Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 11 June 2024 00:06 - - {{hitsCtrl.values.hits}}

Rapid industrialisation and human practices associated with globalisation are major contributing factors to the weakening of the planet’s natural resources, and a sustainable way of living is the need of the hour. It is further intricating with dramatic and unusual climate changes.

Rapid industrialisation and human practices associated with globalisation are major contributing factors to the weakening of the planet’s natural resources, and a sustainable way of living is the need of the hour. It is further intricating with dramatic and unusual climate changes.

According to the World Meteorological Organization (WMO), extreme weather, climate, and water-related catastrophes resulted in approximately 2 million deaths and $ 4.3 trillion in economic damages between 1970 and 2021. In light of this recently “Sustainability” has become a buzzword all over. According to the United Nations (UN) 1987, sustainability is: “meeting the needs of the present without compromising the ability of future generations to meet their own needs”.

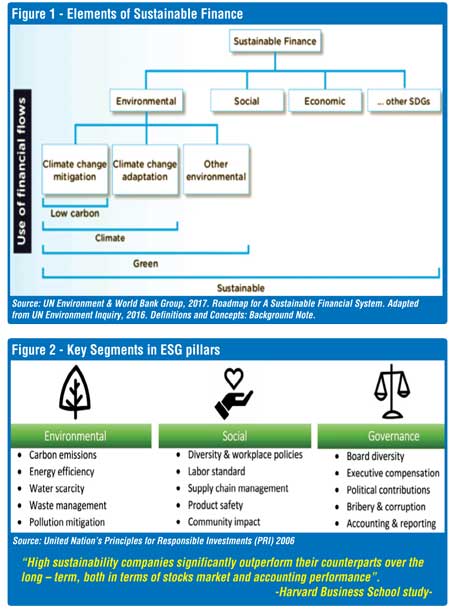

Sustainable finance generally refers to the process of taking due account of Environmental, Social and Governance (ESG) considerations when making investment decisions in the financial sector, leading to increased longer-term investments into sustainable economic activities and projects. Three pillars of sustainable finance are Corporate Social Responsibility (CSR), Sustainable and Responsible Investment (SRI) and Environmental, Social, and Governance (ESG). ESG is the most emergent of the three, having become popular over the past few years.

The elements of sustainable finance are presented in Figure 01 and the key segments in SEG pillars are presented in Figure 02.

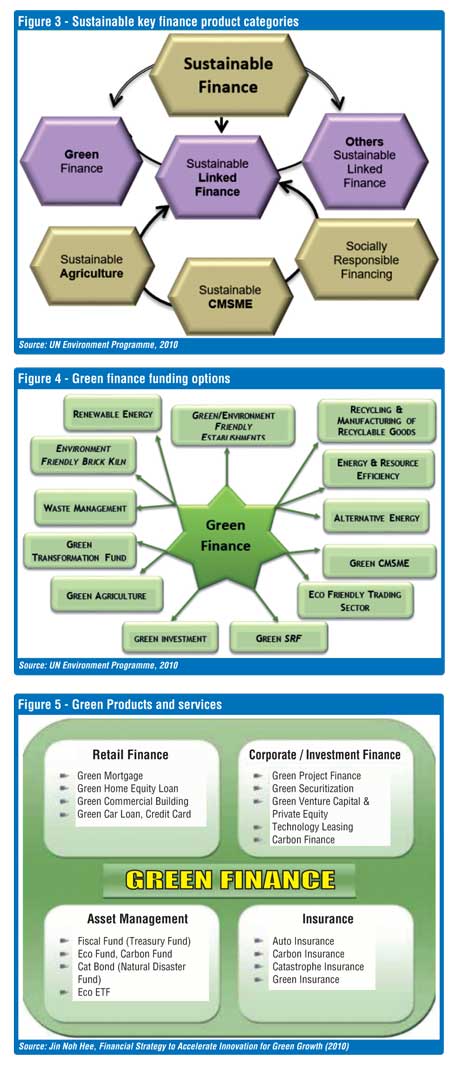

Funding and investment mechanisms of sustainable finance differ from those of non-green finance because green finance needs to consider environmental value in financial activities. Such mechanisms and products are discussed below.

Key stakeholders/influencers in sustainable finance

Key stakeholders/influencers in sustainable finance

The key stakeholders/influencers in sustainable finance include; UN Sustainable Development Goals (SDGs), UN Environment Programme Finance Initiative (UNEP FI), UN Framework Convention on Climate Change (UNFCCC),Climate Bonds Initiative (CBI),Global Reporting Initiative (GRI),International Energy Agency (IEA), International Platform on Sustainable Finance (IPSF), International Sustainability Standards Board (ISSB),Paris Agreement: Task Force on Climate-related Financial Disclosures(TCFD), Green Bond Principles, CBSL Sustainable Finance Textonym, Lenders, investors, and Securities and Exchange Commission of Sri Lanka (SEC).

Products and services related to sustainable finance

One of the important aspects of sustainable finance is integrating ESG considerations into investment processes: This involves taking into account not just traditional financial metrics, such as a company’s revenue or profit margins, but also factors, such as its carbon footprint, its labour practices, and its human rights record.

In addition to integrating ESG considerations into investment processes, promoting disclosure and transparency around ESG considerations is also an important aspect of sustainable finance. The “Initiatives 9”, such as the Global Reporting Initiative (GRI), which provides guidelines for sustainability reporting, which are widely used by organisations worldwide, the Sustainability Accounting Standards Board (SASB), which provides sustainability reporting standards for specific industries, etc.

Products and services related to sustainable finance

A multitude of sustainable finance-related products and services are emerging across several sectors. However, there has been a slow movement in the funding, mainly due to weak sustainable financial literacy among stakeholders, limited risk appetite, governance and ambiguity with risk and return, measurability. In the current volatility, uncertainty, complexity and ambiguity (VUCA) environment lenders and investors are very much careful with their investments. The following could be identified as the major sustainable finance products and services.

Figures 3, 4 and 5 show various green finance options, product and service categories which are currently in the market.

Performance and risk sustainable finance investment

Performance and risk sustainable finance investment

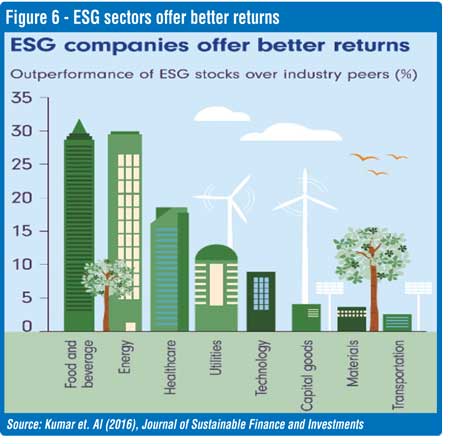

The largest asset management firm in the world, BlackRock, conducted an analysis that revealed that, in 2020, at the height of the COVID-19 pandemic, more than eight out of ten sustainable investment funds outperformed share portfolios that were not based on ESG criteria.

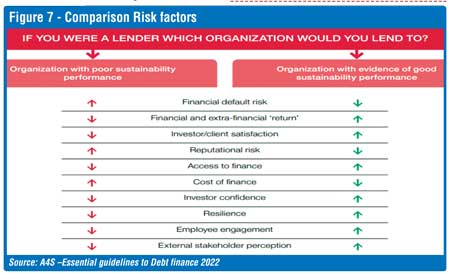

Risk of the sustainable finance

The cost of finance is significantly influenced by credit risk assessment and ratings, which has usually been an inappropriate measure of credit risk for clean energy finance. Factors like inadequate credit information, lack of historical data at the project level, and higher risk of technological obsolescence led to a credit market failure in clean energy finance, leading to mispricing of risk and poor capital allocation to clean energy infrastructure in the economy. The risk comparison for organisations with poor sustainability performance with organisations with evidence of good sustainability performance is given in Figure 07.

Greenwashing may be the biggest risk to the future of ESG investing, but there is no firm agreement on what it means in a legal or regulatory context (Tim Quinson, 2023). Greenwashing is when an organisation spends more time and money on marketing itself as environmentally-friendly than on actually minimising its environmental impact. It is a deceitful marketing gimmick companies use to exaggerate their environmentally friendly actions. To address the risk of greenwashing and navigate greenwashing, Prof Liang (2022) presented three criteria that one can use to assess an operation or investment’s commitment to sustainability, Intentionality, Return and Measurability (IRM).

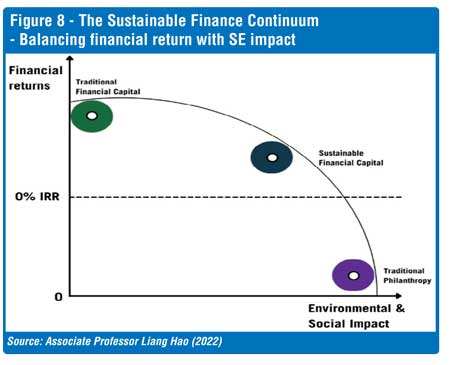

The intentionality of the company or investor refers to their commitment to making a positive environmental or social impact. Their intent can be signalled by joining networks such as the UN Principles for Responsible Investment (PRI), UN Global Compact, or Net Zero Asset Owner Alliance and by clearly disclosing the specific changes they aim to achieve. Companies still need to produce profits while investors still expect a decent return on their investments, but they might accept a lower rate in exchange for sustainability impact. Research by Barber, Morse and Yasuda (Journal of Financial Economics, 2020) found that internal rate of returns (IRRs) for impact funds are 3.4-4.7% lower than traditional funds, though numbers vary across studies. The sweet spot between blending social and financial returns depends on investors’ own utility function but is a clear indication of their commitment to the cause. In terms of measurability, Prof Liang stresses that a company’s operation or an investor’s action needs to be both verifiable and measurable. This means that their claims should be assessed by an independent auditor, and the metrics used to measure sustainability should be “clear, meaningful, transparent and capable of being compared to others”.

The intentionality of the company or investor refers to their commitment to making a positive environmental or social impact. Their intent can be signalled by joining networks such as the UN Principles for Responsible Investment (PRI), UN Global Compact, or Net Zero Asset Owner Alliance and by clearly disclosing the specific changes they aim to achieve. Companies still need to produce profits while investors still expect a decent return on their investments, but they might accept a lower rate in exchange for sustainability impact. Research by Barber, Morse and Yasuda (Journal of Financial Economics, 2020) found that internal rate of returns (IRRs) for impact funds are 3.4-4.7% lower than traditional funds, though numbers vary across studies. The sweet spot between blending social and financial returns depends on investors’ own utility function but is a clear indication of their commitment to the cause. In terms of measurability, Prof Liang stresses that a company’s operation or an investor’s action needs to be both verifiable and measurable. This means that their claims should be assessed by an independent auditor, and the metrics used to measure sustainability should be “clear, meaningful, transparent and capable of being compared to others”.

Conclusion

Conclusion

The main aim of sustainable finance is to mobilise capital towards investments that not only generate financial returns but also positively contribute to a more sustainable and equitable society. Despite extensive attention to sustainable finance by many stakeholders, such as regulators, financial institutions, corporate investment industry, these fields are still emerging and financial literacy on the subject should be enhanced. To summarise this topic and the major takeaways from this study, the following significant points can be concluded Policy and Regulation: Innovation: Increasing demand Impact measurement and reporting, Integration: Integrating sustainability into financial decision-making is a complex and ongoing process, and there is still much work to be done to integrate ESG factors into financial analysis and investment decision-making fully.

(The writer is a well experienced professional banker and independent researcher in economic, banking, risk management, social economic subjects. (Phd – MSU Malaysia, MBA, AIB, MCIM, PGDp, SLIM, Certify Lending IFS UK))