There is ample evidence that if the regulators do the right thing, depositors, taxpayers, etc. can be safeguarded and the banking sector need not go into a crisis

The restructuring of our sovereign debt is primarily driven by the GFN (Gross financing needs), the forward Sovereign Debt Perimeter, the forward Debt Service to GDP and other factors that dominate the IMF’s DSA (Debt sustainability assessment) and is a critical component of the IMF’s EFF. The benefits to Sri Lanka in achieving these DSA metrics have been clearly spelt out and understood and the EFF is the enabler to restarting Sri Lanka’s growth and poverty alleviation trajectory as well as its macroeconomic and banking/financial system stability. The enabler of these metrics is the IMF. They will work closely with the GOSL MoF/Treasury towards a credible composite sovereign debt restructuring and structural macroeconomic stability whilst keeping the country’s MoF/Treasury afloat (as opposed to sovereign bankruptcy) with the EFF and multilateral funding expectations being met.

The restructuring of our sovereign debt is primarily driven by the GFN (Gross financing needs), the forward Sovereign Debt Perimeter, the forward Debt Service to GDP and other factors that dominate the IMF’s DSA (Debt sustainability assessment) and is a critical component of the IMF’s EFF. The benefits to Sri Lanka in achieving these DSA metrics have been clearly spelt out and understood and the EFF is the enabler to restarting Sri Lanka’s growth and poverty alleviation trajectory as well as its macroeconomic and banking/financial system stability. The enabler of these metrics is the IMF. They will work closely with the GOSL MoF/Treasury towards a credible composite sovereign debt restructuring and structural macroeconomic stability whilst keeping the country’s MoF/Treasury afloat (as opposed to sovereign bankruptcy) with the EFF and multilateral funding expectations being met.

External sovereign debt

The optics of the external sovereign debt restructuring debate is dominated by that of the commercial debt of which the larger component is that of ISBs (International Sovereign Bonds). ISBs are mostly held by international funds and global banks. Local institutions and banks licensed to deal in foreign currency hold these ISBs.

- The large/foreign institutional ISB holders for the time being, are amenable to a restructuring and/or re-profiling and/or a haircut on the principal in return for a similar treatment of the domestic sovereign debt. As to why they take this position is varied and opaque, though one intelligent guess is that most current holders for the being have acquired these bonds at a discount at the time Sri Lanka’s sovereign rating was continuously sliding in late 2020 and early 2021. They’d rather recover the acquisition plus holding cost than lose the entire investment, albeit even at the discounted acquisition price.

- The fly-in-the ointment here is their demand for a similar treatment to be imposed on domestic sovereign debt.

- The rest of the external sovereign debt is that of bilateral debt and multilateral debt – any restructuring of which has to be largely political and diplomatic in approach and in resolution. What these creditors have asked in return for any restructured debt agreement, is unknown at best though it can be safely assumed that any concessions extracted from Sri Lanka would be more geopolitically strategic than financial.

Domestic sovereign debt

DDR (Domestic debt restructuring) is all about sovereign domestic LKR debt – debt owed by the GOSL to any individual or institution, whether financial or otherwise. The envisaged DDR does NOT include debt owed by parties other than the Sovereign, to any individual or institution, whether financial or otherwise.

- The DDR is driven by the MoF/Treasury who is the Creditor, and who for multiple reasons, is labouring under the weight of an inability to meet its principal repayment commitment and possibly its interest servicing commitments.

- Without a DDR there will be no ISB debt restructuring, and without these two, the extent of the multilateral and bilateral debt restructuring will be so onerous as to fail.

- A failed composite debt restructuring will collapse the balance of the EFF, not to mention the deep and long scars Sri Lanka will be left with and the heavy burden of bankruptcy.

The fallout of such a sovereign bankruptcy on Sri Lanka and its banks (in international trade) is that Sri Lanka will become a COD (cash on delivery) country in international trade, with future generations scarred beyond recovery the consequences of which would be high outward migration and resource contraction and a growing output decline and eventual collapse.

Key holders of domestic sovereign debt

- Domestic Sovereign debt to the EPF, ETF and the other retirement funds could be restructured so as to ensure there is a minimal drop in returns below the 2021 levels and can be achieved with a mix of coupon cuts with re-profiling and Capital haircuts.

Most such GSec holdings are acquired in the primary market and held to maturity.

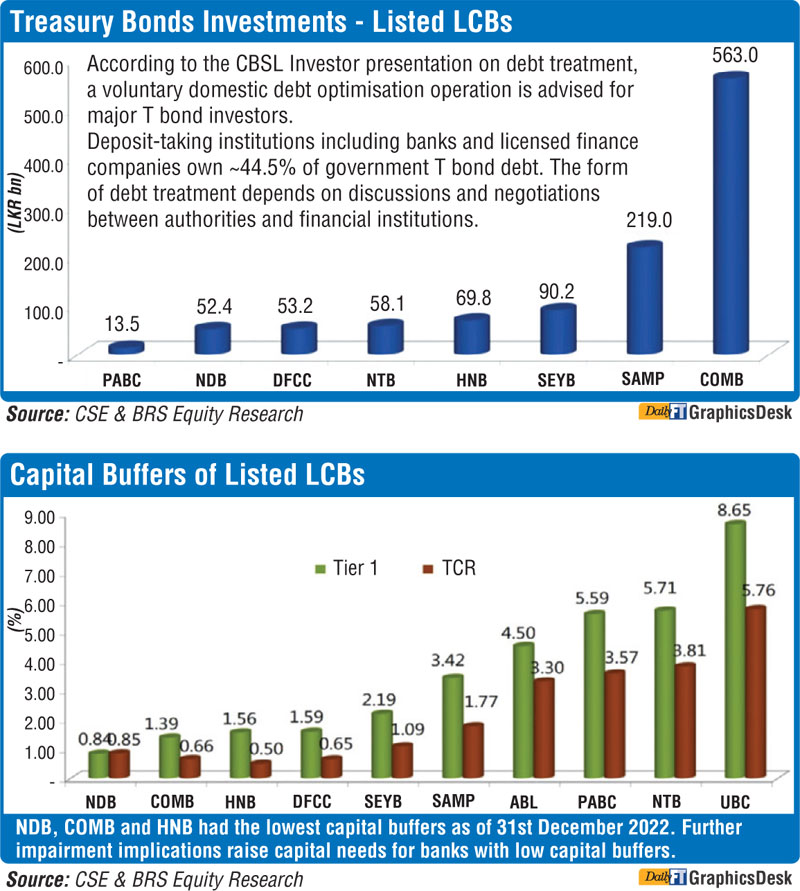

- Domestic Sovereign debt to banks, financial institutions, insurance funds and individuals would also have to be restructured so as to ensure there is a minimal drop in returns below the 2021 levels and can be achieved with a mix of coupon cuts with re-profiling and Capital haircuts.

Such GSec holdings however are acquired in the primary and secondary market and classified as held to maturity or Trading or Available for Sale (AFS).

A MoF/Treasury driven DDR of sovereign debt to banks, financial institutions, insurance funds and individuals would result in an asset impairment and charge to capital.

No need for knee jerk reaction

A rumour floated by interested parties in the media and gaining traction and causing trepidation among the general public is that the banks would request for and get from the CBSL, approval to effect similar haircuts on their Public FDs. The ostensible reason put forward by the banks is that the statutory liquidity ratios need to be held stable by simultaneous and equitable cuts in both assets and the liabilities in their balance sheets. Central Bank Governor Nandalal Weerasinghe however said Sri Lanka’s public bank deposits and stability of the banking system will be safeguarded in any reorganisation of domestic debt.

The FDs are the smaller proportion of the liabilities in the banks liquidity ratios, but carry a disproportionately high propensity for social upheaval and a bank run, possibly even a collapse of a smaller bank. The higher proportion of liabilities in the liquidity ratios are interbank borrowings – both local and foreign and carry a high propensity to disrupt the interbank market and invite retaliation from the foreign correspondent banks.

Either is not a pleasant prospect.

- It is the MoF/Treasury who is the principal sovereign debtor and it is the Secretary to the MoF/Treasury who should be taking the lead and ownership in dealing with and negotiating with the banks and FIs on the DDR – not the CBSL who is the banking regulator, who may incline towards a degree of bias and even sympathy with the banks and FIs they regulate and the banking system whose systemic stability they are responsible for.

The banks should be approaching the regulator for counsel on how to stabilise their balance sheet with a fait accompli DDR imposed by the sovereign creditor, i.e. the MoF/Treasury.

- The FD holders or even the interbank creditors in the recent bank failures of Silvergate Bank, Signature Bank, Silicon Valley Bank (SVB) and even Credit Suisse were not subject to cuts by the regulators concerned. The pain was borne by the AT1 Bond holders and/or the CET1 holders.

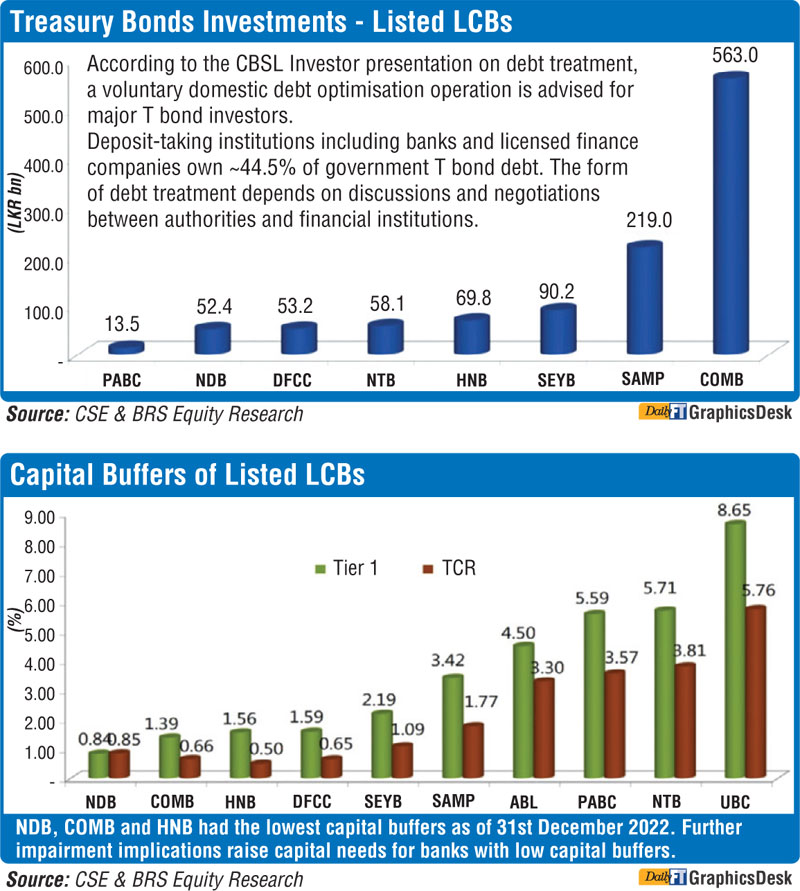

A negative impact to the banks and FIs capital is a given in a DDR. Sovereign debt crises the world over bear testimony to this. The better managed banks and FIs, with adequate capital over the regulatory/Basel III buffers, will absorb this impact, albeit emerging with slimmer buffers to go forward. Others will slip below. Both cases may necessitate regulatory holds on profit distributions, increases to senior management emoluments, capital expenditure, etc.

Options for banks and FIs

- There is however, the clear and painless option of a possible regulatory forbearance on capital, liquidity and leverage ratios, even those defined by Basel III.

The CBSL as implementing agent for Basel III on behalf of the Bank for International Settlements, can do so for an agreed timeframe.

- There are also other perfectly credible options for banks and FIs to take. Capital augmentation with Regulator forbearance on the single voting shareholder limit is one such. Another is an issue of contingent convertible bonds or CoCos, to be redeemed when the CT1 level is restored. Another, though against-the-wall option is to convert any FD and other liability cuts into voting shares subject to regulatory limits on voting equity. A run on a bank generally means funds move from a riskier bank to a safer bank and more so if there is a general perception that the BOD and Management of a bank has not done their job effectively. The Financial Sector globally has already seen 4 major banks collapse this year. Signature Bank, Silicon Valley Bank, First Republic Bank and Credit Suisse. Not one depositor in these banks lost a cent. Those who lost out were the shareholders.

- UBS first offered $ 0.27 per share of CS and after a weekend of negotiating they increased it to $ 0.81 per share and that too was paid as an all share offer (no cash) as 1.00 UBS share for 22.48 CS shares. 12 months ago this stock was trading at circa $6.00 and the Saudi National Bank invested $ 1.5 billion in Nov 2022 at circa $ 4.00 per share for a stake of 10%. Signature Bank and Silicon Valley Bank shareholders lost everything when the FDIC took it over and are now looking to sell it to First Citizen Bank and Flagstaff Bank. HSBC UK paid just GBP 1.00 for the UK part of SVBs business. All these steps were taken by the regulators without any cost to the government or the taxpayers. There is ample evidence that if the regulators do the right thing, depositors, taxpayers, etc. can be safeguarded and the banking sector need not go into a crisis. The President needs to take a leaf out of Theodore Roosevelt’s book, adopting the former US President’s mantra to “speak softly and carry a big stick” to get the banking reforms through.

References:

https://economynext.com/sri-lanka-bank-deposits-protected-in-any-domestic-debt-optimization-cb-governor-120186/

https://www.imf.org/en/Videos/view?vid=6286173458001

The restructuring of our sovereign debt is primarily driven by the GFN (Gross financing needs), the forward Sovereign Debt Perimeter, the forward Debt Service to GDP and other factors that dominate the IMF’s DSA (Debt sustainability assessment) and is a critical component of the IMF’s EFF. The benefits to Sri Lanka in achieving these DSA metrics have been clearly spelt out and understood and the EFF is the enabler to restarting Sri Lanka’s growth and poverty alleviation trajectory as well as its macroeconomic and banking/financial system stability. The enabler of these metrics is the IMF. They will work closely with the GOSL MoF/Treasury towards a credible composite sovereign debt restructuring and structural macroeconomic stability whilst keeping the country’s MoF/Treasury afloat (as opposed to sovereign bankruptcy) with the EFF and multilateral funding expectations being met.

The restructuring of our sovereign debt is primarily driven by the GFN (Gross financing needs), the forward Sovereign Debt Perimeter, the forward Debt Service to GDP and other factors that dominate the IMF’s DSA (Debt sustainability assessment) and is a critical component of the IMF’s EFF. The benefits to Sri Lanka in achieving these DSA metrics have been clearly spelt out and understood and the EFF is the enabler to restarting Sri Lanka’s growth and poverty alleviation trajectory as well as its macroeconomic and banking/financial system stability. The enabler of these metrics is the IMF. They will work closely with the GOSL MoF/Treasury towards a credible composite sovereign debt restructuring and structural macroeconomic stability whilst keeping the country’s MoF/Treasury afloat (as opposed to sovereign bankruptcy) with the EFF and multilateral funding expectations being met.