Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 10 November 2021 00:10 - - {{hitsCtrl.values.hits}}

|

While tax revenue has contracted, Government expenditure has ballooned over time. Today, Government revenue is not sufficient even to meet its expenditure on salaries and wages and transfers and subsidies to households which include pension payments and social welfare payments such as Samurdhi – Pic by Shehan Gunasekara

|

Successive governments have run fiscal deficits. Inadequate revenue collection and unrestrained government expenditure have worsened the country’s fiscal position.

Tax revenue which averaged over 20% of GDP in 1990 has declined to under 10% of GDP in 2020. Ad hoc tax policy changes have significantly eroded the tax base. Weak tax administration has also contributed to the sharp decline in tax collection.

While tax revenue has contracted, Government expenditure has ballooned over time. Today, Government revenue is not sufficient even to meet its expenditure on salaries and wages and transfers and subsidies to households which include pension payments and social welfare payments such as Samurdhi.

In this context, there are various proposals put forward to raise Government revenue. One proposal is the reintroduction of the wealth tax.

A wealth tax is expected to bridge the gap between the rich and the poor, achieving equality. This tax shifts the tax burden to affluent households, taxing an individual’s net wealth, which is the market value of total owned assets. Proponents of wealth taxation argue that this is a progressive system of taxation and is a more powerful tool in comparison to income, estate or corporate taxes as it addresses the issue of wealth concentration.

Moreover, a tax should ideally satisfy basic characteristics of taxation: it should not be distortionary; it should be fair, and it should not be difficult to collect.

The rationale for a wealth tax

The rationale for a wealth tax

One of the earliest proponents of the wealth tax for developing countries was Nicholas Kaldor. Based on his recommendation, a wealth tax together with an income tax, expenditure tax and a gift tax were introduced in Sri Lanka in 1958.1 However, these new taxes yielded little revenue due to difficulties in determining the tax base and problems in administration. Following the recommendation of the Tax Commission in 1990,2 the Government abolished the wealth tax from the year of assessment 1992/1993.3

Wealth taxes have mainly been implemented in European countries. In 1990, twelve countries in Europe had a wealth tax. Today, there are only three: Norway, Spain, and Switzerland. Several non-European countries have also imposed wealth taxes from time to time including such as Argentina, Bangladesh, Colombia, India, Indonesia and Pakistan.

In recent times there has been renewed interest in wealth taxes. Presidential candidates in the US proposed various forms of a wealth tax. In the UK and France, there were proposals to impose “super taxes” on the rich. The primary justification was to address the increasing inequality in society.

Issues with a wealth tax

Despite renewed interest in the wealth tax as a progressive tax based on equity, it scores poorly on the criteria of efficiency, and administrative feasibility.4

Many factors have justified the repeal of wealth taxes in OECD countries. The reasons cited are related to efficiency costs, risk of capital flight particularly in light of increased capital mobility and wealthy taxpayers’ access to tax havens, failure to meet redistributive goals as a result of narrow tax bases, tax avoidance and evasion, high administrative and compliance costs compared to limited revenues (high cost yield ratio).5

To understand the efficiency costs of wealth taxes one can look at taxing a person’s wealth accumulated through savings. Despite the common consensus that taxing savings is an effective way to redistribute, a person’s saving decisions reveal little about their underlying lifetime resources and wellbeing. It only reveals their preference to consume tomorrow rather than today. Thereby a wealth tax imposes a tax on those who prefer to spend their money later as opposed to taxing the wealthy.6 Efficiency costs refer to the reduction of the welfare of the taxed individuals by more than $1 to generate $1 of revenue.7 Therefore, the efficiency cost of a wealth tax in terms of taxing savings is a reduction of future consumption that can be bought with earnings, reducing incentive to work for those who prefer to consume the proceeds later and reducing incentive for young people to save for their retirement.8

Capital flight is the possibility of holding assets outside of one’s resident country without declaring them. As wealth taxes are imposed on residents it increases the risk of the wealthy reallocating their assets to avoid taxation. Therefore a high tax burden encourages taxpayers to change their tax residence to a lower tax jurisdiction or tax havens.9

Both income-generating and non-income generating assets are taxed under wealth taxation. They can include land, real estate, bank accounts, investment funds, intellectual or industrial property rights, bonds, shares, and even jewellery, vehicles, art and antiques.10 However, this tax base for wealth taxes has often been narrowed through exemptions. These exemptions have been justified most commonly on the grounds of social concerns such as the negative social implications of taxing pension assets. Further liquidity issues (e.g. farm assets), supporting entrepreneurship and investment (e.g. business assets), avoiding valuation difficulties (e.g. artwork and jewellery) and preserving countries’ cultural heritage (e.g. artwork and antiques) have also been cited as reasons for wealth tax reliefs.

While some of these exemptions can be justified, they have led to the reduction of revenue raised from wealth taxes. They have also contributed to wealth taxes being less equitable as the wealthiest such as businesses benefit from these exemptions defeating the very purpose of imposing a wealth tax which is to meet its redistributive goals.11

Narrow tax bases in wealth taxation often leads to tax avoidance and evasion opportunities. For example, Spain’s 1994 wealth tax exemption for the shares of owner managers resulted in wealthy businesses reorganising their activities to reap benefits of the exemption resulting in a significant erosion of the wealth tax base.12

Further, several other factors have also discouraged countries to sustain a wealth tax. They are namely, the difficulty in determining the tax base or what assets to be taxed, underreporting and undervaluation of assets, difficulty in measuring wealth taxes13, distinguishing between individuals who are asset rich but cash poor, the constant need to value assets and audit returns increasing administrative and enforcement costs.

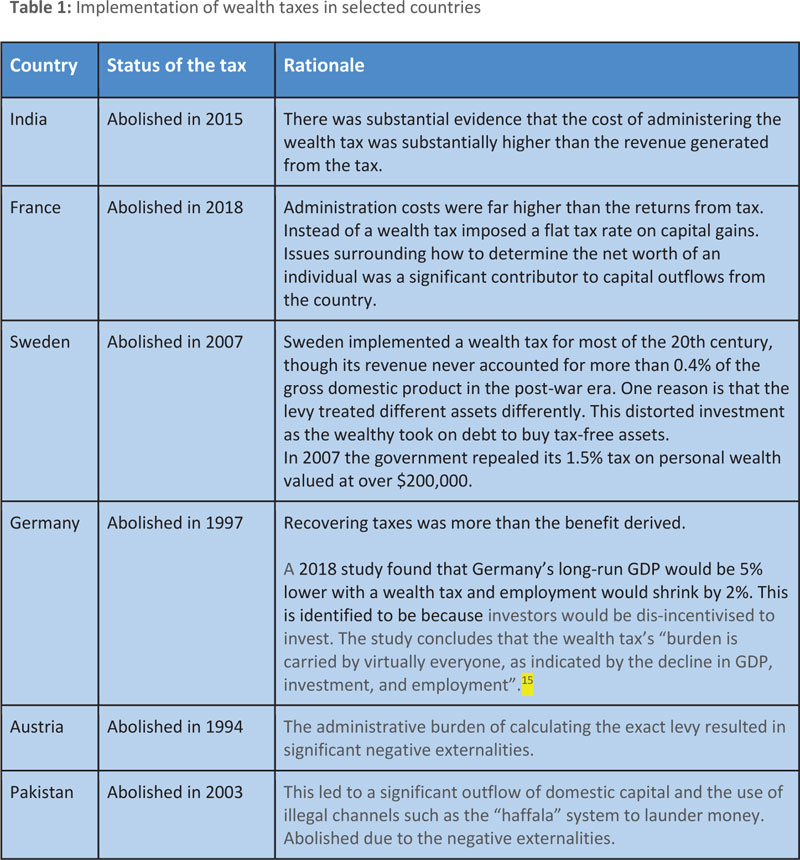

Low revenue collection as well as the other reasons discussed have led to the abolishing of wealth taxes in most countries (see table 1 for details). Tax revenue from individual net wealth taxes in 2016 ranged from only 0.2% of GDP in Spain to 1.0% of GDP in Switzerland. Sri Lanka’s experience with wealth taxation was no different with the tax yielding low revenue as reported by the 1990 Tax Commission.14

Conclusion

Taxing the wealth of the rich to generate income and to eliminate economic inequality sounds promising in terms of political debate. However, wealth taxes have failed to generate adequate revenue, failed to meet redistributive goals as a result of narrow tax bases, proven to have high administrative and enforcement costs, resulted in tax evasion and avoidance due to underreporting and undervaluation of assets, increased the risk of capital flight and access to tax havens and may have contributed to the reduction of investment and employment.

Therefore, imposing a wealth tax may not be the ideal policy response to Sri Lanka’s low tax revenue, especially given the country’s previous experience with the tax yielding low revenue.

(Sathya Karunarathne is the Research Analyst at the Advocata Institute and can be contacted at [email protected]. Learn more about Advocata’s work at www.advocata.org. The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute, or anyone affiliated with the institute.)

Footnotes

1 http://www.ird.gov.lk/en/about%20IRD/SitePages/Policy%20Changes.aspx?menuid=110406

2 file:///C:/Users/admin/Downloads/ipr077%20(1).pdf

3 http://www.neelakandan.lk/Compendium%20of%20Law/Taxation.php

4 https://www.jstor.org/stable/pdf/3551636.pdf?refreqid=excelsior%3Add7c1dab5aed8641aa0083de84a3cd26

6 https://www.wealthandpolicy.com/wp/EP6_PoliticsAndDesign.pdf

7 https://eml.berkeley.edu/~saez/course131/taxincidence_ch19.pdf

8 https://www.wealthandpolicy.com/wp/EP3_Economics.pdf

10 https://www.wealthandpolicy.com/wp/EP6_PoliticsAndDesign.pdf

11 https://www.wealthandpolicy.com/wp/EP3_Economics.pdf

12 https://www.wealthandpolicy.com/wp/EP6_PoliticsAndDesign.pdf

13 https://www.manhattan-institute.org/whats-wrong-with-a-wealth-tax

15 https://www.econstor.eu/bitstream/10419/181277/1/dice-report-2018-2-50000000002757.pdf