Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 5 July 2024 00:00 - - {{hitsCtrl.values.hits}}

While the IMF staff report offered a foundational framework for the proposed IRIT, recent pronouncements from the Government hint at potential divergences from the outlined plan

|

As per the recently published IMF Staff Level Report, it is expected that the Imputed Rental Income Tax (IRIT) would be implemented before the beginning of the tax year, April 2025.

As per the recently published IMF Staff Level Report, it is expected that the Imputed Rental Income Tax (IRIT) would be implemented before the beginning of the tax year, April 2025.

Sri Lanka faced a crippling economic crisis in 2022, culminating in the nation’s first sovereign debt default – the worst economic hardship in its 70-year history. In response, Sri Lanka initiated discussions with the International Monetary Fund (IMF) in September 2022 for a four-year, Extended Fund Facility (EFF) program.

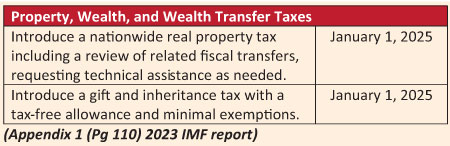

The IMF staff report, prepared in March 2023 following discussions with Sri Lankan officials, outlined tax reforms planned for the 2022-2025 period as a crucial component of the EFF program. Sri Lanka’s March 2023 agreement with the IMF contained significant reforms to Sri Lanka’s tax framework. This included the introduction of nationwide property tax, wealth tax and wealth transfer taxes (such as gift and inheritance taxes), with minimal exemptions and a tax-free allowance, to be implemented from the beginning of the year 2025.

“To reach a primary fiscal surplus of 2.3 percent of GDP by 2025, we will revamp the property tax system and introduce a wealth transfer tax. In particular, we will introduce a nationwide real property tax, and adjust the system of transfers between the central and provincial governments. We will also introduce a gift and inheritance tax with a tax-free allowance and minimal exemptions. Preparatory work for these tax reforms will commence by mid-2023, supported by IMF technical assistance.”

(Pg 89 of 2023 IMF report)

“The full revenue yield from this tax is estimated at 0.4 percent and would materialize in 2026 (with a partial yield of 0.15 percent in 2025). This yield would still fall short by 1 percent of GDP relative to the expected yield of 1.2 percent of GDP from the property tax envisaged for 2025 onwards”. (Pg. 87 of the 2024 IMF Report)

Discussions held in March 2024 with Sri Lankan officials led to a shift in the planned nationwide property tax. Originally envisioned property tax, wealth, and wealth transfer tax as a central reform, have been replaced with an Imputed Rental Income Tax (IRIT) as per the IMF Second Review Report issued in June 2024.

While the above IMF report acknowledges this change, it emphasises the continued importance of implementing property taxation by 2026 to address the nation’s projected fiscal deficit. Notably, the June 2024 report also highlights a shortfall in revenue generation.

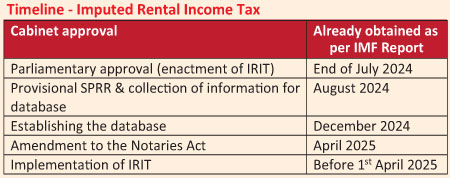

Approved by Cabinet, pending Parliamentary approval and implementation of IRIT

As per the IMF Report, Cabinet approval has been obtained for the IRIT and the other new agreed tax measures.

IMF report states the following:

“We have already obtained cabinet approval of the revenue measures. All measures will be submitted to Parliament by end-June 2024, and we will obtain parliamentary approval for them by end-July 2024.”

(Pg. 86 of 2024 IMF report)

The said Report also points out that tax will be introduced before the beginning of the tax year on 1 April 2025.

Given these constraints, we will introduce an imputed rental income tax on owner-occupied and vacant residential properties before the beginning of the tax year on April 1st, 2025.

(Pg. 87 of 2024 IMF report)

The Report, also indicates that Parliamentary approval will be obtained before the 2025 Presidential Elections for the following:

a) Approval of revenue measures for the 2025 Budget.

b) Expedite the preparatory work needed to introduce the imputed rental tax and implement the 2025 revenue measures.

“New SBs* are proposed to seek the parliamentary approval of revenue measures for the 2025 Budget ahead of the presidential elections and expedite the preparatory work needed to introduce the imputed rental tax and implement the 2025 revenue measures”.

(Pg. 26 of 2024 IMF report)

*SB – Structural Benchmarks

“Navigating the electoral cycle is critical to safeguard reform momentum.

Presidential elections are expected in the fall of 2024. Under the Constitution, parliamentary elections need to take place by August 2025. In the past, the run-up to elections was accompanied by policy slippages and a waning reform momentum. To weather the election-related uncertainties, the program introduced safeguards including new conditionality to frontload revenue measures and a tighter quantitative criterion to lock in overperformance on reserve accumulation”.

(Pg. 26 of 2024 IMF report)

Therefore, the averment in the IMF Report is that IRIT will be enacted into the law with Parliamentary approval prior to the Presidential Elections.

The reason for the deviation from Property Tax to IRIT

IRIT replaces the previously planned nationwide property tax, Wealth, and Wealth Transfer Tax, which was part of the initial agreement reached in March 2023.

According to the IMF report, policymakers appear to have deviated from the initial plan to impose property tax due to two significant hurdles.

a) Constitutional constraints on revenue sharing between local and central governments.

b) Data sharing.

The introduction of the property tax and the gift and inheritance tax by 2025 encountered delays, due to constitutional restrictions on sharing revenues between the central and local authorities and the lack of adequate information on property values. Given these constraints, we will introduce an imputed rental income.

(Pg. 86 of 2024 IMF report)

Giving context to this matter, Sri Lanka is a Unitary State with limited devolution of powers granted by the 13th Amendment to the Constitution. The 9th schedule of the 13th Amendment to the Constitution sets out the matters that have been devolved to the Provincial Council in the Provincial Council list. “Taxes on lands and buildings, including the property of the State to the extent permitted by law made by Parliament” is under the purview of provincial councils. (Also, within the purview of the Provincial Councils is “Turnover taxes on wholesale and retail sales within such limits and subject to such exemptions as may be prescribed by law made by Parliament”).

Extract from the 9th schedule (Provincial Council list) of the 13th Amendment to the Constitution

36.1 Turnover taxes on wholesale and retail sales within such limits and subject to such exemptions as may be prescribed by law made by Parliament.

36.17 Taxes on lands and buildings, including the property of the State to the extent permitted by law made by Parliament.

At present, Social Security Contribution Levy (SSCL), which is nothing, but a “Turnover tax” is another name (a percentage levy on the turnover), is imposed on persons carrying on the business of wholesale or retail sale of any article. According to the Social Security Contribution Levy Act, No. 25 of 2022 (and amendments thereto), the payment of SSCL is to be collected by the Commissioner General of Inland Revenue. (However, as per the Constitution, this is a taxing right given to Provincial Councils, similar to that of taxes on lands and buildings).

What is Imputed Rental Income Tax (IRIT)?

The Imputed Rental Income tax is to be imposed on “owner-occupied and vacant residential properties”. Thereby the tax is imposed on the “deemed income of individuals” (rather than real property itself) that “homeowners could earn if they rented out their homes”.

As per the IMF report, the rate to be applicable is progressive (graduated tax rate) and will have an exemption threshold.

“Given these constraints, we will introduce an imputed rental income tax on owner-occupied and vacant residential properties before the beginning of the tax year on April 1st, 2025. An exemption threshold and a graduated tax rate schedule would make this tax highly progressive.

Imputed rental income is the deemed income that homeowners could earn if they rented out their homes. The tax is imposed on the income of individuals (rather than real property itself) and thus raises central government revenue in accordance with the constitution.”

(Pg 87 of the 2024 IMF report).

Apart from the above, there is no additional details as to the features of IRIT, such as payment dates, the manner of payment, manner of legislative enactment (a unique Act or an amendment to the Inland Revenue Act), types of potential exemptions if any, details with regard to the tax rates.

Net Annual Value concept in the Inland Revenue Act No. 10 of 2006 (IRA 2006)

Net Annual Value concept in the Inland Revenue Act No. 10 of 2006 (IRA 2006)

The IMF report refers to the Net Annual Value concept on lands and improvements thereon, in the IRA 2006 and the consequences thereof.

“A similar tax was previously included in the Inland Revenue Act. No. 10 of 2006. Under this regime, primary residences were exempt and the assessed values for rating purposes were used to determine the base. Given the broad exemption and the use of outdated and downward biased annual values, the tax generated hardly any revenue”.

(Pg 87 of the 2024 IIMF report)

Based on the above, it is evident that the IMF and the policy makers are of view that the Net Annual Value concept did not succeed as expected, as a result of providing exemptions (such as exempting the primary residence of the individuals) and the use of assessed values for rating purposes to determine the base.

While the IMF recommends a wider tax net with progressive rates, the current Income Tax system, with its narrow base and high rates, suggests that policymakers might prioritise other approaches. Additionally, the IMF criticises the “Net Annual Value” concept for its reliance on exemptions (such as exempting the primary residence) and the use of assessed values. This raises the question: “Is there a contradiction between the vision of the IMF with regard to the Tax Base pertaining to IRIT and the intention of the Government”? The Government’s vision seems to be a narrow Tax Base with high threshold/an exemption for the first house, whereas the IMF report indicates a broader Tax Base with thresholds, but no exemptions. There is no indication whatsoever in the IMF report with regard to the “first house exemption.”

Administrative measures

Administrative measures

The IMF report indicates that, for the successful implementation of IRIT, there are several administrative measures such as establishment of a “Database” for property valuation, creation of a digital Sales Price and Rents Register (SPRR) and the introduction of an amendment to the Notaries Act.

- Database on property valuation

Establishing a database on property valuation, that includes information such as assessed values, latest assessment date, and property type in all municipal councils by August 2024.

(Pg. 15 of the 2024 IMF report)

- Sales Price and Rents Register (SPRR)

Fully operationalizing a nationwide digital Sales Price and Rents Register (SPRR) by end-March 2025, accessible by the Inland Revenue Department (IRD), the valuation department, the land registry, and the public (proposed SB). This digital SPRR would be the key resource for assessing property values and the imputed rental income tax. To start, a provisional SPRR could be introduced in August 2024.

A fully operational digital SPRR would be the key resource for the assessment of property values and hence the basis for several taxes, including imputed rental income taxation, capital gains taxation, stamp duties, and local recurrent property taxes.

(Pg. 15 of the 2024 IMF report)

- Amendment to the Notaries Act

Improving data-sharing among relevant government entities through amending the Notaries Act by April 2025 to ensure information on each notarized real property contract is automatically fed into the digital SPRR.

(Pg. 15 of the 2024 IMF report)

While the implementation of SPRR and valuation database could be a stepping-stone towards the implementation of a tax base for asset-based taxes, the success of this approach hinges on the accuracy of information within these administrative measures. Inaccurate data would render these tools ineffective and would impose an unfair and excessive tax burden on the general public.

Timeline – Imputed Rental Income Tax

While the IMF staff report offered a foundational framework for the proposed IRIT, recent pronouncements from the Government hint at potential divergences from the outlined plan. Sri Lankan policymakers have signalled an exemption for primary residences. Further there may be a need to revisit the initially established, rigorous timelines for implementing the required administrative infrastructure. Despite these anticipated deviations, it is reasonable to expect the addition of a new tax to Sri Lanka’s already intricate tax system.

(The writer is Associate Director (Tax) at KPMG. She is a Fellow Member of Association of Chartered Certified Accountants (FCCA, UK), Associate Member of Chartered Institute of Taxation (ACIT), and CA Sri Lanka – Passed Finalist. She holds an LLB (University of London), Masters of Financial Economics (University of Colombo), MBA in Information Technology (University of Moratuwa), and BSc. Information and Communication Technology (University of Colombo, School of Computing).)