Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 18 July 2024 00:10 - - {{hitsCtrl.values.hits}}

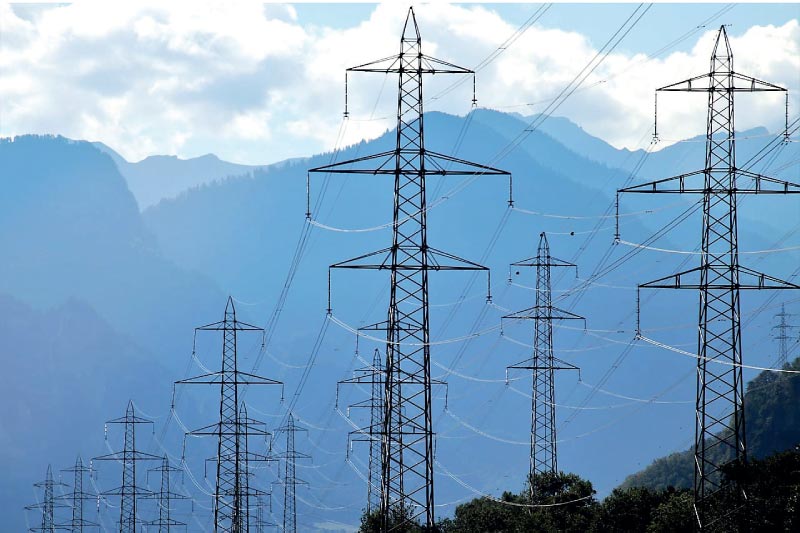

Transmission and distribution losses are relevant when comparing electricity supply from a far-off plant against distributed generation where electricity production is closer to the consumer

News media reports that the Power and Energy Ministry is to sign a Memorandum of Understanding (MoU) with the Indian Government relating to the planned Indo-Lanka cross-strait power grid connectivity within a few months. According to Power and Energy Minister Kanchana Wijesekera, GOSL has made it a priority to complete the grid connection by 2030.

News media reports that the Power and Energy Ministry is to sign a Memorandum of Understanding (MoU) with the Indian Government relating to the planned Indo-Lanka cross-strait power grid connectivity within a few months. According to Power and Energy Minister Kanchana Wijesekera, GOSL has made it a priority to complete the grid connection by 2030.

This milestone (electricity import via SL-India grid intertie) along with other 2030 milestones of thermal plant fuel switching (diesel to LNG) and meeting 70% of electricity demand via use of renewable energy (RE) resources leads towards a complex outcome.

This article highlights the commercial challenge faced when determining the optimal mix of; a) electricity received from India, b) electricity from LNG generation, and c) RE based electricity.

Matters related to technical and environmental issues and risks faced on the technical, commercial, financial and geopolitical fronts – though relevant – are not addressed.

Readers interested in gaining knowledge may refer to the document; “Transmission Service Agreement for Cross-Border Electricity Trade”. (https://irade.org/TSA-Report_.pdf)

A presentation on the Indo-Lanka grid connection was recently made by Eng. Rohan Seneviratne – former General Manager, Ceylon Electricity Board at an IET Sri Lanka Network Forum on 21 March 2024. The following is extracted from the synopsis:

The proposed interconnection would involve high-voltage transmission lines and associated infrastructure to enable the seamless transfer of electricity between the two countries. The goal is to optimise the use of resources, increase reliability, reduce costs for all parties involved and ensure energy security.

Addressing commercial aspects of the trade

While dealing with the technical aspects of such a grid interconnection are within the competency of the highly capable technocrats in India and Sri Lanka, complexities arise when addressing the commercial aspects of the trade.

Is this infrastructure purely for the purpose of buying the ‘commodity’ (electricity) at ‘low cost’ from India? If so, Sri Lanka will benefit from a valuable source of electricity supply while the commercial benefit to India will be the sale of the ‘commodity’. However, this will not help to enhance SL’s green credentials since India’s electricity sector has a high dependence on coal powered generation (over 70%).

Prof. Anura Wijayapala – Head of the Department of Electrical Engineering at University of Moratuwa stated the following at the Prof. RH Paul Memorial Lecture on 9 February 2024:

Sri Lanka’s electricity charges remains highest in South Asia. Connect Sri Lanka to Indian Grid as soon as possible and negotiate a good PPA with India to get benefitted by their cheap power generation.

The purchase price of electricity will bear the cost of the transmission infrastructure. With a wheeling charge applied to cover debt payments and O&M cost of the transmission line (annual income), a minimal amount of MWHrs will have to be transmitted to meet the annual income amount. If the transmitted MWHrs exceeds the minimal annual target, a mechanism will have to be found to accumulate and/or disperse the surplus funds.

SL RE based expansion, LNG generation and India-SL grid intertie

GOSL has set a target of generating 70% of its power via RE by the year 2030 and is opening the sector to attract the significant investment required. Meanwhile, technological trends favour the RE path with cost of solar, wind and battery storage on a downward track and performance of plant continuing to improve.

Another emerging factor in this ‘disruptive’ trend is the cost comparison between centralised electricity supply and distributed generation with use of solar PV and battery storage. Transmission and distribution losses are relevant when comparing electricity supply from a far-off plant against distributed generation where electricity production is closer to the consumer.

A valid question arises: What if a favourable RE scenario leads to accelerated harnessing of the resource beyond the initial expectations of the generation planners? While investor interest grows, should GOSL curtail harnessing of abundantly available RE resources due to commercial commitments to procure electricity from India and LNG fuelled power from thermal plants? Imagine a headline that reads; “Must run thermal generation leads to curtailment of RE based project development.”

Note that the venture enabling existing thermal power plants fuelled with expensive diesel to run on LNG requires the construction of a receiving terminal, regasification plant and pipeline infrastructure leading to the power plants. A minimum quantum of LNG purchase and electricity production will be necessary to make the investment commercially viable. This has an influence on the quantum of RE generation (curtailment possibility).

Although RE based generation is variable and unregulated, there is no exposure to the risks of fuel price and currency that arise with use of imported fossil fuels. Additionally, harnessing RE resources leads to skilled job creation at home while contracting for electricity supply from India appears as outsourcing of jobs overseas.

Maximise RE harnessing in SL with electricity surplus exported to India

President Ranil Wickremesinghe has expressed a desire to sell excess renewable energy to India via a grid connection. Sell at what price? In the well-established RE industry in India, the volume of scale, competitive bidding and financial incentives offered yields low tariffs that could not be matched by a SL RE resource developer. Thus, the RE generated electricity supplied to India over limited, seasonally influenced durations will need to be ‘subsidised’ to meet the going rate in India and in return SL will enjoy grid stability and a two-way power exchange possibility.

This will allow SL to increase RE plant generation with excess electricity ‘wheeled’ to India at the going rate in the region where the electricity is metered. SL must agree on commercial terms with India on the following:

Maximum carrying capacity of the transmission line (MW) for the 2-way exchange.

Electricity from India: Maximum amount of MWhrs to be purchased on an annual and monthly basis and a tariff at the going market rate in the state in India from where the wheeled power is purchased and metered in SL.

Electricity to India: Maximum amount of MWhrs to be sold to India on an annual and monthly basis and a tariff at the going market rate in the state in India where the wheeled power purchased from SL is metered.

SL needs this arrangement more than India. The incentive for India is the commercial benefit of the power trading both ways. Geopolitics may also be a factor.

The advantage for SL is the ability to increase RE power capacity with investment opportunities, skilled job creation and enhanced national energy security while reducing the need for; a) peak or lean RE season generation (fossil fuelled), and b) bulk energy storage via batteries or pumped hydro. However, if analysis indicates that grid quality issues need to be addressed within the SL power system to ensure a stable and reliable power exchange, additional plant and equipment will have to be installed within the SL power network.

Determining the optimal mix from the available options of electricity supply from India, LNG generation and RE generation in an increasing electricity demand/supply scenario will be complex and use of a simulation model will be essential. The objective is to develop commercial guidelines and limits for the electricity trade (India import/export, LNG and RE) that prioritises national development goals. The writer hopes that SL power sector technocrats are aware of the challenge faced, think ‘outside the box’ and seek specialist expertise from overseas.

(The writer is a Management Consultant and Renewable Energy Specialist. He can be reached via email: [email protected].)