Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 31 August 2022 00:00 - - {{hitsCtrl.values.hits}}

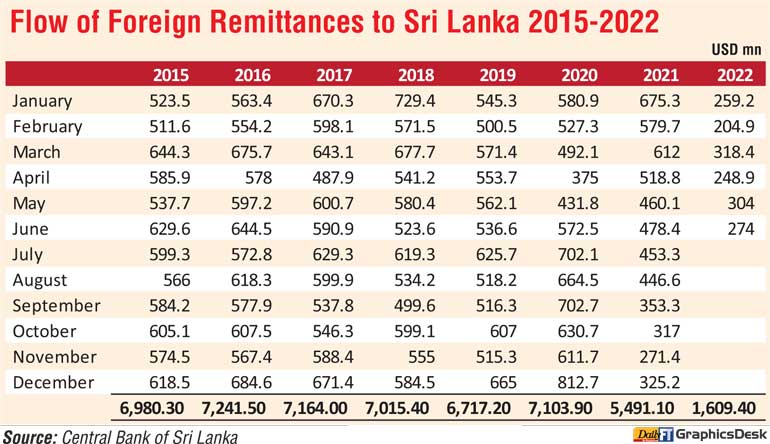

Increasing remittances is key to our recovery effort. Though some officials say the numbers are suspect

According to media reports, the finance ministry temporarily suspended the importation of items listed under 305 HS Codes and connected codes, until further notice on 23 August under the Import and Export Control Act through a government notification. However, it states that any goods specified in these Regulations and which have been shipped on board with the date of Bill of Lading/Airway Bill on or before 23 August 2022 and which arrived at any sea ports or airports in Sri Lanka on or before 14 September 2022, shall be allowed for Customs clearance.

According to media reports, the finance ministry temporarily suspended the importation of items listed under 305 HS Codes and connected codes, until further notice on 23 August under the Import and Export Control Act through a government notification. However, it states that any goods specified in these Regulations and which have been shipped on board with the date of Bill of Lading/Airway Bill on or before 23 August 2022 and which arrived at any sea ports or airports in Sri Lanka on or before 14 September 2022, shall be allowed for Customs clearance.

The communication said that the regulation shall not be applied for importation of any goods, specified in the these Regulations, by any enterprises/operators, approved under the Temporary Importation for Export Purposes (TIEP) Scheme of the Sri Lanka Customs or any enterprises approved under Section 17 of the Board of Investment of Sri Lanka (BOI) Act. Also importation of any goods, specified in these Regulations, by any approved enterprises for processing and re-export purposes will be allowed by the Controller General of Imports and Exports Control on recommendation of the Secretary, Ministry of Industries or Director General, Export Development Board of Sri Lanka on a case by case basis.

The items included in the list range from paper, computers to chocolates and other food preparations containing cocoa, condensed milk, yogurt, coconuts, spirits, roses to perfumes, beauty or make-up preparations, deodorants, undergarments, suit-cases, brief-cases to various clothing items. Several Chambers have expressed concern given the implications this can have on industry in the medium term.

Import controls

The recent import restrictions imposed by the Government certainly have several interpretations such as saving forex to import oil and medicines, boosting domestic production, avoiding re-exporting substandard products and foreign exchange leakage. However, import controls have huge costs at every level in the economy. The significant costs are: 1) Impact on trading partners and FTAs; 2) Impact on local manufacturing for exporting to earn forex 3) Adverse resource relocation to Bangladesh to Indonesia 4) Business closures 5) Goods shortage – all of which can have a big impact on the recovery of the forex starved economy and livelihoods, furthermore amplified with the closing of the open account.

Sri Lanka banned imports via “Open Account” in a move to crackdown on the illegal foreign exchange market (An open account is an arrangement between a business and a customer, where the customer can buy goods and services on a deferred payment basis).

Implications

Import controls have already created huge shortages and inflated prices giving profits to some domestic importers, producers from farmers to others who have always hidden behind import protection to target consumers. Though a few producers benefit, restricting free trade has other negative fallouts and consequences. As an economist pointed out recently, “To think that imports are the cause of the present USD shortage is a completely inaccurate diagnosis of Sri Lanka’s economic situation.”

As the Advocata Institute, a think tank pointed out in a recent report, “Higher rates of imports have been caused by a reckless monetary policy, including quantitative easing and low-interest rates. Our imports have been declining as a percentage of GDP for the last 30 years, as have our exports.

Therefore, thinking that imports are the fundamental problem is a complete misconception.”

Way forward

Whilst there are no easy solutions to the humongous economic challenges the country currently faces, created largely due to the incompetence both at political and officials levels (people are yet to be identified and prosecuted for gross negligence), knee-jerk measures like poorly targeted import restrictions and price controls, meant to provide short-term relief, can in the final analysis really backfire hard and fast as they could augment supply shortages and dent business confidence both locally and internationally.

As top industrialists point out, curtailed input of key raw materials will negatively affect domestic manufacturing for exports. So it is in the best interest of the country to quickly quantify the impact of import controls on the export income and overall economy through a professional upstream/downstream analysis (example; for exports the manufacturer, the distributor, the freight forwarder, any other “middle man” or the end-user, in the transaction) and make the required changes immediately.

The private sector certainly understands the many challenges faced by the country, and would wholeheartedly support smart import restrictions rather than knee-jerk restrictions from time to time.