Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 7 January 2022 00:08 - - {{hitsCtrl.values.hits}}

The FT on Wednesday had a very insightful editorial titled “Time for the IMF”. The editorial noted that the “Government’s announcement of the Rs. 229 billion relief package fits right into this Government’s now preferred mode of operation – firefighting, as opposed to planning and pre-empting.

The FT on Wednesday had a very insightful editorial titled “Time for the IMF”. The editorial noted that the “Government’s announcement of the Rs. 229 billion relief package fits right into this Government’s now preferred mode of operation – firefighting, as opposed to planning and pre-empting.

Further the editorial said, “The funds for the relief package, Finance Minister Basil Rajapaksa has assured, will be sourced from within the budget, without any new taxes being implemented. How this can be done from within a budget that already had a vast amount of question marks surrounding its viability, is anyone’s guess”.

Further the editorial noted that the “Country’s economy is in as dire a state as it has ever been, and now is not the time to protect one’s political standing, while it’s hard to imagine that the conditions imposed by the IMF could be any worse than the predicament facing the public at present. The goal of the Government right now is to eliminate the country’s macroeconomic imbalances, resolve the debt crisis, and boost investor confidence. As unpalatable as it may seem in some quarters, the IMF might just be the best way to achieve those goals.”

|

| Central Bank Governor Nivard Cabraal |

|

| Treasury Secretary S.R. Attygalle

|

Cause of the crisis

The economic crisis in Sri Lanka was largely driven by the pandemic fallout and the massive drop in tourism income – the No. 2 foreign exchange earner for the country. But unlike Sri Lanka, those countries with similar income streams have managed their finances much better than Sri Lanka and are now on the path of recovery. The tax cuts, high public spending, and large debt payments have pushed the country to near bankruptcy in 2022. Rising inflation and shortages has impacted those lower middle-class families that were reasonably well off prior to the pandemic. According to the World Bank nearly 500,000 additional people have now fallen below the poverty line post-pandemic.

Options

The Government to ease the burden of the public due to the ever-increasing COL could continue to print more money to provide relief, to prevent a massive pushback from the public, while the Government buys some time as they seek debt relief from their various lenders and get budget support from friendly countries like India and China. The $ 500 million ISB that is due in January will certainly be paid on time. Some of it is held by local banks. In the next 12 months around $ 7 billion has to be found to pay off all the loans falling due and others. This is no easy task given the re-emergence of a new COVID variant – Omicron.

Tourism income is set to improve, but would be 23/24 before Sri Lanka sees a full recovery in that sector. So, Sri Lanka’s financial position is not what the country wants. Whilst the country looks to India and China for debt relief, joining an IMF’s COVID relief program may be the best option for the country according to several economists. Successive governments have blamed each other for piling up current debt. This debt situation is clearly not sustainable. Some governments had even piled up large amounts of government debt via the state-owned enterprises which is all off the books of the treasury.

Various solutions to the debt crisis have been proposed by the opposition and experts, such as swaps, selling SOEs, going to the IMF and bilateral loans. All these are temporary fixes. We must have a program to drive up exports and attract FDI. The banks must wake up and play a special role in this effort.

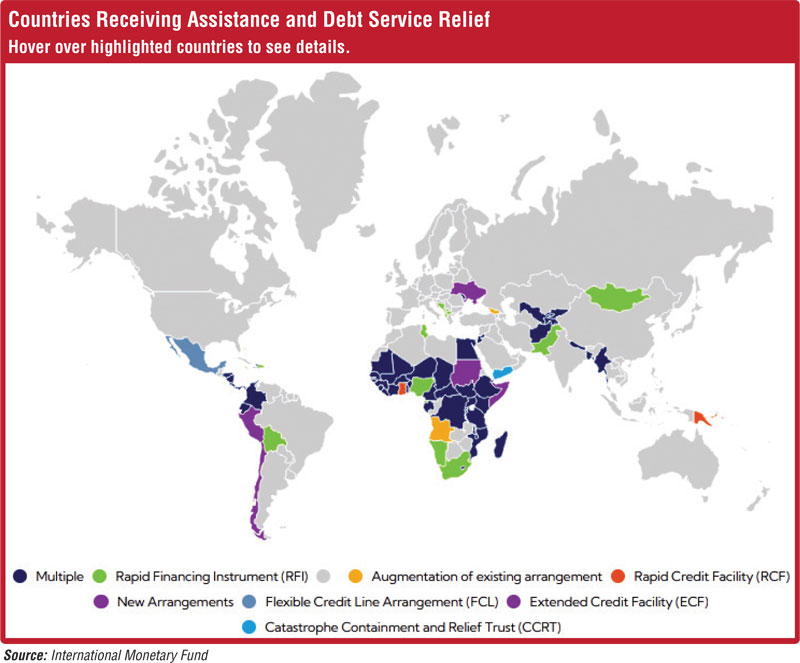

Going to the IMF

Whether the IMF is willing to provide Sri Lanka with a bail out in the form of a loan, in addition to the traditional policy advice and technical assistance is not certain and will certainly come with conditions attached as pointed out by Basil Rajapaksa. In the early days of the crisis according to World Bank sources – debt service suspension initiative and low interest loans were made available under a framework. Many of these concessions have now expired. Like Sri Lanka, several low-income countries are still finding it increasingly difficult to service their sovereignty debt as these countries are forced to make a choice between servicing their debt and protecting the livelihoods of its people.

In the final analysis, 2022 will continue to be a challenging year for all low-income countries that need concessionary debt treatment, therefore a new framework led by the muscle of the G20 and supported by private sector creditors will be critical to unlock IMF financing for debt-ridden countries. Therefore, multilateral action is urgently needed for sustainable debt support until the pandemic starts winding down.