Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 30 November 2021 01:39 - - {{hitsCtrl.values.hits}}

While Sri Lanka is facing a severe economic crisis manifested by rising prices, consumer goods shortages, high cost of living, low international reserves, foreign exchange scarcity, and slow economic growth, the authorities are still reluctant to adopt any credible policy reform package with the assistance of the International Monetary Fund (IMF). The fiscal deficit, which is the root cause of current macroeconomic imbalances, is most likely to remain even higher next year as Budget 2022 fails to address the revenue shortfalls, expenditure hikes, and debt sustainability risks.

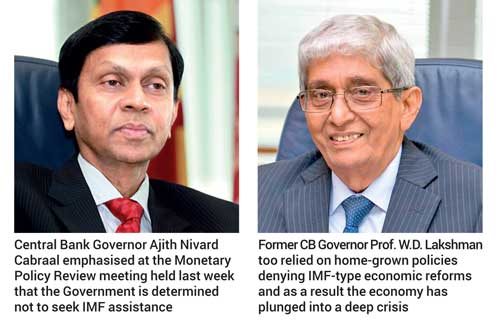

Central Bank Governor Ajith Nivard Cabraal emphasised at the Monetary Policy Review meeting held last week that the Government is determined not to seek IMF assistance. According to him, the six-month Road Map of the Central Bank of Sri Lanka (CBSL) based on home-grown policies addresses all outstanding economic issues, and therefore, there is no need to go to the IMF to seek its advice on economic reforms or debt restructuring.

He emphasised that the CBSL has enough expertise to formulate credible economic policies. However, it should be noted here that the problem is not about the availability of local expertise, but how to resolve the economic imbalances through a credible adjustment program winning foreign investor confidence. The Road Map does not present any such credible policy reform package.

Disastrous effects of the home-grown solution

Former Central Bank Governor Prof. W.D. Lakshman too relied on home-grown policies denying IMF-type economic reforms, and as a result, the economy has plunged into a deep crisis, as reflected in the severe economic hardships encountered by ordinary citizens with long queues for essential commodities, high consumer prices and unbearable cost of living.

As the Central Bank continues to accommodate fiscal deficits by lending to the Government without any resistance, the money supply grows faster creating demand pressures on both consumer prices and imports. Meanwhile, a drastic decline in foreign reserves has restricted the CBSL’s ability to defend the rupee, and foreign currencies are now traded in the black market at much higher rates above the officially announced exchange rate. Continuous reliance on the so-called home-grown policies will aggravate the current economic problems.

Corruption-led economy

The economic crisis that Sri Lanka is facing today has two dimensions. First, as in the case of the rest of the world, the economy is severely hit by the COVID-19 pandemic. Second, we must note that the economy had not performed well even before the pandemic. GDP growth was on a declining trade over the last 15 years, and the growth rate was down to 3% immediately before the pandemic due to several causes including low productivity growth, low research and development (R&D), outdated technology, lack of innovations, anti-export bias policies, low foreign direct investment (FDI) inflows and macroeconomic imbalances.

Widespread corruption has further weakened investor confidence and the country’s growth prospects.

Economic instability

Continuous fiscal deficits have led to increased borrowings by the Government causing huge debt service commitments. The balance of payments deficit also widened before the pandemic. Relying on home-grown policies during the last two years without addressing the debt sustainability issues has led to aggravating the economic crisis.

The economy now faces severe internal and external imbalances. Internally, inflation is picking up due to excessive money growth, exchange rate depreciation, and supply-side constraints. Externally, the balance of payments problems exacerbated by heavy foreign debt commitments have led to the depletion of foreign reserves and rapid rupee depreciation over the past couple of months.

Fiscal dominance over monetary policy

In terms of the Monetary Law Act, the CBSL is directly responsible for maintaining price stability, which is a prerequisite to economic growth. The policy instruments available to CBSL for the purpose include open market operations (OMO, i.e., buying and selling Treasury bills and bonds), policy interest rates, Statutory Reserve Ratio (SRR), officially announced exchange rate, and foreign exchange trading.

As the CBSL is continuing to lend to the Treasury to finance its cash shortfalls, the monetary policy is severely constrained by fiscal deficits reflecting fiscal dominance over monetary policy. The CBSL is not in a position to mop up any excess liquidity through OMO by selling Treasury Bills in the market as it continues to accumulate such securities to accommodate fiscal needs. This has resulted in a steep rise in the monetary base, and currency (notes and coins) issues. The CBSL does not exercise its freedom to adjust the policy interest rates due to debt commitment implications of interest rate hikes.

As regards the exchange rate too, the CBSL itself has opted to give up a flexible exchange rate system due to possible adverse effects of rupee depreciation on foreign debt commitments.

Monetary policy is inactive

As a result of the failure of the CBSL to resist fiscal accommodation, it has lost its grip on the key policy instruments – interest rates and exchange rate. In the absence of those policy instruments, an open economy cannot sustain, in terms of the well-tested Mundell-Fleming model.

Money supply rose by 18% over the last 12 months mainly due to bank credit disbursed to the Government, as discussed earlier. CBSL’s net credit to the Government rose exorbitantly by 217%. Commercial bank net credit to the Government increased by 16%. But commercial bank credit to the private sector rose at a slower rate of 14%

Exchange rate distortions

As the CBSL has kept low interest rates and an overvalued exchange rate, capital flew out of the country. Foreign capital was withdrawn from the Government debt securities and the Colombo Stock Exchange in the recent past.

The multiple exchange rates persistent in the unofficial market and the severe shortage of foreign exchange have caused enormous difficulties to the export sector. The US Dollar is now traded at varying rates in the banking sector despite Central Bank’s moral suasion efforts to keep the rate around Rs. 200 per dollar. The black-market rate is reported to be high as much as Rs. 260 per dollar nowadays.

CBSL’s Road Map avoids fundamental issues

CBSL Road Map has not addressed the fundamental problems pertaining to the foreign exchange crisis. Instead, it envisages easing the balance of payments problems mainly through non-debt forex inflows such as swaps, Government-to-Government borrowings, monetarisation of underutilised assets, export proceeds conversion rules, monitoring forex inflows, attracting foreign investment to Sri Lanka Development Bonds (SLDBs), and maintaining a fixed exchange rate system at Rs. 199 – Rs. 203 against the US dollar.

Such narrow policy measures fail to address the severe balance of payments problem and the debt crisis. They are mostly short-term solutions that have an ant-export bias.

Since the announcement of the Road Map, the foreign payments situation has worsened resulting in a severe forex shortage reflecting policy ineffectiveness.

Debt problem unaddressed

We can use two benchmarks to check whether Sri Lanka is facing an external debt problem. These are the matrices used in the Debt Sustainability Assessments (DSAs) of the World Bank and the IMF. First, Sri Lanka’s debt solvency ratio (gross public debt to GDP) at 108% of GDP is much higher than the threshold of 55% of GDP. Second, the country’s liquidity ratio (debt service payments on long-term public and publicly guaranteed debt as % of Government revenue) at 64% is much higher than the threshold of 23%.

The debt problem is compounded by high foreign debt accounting for 40% of total debt, and commercial borrowings accounting for 60% of total foreign debt.

In terms of the solvency and liquidity benchmarks, Sri Lanka is ranked in the “extremely speculative/substantial risk” category, along with seven other countries – Angola, the Congo, Congo DRC, Gabon, Lao PDR, Mali, and Mozambique. These eight countries, including Sri Lanka, are now classified as “next in line for default”. Thus, Sri Lanka is now getting closer to the “default imminent” category.

The policy reforms that are essential to tackle the debt problem have not been presented in Budget 2022 or CBSL’s Road Map.

Prudent monetary policy not forthcoming

Instead of harping on a fragile home-grown solution, the CBSL should have formulated its monetary policy based on a coherent medium-term macroeconomic policy framework with consistent fiscal and monetary policies targeting price stability and balance of payments equilibrium. As reiterated in this column previously, the high money supply growth caused by excessive bank lending to the Government is a major source of macroeconomic instability. As an autonomous body, the CBSL should have the backbone to resist such lending and insist on fiscal discipline.

CBSL should have adopted a flexible exchange rate system instead of its present artificial fixed exchange rate system that discourages exports and encourages imports. Also, there is a need to allow interest rates to be determined through market forces, instead of interest rate caps enforced by the CBSL at present.

CBSL should be insulated from political pressures

It is the responsibility of the CBSL to urge the Government to approach the IMF and adopt a strict macroeconomic policy framework targeting fiscal deficit reduction and debt sustainability. Assistance from the IMF would not only enable the Government to reschedule the present unmanageable external debt commitments but also to win foreign investor confidence.

The CBSL must be independent of political pressure. The Central Bank Bill which was drafted three years ago to replace the present Monetary Law Act would have been a launching pad to evolve “inflation-targeting monetary policy” coupled with strict fiscal discipline under the Fiscal Responsibility Act (FRA). Following the recent postponement of fiscal targets stipulated in the FRA until 2030, economic revival backed by strong macroeconomic fundamentals seems to be a distant reality.

(The writer is Emeritus Professor of Economics at the Open University of Sri Lanka and a former Central Banker, reachable at [email protected])