Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 20 August 2022 00:05 - - {{hitsCtrl.values.hits}}

My friend Harsha de Silva who is among the handful of non-corrupt politicians in the country has now become the undisputed economic spokesperson for the entire opposition. Few days ago he came up with a specific roadmap for economic recovery. He has said according to the FT, the Opposition has taken a bold step to provide the Government with its own blueprint titled ‘Out of the Debt Trap and Towards Sustainable Inclusive Development’. The document presented in Parliament by de Silva on Friday consisted of a 10-point common minimum program for Sri Lanka’s economic recovery.

My friend Harsha de Silva who is among the handful of non-corrupt politicians in the country has now become the undisputed economic spokesperson for the entire opposition. Few days ago he came up with a specific roadmap for economic recovery. He has said according to the FT, the Opposition has taken a bold step to provide the Government with its own blueprint titled ‘Out of the Debt Trap and Towards Sustainable Inclusive Development’. The document presented in Parliament by de Silva on Friday consisted of a 10-point common minimum program for Sri Lanka’s economic recovery.

De Silva going one step further said it has been months now since Wickremesinghe became Prime Minister and now President, and whilst the main Opposition agrees with his broad game plan for Sri Lanka’s economic recovery, there has not been any specifics spelt out thereafter. The SJB MP expressed concern on the delay, noting that Sri Lanka has no time to lose and people are losing confidence that there is no plan. Whilst there is a lot of sense in what Harsha is saying, however, the situation on the ground needs far more hardwired decisions and action than just visionary statements.

For example, we all know the economy needs an infusion of about $ 1 billion to ride through the next three months. How do we raise this money? Can the banks or the Government do this? Have the bilaterals or the multilaterals worked a deal with the Government? What are our options in the absence of a deal? The banks are being blamed for fuelling the GOSL’s borrowing binge on commercial terms in the past. So the prudent option is to shrink the economy to a level where we can manage our forex demands or look at other short-term options to raise money using new instruments.

There are great examples from Romania and Greece. I suggested several short-term options in a recent article in the FT to boost our forex flows. Business tycoon Dhammika Perera has suggested several practical short-term options. Obviously he knows what he is talking about. His company raked in 20 billion profit in one quarter (ft.lk Hayleys achieves record-breaking Rs. 20 b profit before tax in 1Q: https://www.ft.lk/front-page/Hayleys-achieves-record-breaking-Rs-20-b-profit-before-tax-in-1Q/44-738734).

Debt restructuring

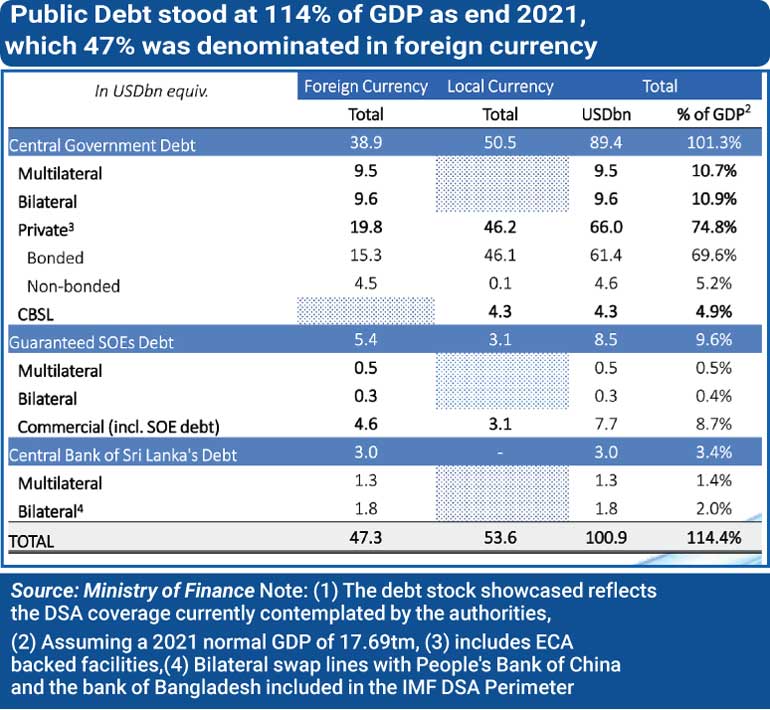

The other big ticket item is debt restructuring. Harsha says Sri Lanka must engage with its creditors and restructure its debt on an urgent basis, and for this the country must demonstrate its willingness to achieve debt sustainability through a system of reform. We all know this must be the topmost priority for the country. The Finance Ministry according to the Daily FT of 17/08 says: “Engaging with the International Monetary Fund to secure a program, hiring financial and legal advisors, initiating the design of an economic reform program, engaging with bilateral creditors, and notably to secure emergency liquidity credit lines were among the measures taken by the Government. Further they said: “As per the Debt Sustainability Analysis conducted by the IMF, Sri Lanka’s public debt has reached unsustainable levels, standing at 114% of GDP as at end 2021, of which 47% was denominated in foreign currency.

President Ranil Wickremesinghe said recently, “Sri Lanka’s debt advisors are currently looking at local debt, as a restructuring plan to negotiate with our creditors, this is being developed as part of efforts to make debt sustainable in order to obtain support from the IMF. The latter has specifically told us to bring a sustainable debt restructuring proposal through negotiations with China as well.”

Local debt haircuts would have to deal with the resultant banks’ capital augmentation through capital injections, where possible from FDIs or local investments with better bank prudential behaviour and strong and competent boards, independent of GOSL suasion on bond investments factors they see as the “radix causa” of the LKR liquidity crisis that benefited themselves and not the nation and that fed into the USD liquidity crisis, and its devastating results on bank balance sheets. The impact on insurance firms, asset managers, large corporates and wealthy households could also be directly affected. Indeed, non-banks hold around half of the stock of domestic debt. The knock-on consequences could be severe and should be factored into any policymaker cost-benefit analysis exercise.

The Governor of the Central Bank has however ruled out any haircuts on domestic debt restructuring. Let us hope he can convince the private creditors ($ 20 billion) to agree to his terms. The unplanned default has also put pressure on the process. There are several other options that need to be explored. The mere possibility of such a course of action being taken highlights the very difficult situation the country finds itself in after years of economic mismanagement and months of political paralysis. So the challenges are humongous and cannot be sorted with a stroke of a pen or a press conference. What is more important is to sanction first and then prosecute all those Government officials, politicians and advisers who are responsible for halving Sri Lanka’s net worth and forcing Sri Lanka to default.