Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 10 August 2022 00:25 - - {{hitsCtrl.values.hits}}

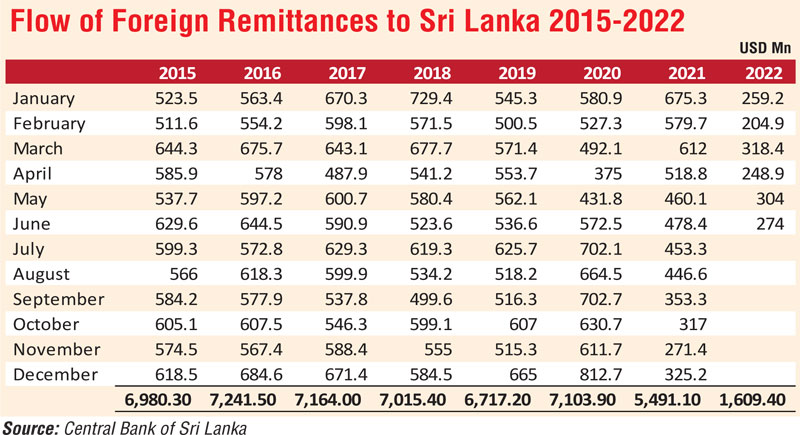

Sri Lanka’s remittances need to double immediately; however, are we addressing the underlying issues?

Our economy runs on money, its availability and its price and when the cost of money in the form of interest rates keeps increasing in the banks and NBFIS, business growth slows down sharply or even gives way to a recession (according the WWW a recession is a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP). A more complex symptom is unemployment. The banks’ lending rates have risen too quickly in the recent past to a level that is now unbearable to most businesses (big and SMEs).

Our economy runs on money, its availability and its price and when the cost of money in the form of interest rates keeps increasing in the banks and NBFIS, business growth slows down sharply or even gives way to a recession (according the WWW a recession is a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP). A more complex symptom is unemployment. The banks’ lending rates have risen too quickly in the recent past to a level that is now unbearable to most businesses (big and SMEs).

Massive policy interest rate hikes are generally associated with high inflation that might have been fuelled by earlier lax monetary policy adopted. Ironically there is no one-size-fits-all measure of how quick is too quick, and no way to know whether the Central Bank has made optimal tradeoffs between growth and inflation.

Inflation

The country’s annual inflation according to newspapers hit a record high of 54.6% June as the cost of food rose by more than 80% amid the crisis. In a desperate measure to contain inflation due to the ongoing economic crisis, the Monetary Board of the Central Bank of Sri Lanka’s according to newspapers decided to increase the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by almost 800 basis points to 14.50% and 15.50% from where it was at the time the USD was ostensibly floated to its current managed peg, ostensibly to tackle the rising domestic inflation – inflation which was primarily driven by the USD depreciation in the imported foods content and only secondarily by the fertiliser and transportation of the locally produced food content. These rates are at the highest in 21 years and the central bank has said repeatedly that they had noted a higher-than-expected increase in inflation.

The high inflation is expected to remain for a while, thus the Central Bank has resorted to further monetary policy tightening to contain any build-up of adverse inflationary impact on the economy. The Central Bank, according to newspapers, said that the policy adjustments would help the economy to contain its inflation to between 4 and 6% in the medium term. The Central Bank raised rates by 700 basis points in April 2022 and another 100 in July 2022. However the root cause for inflation in Sri Lanka is the forex crisis.

In effect we have happily imported inflation into the country. The tools we are using to contain inflation may actually push the economy into a deep recession and severely affect the livelihoods of the SMEs. A less impactful tool would be to better manage our current account by scaling down USD outflows (the high value bulk of which is at largely reduced levels presently), enhancing the surrendered USD outflows and consequently improving the current account deficit and easing the pressure on the USD. The large import content of the food inflation can then be reduced with import substitution driven by input factor availability. The remittance flows also must be addressed concurrently.

Impact of interest rates

Usually interest rates are the CBSL’s main tool to combat inflation. According to analysts CBSL got inflation all wrong. And now they’re trying to correct their mistakes by pretty quickly increasing interest rates. And that is slowing the economy, some however argue it was the right thing to do. The micro, small, and medium scale businesses, and the financial sector performance will have far-reaching adverse consequences of a prolonged period of borrowing rates of over 22%. Very few businesses can make money by borrowing at those rates.

High interest rates usually have a negative impact on the stock market. Those who have a deep understanding of managing banks will know this very well. The impact of these high borrowing rates will be seen in a few months. Meanwhile the Government is struggling to pay for imports of essential goods, including fuel, essential food and medicine. The high interest rates have had a huge impact on consumption and investment.

Currently the government revenue is insufficient to service the interest on domestic debt of the GOSL and casts a shadow on overall debt sustainability. High LKR rates paid by the GOSL on its domestic debt, would be watched closely by foreign bondholders, when restructuring our debt to them. The ISB holders at present are being engaged by consultants. The final terms for the ISB restructuring require a third to agree for it to be applicable. Most bond holders want an IMF program on fiscal management and consolidation, all other debt (Multilateral and Bilateral) would need to be restructured by GOSL with the assistance of the IMF. Therefore FDIs and local investments are a must.

Conclusion

The World Bank, ADB and IMF, and friendly countries will step in to support the country if it is politically stable. Our closest neighbour India was appreciated publicly by the President for the support given during the crisis. Certainly India-Sri Lanka relations is a highly positive one, including some of our longstanding friends. Therefore a national government that has the people’s confidence will be a good way to move forward. The president knows this and is moving in the right direction. National unity will certainly decide our fate.