Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 18 June 2024 00:06 - - {{hitsCtrl.values.hits}}

SMEs play a pivotal role in the economic development of the nation. Hence, priority should be provided to SMEs whenever new policies are articulated

Tax is an important source of revenue stream of any economy as it contributes significantly to national revenue. Amounting to approximately 88% of total national revenue, tax revenue is then utilised by the Sri Lankan Government to settle ongoing national loans, recurrent expenditures, and capital expenditures. Tax systems in Sri Lanka have undergone significant changes since inception of the taxation policies. In late 2019, the tax revenue drastically dropped due to the new policies articulated by the Government. The situation worsened during the COVID pandemic in 2020 until recovery.

Tax is an important source of revenue stream of any economy as it contributes significantly to national revenue. Amounting to approximately 88% of total national revenue, tax revenue is then utilised by the Sri Lankan Government to settle ongoing national loans, recurrent expenditures, and capital expenditures. Tax systems in Sri Lanka have undergone significant changes since inception of the taxation policies. In late 2019, the tax revenue drastically dropped due to the new policies articulated by the Government. The situation worsened during the COVID pandemic in 2020 until recovery.

During restructuring process of Sri Lanka to combat the COVID pandemic and the economic crisis, the main point highlighted by economic experts and the public were to restructure the tax policies as well as the tax system. Sri Lanka has witnessed three consecutive amendments to the Inland Revenue Act, No. 24 of 2017 within a short period of time to combat the economic crisis. These amendments were helpful to increase the national revenue but their effect on the Small and Medium Enterprise population sustainability is questionable.

A Small and Medium Enterprise (SME) is considered as a building block of an economy. As of 2018, SMEs comprise of 75% of total enterprises and contribute to 52% of GDP (Asian Development Bank, 2018). The major contributors to the GDP were affected by the policy changes and compliance requirements imposed by the Sri Lankan Government. Some scholars argued that Government support should be directed towards businesses to strengthen their business activities (Robinson and Kengatharan, 2020). It is argued that Government should amend the policies and acts to safeguard SMEs (Wimalaweera, 2020).

Tax framework

In every nation, the tax system is built around the fundamental principles identified as cannons of taxation by Adam Smith in his book “The wealth of Nation”. These principles are equity, certainty, convenience, and economy. These explain that the tax system should ensure every person in the nation contribute towards the tax revenue up to their capacity, time, manner, and quantity of payment should be clear, each tax should be levied in a manner and time which is convenient for the tax contribution, and minimise the administration cost and compliance cost to the minimum.

Taxation policies in Sri Lanka can be summarised as direct taxes, indirect taxes, provincial taxes and import levies. Direct taxes do not contribute to the majority of the Government revenue. Taxes for goods and services, indirect taxes, amount to the majority of the tax revenue, Rs. 857,459 million (Central Bank Annual Report, 2022) which is 48% of total revenue. SMEs direct main concern towards individual/partnership/corporate income tax and Value Added Tax (VAT).

The Inland Revenue Department (IRD) stands as the administration body of the Sri Lankan tax system. Sri Lanka Customs also serves as a tax collection point during imports and exports. The main task of the IRD is to promote tax compliance, assess and collect taxes, and also supervising other types of taxes. These institutions play a crucial role in enforcing the taxation policies articulated by the Parliament of Sri Lanka, conduct audits, and ensure taxpayers meet their obligations under prevailing tax related laws and regulations.

Taxes serve not only as a revenue generating tool but also as a motivator and demotivator for several businesses. For example, the purpose of Excise duty is to demotivate alcohol and cigarette consumption while income tax exemptions for solar businesses motivate startups in the solar panel industry. Further, taxation policies also help to redirect the funds towards the infrastructure development and increase the number of new startups.

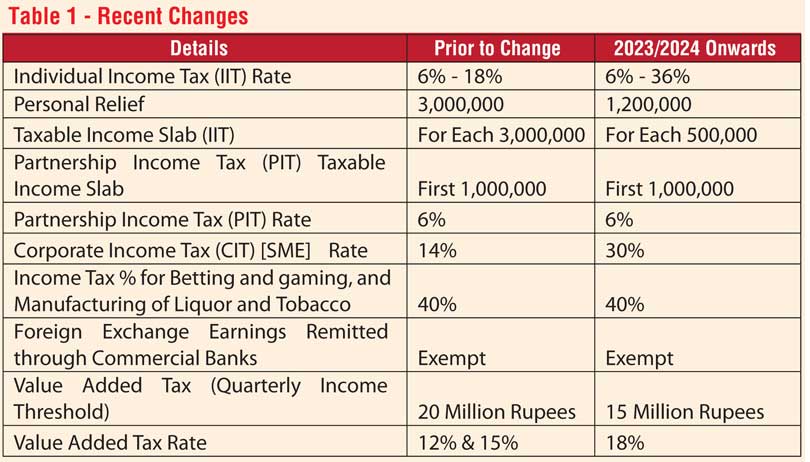

Recent changes in income tax and VAT

The main change as per the Act is that all individuals above 18 years have to register for individual income tax mandatorily. Further, the income slab of Rs. 3,000,000 to Rs. 500,000. The initial personal relief was also reduced from Rs. 3,000,000 to Rs. 1,200,000. The progressive personal income tax rates range from 6% to 36%. During Year of Assessment 2021/2022 the income tax rates range from 6% to 18%. SMEs also operate as partnerships. Partnership firms initially do not pay any taxes for the first Rs. 1,000,000 and for the divisible profits exceeding 1 million 6% of partnership tax should be paid, which was unchanged for the past three years.

Other than personal and partnership income tax, SME companies were enjoying 14% concessionary tax rates under the previous amendments of the Inland Revenue Act of 2017. The recent change has increased the tax rate to 30% not only to SMEs but also to other companies. Meanwhile, irrespective of the size, any business engaged in betting and gaming, as well as manufacture or import and sale of liquor or tobacco must contribute 40% from their profits toward corporate income tax. All persons who are earning in foreign currency and remit the funds through a commercial bank in Sri Lanka is exempt from paying taxes for that earnings.

The VAT rates and the registration threshold change is one other vital change occurred recently. According to the Value Added Tax (Amendment) Act No. 16 of 2024, the standard VAT rate has been increased from 15 per centum to 18 per centum for any taxable period starting from 1 January 2024. Further, the Act consists of provisions reducing the registration threshold from Rs. 80,000,000 to Rs. 60,000,000 for the taxable period of 12 months (Rs. 15,000,000 for the quarter). As per Section 10 of the VAT Act, a person should make an application within 15 days from the date on which the person is liable to register. For example, if a person reaches the total supply of Rs. 15 million on 12 February 2024 for the quarter January/March, the person should make an application to register for VAT on or before, 27 February 2024. Any person can voluntarily register for VAT at any time.

Other than these changes, certain administration policies were also changed. Such changes include mandatory registration with online facilities, and filing of the returns via online platform provided by the IRD.

Impact on SMEs

SMEs comprise of private limited companies, sole proprietorships, and partnerships. Irrespective of the form of business, all SMEs are required to remit their fare share towards the tax revenue. All businesses and individuals should mandatorily register with the Inland Revenue Department. This has imposed a major compliance issue for persons who do not fall under the obligation to pay taxes. One major impact from this issue is that the SMEs have to unnecessarily spend their time on paperwork than spending on the expansion of the business.

SMEs operating as a partnership is not having any impact on the tax rates changes or the relief claim. This results in a stable business and performance evaluation. However, the partners are liable to pay their personal taxes for the profit share. The advantage for the partners is that the tax paid on the partnership can be claimed as per the profit share proportion, finally, contributing towards national revenue via personal income tax.

SMEs operating as sole traders and companies were affected by the recent changes. Earlier, the SMEs were enjoying a concessionary rate of taxation of 14% and sole proprietorship up to a maximum of 18%. Once the policies changed, many SME companies are put in a precarious situation since the sudden hike in rates were not able to be borne by the SMEs. Especially, the startups created in 2022/2023, were suffocated to pay higher tax rates hindering their expansion by limiting their potential to invest on non-current assets and innovation. This was the result on 30% corporate tax rates and maximum 36% individual tax rates.

However, SMEs generating revenue in foreign exchange via a commercial bank in Sri Lanka are exempted from paying taxes. This is a strategic move to increase the foreign reserves of the Central Bank of Sri Lanka. Further, exemptions and reliefs are provided to businesses engaging in generation of sustainable energy and by products of such production.

Conclusion

Even though concessions such as solar panel investment deductions, exemptions for income generated in foreign currency are provided to the taxpayers, we must acknowledge the fact that not all parties are complying with the fundamental principles of the taxation. Large firms engaging in foreign transactions are earning a higher revenue and paying less taxes proportionately compared to the SMEs in Sri Lanka. Hence it is important to address this imbalance through the tax policies imposed by the Sri Lankan Government.

SMEs can start their activities in a less formalised manner as a sole trader or partnership and facilitate their expansions by leveraging lesser tax rates compared to the corporates. Further, they can invest in sustainable energy and engage in crowd exporting to overcome the tax burdens in their business activities. It is crucial to get professional advice from the renowned tax specialist to comply with all the regulations imposed by the Government and to have a clear plan on battling with increased tax rates and working capital management.

In conclusion, the Sri Lankan tax policies have both positive and negative impacts over SMEs in Sri Lanka. SMEs play a pivotal role in the economic development of the nation. Hence, priority should be provided to SMEs whenever new policies are articulated. The SMEs should seek professional advice to navigate in the troubled waters tax environment.

(The writer is an undergraduate at the Department of Entrepreneurship, University of Sri Jayewardenepura.)