Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 1 January 2024 00:06 - - {{hitsCtrl.values.hits}}

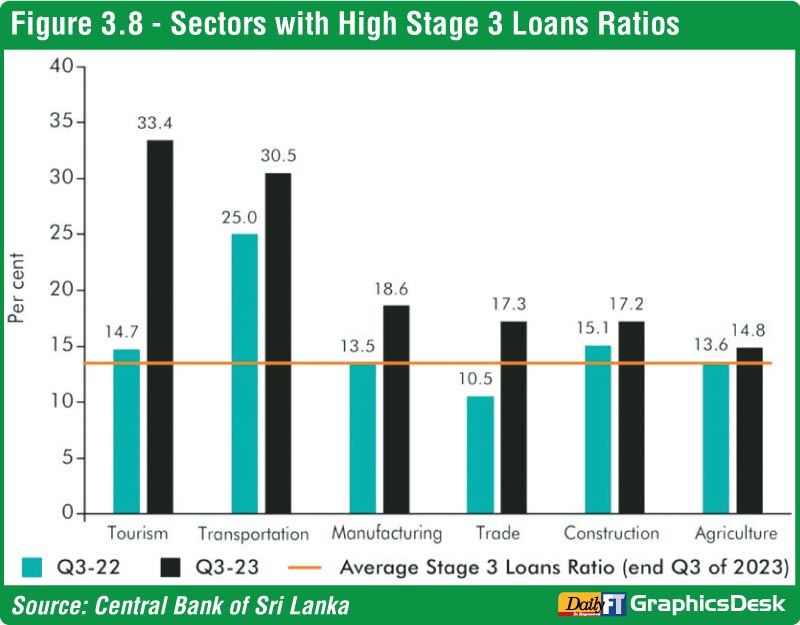

When banks do further debt restructuring, the entire loan goes into stage 3 as per IFRS9

There is huge pressure on the Government to defer parate rights for 12 months to give some breathing space to the tourism sector and SMEs, largely due to the super high borrowing rates of 2022. For example, the hospitality sector debt as at April 2019 stood at $ 300 million. The amount has now nearly doubled to $ 700 million (mainly due to unrealistic interest rates and penalties) – which is simply not sustainable particularly as tourist arrivals are less than the 2018 figures and also the room rates are still less than 2018 rates.

There is huge pressure on the Government to defer parate rights for 12 months to give some breathing space to the tourism sector and SMEs, largely due to the super high borrowing rates of 2022. For example, the hospitality sector debt as at April 2019 stood at $ 300 million. The amount has now nearly doubled to $ 700 million (mainly due to unrealistic interest rates and penalties) – which is simply not sustainable particularly as tourist arrivals are less than the 2018 figures and also the room rates are still less than 2018 rates.

Whilst bankers say they need to hold the whip of “parate rights,” SMEs say banks shouldn’t be allowed to crack it irresponsibly. What has happened in the recent past they say is irresponsible cracking of the whip. But the whip is important for banks because there are wilful defaulters who piggy back on the current sentiment to exploit the banking system. So, there is a need to be extremely cautious when compromising on parate rights to prevent these elements to exploit banks and also affect the ratings of banks. The bigger issue is some of the banks have the minimal or no collateral for large ‘too big to fail’ exposures, this could have cataclysmic impacts to banks and country if they go down.

Therefore banks need serious skills at board level to manage these challenges. Of course legislation could be brought to ensure that the genuine entrepreneurs are protected. CBSL needs to reach out to the respective banks on individual/group cases and put pressure on them to provide relief to the genuine cases. Banks certainly need good businesses to lend. So it is in their interest to help them to ride over the current crisis largely caused by the mismanagement of the economy and the COVID wave of 20-21.

|

President Wickremesinghe terming the task of economic revival following bankruptcy a “formidable” one, recently noted, “Our country’s situation is now better than what it was a year ago. I am not saying that the economy has recovered completely. It has become comparatively better”

|

Expectations from banks

Banks are only expected to pursue parate after exhausting all revival and recovery options, (typically after around 3 to 4 years of efforts – moratoriums, restructures, concessionary rebates and WC loans, revival efforts, etc.). Any compromise of the parate rights should not strengthen the claims of wilful defaulters. There is an increasing trend of stay orders and opportunity for fair hearing by courts where businesses get 1-2 years further breathing space. Once a precedent is created to defer it will be politically difficult to reintroduce. This will create moral hazard as even good customers will resist servicing debt causing an increase impairment levels of banks to rise further, threatening the banking sector stability.

It will become more difficult for SMEs to borrow as banks will further tighten underwriting standards, this will stifle credit and GDP growth in 2024, weakening economic resurgence. If there is no economic resurgence in 2024 (following four consecutive years of negative growth) this will exacerbate youth and skilled migration, increase poverty levels and make it more difficult to attract FDIs. 80% of troubled SME businesses have revived with the current business environment, due to tourism and remittances rebounding in the last six months, but certainly there is a need for working capital requirements and debt payment support.

President Wickremesinghe terming the task of economic revival following bankruptcy a “formidable” one, recently noted, “Our country’s situation is now better than what it was a year ago. I am not saying that the economy has recovered completely. It has become comparatively better.”

Options for the Government

To address the challenges faced by SMEs under the current parate law, a more specialised and financial structure and financial engineering is necessary. The proposed amendments should aim at creating a balanced framework that protects the interests of both the banks and the SMEs. One credible option is to introduce a tiered recovery program. The parate law (which was introduced to prevent the undue law delays that gave undue advantage to borrowers) certainly needs serious reform. Therefore a good start would be to establish a structured tiered recovery program. This system would mandate banks to exhaust certain steps before resorting to parate action. These steps could include mandatory negotiation periods, structured repayment plans, and engagement with restructuring advisers. Such a system would ensure that parate execution is truly a last resort, especially for those businesses who were viable prior to COVID or before the interest rates went through the roof.

Another proposal is the creation of a specialised SME/tourism restructuring board to ensure that both parties have fair representation. The tribunal could offer alternative solutions like loan restructuring, temporary moratoriums on payments, or even partial loan forgiveness in extreme cases. Another compromise could be to limit the forced sale to a certain percentage of the asset value, giving the SME time to recover and pay off the remaining debt. This would prevent complete asset seizure at the first stage of default.

Also with the support of WB/IFC set up a mandatory financial counselling and support for SMEs. CBSL must mandate banks to provide financial counselling and support services to SMEs before initiating parate execution. This would include advice on financial management, assistance in restructuring businesses, HR solutions, governance and guidance on alternative financing options. With the support of the World Bank the Government should look to set up an insurance credit guarantee fund or a bad bank. This fund would act as a safety net, reducing the risk for banks and giving them more flexibility in dealing with loan defaults.

Tax credits for banks supporting SMEs is also an option. This could include tax breaks for banks that restructure loans instead of resorting to parate execution. Broadly should be a tax rebate to banks on the interest cost on the restructured loans. One option is to consider granting exemption from FS VAT for interest income derived from lending to thrust sectors such as tourism, renewable energy sector, etc., so banks can consider lending at subsidised rates.

In the final analysis given the role of tourism and SMEs in Sri Lanka, the Government needs to reach out to support them while also protecting the interests of the banking sector. The Government should not test the system beyond a point. Some push back with the IMF is required, but with the right human resources. Certainly not with half backed bureaucrats. It is therefore essential that any changes to parate law are carefully done to ensure a sustainable solution in the medium term for both SMEs and banks. Also not adversely impact their ratings.

The proposed bad bank is a must (a bad bank is a bank set up to buy bad loans and illiquid assets of financial institutions. The institutions holding the nonperforming assets will sell these holdings to the bad bank at market price) and finally the realignment of the two former development banks (Govt. has significant stakes) to help the industry with long-term money. We can no longer be experimenting with poorly baked solutions.

References:

https://www.pressreader.com/sri-lanka/daily-mirror-sri-lanka/20180720/282080572619387

http://island.lk/parate-execution-is-the-last-resort-to-protect-depositors-funds-slba/

(The writer is a former Chairman of the largest private commercial banks and a director of a development bank and chaired the banking sector consolidated committee in 2017.)