Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 16 January 2019 00:00 - - {{hitsCtrl.values.hits}}

(8) An analysis of overall effectiveness of Australian FTAs

According to the Australian productivity research report (2010), businesses in Australia have provided little evidence that Australia’s Bilateral and Regional Trade Agreements (BRTAs) have generated significant commercial benefits. The information available suggests that, where benefits accrue, they are mainly to existing exporters. (Chapter 7)

While bilateral tariff preferences between the members of a trade agreement can yield economic benefits to those countries, the net benefits are likely to be small. Greater net benefits are available through countries lowering their own trade barriers on a non-discriminatory, most-favored nation basis. (Chapter 8)

Non-discriminatory trade agreements are more likely to result in net trade creation and associated economic benefits than agreements with restrictive preference structures. (Chapter 8)

(a) How can Sri Lanka gain an advantage/protection for domestic industries when negotiating FTAs with larger economies?

Sri Lanka as a developing country and within the framework of the Multilateral Trade: Negotiations under the enabling clause can gain an advantage on trade negotiations in terms of trade liberalisation at a level of less than full reciprocity with large trading partner who has greater economies of scale and magnitude in production and export values as India or China.

This was under the Tokyo Round of Negotiations under the GATT and providing a way by which countries that are less developed could obtain tariff concessions without reciprocity from developed countries like in the case of GSP and special and differential treatment with countries that are relatively more developed than them in free trade negotiations. (Differential and more favourable treatment, reciprocity and fuller participation of developing countries – decision of 28 November 1979-l/4903.)

However (practically) even this approach does not guarantee the actual benefits for Sri Lankan industries. In fact, what is important is not the number of tariff lines that are liberalised, but as to whether Sri Lanka is capable of producing these items.

For example, India under ISFTA has granted duty free access to well over 4,000 items but even after 18 years Sri Lanka is still not capable of making these items for exports. Even if Sri Lanka has the capacity to produce such items and export under tariff concession to India, there are many non-tariff measures such as non-recognition of quality certificates, quota system, and inter-state taxes blocking the way for Sri Lankan exports to India. At the time of negotiating ISFTA with India Sri Lankan, negotiators ignored these aspects of international trade.

(b) Effects of GATT XXIV and Sri Lanka/China free trade negotiations

FCCISL greatly values the historical and religious bond between Sri Lanka and China and appreciates China’s active role in economic development of Sri Lanka by financing massive infrastructure projects such as highways, power plants, aviation and harbour. However, FCCISL has very serious concerns about the Sri Lankan negotiators who conducted the FTA negotiations with China in the recent past.

It is regrettable that Sri Lankan negotiators have conceded to the request of China and agreed to conduct FTA negotiations based on GATT Article XXIV. Apparently, this has been agreed upon by Sri Lankan negotiators in 2014 led by the very same chief negotiator who led the team of Sri Lankan negotiators at much controversial SL-Singapore FTA (SLSFTA) negotiations.

The obligations of GATT XXIV, particularly Article 8 (a) (i) are extremely heavy and harmful to a small and vulnerable economy like Sri Lanka. Accordingly, Sri Lanka has agreed with China to liberalise substantially all the trade and at least with respect to substantially all the trade in products.

We reliably understand that some valiant efforts have been subsequently made by the Department of Commerce (DOC), which is the focal point for WTO in Sri Lanka. DOC, since its establishment in 1947 possess experience in dealing with bilateral and multilateral trade agreement is well aware of implication of agreeing to cover “substantially all trade” especially in the case of a developing country like Sri Lanka. It is a nebulous concept that there is no agreement or measurement as to what constitutes “substantial trade” and still a subject of rules negotiation of the WTO!

The Department of Commerce has been consistently maintaining the stand that Sri Lanka should conduct negotiation under the Enabling Clause that provide more flexibilities instead of the GATT Article XXXIV to the Sri Lankan Government. In fact, the goods chapter of the China-ASEAN FTA was signed under enabling clause and a number of FTAs in the region involving Sri Lanka too signed up under enabling clause. For example, SAFTA, SL-India, SL-Pakistan.

Consequently, Sri Lankan negotiators should have flagged the enormous asymmetries and disparities of economies of scale existing between the giant China and smaller country like Sri Lanka. Unfortunately the prudent advice given by DOC were ignored by negotiators. FCCISL commends the salutary role played by DOC and its current topmost senior officials in protecting the interest of Sri Lanka and its domestic manufacturers.

The current chief negotiator who also had worked as a senior official for DOC is for sure well conversant about the benefits and flexibilities of conducting negotiations under Enabling Clause but for reasons best known to him as the Chief Negotiator at subsequent discussions with China, negotiations were conducted under article XXIV and agreed to liberalise 90% of its tariff lines and keep only 10% of its entire tariff lines as sensitive/negative list without tariff reduction!

As a damage control measure, the senior officials of DOC had righty so recommended a Review Clause. However, there is a strong speculation that China may request a political directive similar to that of the political directive on the 90% liberalisation and 10% negative list to delete the Review Clause! If this happens, the last chance of protecting Sri Lankan industries against the ill-effects of the proposed FTA with China will be lost.

In this context, FCCISL and its islandwide membership are afraid of future happenings at trade negotiations with other partner countries. If the composition of the present team of negotiators is not changed Sri Lanka can only expect the repetition of same mistakes already made by Sri Lankan negotiators at all future negotiations.

(9) What should Sri Lanka focus on to generate bigger export volumes?

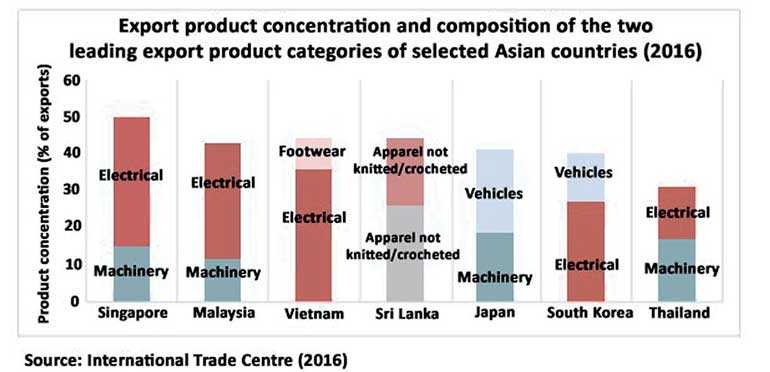

Lessons from Asia Pacific: The chart shows the level of export concentration of the largest two product categories exported out of nearly 100 product categories from selected Asian countries, including Sri Lanka. The data reveals that a heavy reliance on a few product categories is not unique to Sri Lanka and that other countries also show similar trends.

However, Sri Lanka in terms of the product cataogory differs from other asia pacific countries.Sri Lanka’s leading two exporting products such as apperal has a law unit cost but other two leading major exports of Asia Pacific countries has a high unit cost giving bigger volumes to GDP. As a result these Asia Pacific countries have been identified as countries that have export success stories. It’s noteworthy to remember in 1988 Vietnam exports (goods and services) contributed only 3.95% to its GDP but in 2017 it was 101.56%.

(10) Economic modelling/viability of FTAs

The Australian Department of Foreign Affairs and Trade (DFAT) commissioned the CIE (Centre for International Economics) to conduct economic modelling of the benefits of Australia’s North Asian Free Trade Agreements. The aim of the project is to understand the combined implication of these agreements for the Australian economy, with a focus on macroeconomic indicators. The analysis considers the effects of liberalisation of trade in goods, services and foreign investment.

The North Asian FTAs are the Korea-Australia Free Trade Agreement (KAFTA), the Japan-Australia Economic Partnership Agreement (JAEPA) and the China-Australia Free Trade Agreement (ChAFTA).

Scenario (1) seeks to represent a situation in which Australia does not implement FTAs with Korea, Japan or China but other countries continue to implement trade agreements with these North Asian trading partners. The results of this scenario are compared to a baseline (or business as usual) scenario in which none of these FTAs with Korea, Japan or China are assumed to exist so it provides insights into the implications for Australia of other countries pursuing bilateral trade liberalisation with Australia’s North Asian trading partners while Australia does not pursue these trade agreements

Scenario (2) seeks to illustrate the impacts of the FTAs Australia has recently completed with Korea (KAFTA), Japan (JAEPA) and China (ChAFTA). These FTAs are modelled in addition to the FTAs modelled in scenario 1. KAFTA and JAEPA are assumed to be implemented from 2015 and ChAFTA implemented from 2016. As the scenario aims to assess the impacts of the three FTAs as implemented, it is compared to scenario 1, which most closely represents the current situation with all FTAs in place. Scenario 2 includes liberalisation of trade in goods and liberalisation of services trade.

According to the results/forecast for North Asian FTAs on Liberalisation of goods and services the three FTAs are expected:

(a) to lead to an increase in exports to North Asia of up to 11.1%, compared to what would be the case without the FTAs in 2035

(b) to lead exports to all destinations of up to 1.5% compared to what would be the case without the FTAs in 2035

(c) together, the combined liberalisation (goods and services) under the FTAs is projected to lead to a net increase in both GDP (a measure of economic output in Australia) and real household consumption - a measure of economic welfare of Australian households. (Page 2 of the Executive Summary of Economic benefits of Australia’s North Asian FTAs by the CIE.)

Now the question arises: Has Sri Lanka done a scenario planning like this prior to signing of any FTAs? It’s also noteworthy to state that according to the report of the Presidential Committee of Experts to evaluate SLSFTA ( para 3.11) that the “entire negotiation process was carried out without any feasibility and cost benefits of a trade agreement with Singapore from a Sri Lankan point of view”. As this is a deep bilateral agreement covering a wide range of beyond the border policies, it is extremely risky to conduct negotiations for an agreement of this nature without comprehensive feasibility and cost-benefit studies.

(11) Recent trends – Change of the direction of wind at USA’s approach to trade liberalisation

During the 2016 presidential campaign, Donald Trump repeatedly claimed that the United States was being taken advantage of by its trading partners. Bad trade deals, he said, were to blame for lost jobs and deepening trade deficits.

In one of his first official acts, President Trump withdrew the United States from the Trans-Pacific Partnership (TPP). It’s noteworthy to state that Trump’s election opponent, Hillary Clinton, also opposed the deal. He took this precipitous step without even considering renegotiating or rebranding the pact. Other countries have continued to implement the agreement, leaving the United States outside the major trade deal in the Pacific.

President Trump also threatened to withdraw the United States from NAFTA. Yet in this case, he opted to continue negotiations. Despite the administration’s hostile stance during the talks, the renegotiation of what Trump called the “worst trade agreement ever” succeeded with few significant changes to the original deal.

The new United States-Mexico Canada Agreement (USMCA) increases the proportion of an automobile’s parts that must be sourced inside North America for the vehicle to count as made inside the bloc, slightly opens Canada’s dairy market to American and Mexican exporters, strips out some protections for foreign investors in Mexico, and updates the old pre-internet NAFTA with provisions on e-commerce and digital data from the TPP. Although some parts of the renegotiated agreement will promote more trade within North America, others seem to restrict it

The move to protect American industry from unfair trade practices was the latest salvo in Trump›s ‘America First’ trade agenda.

Dumping and subsidies: The Trump administration has ramped up efforts to clamp down on dumping and unfair subsidies of foreign goods sold in the US market. US Commerce Secretary Wilbur Ross said he has doubled the cases compared to the prior administration. This has meant a steady drum beat of announcements of tariffs on goods from Chinese aluminium foil to Spanish olives to Vietnamese tool chests. President Trump in January 2018 slapped tariffs of up to 30% on imports of solar panels over four years, and up to 50% on washing machines over three years, saying foreign-made goods had left US producers hanging by a thread.

Korea-US Free Trade Agreement – Like NAFTA, President Trump said the agreement with Korea, the sixth-largest US trading partner, is a “horrible” deal that should be renegotiated or scrapped entirely.

US and South Korean officials are currently in talks to revamp the 2012 pact – the Korea-US Free Trade Agreement also known as Korus – which is now one of the only trade pacts still standing in the Pacific region since USA withdrew from the TPP.

(12) Summary

FTAs are highly regarded as a mechanism to promote international trade between countries but their strengths and weaknesses are now known to everybody. It is a fact that Regional Trade Agreements (RTAs)/Bilateral Free Trade Agreements can have incremental, positive or negative effects on trade depending on their design and implementation. It is foolish, without adequate preparation or analysis, for a nation to presume gains in Free Trade Agreements on the basis of mere gut feelings or wishful thinking of policymakers. The interesting policy question then is not whether FTAs are categorically good or bad, but what determines their success.

Many believe that FTAs are meant for business only. This is only a partly-correct assumption. In fact, several external and internal factors, as well as economic, political and security-related factors are driving nations to enter into FTAs. It is not a secret that some countries show a great deal of interest in signing a FTA with Sri Lanka due its geopolitical interest. In this context, the question comes to our mind: Are FTAs actually free?

The Sri Lankan Government needs to learn from its mistakes related to FTA negotiations made so far when negotiating with prospective partner countries.

It is interesting to remember what President Washington, the first President of the USA, said in his Farewell Address to nation. He warned his fellow citizens that when it comes to trade negotiations, “There can be no greater error than to expect, or calculate upon, real favours from nation to nation.” He also advised that trade agreements should be “temporary,” and “abandoned or varied, as experience and circumstances shall dictate”. Today the USA has come back to this reality having paid a high price for its FTAs signed with other partner countries.

FCCISL in principle stands for free flow of goods and services without impediments and barriers among countries but admits the right of any country to safeguard its local industry against excessive imports.

FCCISL in the best interest of Sri Lankan entrepreneurs wishes to call firstly for a more transparent approach to trade agreements and secondly call for an effort to convince rationality of adopting FTAs with a particular country with a strong analytical and realistic justification that may even change the negative perception (if any) of the business community. Unfortunately such meaningful justification is yet to be seen but valiant efforts are being made after concluding the trade deals to assess the impact of the FTA. A good example is the appointment of Presidential Committee of Experts on SLSFTA.

FCCISL together with its 63 chamber members (from national, sectoral and regional business associations) recommends the following suggestions for the GOSL to seriously consider at future trade negotiations with partner countries:

(a) Let us first have a proper National Trade Policy in place: It is important that before being engaged in further FTA negotiations the Sri Lankan Government should formally develop and publish a comprehensive National Trade Policy Strategy. The strategy is to consider trade policy developments and opportunities in the broad and where they are identified, key issues with priority partner countries or regional groupings. The strategy document should provide an overall view of Sri Lanka’s actual and potential trade policy initiatives, and the Governmental efforts devoted to them, including options for multilateral, bilateral and unilateral reductions in trade. Designing and implementing a sound trade policy, which should be consistent with national development strategies and needs. National trade strategies should not be the end but should be seen as means to accomplish larger development goals of the country, cross cutting issue in attaining SDGs, hence developmental aspects of FTA should be built into the analysis. Hence, formulation and designing of trade policy should be done through a fully inclusive process with all stakeholders, which may it takes some times a longer time. (The New Trade Policy (NTP) of the Sri Lankan Government has many weaknesses and those have been identified by page 21-32 of the Report of the Presidential Committee of Experts to Evaluate SLSFTA.

(b) The selection of proper and fit officials for the position of the chief negotiator and members of the negotiating committee: Due to the seriousness and significance of the decisions and its impact on the national economy its best that the Sri Lankan Government introduce a selection process similar to that of the process for the selection of secretaries and ambassadors (e.g. Parliamentary Committee on High Posts) to select the chief negotiator and the members to serve on the National Trade Negotiation Committee.

(c) Right selection of partner country: In the case of Sri Lanka, the selection of partner country for a FTA is not strategically prioritised this has always been a political decision and ideally selection of a prospective partner country to the Cabinet has to be recommended by a team of independent experts having done an adequate assessment of all viable options (other than FTAs) for achieving trade policy objectives with partner countries. The list of such partner countries can be termed as priority list for the Government with the minimum acceptable outcomes and exit strategies for each country.

(d) Right selection of the type of the agreement: In case of Sri Lanka, it considers only FTAs as an instrument for international trade. If however we look at India, it gives us an excellent example as to how to choose the instrument. For example, India signed the multilateral Asia Pacific Trade Agreement (APTA), a Preferential Trade Agreement with seven countries followed by an FTA with Sri Lanka and then signed up a Comprehensive Economic Partnership Agreement (CEPA) with South Korea. Sri Lanka also needs to consider options to suit its strategic objectives.

(e) Negotiations process:

(1) Pre-negotiations: As the Australia Productivity Commission has recently proposed, pre-negotiations should be backed by economic modelling with realistic scenarios and be overseen by an independent body. This should take place after Cabinet decision to trigger a negotiation.

(2) A review clause has to be included in the trade agreements to minimise the ill effects of any trade agreement.

(3) Representatives from major trade chambers should be included at all negotiations as observers.

(4) A full and public assessment of a proposed agreement should be made after negotiations have concluded — covering all of the actual negotiated provisions.

(5) After finalising the agreement the text needs to be subject to independent and transparent analysis by an independent body.

(f) Parliamentary process:

(1) It is important to brief the progress on trade negotiations to members of the Parliament from time to time.

(2) The signed agreement has to be tabled in Parliament for parliamentary review before enabling the legislation. There is a need for independent analysis as an input to the pre-ratification, which should be done at parliamentary level.

(3) It is important to amend the Right to Information Act, which excludes availability of trade negotiations for public information.

(g) The Government of Sri Lanka needs to respect the complex and time-consuming nature of FTA negotiations and should avoid putting FTAs on fast-track models.

(h) The Government of Sri Lanka should avoid overselling the likely benefits of the trade agreement to public before finalisation and instead to have a fruitful and constructive dialogue with the business community.

(i) Sri Lanka when signing FTAs should ensure that the leading exports of the country have access to the export destination without being discouraged by trade barriers.

(j) Sri Lanka needs to introduce a proper monitoring and review mechanism after signing FTAs and the findings should be reviewed on regular basis.

CONCLUDED

(The writer is Secretary General/CEO of FCCISL. He was a member of the NTFC study tour to Australia in 2018 organised by ITC/EU.)