Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 1 November 2018 00:21 - - {{hitsCtrl.values.hits}}

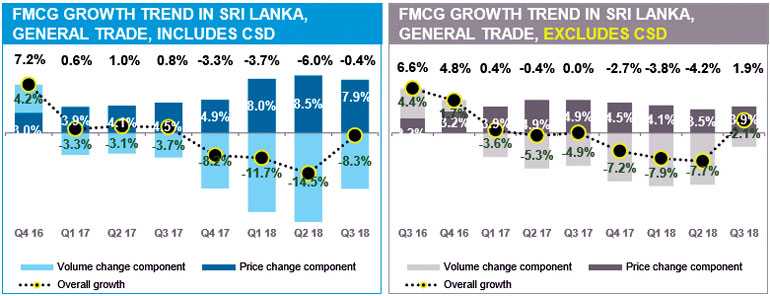

Consumption down by 8.3% but decline arrested after five quarters in a row

Whilst the country is moving to unravel the constitutional challenge at hand, the good news emerging is that consumption that has been in decline quarterly has seen a turnaround in the last quarter (Q3-2018), as per the latest Nielsen Report. But the worry is that the Business Confidence Index (BCI) has hit an all-time low of 87 which is the lowest sentiment expressed in the last 24 months.

Sri Lanka’s consumption from General Trade has been declining six quarters at -3.3% (Q1-2017) to -3.1% (Q2-2017) to -3.7% (Q3-2017) to end the year at -8.2 (Q4-2017) which resulted in the Consumer Confidence Index (CCI) hovering to a 54. In 2018 things deteriorated drastically with a -11.7% (Q1-2018) to -14.5% (Q2-2018) which was the time that the dollar started depreciating.

Given that most of the items of consumption are imported – rice, floor, sprats, chick pea, canned fish, sugar, etc. – the last quarter data reversing the trend to be -8.3% (Q3-2018) means that the Sri Lankan housewife is lifting its head after a continuous fall even though the consumption remains contracting. Which is an issue that must be addressed.

Deep dive– last quarter

If one does a deep dive on the numbers, we see that the Food and Beverage sectors continues to contract sharply at 10.5% volume change which is means that the household is under severe pressure and it will have an impact on many companies operating in this business sector.

Personal care consumption has picked up but yet at -1.3% in volume whilst in value it is growing at 5.1% which means that the consumer is stretching to keep the quality of life going. Household products in volume is at -5% whilst overall being flat as the price change being similar in quarter 3-2018, which will have a direct impact to the household and personal care businesses turnover. This in turn will have an impact to innovation and monies invested on R&D by the private sector.

Exports at 3.8%

As per the National Export Strategy launched recently, the country is targeting $28 billion by 2022 at a growth of 10%. However the growth P1-7 was 5.7% whilst last month as per Central Bank data has further dropped to a +3.8% which means that we are well away from the targeted export number. It’s important to at least now decide what are the reforms required and then agree on the key policy reforms required to make Sri Lanka competitive.

It is better that we develop the ‘Machinery’ and ‘Electronics’ business just like what Vietnam, Thailand, Bangladesh, Cambodia and India did if we are to learn from the experience curve from others. Let’s accept it, unless we drive the export revenue we cannot cushion the emerging markets currency crisis.

What is important to note is that almost 45% of the apparel exports are to the US where the currency depreciation is at 0% whilst the consumer confident is at the highest at 121 and the GDP booming at 2.9%. Hence we must take the note sent by the US Government on the current constitutional crisis.

The UK accounts for 17% of the apparel exports and once again the consumer confidence is at 101 and currently depreciation is at 3% which means overall consumer demand will remain robust. But we must be keeping an eye on the GSP+ not been used as an instrument to wrestle the recent Prime Ministerial change decision. This will require strong dialogue with the stakeholders and understanding for the decision. Which is a skill that Sri Lanka strongly require in the next six months’ months in my view.

Tourism

The currency depreciation of 5% in the last in the last two months will have a positive rub-off on tourism, given that the destination becomes cheaper by 5% to an overseas visitor. The whole industry is waiting for the launch of the much-awaited global marketing campaign and even though there are many thoughts on the campaign ‘So Sri Lanka,’ in my view we need some identity and this must be launched at planned WTM in London next week. This will have a positive rub off on the media attention that Sri Lanka has been attracting due to the political developments.

Let’s also not lose sight on the accolade that the country received by Lonely Planet to be ranked No. 1 globally, beating Germany, Zimbabwe, Panama, Kyrgyzstan, Jordon, Indonesia, Belarus São Tomé and Belize. We must now focus on new product development and look at the best practice that Kerala did after the floods that tells the world how to manage a destination marketing brand.

Key issues

Whilst we are focusing on the political developments it’s important to understand that 78% of the economy is being driven by the private sector. As per the Nielsen Business Confidence index the key issues as at September 2018 is Taxes – 100% say it, Currency – 71% say it, Interest rates – 23% and Inflation – mentioned by 45%, which are the touch points that the policymakers will have to address in the Budget 2019.

Next steps

Whilst Sri Lanka is at challenging times in the next two weeks and thereafter the looming elections at provincial level and then the general election, the focus of us in business must be keep the ‘motivation’ high in the work place and avoid corridor talk on ‘politics,’ even though the latter happens to be the most popular topic just like any other island nation.

(The writer is the Country Director for a global US investment company for the South Asian region. He is an alumnus of Harvard Executive Education. The thoughts are strictly his personal views.)