Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 12 November 2024 01:33 - - {{hitsCtrl.values.hits}}

Having saddled the nation with a disastrous International Sovereign Bond (ISB) restructuring that ballooned debt repayments by billions (see https://www.ft.lk/columns/Sri-Lanka-s-ISB-restructure-Debt-trap-backed-by-IMF-and-Ceylon-Chamber-of-Commerce/4-768633), the Central Bank Governor (CBSL) now pushes for lifting the import ban on personal vehicles – a blatant kowtow to the IMF’s imperial agenda. Two days after the Governor’s remarks National People’s Power (NPP) Government spokesperson Minister Vijitha Herath announced that the import ban on all vehicles will be lifted by 1 February 2025 as previously proposed by unelected Ranil Wickremesinghe administration.

Having saddled the nation with a disastrous International Sovereign Bond (ISB) restructuring that ballooned debt repayments by billions (see https://www.ft.lk/columns/Sri-Lanka-s-ISB-restructure-Debt-trap-backed-by-IMF-and-Ceylon-Chamber-of-Commerce/4-768633), the Central Bank Governor (CBSL) now pushes for lifting the import ban on personal vehicles – a blatant kowtow to the IMF’s imperial agenda. Two days after the Governor’s remarks National People’s Power (NPP) Government spokesperson Minister Vijitha Herath announced that the import ban on all vehicles will be lifted by 1 February 2025 as previously proposed by unelected Ranil Wickremesinghe administration.

The Governor, with zero role in generating foreign exchange, is dictating its fate. With IMF’s blessings, he assured that the economy’s foreign exchange position could handle a consumerist spending spree at the expense of bolstering national savings and production. Sri Lanka, he claims, can be flooded with gas-guzzling automobiles instead of building industries that foster employment that requires scientific learning, as opposed to repetitive manual labour with life-consuming work hours of our manufactured exports. He assures that this market-driven madness, fuelled by the often subhuman conditions endured by our migrant workers, Free Trade Zone workers and indentured labour of the estates earning below subsistence wages can be achieved without endangering external sector equilibrium and further diminishing living standards of the masses.

Champion their true purpose

The IMF demands this “liberalisation” – a euphemism for enriching foreign corporations at the expense of Sri Lanka’s future stability and development. Conveniently forgotten is the IMF’s own 2022 assessment under Article IV consultation, partially blaming our economic collapse on the very consumerism they now endorse! Back then, they advocated for reducing our “unbearably large car fleet” which even now consumes 24% of total import expenses while the passenger vehicles import ban is in full force and the price of crude oil is relatively low at around $ 70/barrel. Now, with the dust seemingly settled on Sri Lanka’s external and fiscal position, they champion their true purpose: maintaining the imperial division of labour and promoting the interests of industrialised nations holding the majority vote of the IMF. This will perpetuate Sri Lanka’s underdeveloped and debt-ridden status locking us into a cycle of political economic dependence and stagnation.

Governor Weerasinghe assures that this tyranny of the elite and the IMF won’t harm the economic stability and living conditions of the workers who generate our foreign exchange, which will now entertain the fancies of the local rich expanding the markets of industrialised Asia and the West. Yet, the external situation and looming ISB repayments following a disastrous restructuring agreement paint a grim picture. Lifting the ban will push us towards another balance of payments crisis and a foreign debt implosion as early as next year.

Sri Lanka’s monthly import bill surged from approximately $ 1.4 billion during the last two and a half years to nearly $ 1.7 billion since July 2024, recording an increase of over 20% while export receipts stagnated around $ 1 billion monthly. Trade deficit as a result ballooned to $ 634 million in September 2024 escalating by a whopping 68%! Net tourism receipts dwindled since September 2024 due to both a slowdown in receipts and an increase in outbound travel of Sri Lankans costing $ 104 million in September 2024. This has further eroded the surplus in services account to $ 156.1 million from $ 308.8 million in September 2023, recording a collapse of nearly 50%. The sharp decline is even more significant given that tourism receipts for 2023 were significantly below 2024.

In the face of reducing net foreign exchange receipts Sri Lanka’s balance of payments surplus stands at $ 2.2 billion as of September 2024 thanks to increasing foreign remittances by migrant workers. This amounts to $ 4.8 billion in Jan-Sep 2024. Foreign remittances are keeping us barely afloat by exporting youth and mainly women’s unemployment and domestic destitution. Foreign reserves are $ 4.5 billion excluding the currency swap facility of $ 1.5 billion with the People’s Bank of China which has conditionalities on usability and is denominated in Chinese Yuan. This means that over the past three months, Sri Lanka’s real import cover has fallen to as low as 2.6 months, nearing an economic freefall.

Adding fuel to fire

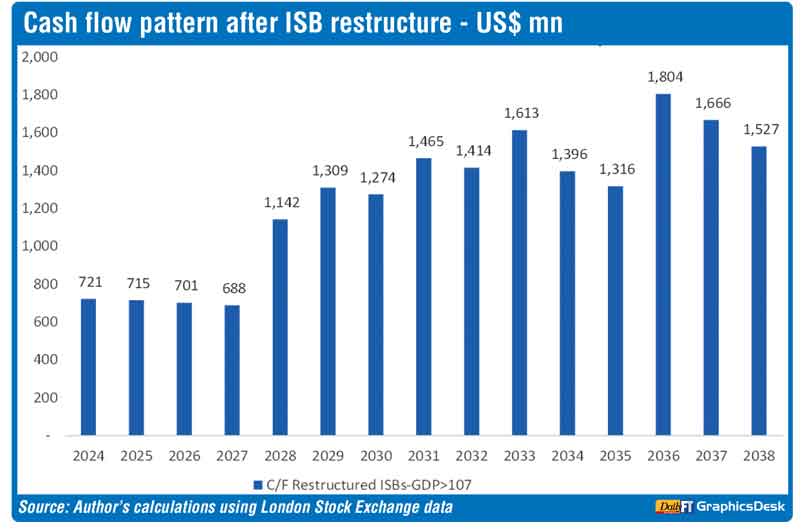

Adding fuel to fire, the disastrous ISB restructuring deal championed by the CBSL hand in hand with the bilateral debt agreement will increase Sri Lanka’s debt servicing costs by approximately $ 1.85 billion in 2025 if repayments commence from next year. This is so given that Sri Lanka has to pay a 1.8% consent fee on the original ISB principal claim of $ 220 million on top of the $ 501 million interest and principal payments in 2024 fuelled by $ 1.7 billion plain vanilla bond with 4% interest on past due interest while interest on restructured bilateral debt will amount to approximately $ 210 million (2% on $ 10.5 billion in bilateral debt) during the year. If repayments commence in 2025 total repayments on restructured foreign debt will surpass $ 1.8 billion for the year.

This, coupled with the pent-up demand for personal vehicles can easily push the total import bill by another $ 1.5 billion. For instance, seven years ago in 2018, Sri Lankans imported personal vehicles amounting to $ 1.6 billion without accumulated unrealised demand. This means that Sri Lanka’s foreign exchange outflows will increase by approximately $ 3.3 to 3.5 billion in 2025, sufficient to wipe out 75% of existing foreign reserves. Sri Lanka’s total export receipts must surge 20% to survive these additional expenses without wiping out foreign reserves. Any external shock – a spike in fuel prices or an unceremonious travel advisory – could trigger a full-blown crisis, collapsing the currency and crushing living standards.

Furthermore, Sri Lanka’s terms of trade deteriorated steadily over the past one-and-a-half decades. The unit value of the terms of trade index by September 2024 stands close to 90, well below the 100 level at the base year in 2010. This means that Sri Lanka’s unit price of exports has deteriorated by over 10% compared to imports during the period. Hence, this indicates that the sum of Sri Lanka’s price elasticities of imports and exports is less than one. Therefore, according to the Marshall-Lerner Condition, the balance of payments would not improve simply through a market-determined exchange rate in the face of long-run deterioration of terms of trade.

The current NPP administration must realise that they are sleepwalking on thin ice, thinner than the CBSL Governor and the IMF want them to believe, leading them blindfolded towards a catastrophe. This path could spell doom, handing power back to the very elite they were elected to replace within the first year after assuming power. A series of wrong moves will shift power firmly back to the defeated elite providing them an opportunity to reestablish their rein.

(All data on Sri Lanka’s external trade was obtained from CBSL External Sector Performance, monthly press releases)

(The writer co-authored the book ‘A History of Underdevelopment and Political Economy of Inflation in Sri Lanka’ (2020), Singapore: Palgrave Macmillan. He is currently a PhD student in Economics at the University of Sri Jayewardenepura and holds a Master’s in Economics from the University of Colombo.)