to release it to public domain to generate a fruitful public discussion of the issue.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)