Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 9 April 2025 00:28 - - {{hitsCtrl.values.hits}}

Even if negotiations help reduce these tariffs for Sri Lanka or the world, that still leaves the world open to the storm that has already been unleashed

Introduction – Trump’s tariffs are beyond a short-term shift

Introduction – Trump’s tariffs are beyond a short-term shift

Worries over Donald Trump’s reciprocal tariffs are taking the world by storm. In Sri Lanka, the much-larger-than-expected 44% reciprocal tariffs are undoubtedly going to be massively consequential. Yet these tariffs signal a much bigger and far more impactful shift, that affected both the short-term and the long-term.

The global economy was driven by US deficits for over 50 years

While the global economy has been under a US dollar system since the end of WW2, the current form of it only really took shape in the early 1970s. When the US went off the gold standard and moved into a fully fiat-based monetary system, the relationship of the US to the rest of the world changed pretty significantly. The consumption of the US household increasingly and aggressively started becoming one of the core features of the modern world. The US financed this consumption through increasing external and fiscal deficits, which were balanced by corresponding surpluses in varied countries across the years.

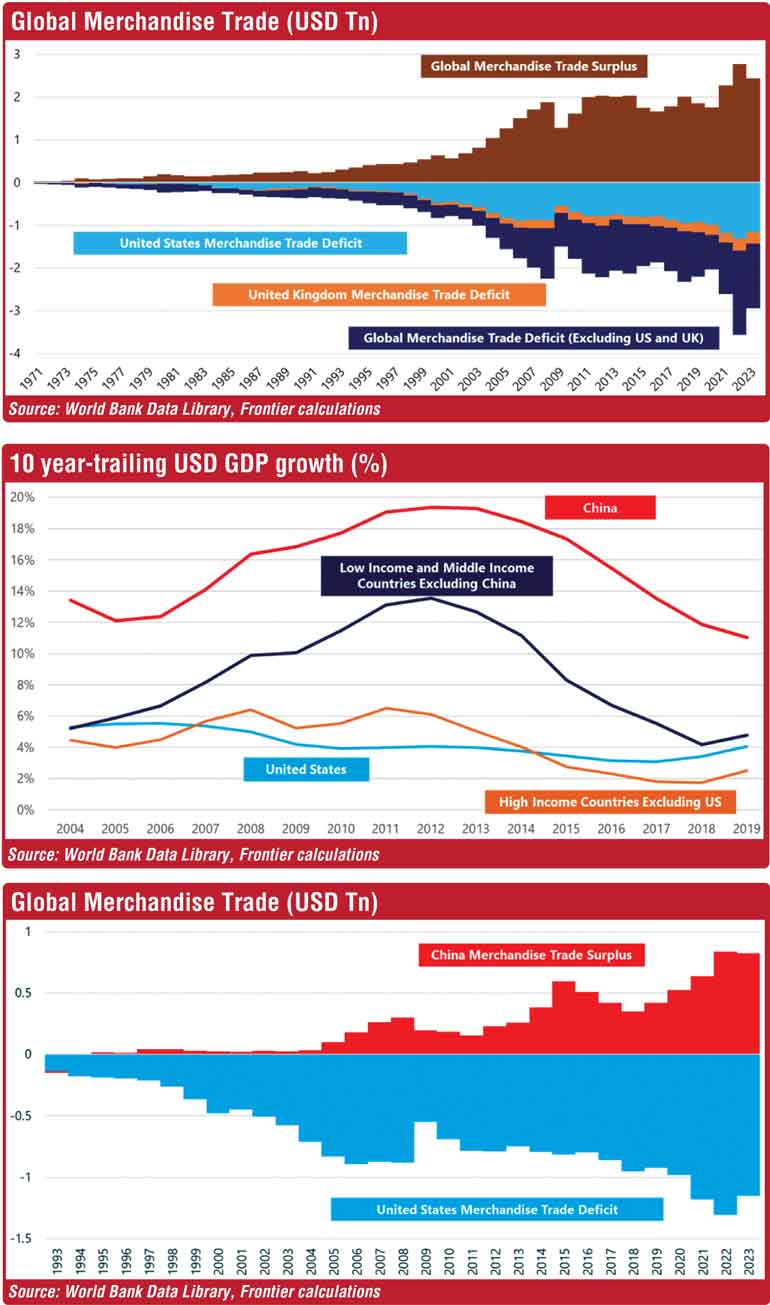

Since the 1970s, the US has consistently run the biggest merchandise trade deficit. A few other countries (notably the UK and increasingly, India) have run smaller, yet significant, deficits as well, but even these are dwarfed by the US. Other deficit countries add up to a lot, but are individually pretty small. All this has also gone alongside increasing borrowing across the world in order to finance these deficits, but primarily towards the US.

Where has the money to lend to the US come from? Various countries have produced more goods than they have consumed and essentially run surpluses. They have sold these goods to the US, used the money paid by the US to then lend to the US. One could also look at this the other way around; the US has borrowed from these production surplus countries to buy the goods they produce. The circular nature of this is only allowed by the power of global finance – which is why global debt has risen so much across this same period.

Across the last 20 years, Chinese surpluses have increasingly balanced the US deficit

Slowly from the mid-90s, and increasingly from the mid-2000s, China started to become the single biggest producer in the world. This meant that China became the clear counterparty running a surplus that countered the US deficit. For the first few years where this was clear, China directly lent to the US. After a while, when keeping this up overall became hard for China’s internal econo-political dynamics, the money ended up indirectly flowing to the US.

This replaced the previous part of this global system where there were multiple countries that ran surpluses at varied points. This meant that different countries were sending money to the US at different points, and there were varied big shifts in global capital flow that went alongside. In the 70s, it was the petroleum producing nations of the world. The 80s and 90s saw Japan and Germany playing this role.

But as China increasingly became the single biggest player that ran surpluses, it ended up having continuously higher production capacity, capital surpluses, and the corresponding local political and social structures that went alongside it. China’s banking system has been geared towards this, China’s political successes have been due to this, and even Chinese jobs and culture have been shaped very closely by this.

A US deficit-China surplus world comes with unique strengths and weaknesses

The twin pillars of this US-China global economic order ended up creating plenty of specific incentives within both the countries as well as across the rest of the world. Within the US, the idea of needing to run continued deficits to drive strong growth has been especially unpopular, particularly given the more free-market origins of this monetary system. In China, the strength of the production systems meant that shifting away from them would create relatively big economic pain, that would run the risk of political and social costs within the Chinese system of decentralised centralisation. For the rest of the world which ultimately ended up intermediating trade and capital flows between these two, different versions of these costs and benefits were felt as well.

One positive outcome of this system is that you have a relatively consistent pathway for global trade and global capital to flow through. You produce in China and sell to the US. That meant for countries in between, you had a relatively consistent flow of capital. This stability is likely a big part of why during this period, you had a large explosion in global growth, especially in the developing world that intermediated both trade and capital between the US and China.

However, the risks are that this system requires both the US and China to run these deficits and surpluses continuously. For the US, the idea of running consistent deficits has been a continuous political problem. Time and time again, the economic consequences of running these deficits, both in terms of debt but also in terms of inequality, have pushed political change. For China, the same is true in the opposite direction. In the mid-2010s for example, China tried to deal with this by attempting a different economic strategy – but the system ended up revolting. Since then, China has only doubled down on its production-surplus economic strategy.

A world without US deficits or Chinese surpluses will be fundamentally different

The tariffs that the US administration is imposing are fundamentally about this factor – and in some sense explicitly said to be so. If closing trade deficits with the world is the main driver, then the fundamental foundation of the global economy for 50 years or more is at risk. If the US is successful, then for China, the main counterparty, this necessitates falling surpluses or new deficit partners. For the rest of the world, this economic tussle will mean far bigger shocks and sustained worries than merely a singular increase in tariffs.

Closing the deficits, if successful, will mean that the US is no longer going to be the consumer of the world. In that sense, there is no longer a need for the rest of the world to run production surpluses, but from another crucial sense, there is also no ability to. Who would buy China’s products if the US is no longer a consumer? That will mean big changes not just to the US, not just to China, but to everyone who intermediates between them.

The immediate whiplash of this is what we’re going through now – Trump’s tariffs. Even if negotiations help reduce these tariffs for Sri Lanka or the world, that still leaves the world open to the storm that has already been unleashed. One extremely important point to watch out for here is China. The US is only one half of the global system. How will China respond both immediately and over time? That means big changes are still possible.

Conclusion – Prepare for a changing global economic system

If the global economic system is fundamentally changing, both the short-term and the long-term can see huge and unprecedented changes. For the short-term, they can be as massive as the tariffs but they might not be limited to them – both positively and negatively. For the long-term, that is about being flexible enough to prepare for whatever way the world changes. That will be a tall ask, but if the world is truly changing, it will be a necessary ask in the end.

(The writer is the Head of Macroeconomic Advisory at Frontier Research, a Colombo-based firm that engages in macroeconomic research and advisory for corporate and investment clients on Sri Lanka, South Asia, and South East Asia. He can be reached at [email protected].)