Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 9 August 2024 00:22 - - {{hitsCtrl.values.hits}}

The repeal of the BOI Law does not mean scrapping/termination of the tax holidays and concessions that have already been granted

The Economic Transformation Bill was issued by way of Gazette on 14 May 2024 and was passed in Parliament on 25 July 2024. The Act is still not available publicly and this article is based on the Economic Transformation Bill.

The Economic Transformation Bill was issued by way of Gazette on 14 May 2024 and was passed in Parliament on 25 July 2024. The Act is still not available publicly and this article is based on the Economic Transformation Bill.

The Economic Transformation Act (ETA) is to provide for the National Policy on Economic Transformation and for the Establishment of the Economic Commission of Sri Lanka, Investment Zones in Sri Lanka, office for International Trade, National Productivity Commission, and Sri Lanka Institute of Economics and International Trade.

The ETA seeks to also replace the Board of Investment (BOI) established by way of Board of Investment of Sri Lanka Law No. 4 of 1978 and amendments thereto. Hence this marks a high watermark in the Investment Law regime in Sri Lanka. As many would recall Greater Colombo Economic Commission established in 1978 under the Greater Colombo Economic Commission Act No. 04 of 1978 was renamed as BOI Law No. 04 of 1978. Unlike the name change that was carried out in the past of the Greater Colombo Economic Commission into BOI via a statutory amendment, the present transformation entails repeal of the previous statute and enactment of a new statute to execute the transformation.

The ETA includes 196 Sections laid out in 38 Chapters.

The objects of the national policy on economic transformation

The Act spells out the objects of the National Policy (S.2 of the ETA). One of the objects of the national policy is to avoid an economic crisis.

The objects further state that the goal is to ensure all citizens achieve an adequate standard of living, including food, clothing, housing, improved conditions, and leisure opportunities. And to obtain rapid national development through public and private economic activities, guided by laws for social welfare and the common good.

As per the Act, the national policy on economic transformation should include the restructuring of the debt owed by the Government and the transformation of Sri Lanka to a highly competitive export oriented digital economy (S.3 of the ETA).

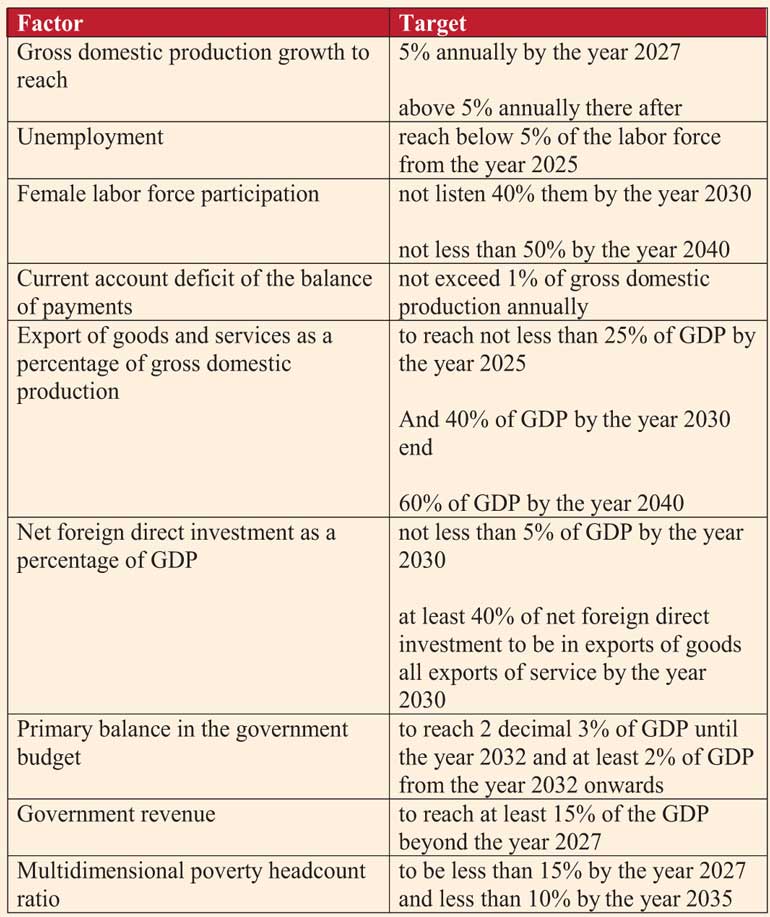

Targets set for economic transformation

The ETA specifies that it is the duty of the Cabinet of Ministers to base the National Policy on Economic Transformation on the following targets.

Whilst requirement to submit reports in connection to this is provided for in the Act, no penal provisions are visible in the Act in relation to failure to execute the duties.

The ETA states that the cabinet of ministers should prepare a report on the policy framework and strategies and present the report to the Parliament to give effect to the national policy. This should be done every five years commencing from the year 2025.

The Act states that the policies of the Government programs, Regulation, Circulars and Directives should confirm to the national policy on economic transformation (S.6 of the ETA)

Agencies to assist the Government

The following agencies are established by the Act to assist the Government in achieving the object of rapid growth for national economic transformation. They are

1. Economic Commission

2. Zones SL

3. Office for International Trade

4. National Productivity Commission

5. Sri Lanka Institute of Economics and International Trade.

Colombo Port City

As per provisions in the Act, the Economic Transformation Act does not apply to the Colombo Port City Special Economic Zone established under Colombo Port City Economic Commission Act No. 11 of 2021.

One may question the rationale of totally excluding the application of the Economic Transformation Act to the Colombo Port City, as the Colombo Port City was established with the expectation of achieving a leapfrog development in the Sri Lankan Economy. Although the Colombo Port City is established by a distinct Statute, if the object and the expectation of the ETA, is to keep an eye of the economy of the country, a significant project as port city should also be integrated to the ETA.

For instance, where specific economic ratios to be achieved by Sri Lanka within specified time frames is set out in the Act, the contribution stemming from Port City for achieving these economic ratios should also be integrated. Afterall, Port City is part of Sri Lankan territory and an essential element of the country’s economy and plays a key role in attracting FDI’s into the country. One may wonder how one could monitor the economic transformation of Sri Lanka by keeping a blind eye to the success or otherwise of the Colombo Port City.

Economic Commission

The Act provides for the establishment of the Economic Commission (EC) as a body corporate with the power to sue and to be sued, akin to the Board of Investment however unlike the BOI, the statutory provisions provide for establishment of branch offices outside Sri Lanka. More likely than not in practice this would entail maintenance of separate physical offices in different countries with substantial costs to be defrayed with taxpayers’ money.

Given the high tendency in the Sri Lankan culture for spending colossal amount of taxpayers’ money for placement of individuals in foreign jurisdictions, integrating branch offices of EC with the foreign missions is a promising strategy to optimise resource utilisation and accelerate economic growth. By carefully considering the potential challenges and implementing appropriate measures, Sri Lanka can effectively leverage this approach to achieve its economic transformation goals.

As per S.12 of the ETA, the EC aims to create a favourable investment climate, facilitate sustainable foreign direct investment (FDI), and promote international trade. It evaluates the need for investment zones, encourages ease of doing business, and identifies strategic investments that benefit the overall economy. Additionally, the commission reviews and recommends incentives for investment promotion, fosters industrial and commercial enterprises, and contributes to Sri Lanka’s economic growth.

The EC is empowered by the Act (S.13 and 14 of ETA) to carry out its duties and functions, including the administration and management of its affairs via Board of Members. The President appoints one of the members of the Board to serve as the chairperson of the EC board. The term of office for an appointed member is three years.

Incentives and exemptions

The EC has the authority to recommend incentives and exemptions for investors. These recommendations can apply when the Minister prescribes them through regulations. Importantly, investors will still be eligible for any other incentives and exemptions provided by other applicable laws. The incentives and exemptions can be provided for 12 statutes identified in the schedule and which includes, Customs Ordinance, Inland Revenue Act, No. 24 of 2017, Finance Act, No. 18 of 2021, Foreign Exchange Act, No. 12 of 2017, Companies Act No. 07 of 2007, etc.

Repeal of the BOI Law

The BOI Law is repealed from 25 July 2024 (S. 194 of ETA). The provisions of the ETA has set out transitional provisions in relation to the existing BOI agreements entered into by the enterprises.

The repeal of the BOI Law does not mean scrapping/termination of the tax holidays and concessions that have already been granted. They continue to be in force. It is specifically set out in S.194 (2) (d) that all approvals, licences, authorisations and permissions issued by the BOI and in force on the day immediately preceding the date of commencement of this Act, shall, subject to such modifications as agreed between the Economic Commission or Zone SL, as the case may be and the investor continue to be valid and in force.

Perhaps a significant point to note in the above clause is that it also provides modifications mutually agreed between the enterprise and the Economic Commission or Zone Sri Lanka as the case maybe.

(The writer is Principal – Tax and Regulatory at KPMG.)