Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 4 March 2020 01:33 - - {{hitsCtrl.values.hits}}

- Brand value cross Rs. 55 b

The total telecom sector advertising spend Rs. 10.8 b (rack rates)

The lifeblood of an organisation are the brands it owns, the logic being that the connections a company makes with a consumer is via the brands it owns. The stronger the connection the more value the company will have in the market place. The day the brands lose faith with a consumer, over time it will lose market share and finally affect the value of the company.

Let’s accept it, investors like to hold shares of well-known companies. Employees like to work for companies that are known and respected by the community. Consumers tend to trust the brands that a reputed company markets. Hence we see the power of a brand in the day-to-day activities of a company.

Sri Lanka invested Rs. 120 billion on TV, radio and press on rack rates whilst the telecom sector accounted for around Rs. 10.8 billion, which gives us an idea of the entrenched marketing that happens in the Sri Lanka brand market.

Typical definitions indicate that a brand is a name or a symbol that defines to a seller the products that one markets which helps to differentiate one from the competitors. One can also argue that a brand is a tool that helps create and form a relationship between the enterprise and a customer.

Dialog Axiata is a subsidiary of Axiata Group Berhad. The company has invested over $ 2.5 billion in Sri Lanka with the advanced mobile telephony/high speed mobile broadband services having around 13.8 million subscribers which indicates the strong consumer orientation the company drives in Sri Lanka which has 21 million people.

The company is known for innovation and being the forerunner in the mobile industry. In 2019, it was awarded as the top telecommunications brand which explains the aggressiveness that the company works on.

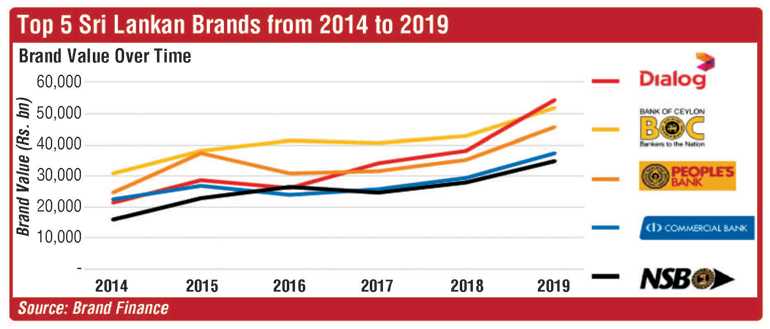

If we analyse the performance of the brand in 2016 Dialog was valued at Rs. 34.1 billion whilst Bank of Ceylon (BOC) was leading the country with Rs. 41.4 billion.

Year 2017 was tough with the total FMCG consumption declining quarter on quarter to a negative performance. The Sri Lankan consumer was squeezed. Dialog registered 11.9% growth to reach a Rs. 38.1 billion performance whilst BOC declined by -2% to settle at Rs. 40.6 billion.

In 2018 Dialog grew by +41.9% to Rs. 54.1 billion whilst BOC registered Rs. 42.8 billion at a +6% growth. Dialog catapulted to become the most valued brand in Sri Lanka on the promise ‘The Future Today’ with the imagery of a sleek sharp innovative brand which is an example to Sri Lanka.

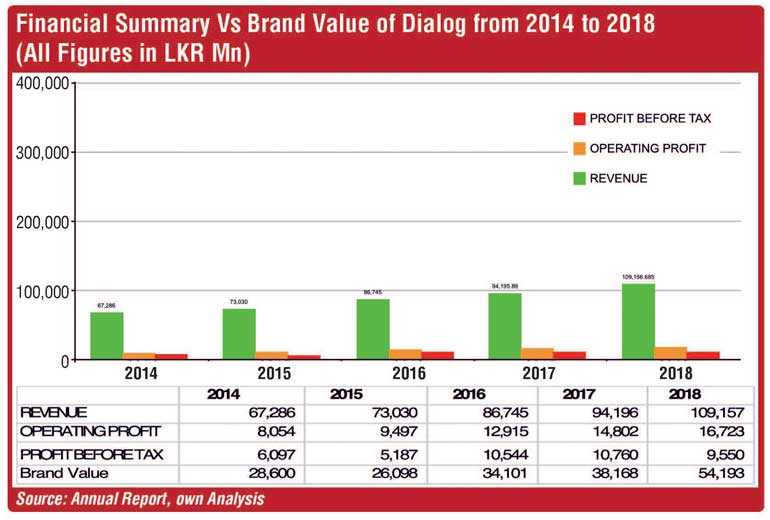

If one does a deep dive on the 2018 performance the company grew the top-line at a +15.8% growth to Rs. 109.1 billion. Operating profit was at +12.1% to Rs. 16.7 billion whilst profit before tax dipped by -11.2% to Rs. 9.5 billion due to strategic investment. The beauty about the management style is the continued investment in strategic marketing that has driven brand value by 41.9% to Rs. 54.2 billion. It demonstrated the company’s commitment to building the brand equity so that the company can leverage in the future in new products. It’s a lesson for Sri Lanka.

We saw similar optimism in the FMCG sector where in the Q1-2018 the overall FMCG consumption registered at -11.8% decline in volume growth whilst in Q2 the household consumption slowed down by -14% whilst in Q3 the decline reduced but yet was a -8% and Q4,2018 it was -3% as per the Nielsen retail audit data. But the private sector continued to be bullish and invested Rs. 120.5 billion on advertising on TV, radio and press at a growth of 19% whilst in 2019 with all the issues a staggering Rs. 125.4 billion was invested at a growth of 4% on a year-on-year basis which tells the spirit of the private sector on brand marketing.

As we head into General Elections the scorecard of the current administration is not health. Inflation that was 4.5% in November last year has increased to 7.6% in January and February to 6.2% squeezing the consumer. The overall country rating which was B stable is now at B negative whilst the stock exchange that was at 6100 has declined to 5700.

The economy was given an injection with the one-year debt moratorium and wage increase in the tea estate workers which unfortunately has been a nonstarter due practical operational issue. The VAT relief given has been only a business lifeline as the majority have not passed it down to the consumer which is unfortunate but legislation does not support a diktat to be given by the Government.

The Covid-19 virus better known as coronavirus is creating havoc globally with the total financial industry taking a $ 1.3 trillion hit whilst the aviation industry is going into lockdown mode whilst tourism is at the crossroads. Thailand has already estimated for a $ 1.6 billion hit on tourism only from the Chinese market. I guess now with South Korea and Italy being challenged with the virus, the overall impact to tourism will have to be recalculated. Tough times will require tough decisions I guess.

(The thoughts are strictly the writer’s personal views and not the views of the organisation he serves in Sri Lanka or internationally. He heads an US-Indian Artificial Intelligence company for Sri Lanka, Maldives and Pakistan.)