Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 20 December 2018 00:00 - - {{hitsCtrl.values.hits}}

In the backdrop of the exchange rate fluctuations due to the strengthening of the dollar, the Indian Government pushed for ‘governance’ by asking the British Government to extradite the Indian liquor baron Vijay Malaya who has taken refuge in the UK after defaulting 13 banks in India.

The media hailed the decision by the Modi Government and pushed for finding all refugees who have engaged in similar acts in the past, given that most of them are alleged to have worked in collusion with banking officials and politicians.

This is a clear lesson for Sri Lanka given the President’s speech on the appointment of the Prime Minister on 16 December where he clearly referred to the issue of the Central Bank bond scam and the action taken to hold the responsible officers for the issue.

India powers to $ 2 trillion

Even though India has slipped one place from eighth to ninth position, the power of the country is seen by the 5% growth to the $ 2.1 trillion by a strong performance on exports, tourism and FDI which are key pivots to the nation brand computing score whilst the Modi Government is keeping the pressure on the governance front like in the case of the Malaya of Kingfisher fame. Once again a lesson for Sri Lanka on how competitive a nation must become in today’s world.

India as a nation has beaten Australia, Spain, Mexico and Switzerland, which indicates the power of driving the economy. India has jumped five places in the Global Competitiveness Index in the World Economic Forum (WEF) due to the strong reforms driven on research, innovation and nation’s e-governance which includes digitalisation at a provincial level. Once again this indicates the State role in facilitating the private sector to power the nation.

In 2017, countries like Algeria and Ukraine beat Sri Lanka on nation brand value which is the competitiveness of the country on a combination of factors that includes governance, people, tourism, exports and FDIs. The next set of countries that will overtake us will be Slovenia, Iraq and Angola, which is we must not allow at any cost. The question is, who do we have to tell this reality?

Indian brands grow 110% to $ 146 b

The HDFC brand continues to be the strongest brand in India with 21% growth to $21.7 billion dollars as per WPP analysis. This further consolidates the position that India remains the fastest growing country on brands, beating China. It also tells us about the policy reforms that the Modi Government is carrying out to facilitate the private sector to drive the economy whilst outpacing China.

In simple words the conducive Government policy with the increasing use of digital technology is shaping India to be a dominant country globally in the top 10 rostrum – a lesson that Sri Lanka can pick up irrespective of which party was responsible for the last three years’ economic lag, the Central Bank robbery that increased interest rates by 3% and the drastic decision by the President that led to the judicial impasse.

Malaya issue

A man with an image of the celebrating the ‘Good Times of India’ anchored by Kingfisher Airlines is on multiple bailable and non-bailable warrants issues against him by various judicial courts in India, due to the complaints lodged against him by Enforcement Director (ED), Central Bureau for Investigations (CBI) apart from the 13 banks that are stating that commitments have not been met.

The court verdict on the extradition from the UK was damning given the strong language used which actually can create a dent in brand India given the linkages to the alleged link with politicians and banks that have lent money based on a nontangible asset like brand value of the company.

Be that it may, the lesson for Sri Lanka is how important it is to push the law-enforcing officials on the alleged scams at SriLankan Airlines, etc. that were investigated by organisations like FCID and CIABOC but has not proceeded for conclusion. These impact the overall performance of a country which is valued by the nation branding score.

Pakistan – trailblazer at 15% growth

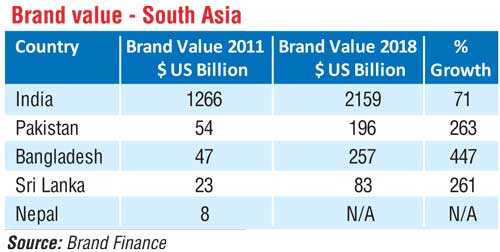

Believe it or not, a country straddled by political instability, terrorism and internal issues, Pakistan, is a trailblazing nation that has grown its brand value from a mere 54 billion in 2011 to $ 196 billion in 2017, at a year on year growth of 15% and a commanding 263% growth between 2011 and 2018 which is rooted to the deep cutting-edge reforms at play. Another clear lesson for Sri Lanka.

The country has been implementing the IMF reforms though it is hurting the people which is a key pick up to Sri Lanka in my view. The appointment of cricketing legend Imran Khan as the Prime Minister and the focus drive taking place with China-Pakistan economic corridor will sure add weight to the country’s performance.

The reality as at now is that Sri Lanka has been downgraded by international rating agencies Moody’s and Fitch, the country has slipped on the nation brand ranking from 59 to 61 this year; from a consumer household consumption point of view – food, household and personal – it has contracted seven times in a row quarterly, meaning from 2017 onwards, which is very serious. So whilst we see neighbours India and Pakistan pushing the economic agenda, for Sri Lanka it is more a case of survival.

SL will bounce back

Whilst things can be rough given that Sri Lanka has slipped two places in the global Nation Branding Index and been beaten by Algeria and Ukraine hopefully, with the appointment of the Prime Minister last Sunday we might be able to stabilise the economy.

If we track back to the darkest times in Sri Lanka’s history in 2009, Sri Lanka experienced the toughest environment where the city was being raided daily by the LTTE, whilst the barrel of oil was being traded globally at $150 plus with Sri Lanka having just under one month of cover on foreign exchange reserves. The stock exchange had crashed to 1900 by April 2009. But Sri Lanka rode the wave.

The war came to a close by May 2019 and Sri Lanka recovered within six months to beef up reserves to $ 6 billion and the stock market spiralled past 7000 whilst the economy that was just $ 30 billion in 2009 crossed $ 80 billion in just six years. That is the power of brand Sri Lanka and on the resiliency attribute withered Sri Lanka will sure bounce back to become a strong nation. My estimate is that it will be 2020 when Sri Lanka can get back the lost glory.

The issue

But the issue that we must not forget is that the world is moving faster and is passing Sri Lanka. We are continually getting beaten on FDI investments, the ability of attracting quality tourists and entering quality export markets.

In 2017, countries like Algeria and Ukraine beat Sri Lanka on nation brand value which is the competitiveness of the country on a combination of factors that includes governance, people, tourism, exports and FDIs. The next set of countries that will overtake us will be Slovenia, Iraq and Angola, which is we must not allow at any cost. The question is, who do we have to tell this reality?

(The thoughts are strictly the writer’s personal views and do not reflect the organisations he serves in Sri Lanka or globally. Dr. Athukorala was the first Executive Director of the pivotal policymaking body the National Council for Economic Development in the Finance Ministry.)