Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 29 May 2024 00:11 - - {{hitsCtrl.values.hits}}

We need to welcome foreign investment in meeting our energy demands and not subject them to selective outage

By A Special Correspondent

|

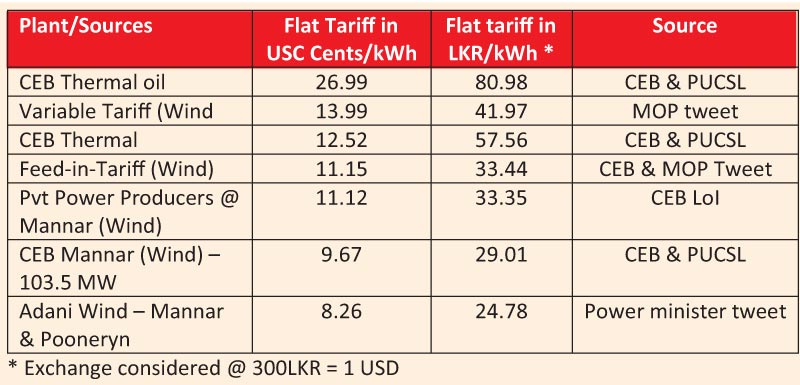

Recently, Minister of Power and Energy Kanchana Wijesekara took to X, formally known as Twitter, to announce the conclusion of intense negotiation between the Government and Adani Group. Under this, the country will purchase power from wind plants built by the latter at 8.26 US cents a kilowatt hour for 20 years, to be paid in LKR on the prevailing exchange rate at the time of payment. “On the current exchange rate considered as, 1 USD = Rs 300, the cost of energy will be Rs 24.78 per kWh. The current average cost of energy in SL is Rs 39.02 per kWh,” the minister added on X.

India’s Adani group has proposed to invest about $ 740 million in the country to set up two wind power projects with a cumulative generation capacity of 484 MW. The tariff is by far the best the country has seen, as is evident from the given table.

According to CEB data, in 2022, its own cost for thermal power (coal + fuel oil) was Rs. 26.65 per unit. It purchased power from thermal IPPS at an average cost ranging from (for different IPPs) Rs. 49-130!

Instead of celebrating the tariff negotiated by the Government, critics of the project have now shifted the goal post further by demanding that the project should now undergo a Swiss auction, with new players being allowed to bid for the same project.

The question is, are these people even aware of the laws of the land before making such outrageous demands? Over the last 2-3 years, Adani has been patiently waiting to get the project greenlit and has followed every single regulation and guideline. Sri Lanka’s Electricity Act allows proposals under the G-2-G mechanism and Adani’s project and developers respond against it. As per procurement guidelines demands, any tender needs to go through the same process of Technical Evaluation by the Project Committee of CEB and thereafter tariff negotiation by the Cabinet Appointed Negotiation Committee (CANC). This has been followed for all other developers whose tariff got recently approved i.e. Oddamawadi 100 MW Solar, Siyambalanduwa 100 MW Solar and Poonakary 700 MW Solar+Battery. We don’t hear of demand for Swiss auctions for any of these projects even though they are higher than Adani’s tariff (8.75 cents/unit). Adani’s project has also been approved by the regulator Public Utilities Commission of Sri Lanka (PUCSL).

As per the Government’s notification issued in September 2019, the Swiss Auction procedure has been disallowed for projects, citing procedural issues and also time taken! This also means that even if Adani were to quote a lower tariff post-finalisation of a competitor’s tariff, it cannot be considered. So how are the naysayers demanding something which is not presently recognised by the law of the land?

Sri Lanka has set an ambitious goal of achieving 70% Renewable Energy (RE) generation by 2030 and becoming carbon neutral by 2050. In FY24, fossil fuel-based power plants met 54% of total power demand, and under 8% came from solar or wind, with hydro contributing 31%. Over the next 25 years, power demand is projected to grow at an annual rate of ~5% and SL will be required to produce an additional ~7,000 MW of fresh RE, mainly consisting of ~4,700 MW of solar and ~1,800 MW of wind power. With a limited scope of adding large-scale hydro projects in the future, it is the wind and solar which will have to do the heavy lifting for SL to meet its RE generation goals.

Much of the additional capacity will need to come from private sector sources as CEB will not be able to bridge the gap on its own. Its RE capacity has been rather stagnant at 100 MW for years now.

Therefore we need to welcome foreign investment in meeting our energy demands and not subject them to selective outage.