Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 14 June 2018 00:00 - - {{hitsCtrl.values.hits}}

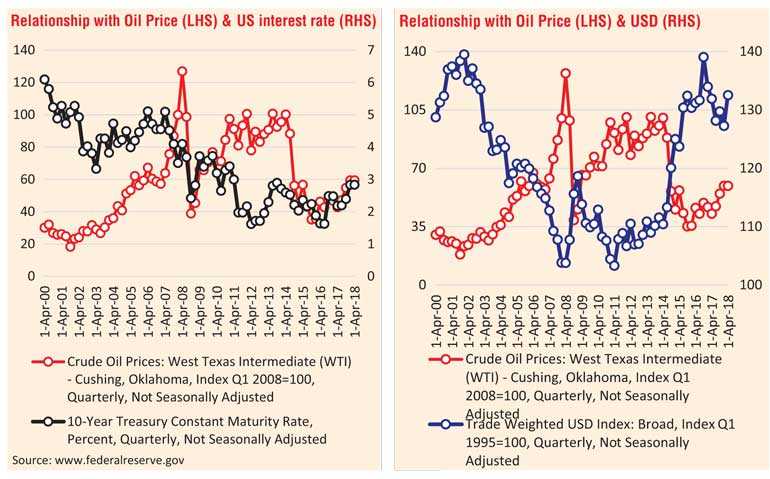

The three most important global prices – oil, United States Dollar (USD), and US interest rates – have hit fresh highs. This is an unprecedented development. These prices don’t often move together, rather they move in opposite direction.

The long-term oil price direction is believed to be decided based on the relative strength of the USD, hence these two prices move in opposite directions. On the other hand, direction of US interest rates and underlying strength of US economy in general decides the direction of the currency. These collective actions in turn set the direction of the commodity market, including oil prices. However, synchronised surge in all three prices is uncommon and has added serious strain to the global economy.

It has been a busy week for the world’s three most powerful central banks with the US Federal Reserve setting the pace in a retreat from the era of easy money. When this piece appears in print, the decision would be known to the markets.

Three meetings within 36 hours of each other is expected to conclude with the Fed raising interest rates, the European Central Bank indicating its plan to cease buying bonds, and the Bank of Japan maintaining its massive stimulus program. Implication of these central bank actions are far reaching beyond the boarders and complicated.

The Fed action and emerging economies

It is noteworthy to observe the divergence of policies of central banks for almost half the global economy and three-quarters of the official currency reserves. It also threatens to intensify pressure on emerging markets, which are already unnerved by the withdrawal of US monetary stimulus. The Fed is in the lead of exit cycle, the ECB may anytime decide withdrawing after more than three years of quantitative easing due to the mounting optimism that the world economy remains on track for a solid expansion in 2018.

The Fed action is solely based on its focus; managing the domestic economy regardless of possible fallout elsewhere in the global economy. Emerging markets are at risk from higher US interest rates forcing up the dollar and prompting investors to shift money back to the US.

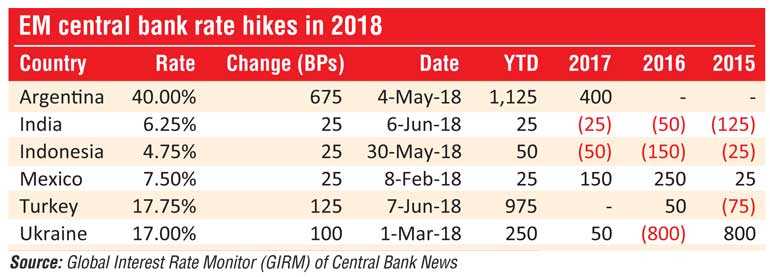

During the last few weeks, Turkey, India, Argentina, Indonesia and Mexico lifted their domestic policy interest rates to protect their economies, while Brazil again intervened to defend the currency. Amidst looming crisis, central banks of the emerging economies called on the Fed to be mindful of its actions.

Easy money era

After the financial crisis in 2007/08, followed an extraordinary period of repressed volatility in financial markets, ultra-low interest rates, and dollar weakness unleashed another surge of capital flows to emerging countries, which tend to return to US at the first sign of trouble.

Empowered by exceptionally generous global financing conditions and quantitative easing by the developed world central banks, a number of emerging-market companies have resorted to external dollar borrowing, substantially increasing their financial vulnerability to higher interest rates and adverse USD movement.

Argentina

Inconsistent policy has worsened the debt problem and threat of currency depreciation in Argentina. The Central Bank of Argentina (BCRA) switched to an emergency mode in May by increasing the policy rate (the seven-day repo reference rate) by 675 basis points to an all-time high of 40.00%.

The decision marked the third rate hike within a short span. On 27 April, the Central Bank surprised markets by increasing interest rates 300 basis points from 27.25% to 30.25%; this was followed by another hike on 3 May, bringing the rate to 33.25%. The action temporarily helped to arrest the currency slide.

Turkey

Turkey is a classic example how conflicting ideologies can cause serious economic hardships. With twin deficits, Turkey was not in favour of raising its interest rates and forgoing its high economic growth (i.e. 7.3% in 4Q2017) in order to combat inflation which was running above the policy target and protecting its currency (Lira). The Turkish lira has slid by over 25% YTD, the country was out of options and had to resort to orthodox monetary policy action, the Central Bank of the Republic of Turkey’s (CBRT) decided to raise interest rates by a massive 300 basis points at an emergency meeting in May and followed by another hike of 175 basis points. The CBRT also decided to simplify policy instrument choosing one-week repo auction rate as its policy rate.

Pre-emptive action by India and Indonesia

The Indonesian central bank (the BI) decided to increase their policy interest rates; 7-day Reverse Repo Rate by 25 basis points to 4.75%. The Central Bank stated the decision as pre-emptive, front-loading, and ahead-of-the-curve moves to strengthen stability, especially exchange rate stability against a higher than expected Fed Fund Rate (FFR) hike and increasing risk in the global financial market. The inflation forecast of 3.6%, is closer to the mid-point of the 2.5-4.5% inflation target. By switching to tightening bias, Indonesia sends clear signal to the markets that the bank will continue to prioritise external stability even if it weakens the growth outlook.

India observed a spiked in core inflation while softening food inflation. The country suffers more from the increased in oil prices. The central bank (RBI) decided to raise interest rates exiting from its softening cycle. The RBI action is viewed as a signal up front of its readiness to take preventive action and not repeated jumps in inflation and run on its currencies.

EM policy direction

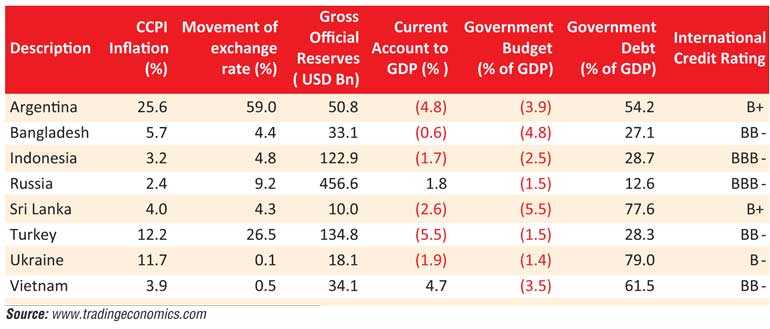

Synchronised USD appreciation, international oil price gains and a Hawkish fed induced capital flight back from emerging markets, could pushed domestic inflation if accommodative policy is maintained. Turkey’s case having an accommodating policy while inflation being allowed to run higher caused severe loss of investor confidence and a spiralling effect on the currency, which was visible in the sharp Turkish Lira depreciation.

The US exit strategy and ECB’s gradual withdrawal of its stimulus programme has caused a reversal of the capital flows back to the developed world. The emerging market currency slide prompted by the developed world central bank actions have caused emerging market central banks to quickly resort to emergency monetary policy actions lifting domestic policy interest rates. Countries with twin deficits especially will be vulnerable such external shocks and should be prepared to high interest rates regime.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)