Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 26 September 2023 00:10 - - {{hitsCtrl.values.hits}}

One of the most immediate and visible costs of inflation is the erosion of purchasing power. As the general price level rises, the value of a unit of currency declines, meaning that consumers can buy fewer goods and services with the same amount of money. This effectively reduces the standard of living for individuals and households, particularly those on fixed incomes, as their real income decreases

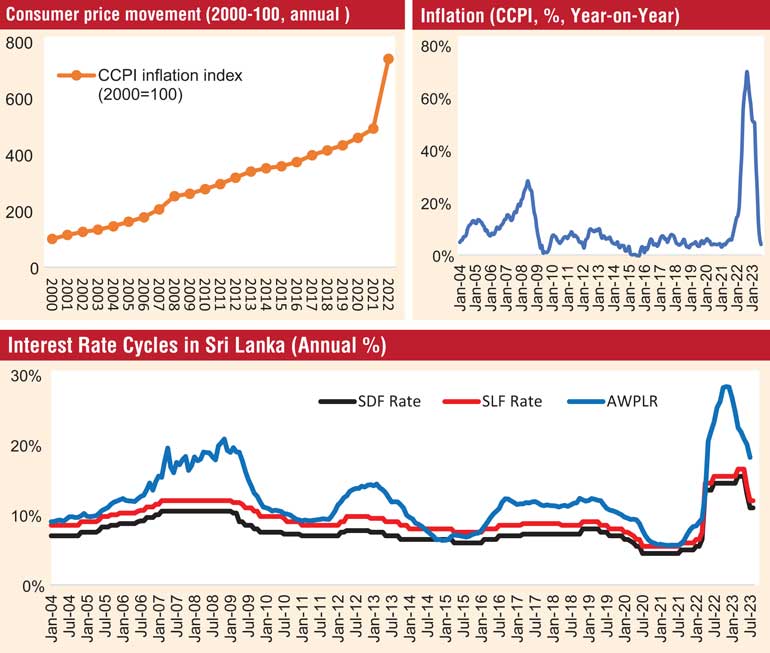

Sri Lanka reported year-on-year (y-o-y) inflation of 4% in August 2023. During 2022, the country was among the top 10 countries with high inflation. Steve H. Hanke, a professor at Johns Hopkins University who tracks hyperinflationary countries around the world, was constantly showing Sri Lanka featuring amongst hyperinflationary countries during the majority of 2022. Inflation, as measured by the Colombo Consumer Price Index (CCPI), has reached a single digit level in the last two months. More importantly, food inflation has been recorded as negative.

Sri Lanka reported year-on-year (y-o-y) inflation of 4% in August 2023. During 2022, the country was among the top 10 countries with high inflation. Steve H. Hanke, a professor at Johns Hopkins University who tracks hyperinflationary countries around the world, was constantly showing Sri Lanka featuring amongst hyperinflationary countries during the majority of 2022. Inflation, as measured by the Colombo Consumer Price Index (CCPI), has reached a single digit level in the last two months. More importantly, food inflation has been recorded as negative.

It appears that inflation is finally well under control and remains within the comfortable corridor of the central bank. Yes, inflation is in single digits, yet prices remains elevated. Many people ask this question. If inflation is in single digits, why prices are so high?

Inflation has receded to a single digit level. Inflation measures the movement of the general price level in the economy. In simple terms, inflation is defined as a sustained increase in the general price level of goods and services over time. Domestic inflation in Sri Lanka reached a peak of 69.8% in September 2022. This means the general price level in the country increased by 69.8% in comparison to the previous year.

Inflation in August 2022 was 64.3%. If the general price level was 100 in August 2021, it increased to 164.3 by August 2022. Now, inflation in August 2023 (one more year later) is 4%, meaning that prices have further increased by another 4% from a level of 164.3 reported in August 2022. In fact, prices have gained at much lower rate than previous year. Lower inflation means that the rate at which the prices are increasing is indeed lower. This does not mean that prices are coming down. The price level in fact increases, but at a much lower pace.

The history of inflation control in Sri Lanka has not been credible. The country has had frequent upticks in inflation, largely due to monetisation of fiscal deficits.

Inflation in 2022

Central banks around the world have been trying to tame runaway inflation in 2022. Inflation was seen out of control in most part of the world in 2022. The uptick in inflation was initially a result of supply shocks experienced during the COVID-19 pandemic. With the gradual re-opening of most countries, and the expected expansion of aggregate demand in the global economy under a highly accommodative monetary policy environment, inflation rose out of control in most parts of the world. As a result, there was a globally coordinated effort by most central banks to arrest this inflation. The Federal Reserve; (the Fed, Central Bank of the United States) increased its benchmark policy interest rates; the Federal Fund Rates increased to record high levels while other key central banks; Europe Central Bank (ECB), Bank of England (BoE) continued with raising interest rates.

Central banks around the world have been trying to tame runaway inflation in 2022. Inflation was seen out of control in most part of the world in 2022. The uptick in inflation was initially a result of supply shocks experienced during the COVID-19 pandemic. With the gradual re-opening of most countries, and the expected expansion of aggregate demand in the global economy under a highly accommodative monetary policy environment, inflation rose out of control in most parts of the world. As a result, there was a globally coordinated effort by most central banks to arrest this inflation. The Federal Reserve; (the Fed, Central Bank of the United States) increased its benchmark policy interest rates; the Federal Fund Rates increased to record high levels while other key central banks; Europe Central Bank (ECB), Bank of England (BoE) continued with raising interest rates.

Episodes of hyperinflation

There are many incidents of hyperinflation in the world history. Germany experienced a period of hyperinflation from 1921 to 1923, which had a significant impact on the country, Europe, and the world. The process of hyperinflation in Germany was complex and can be attributed to three main factors: excessive printing of paper money, the inability of the Weimar government to repay debts, and reparations incurred from World War I, all which occurred alongside political problems both domestically and internationally. The hyperinflationary cycle resulted in soaring prices and a loss of value in the German currency. As a result of this unpleasant experience, Deutsche Bundesbank (the central bank of Germany) has become one of the most conservative central banks.

Sir Mervyn King, former Governor of the Bank of England (BOE), explained why managing inflation is so important: “Once higher inflation becomes entrenched, it may be costly to dislodge. Past UK recessions were associated not with slowdowns in the world economy, but with attempts to squeeze inflation out of the UK economy. The best thing that we can do to promote economic stability is to avoid inflation, and inflation expectations, from becoming dislodged from the target in the first place.”

Monetary policy tools

Most central banks use interest rates as a key monetary policy tool, by changing interest rates in order to control the money supply within the economy, and thereby the aggregate demand. Most central banks use a key benchmark policy interest rate. Central banks use these short term (mostly overnight) interest rates as a monetary policy instrument to manoeuvre the level and direction of interest rates towards a desired level.

The Fed uses the ‘Federal Fund Rate’ as its benchmark policy interest rate. Sri Lanka uses a policy rate corridor consisting of two rates, known as the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR). The Central Bank of Sri Lanka (CBSL) uses this policy rates corridor to set the direction of interest rates to control inflation by controlling the money supply within the economy.

Three main causes of inflation is identified. Cost-push inflation is a result of cost increase mostly due to supply shocks. Demand-pull inflation is caused by factors of demand side. Inflation expectations also drive inflation as many expect higher prices in the future. Central banks can control demand side inflation and inflation expectation by policy rate hikes. Central banks cannot control supply side inflation, as those are result of systemic supply shocks. Unless it is accommodated through expansionary monetary policy, supply side inflation recede as the supply shocks disappears.

Interest rate cycle

When the Central Bank decides that inflation is higher than expected, the bank increases its benchmark policy interest rates. If the central bank continues to raise its benchmark policy rates, it is considered a tightening cycle. Similarly, if the central bank continues to cut the benchmark interest rates down, it is known as a softening cycle or an expansionary monetary policy.

The purpose of interest rate hike is to lower the aggregate demand. The Increase in interest rates have always resulted in economic contraction. The level of contraction depends on the stage of economy and the magnitude of rate hike.

Cost of inflation

One of the most immediate and visible costs of inflation is the erosion of purchasing power. As the general price level rises, the value of a unit of currency declines, meaning that consumers can buy fewer goods and services with the same amount of money. This effectively reduces the standard of living for individuals and households, particularly those on fixed incomes, as their real income decreases.

Sustained inflation can create uncertainty in the economy. When businesses are uncertain about future prices, they may delay investment decisions or raise prices, which can dampen economic growth. Inflation can distort price signals in the economy. When prices rise due to inflation rather than changes in supply and demand, it becomes more challenging for businesses and consumers to make informed decisions about resource allocation. This can lead to misallocation of resources and inefficiencies in the economy.

Conclusion

Sustained high inflation is harmful to the economy. Controlling inflation is the primary job of a central bank. Central banks use benchmark short-term policy interest rates as the primary tool to control the money supply, and thereby reduce the aggregate demand of the economy to control inflation. During 2022, inflation in most countries remained stubborn. Most central banks have raised policy interest rates to record high levels in the recent past to tame this inflation. Sri Lanka underwent different problems, but however had to raise interest rates to a record high level to control the runaway inflation experience in 2022.

However, inflation has receded since then, although prices appear to be still high. The public is concerned why prices are not coming down when inflation is low. Inflation measures the movement of the prices. It does not reflect level of prices. Lower inflation means the prices are still going up, albeit at a lower rate.

(The writer is a CFA charterholder, capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)