Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 26 August 2020 00:00 - - {{hitsCtrl.values.hits}}

It is high time for policymakers and the current Government to study the business case and if feasible, including the establishment of an electronic industry in Sri Lanka to the country’s strategic plan

China’s heavy dependence on foreign chips has worried Beijing since the 1980s. China imports approximately 85% of its annual chip requirement, and a significant portion of that is imported from the US.

With the trade tensions between the US and China escalated during the past two years, the US banned some of its major chip designers and manufacturers from exporting the technology to China. It hurt China big-time because companies such as Huawei and ZTE, which heavily relied on chips imported from the US, had to experience slow growth rates due to the lack of supplies of semiconductor technology.

However, the good news for China is compared to the early 2000s, China now has a solid foundation in tech, a great talent pool, and a huge market size along with the belt-and-road initiative, which has given China easy access to Europe through middle-east and Africa through the South Asian region.

Therefore, China has started a new project to develop a strong semiconductor industry, which will reduce its reliance on the US and other Western powerhouses to fulfil its semiconductor requirement. The plan is to design and produce 70% of its semiconductor requirement within China by 2025. It looks a daunting task, though. However, the Chinese strongly believe that it is doable.

In fact, they must somehow do it because they have a strong case to do it. When studying Made in China 2025 initiative, it is quite evident that China has realised the significance of positioning as a designer and producer of high-end goods than continuing as a low-end manufacturer. This would allow them to capture much superior value from the global value chain.

Based on the outcomes of the trade war, China has realised the overreliance on semiconductors as a bottleneck for Made in China 2025. What will happen if the US and its allies decide to stop the supply of semiconductors to China at some point? It might never happen. However, what if it really happens? China’s efforts to neutralise the adverse effects of such an occurrence have ignited a new cold war between the US and China. We can call it Cold War 2.0.

Cold War 2.0 and Sri Lanka

A technological cold war might generate loads of opportunities for Sri Lanka. Out of many possibilities, one opening stands out from the rest. If Sri Lanka can form a policy framework that would be capable of attracting low-end activities of the global semiconductor value chain, it would pave the way to establish electronics and consumer electronics as industries in Sri Lanka.

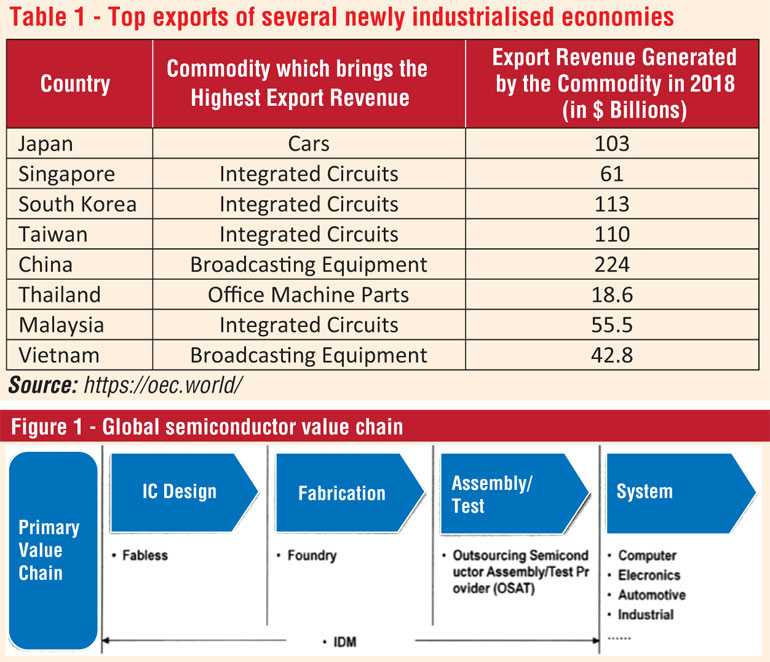

To understand this clearer, let us have a look at the global semiconductor value chain at a higher level. The entire value chain is depicted in figure 1.

Companies that design and manufacture integrated circuits (ICs) are known as integrated device manufacturers (e.g., Intel, Samsung, etc.). Fabless semiconductor companies are the ones that focus only on the IC design component of the value chain (e.g., Qualcomm, Nvidia, etc.). Companies that undertake the fabrication of the semiconductor wafers without designing them are called pure-play foundries (e.g., TSMC, X-Fab, etc.).

At present, China is predominantly engaged in the foundry and assembly/test businesses. They are currently developing strategies to gain knowledge of IC designing because that is the heart of this value chain. Whoever possesses knowledge of IC designing would win the war of technology in the future.

Furthermore, with the advent of Industry 4.0 and 5G, China is interested in designing and developing new technologies related to consumer electronics, telecommunication, new-generation information technology, advanced numerical control machine tools, and robotics, aerospace technology (including aircraft engines and airborne equipment), and biopharmaceuticals and high-performance medical equipment through research and development.

Then what would happen to their interest in foundry and assembly/test businesses? Compared to the revenue generated through the designing phase of any value chain, manufacturing generates relatively low revenue. Therefore, China might be willing to take their foundry and assembly/test businesses to Africa and other parts of the world, which supports their belt-and-road initiative.

This is where Sri Lanka’s policymakers must intervene. Strategically, the city of Hambantota is quite essential to the belt-and-road initiative because the success of the Greater Hambantota project is a major boost to the Made in China 2025 initiative.

Considering the geographical location, Magampura Mahinda Rajapaksa Harbour and Mattala International Airport, if the correct policy framework can be presented to the Chinese, there is a higher chance for Sri Lanka to capture a certain percentage of the value generated by global foundry and assembly/test business.

The total value generated by the global foundry business amounted to $67 billion in 2018, and it is forecasted to grow by up to $82 billion by 2023. And the total value generated by the global assembly/test industry amounted to $29.5 billion in 2018. With the advancement of technology, both industries will keep growing for the next 20 years.

Based on this background, considering the shifted interest of the Chinese and the growth potential of foundry and assembly/test industries, if Sri Lanka can act fast now, there is no better time to start the electronic revolution in the country.

Electronics and post-World War 2 economic development

In recent times, Sri Lanka demonstrated a lot of interest in developing sectors such as tourism, textile, agriculture, fisheries, foreign employment, and information technology to increase its export revenue. While appreciating the efforts of the Sri Lankan Government, this article would like to suggest the government to start focusing on establishing a robust electronic industry in Sri Lanka by 2030.

When analysing the export statistics of the newly industrialised economies that gained economic development after World War 2, it is quite evident that the electronic industry should be an integral part of any nation which is willing to attain economic development. This can be observed by studying the table that depicts the number one export of several newly industrialised economies.

It is possible to further study exports of each of the countries mentioned in Table 1 by visiting https://oec.world/. By doing that, you will be able to gain an understanding of the reliance of those economies on the industries related to electronics. Therefore, it is high time for Sri Lanka to start developing its roadmap to capture a portion of the value generated by industries related to electronics. Capturing a portion of the value generated by foundry and chip assembly/test industries might be an ideal starting point. It is up to the policymakers to explore the opportunities.

Primary semiconductor industries and peripheral industries

Historically, any country that has established a substantial foundry and assembly/test business has been able to attract investments for other peripheral manufacturing businesses that require chips as raw material.

Consider Taiwan; once Taiwan established a name for the foundry business, it started getting investments from producers of motherboards, monitors, modems, and electronic products. Today Taiwan is the world’s largest producer of motherboards, monitors, and modems. Sri Lankan policymakers have the option of analysing these trends and developing a roadmap to establish strong peripheral industries related to primary semiconductor industries (i.e., foundry and chip assembling/testing).

The main objective of this article is to highlight the opportunity Sri Lanka has to establish an electronic industry through opportunities that might spin-off from the cold war between the US and China for the dominance of the world electronic industry. Now, China is setting up plans to move into more knowledge-intensive businesses in the electronic industry (i.e., artificial intelligence, 5G, etc.). And this provides Sri Lanka an opportunity to move into primary semiconductor industries and establish a name as a prime location for electronic manufacturing.

Not only that, if Sri Lanka could build a brand as an ideal location that facilitates electronic manufacturing, it could also pave the way to attract various other types of electronic manufacturing opportunities. The establishment of a strong electronic industry would pump huge amounts of export revenue and foreign direct investments and accelerate the economic development of Sri Lanka. Furthermore, the impact of such an industry alone to the Sri Lankan economy might be much higher than the cumulative effects of primary industries such as tourism, textile, agriculture, fisheries, and foreign employment.

Based on this background, it is high time for policymakers and the current Government to study the business case and if feasible, including the establishment of an electronic industry in Sri Lanka to the country’s strategic plan. Actioning this is of high importance because, “Technology is a game for the rich; a dream for the poor; a key for the wise” – Nawaz Sharif.

(The writer is a PhD Candidate, Swinburne Business School.)