Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 28 June 2022 01:56 - - {{hitsCtrl.values.hits}}

Financial literacy and personal financing

Financial literacy skills are very important for MSMEs and people living in rural areas as knowledge on financial transactions and financial concepts is vital for proper budgeting in their households or businesses to accommodate timely payments. Financially literate people should be able to distinguish between the financial institutions from which the loans should be taken for asset enhancement or investment purposes and the financial institutions in which surplus funds should be saved or invested. The decisions taken without having proper financial knowledge may end up in loss of personal assets of individuals or SMEs which could have repercussions on economic stability.

Financial literacy and savings

Attitudes towards savings and people’s behaviour towards savings are crucial when it comes to financial literacy. Financially literate people and households tend to maintain a certain amount of their income as savings in a formal financial institution for future financial security, without spending their income in full. People who are well-informed about financial markets maintain their savings only in the formal financial sector and always pay attention to the level of their savings. People who are not financially literate tend to take greater risks by keeping their savings in the informal financial sector.

Financial literacy and borrowings

If individuals do not have adequate savings, they will have to obtain funding from another source to fulfil their various requirements. If the public knows and understands the debt instruments available in the money market, they will be able to get the amount of funds when needed from a formal financial institution at an affordable price. By using the loan for the purpose for which it was obtained, the expected goals can be achieved and the difficulty of repaying the loan can be minimised. If the individuals or MSMEs maintain an acceptable financial discipline, borrowing more will not be a problem for them.

There is a tendency to pursue loans at high interest rates, mainly due to non-fulfilment of the requirements for obtaining loans from the formal sector, inability to meet certain conditions in the formal financial sector and the relative ease of access to loans from the non-formal sector due to the fewer documents required. Such informal lending institutions are active on a large scale throughout the country and many people in the country have fallen victim to these institutions, particularly women in the rural areas.

Financial literacy and investing

Simply, investment is putting money in various financial instruments, shares, properties etc. with the expectation of generating profits in the future. A large proportion of the Sri Lankan general public does not have an understanding about all the financial instruments available for them to invest their saved money. This stems from the lack of financial literacy. Except for the students who follow finance related degrees, the general public does not have the basic financial knowhow to save a percentage of their income on a regular basis, build up an emergency fund and invest a portion of their income in various financial instruments as a risk diversification method. Educating the general public about the investment approaches would enable them to use their savings in such a way that would have a positive impact on the economy, helping the country to achieve a higher GDP.

How to improve financial literacy level in Sri Lanka?

Many governments and private institutions have taken various initiatives to enhance the level of financial education among the public. In particular, having identified its importance, the Central Bank of Sri Lanka (CBSL) has given high priority in its Strategic Plan to enhance the financial literacy levels in the country. The CBSL has identified Financial Literacy and Capacity Development as one of the key areas in the National Strategy for Financial Inclusion implemented in collaboration with the Government of Sri Lanka. In addition to the CBSL, government agencies such as the Colombo Stock Exchange, public/private financial institutions and professional accounting firms implement knowledge exchange programs targeting various segments of the society.

Despite the measures that have been taken by the Government and other institutions to increase the financial literacy level of the country, there is ample space for further improvement. Nevertheless, the role played by these institutions should be appreciated and their efforts to enhance financial literacy in Sri Lanka should be coordinated and expanded. In addition, various other international organisations, and Non-Government Organizations (NGOs) operating in Sri Lanka are implementing financial education development programs for various sections of the society. However, it is observed that most of these initiatives are scattered and implemented in line with the mandates of the respective entities.

In order to achieve the desired results, those isolated efforts require to be well-coordinated and monitored through a centralised mechanism. The CBSL is in discussions with all parties within the National Strategy for Financial Inclusion as a comprehensive program to develop a common mechanism to promote financial education as a part of the development agenda. At present, the access to technology is in the process of being expanded, to include certain lagging areas that are economically marginalised, to prevent widening inequity.

Financial education for school core curriculum

Compared with the other countries in the South Asian region, Sri Lanka has a well-established free education system and the highest literacy rate in the region. However, according to a recent study of Sri Lankan university undergraduates with non-financial majors, indicated that only 42.83% were financially literate; and revealed that their knowledge in the investment sub dimension was even lower as 28.16%. (Edirisinghe S. et al, 2020). This gap could be improved by using the school curriculum to educate adolescents on financial literacy.

Financial education must be methodically included in school workbooks. Maintaining bank accounts in all public and private sector schools, such as savings, borrowing, budgeting, cash flow planning and investment, macroeconomic fundamentals such as government tax revenue, GDP, government expenditure, inflation and consumer education, should be included in the school curriculum. Children and adolescents need to be made aware of the need for formal retirement plans to ensure their future financial security.

The Ministry of Education is currently preparing the basis for such an approach. Every citizen of the country plays a direct or indirect economic role and involves in financial dealings. Therefore, not only children but all segments of the society like politicians, farmers, the workers in the public and private sectors, housewives, entrepreneurs of the country should be financially literate. Thus, programs related to financial education should be conducted using electronic, print and social media, covering the entire country. It is also important to make books, magazines and cartoons available in all media on topics related to financial literacy.

All higher education institutions, vocational training institutes, in addition to their core field of study, should include subjects on personal finance in their curriculum. People need to be familiar with electronic financial transactions. Financially educated citizens can manage their personal finances properly and have a positive impact on the overall economy, while balanced and participatory development also has a positive impact on maintaining a stable financial system. This will be a step towards reducing poverty in the country.

National Financial Inclusion Strategy

The primary objective of implementing a National Financial Inclusion Strategy (NFIS) is to create a well-informed and equitable approach to access the highest quality, the safest and the most affordable financial services accessibility to all individuals and households through the expansion of financial education. Enhanced financial inclusion provides timely financial services to all individuals, in particular entrepreneurs in the society at an affordable cost. Also, financial inclusion empowers households to manage formal cash flows and increase investment in entrepreneurial activities.

Furthermore, it encourages investments in new and more productive economic activities that contribute to economic growth and job creation, enhancing access to formal sector finance for MSMEs. It also provides opportunities for financially disadvantaged people to have a better quality of life, as well as access to and use of financial services and products that help them to plan ahead and better manage their finances. This NFIS aims to facilitate the provision of a wide range of financially accessible services to suit the financial needs of every individual and institution in the country, including those who are still outside the formal financial system, leading to economic growth.

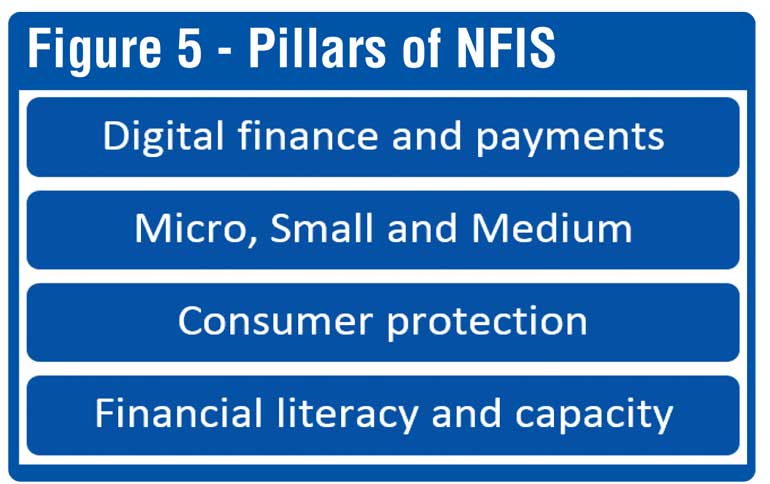

The NFIS for Sri Lanka has been articulated with the participation of many stakeholders in the public sector, private sector and the academic sector. There are four pillars under NFIS as shown in Figure 5.

Furthermore, since financial education has been highlighted as a major catalyst in the overall process of financial inclusion, priority has been given to intensify the relevant activities in the field under the NFIS. Such policies are included in the action plan of the NFIS with the consent of all stakeholders, including the institutions directly responsible for the implementation of the relevant policies. A coordinating and implementation control structure has been established to ensure the effective implementation of the NFIS.

Realising that Sri Lanka needs more than just easy access to financial products and services for financial inclusion, it has already taken the necessary steps to improve financial awareness. These include capacity development programs on financial literacy conducted by the CBSL through various Ministries and Government Institutions, skills development programs on MSMEs on financial management and low income and risk areas.

Conclusion

Considering the positive correlation between financial literacy and financial stability, propagating financial literacy among individuals, households, institutions, and the society would bring about future financial security and ensure the prosperity of a country. It shows that financial literacy of the society makes a positive contribution to the balanced and participatory development of a country and financial education is extremely important to increase financial literacy. All sections of the society should have the knowledge of financial transactions, financial markets, financial products, and simple financial concepts.

Improving personal financial management involves making regular savings as a habit, exercising prudence in borrowing and well-informed investment decision-making, all of which would help build up financial assets over time and develop suitable buffers such as contingent funds and retirement plans. Engaging in financial transactions without such knowledge and information could have socioeconomic consequences.

Many people who are living in the rural areas of Sri Lanka, especially the low-income segments, have been excluded from the formal financial sector due to lack of financial literacy. Financial literacy facilitates the understanding of what is needed to achieve a financially balanced, sustainable, and decent lifestyle. Improving financial education can benefit people in all walks of life, at all ages and in different income groups with different priorities.

The discipline created through proper financial education, enables individuals to establish greater economic security and stability during the latter part of their lives while increasing their incomes, savings, assets, and investments. It helps people to plan their pensions and savings wisely and provides them with the information and skills they need to make prudent investment choices to ensure they have adequate savings for a contented retirement.

A comprehensive public integration program is needed to improve financial literacy. The CBSL, in collaboration with the Government, is currently implementing the NFIS. Financial education is given high importance in this program and steps are being taken to include financial literacy related subjects in the school textbooks. The presence of people with financial literacy is crucial for the participatory and balanced development of a country. The steps to increase the levels of financial literacy must be taken since it will positively affect the country’s GDP per capita and is bound to have positive effects ripple across the country to help people withstand economic shocks.

References:

Bank Quest, The Journal of Indian Institute of Banking & Finance, January - March 2012

U Batsaikhan and M Demertzis (2018), Financial literacy and inclusive growth in the European Union, Policy Contribution Issue no. 08

Ramachandran, Ramakrishnan (2012), Financial Literacy and Financial Inclusion. 13th Thinkers and Writers Forum, Available at SSRN: https://ssrn.com/abstract=2204173

Antonia Grohmann and Lukas Menkhoff (2017), Financial literacy promotes financial inclusion in both poor and rich countries, DIW Economic Bulletin

Arora. A (2016), Assessment of Financial Literacy among working Indian women

Alliance for Financial Inclusion (2010), “Consumer Protection: Leveling the Playing Field in Financial Inclusion” Bangkok, Thailand

Financial Times (2020), Financial literacy among undergraduates: Research findings of concern,

Global Financial Literacy Excellence Centre, (n.d.). Retrieved from S&P GLOBAL FINLIT SURVEY: https://gflec.org/initiatives/sp-global-finlit-survey/

Part 1 of this article was published in the Daily FT yesterday and can be seen at https://www.ft.lk/columns/ Financial-literacy-A-closer-look-at- Sri-Lanka-Part-1/4-736698

(The writer is Senior Assistant Director at the Central Bank of Sri Lanka.)