Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 31 January 2025 03:17 - - {{hitsCtrl.values.hits}}

A rubber plantation affected by the new leaf disease. The secondary leaf fall is more than 75%

Sri Lanka earned $ 930 million from the export of both raw rubber and rubber products in 2023. Out of that the major share, around $ 900 million came from the export of rubber products. In the same year, Sri Lanka was able to produce only 64 million kilograms of natural rubber compelling the industries to import more than 30 million kilograms of natural rubber to the country. Foreign exchange outflow from the country for importation of the shortfall in raw rubber requirement is around $ 50 million.

Sri Lanka earned $ 930 million from the export of both raw rubber and rubber products in 2023. Out of that the major share, around $ 900 million came from the export of rubber products. In the same year, Sri Lanka was able to produce only 64 million kilograms of natural rubber compelling the industries to import more than 30 million kilograms of natural rubber to the country. Foreign exchange outflow from the country for importation of the shortfall in raw rubber requirement is around $ 50 million.

But the country has the potential to save this foreign exchange loss from the country by becoming self-sufficient in its natural rubber requirement. Not only that, the availability of natural rubber in the country will attract more investments to the natural rubber product manufacturing sector of the country further enhancing the foreign exchange earnings and employment opportunities in the country.

Global scenario

The writer attended the International Rubber Conference 2024 (IRC 2024) held in Indonesia and organised by the International Rubber Research and Development Board (IRRDB) in collaboration with the Indonesian Rubber Board. Key takeaways from the conference includes that the current global demand and supply of natural rubber is 15.2 and 14.5 million metric tons respectively. The global demand for natural rubber is expected to grow by 2.5% per year. However, production is predicted to grow only at a rate of 1.5%. Director General of the International Rubber Study Group (IRSG) identified fluctuating rubber prices, new regulations such as EUDR (European Union Deforestation Regulations), Circular Leaf Spot Disease (CLSD) and diversifying rubber lands to alternate crops to negatively impact global natural rubber production.

The Secretary General of the Association of the Natural Rubber Producing Countries (ANRPC) stated that the CLSD had spread widely across several rubber producing countries causing significant yield reductions, up to 30 to 40%, in seriously affected areas.

EUDR will be effective from 30 December 2025 to ensure traceability and sustainability of the rubber cultivations. With this regulation in force, legality of the ownership of the cultivation and traceability in the supply chain will need to be established. Deliberations highlighted the need for participants/producers to be incentivised to overcome their less interest to engage themselves with such regulations.

Some factors highlighted above may increase the gap between global natural rubber supply and demand and the indications are that the global NR prices will remain to stay high in the future. Thus, the outlook for the global rubber industry is good.

Sri Lankan scenario

Sri Lanka’s natural rubber production has declined from 98.5 million kilograms in 2014 to 64.4 million kilograms in 2023. During the corresponding period the mature rubber extent in the country is reported to have come down from 106 and 85 thousand hectares. Data also reveals that the mature rubber extent in the country has declined from 121 to 85 thousand hectares and the land productivity has increased from 629 to 835 kg/ha/year from 2021 to 2022. Such drastic changes in industry performance with in a year is not natural and needs investigating. Statistics need to be gathered and recorded accurately for policy makers and investors to arrive at informed based decisions regarding the industry.

National productivity level of rubber cultivations is generally lower than the potential in all rubber growing countries. In Sri Lanka it is hovering around 800 to 900 kg/ha/year whilst it is around 1,300 to 1,400 kg/ha/year in countries like India, Thailand and Ivory Coast. One major reason for relatively high yields in certain countries is the more conducive soil and climatic conditions. Generally, in flat lands adoption of agricultural practices are easier and soil degradation is less. Also, with less rain fall diseases are less and number of tapping days are more. But in all countries the land productivity is less than the potential due to multiple reasons.

Having lower number of plants than the recommended number of plants per unit land area, productive stand becoming lower and lower due to increasing incidence of tapping panel dryness (a disorder which causes rubber trees not to produce rubber), not tapping the rubber trees due to lack of harvesters and interference of rain, poor quality of tapping due to the use of unskilled tappers, sub-optimal nutrient inputs, further reductions in healthy productive trees due to diseases like white root disease, wind and lightning damages are some of them. Most of the reasons identified above, that leads to low productivity, is evident in traditional rubber growing areas in Sri Lanka negatively impacting the national production.

New threats to rubber production

In the year 2019, rubber plantations in the country were affected by a new leaf disease. Around this period, rubber plantations in other countries too got affected by the same disease. This new disease is believed to be caused by one or more than one fungus. Severity of the disease is more in high rainfall areas. To-date there is no effective method developed by any country to control the disease. Hence, the disease prevails to date even under good agricultural practices. The alarming situation is that in the wetter areas two secondary/abnormal leaf falls have occurred during a year consecutively for the past three to four years. This scenario will seriously retard the health and growth vigour of rubber plants. It is definitely a threat to the future performance of the rubber cultivations in the traditional rubber growing wet regions.

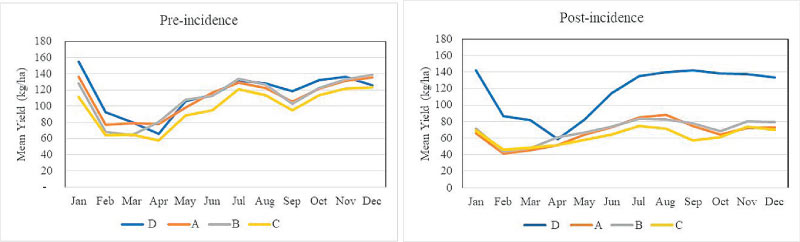

In a recent study undertaken by the writer, the monthly rubber yields before (pre-incidence) and after (post-incidence) the new leaf disease impacting rubber yields were compared in estates located in both the intermediate (D) and wet zones (A, B and C) (Fig. 1). It is apparent that rubber yields are similar prior to the onset of leaf disease whilst the rubber yields are significantly less in wet zone after the incidence of the new leaf disease. The yield drop in the wet zone estates after the incidence of the leaf disease is estimated to be around 40%. This yield drop could further escalate in the future years if the new leaf disease continues to infect the rubber plantations.

The other threat the rubber growers in the traditional rubber growing areas are facing currently is the high annual rain fall and the increased number of wet days per annum. Annual rainfall in the past four to five years have surpassed 5,000 mm with around 250 to 275 rainy days. This situation increases incidence of pest and diseases incurring high costs for their management and lowering the quality of rubber clearings. Weed management, fertiliser application and worker availability are also negatively impacted due to increased rains. For harvesting of mature rubber rain guards have now become mandatory. Yet both the tapper and land productivities are compromised due to rain interference leading to lower rubber production and poor financial performances.

Interventions needed

The Government of Sri Lanka should be mindful of the consequences of the new leaf disease and the changes in climatic conditions on the rubber industry of the country. The political leadership should drive the relevant government institutions and departments to come out with suitable solutions to mitigate adverse impacts due to above within a given timeframe. The main strategies that may be considered by relevant authorities to prevent the ongoing down fall of the rubber industry in the country and to harness its potential benefits is to develop methods to combat the new leaf disease through chemical or biological methods, breeding for resistance and escaping from the disease vulnerable areas by moving rubber cultivations to non-traditional areas.

Controlling the disease with either chemicals or biological agents need to include effective application methods considering the height of trees and terrain of rubber lands in affected areas. Promoting and facilitating rubber cultivations in the relatively dry non-traditional areas will have the advantages of soil less prone to degradation, a terrain conducive to implement agricultural practices and enhance worker productivity, more tapping days, less diseases and weed growth whist escaping from the threatening new leaf disease. The political leadership and relevant Government authorities have to be more serious about the threats the rubber industry is facing and by addressing them the country will be rewarded with an increased dollar income.

(The writer is a lecturer at the Department of Plantation Management, Wayamba University of Sri Lanka and former Director, Rubber Research Institute of Sri Lanka.)