Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 8 June 2020 00:30 - - {{hitsCtrl.values.hits}}

Nikolai Kondratieff on business cycles

The business cycle theory presented by the Russian economist of the early 20th century, Nikolai Kondratieff (in Russian Kondratiev) has received attention of the mainstream economists in the West only recently. Until about the early 1990s, he had been relatively unknown, though his theory had had a profound impact on the understanding of business cycles. There was a reason for it. Except a few articles published in leading economics journals in the West, all his writings, done in Russian, had only been translated into English fairly recently. That was because, despite his Marxist leanings, he was considered a traitor by the Soviet establishment. On this charge, he was arrested in 1930, kept in prison for 8 years and executed by a firing squad in 1938 at the prime age of 46 years.

His crime? He had discovered through empirical research that capitalist societies had repeatedly undergone ups and downs in their economies – known as business cycles – but had managed to recover to a new position every time they had suffered from an economic downturn. Such business cycles had typically been experienced by Western economies for long periods of about 50 to 60 years which he designated ‘long-waves’.

This was against the worldview presented by the Soviet leadership at that time. Their worldview simply said that capitalist societies are inherently defective and would see their eventual downfall, whereas communist societies are permanent and progressing continuously. The fate which Kondratieff received at the hands of the Soviet leadership at that time was typical of any authoritarian rule. The authoritarian rulers throughout history have shown that if you express any view opposed to theirs, you have to pay for it dearly.

That dear payment in the Soviet Union took the form of trading your life for intellectual subservience. Kondratieff did not agree to this trade-off and preferred to be executed. He was in oblivion for five decades and was resurrected among the mainstream of Russian academia only after the Soviet Union collapsed in 1990.

Birth of Kondratieff Waves

Before his arrest and incarceration in prison, he was a leading member of the Soviet establishment. He helped Vladimir Lenin to prepare his New Economic Policy to make a turnaround of the fast-decaying Russian economy immediately after the October Revolution of 1917. He prepared the agricultural policy in which small farmers could produce food products for the market.

Kondratieff’s main research interest was business cycles and in furtherance of this interest, in 1920, he set up The Institute of Conjuncture in Moscow. This led to the publication of a series of papers and books on business cycles starting from the 1922 publication, ‘The World Economy and its Conjunctures after the War’ and culminating, in 1925, in his main work on the subject, ‘The Major Economic Cycles’.

Before this major work, he published a paper in 1924 distinguishing between a selected point in the economy – known as making a static view – and the movement from that point to a forward point in the future, called the dynamic progression of the economy. All that matters to an economic planner is not this convenient static view but how the economy would progress over time as presented by its dynamic developments. It enables the planner to grow along with the growth of the economy and gauge for himself its strong features as well as weak points.

This is similar to a mother living with her son or daughter. She would personally experience how he or she is growing and what are his or her strengths and weaknesses. Any intelligent mother would know that his or her growth is only in the forward direction and she could not rewind the clock to an earlier point in his or her life to try out a new beginning, even if she would have loved to do it. Noting this forward direction of economies and inability to move back to an earlier point in history, Kondratieff observed that all economies were subject to a series of repetitive ups and downs in long waves each spanning over 50 to 60 years.

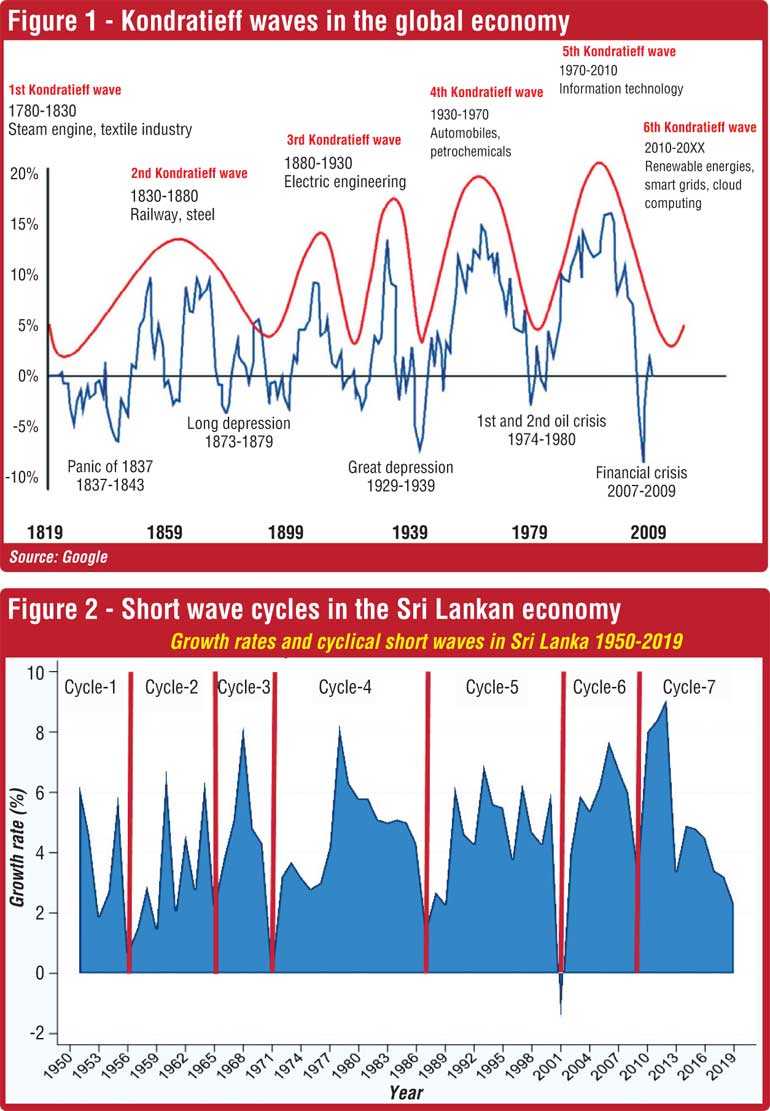

Out of respect for the discoverer of these long waves, the Austrian-American economist Joseph Schumpeter designated them as Kondratieff Waves or simply K-Waves. The subsequent economists have found that these long waves are in fact a reality and discovered seven such waves pertaining to Western economies as presented in Figure 1.

Presently, the world is going through this last wave that had started in 1970. At the tail end of the seventh wave, the global economy has been hit by an unexpected event in the form of COVID-19 pandemic pushing it further down in the downswing, probably in to the negative area, and postponing the progression into the eighth wave.

|

|

|

Frenchman Clément Juglar on commercial crises

Of course, before Kondratieff, the French physician and statistician, Clément Juglar had identified in two publications, first in 1880 and the other in 1889, long commercial crises akin to modern day business cycles. He identified three phases of a commercial crises, prosperity, crisis and liquidation.

When an economy starts doing better in the prosperity period, people become overexcited and begin to spend more than what they earn, funded by borrowing. Hence, the banks too experience an expansion of credit and ride the upswing freely exploiting new profit-earning opportunities. But soon, the system applies its own brakes and makes the overconsumption, not supported by real production, unviable. Crisis hits and most of the less profitable businesses are liquidated, followed by more solid ones. Banks which have liberally expanded credit also go under along with the commercial businesses. This is the danger of bubble building in an economy which economists talk today.

Recovery from the crisis, according to Juglar, comes from the reawakening of the spirit among investors through an oversupply of savings and the consequential reduction in interest rates. Thus, the recovery from the crisis is basically a monetary phenomenon: Lower interest rates, make even the less profitable investments profitable and encourage businesses to make a re-start. Hence, the economy continues with the same tempo and same production techniques. It is like a human body that makes a series of readjustments when hit by a disease. The sick man recovers but continues with the same body until another disease hits him.

Departure of Kondratieff from Juglar

This is the point of departure by Kondratieff. According to him, it is by deliberate human action which brings about a new technique of production that helps an economy to move from one wave to another. There are four stages in each long wave: prosperity, recession, depression and improvement. In the prosperity, everyone rides on the bandwagon of new good life offered to him. But soon, like the analysis made by Juglar, they overdo it causing the economy to be overstretched beyond its capacity. That causes to recession to set in making it doubtful to continue with the same tempo of consumption.

It is then followed by depression marking the downswing of the wave. During this period, the necessity is felt to come out of the depression through the invention of new techniques. The commercial application of these inventions begins paving way for an upswing in a new wave. Without these commercial applications, scientific inventions become purposeless. This is how Kondratieff had presented it in his 1935 article to Review of Economic Statistics.

Kondratieff: Inventions alone are not sufficient

Says Kondratieff: “Scientific-technical inventions in themselves, however, are insufficient to bring about a real change in the technique of production. They can remain ineffective so long as economic conditions favourable to their application are absent.

This is shown by the example of the scientific-technical inventions of the seventeenth and eighteenth centuries which were used on a large scale only during the industrial revolution at the close of the eighteenth century.

If this be true, then the assumption that changes in technique are of a random character and do not in fact spring from economic necessities loses much of its weight. We have seen before that the development of technique itself is part of the rhythm of the long waves.”

Further elaboration by Joseph Schumpeter

The Austrian-American economist, Joseph Schumpeter, who coined the term Kondratieff waves, further developed this idea by distinguishing innovations from inventions. Inventions are new creations by scientists and engineers. But they have to be commercially developed by a process known as innovations. Hence, as Kondratieff too had presented, inventions are nothing but mere paper-works.

A good example is that Stephen Wozniak, the engineer, invented the first Apple Mackintosh Desktop computer. It would not have seen the light of the day, if there was not an entrepreneur called Steve Jobs who found ways of funding, mass production, marketing and after-sale service provision for the new invention. Similarly, the US company Corning Incorporated had invented the scratch-free Gorilla Glass in 1960s for the US Air Force. Since it was not used by the Air Force, it remained only as a prototype in the labs of Corning Incorporated until 2004 when Steve Jobs used it for his first iPhone model.

Schumpeter has presented two further requirements for a capitalist economy to sustain and progress. One is the diffusion of knowledge among a large number of people about the new innovation.

The other is the imitation of same by prospective entrepreneurs. Schumpeter has thus further elaborated on what Kondratieff had categorised as the existence of favourable economic conditions.

Every long wave is followed by adoption of new technologies

What this means is that business cycles are common occurrences, they take the form of long waves spanning over 50 to 60 years and every wave leads to a new cycle which is based on new technologies.

Thus, it is technology which keeps the capitalist system moving forward in a continuing evolutionary process.

This evolution is halted only if it fails to come up with a new technology to address the existing problems. Given the current ever-expanding research base in advanced economies, it is unlikely that the world would reach a stage in which it is no longer capable of coming up with a technology that could not be commercially applied.

Sri Lanka’s short waves in post-independence history

This gives an opportunity for us to examine Sri Lanka’s growth cycles since independence in 1948.

In terms of Kondratieff waves, Sri Lanka should have completed one single wave and moved into the initial upswing phase of the second wave.

But as shown in Figure 2, Sri Lanka’s growth cycles since independence have been fairly short spanning over 3 years at the shortest and 15 years at the longest. What this means is that the country has failed to sustain its growth momentum for a sufficiently long period to ensure continued economic advancement.

What have been the causes for this unhealthy development? Many. First, the overexpansion of the public sector by successive Governments has diverted the resources that would have been used for developing its ‘research, development and application base’ to current consumption. Every General or Presidential Election is preceded by a generous offer to provide employment to the unemployed, especially the graduates passing out from universities, in the Government service.

Second, this consumption-orientation has created unsustainable budget deficits leading to many macroeconomic issues: expansion of debt, money printing, inflation and pressure for the exchange rate to depreciate.

Third, the economy-wide inefficiency as demonstrated by low ranking in the ease of doing business indexes has taken the incentives away from entrepreneurs to invest in newly innovated products. To eliminate these inefficiencies, it is necessary to undertake structural reforms in both the real economy and the public sector. However, every successive Government has paid only lip service to this requirement. Fourth, Sri Lanka has failed to attract new technologies from those who have developed them in the initial period and develop its own research capability in later periods. This requires a complete overhaul of its education system.

Students are throughputs and once they go through the education mechanism, what should come out should be individuals who are capable of thinking independently.

Human society has progressed not by ideas that are accepted unquestioningly but by ideas which are created in independent minds. For this purpose, the ability and capability to question the existing order is a must. The biggest enemy of progress in this sense is subservience.

SL should act now to avoid further disasters

Sri Lanka’s business cycles have been short, making it a country of the poor. It is poor because it is poor of ideas, creative thinking and a critical pool of capable entrepreneurs.

Hence, every time it has completed a business cycle, it has moved to the same old production system. This has trapped the country in an unwarranted state of poverty.Its last business cycle, started in 2010, has now completed 10 years. There was reasonable expectation that it would jump quickly to its next short wave within the coming two to three-year period.

But the disastrous COVID-19 pandemic has pushed the country to negative region thereby prolonging the economic recovery process. But it gives an opportunity, driven by necessity, to move for the needed structural reforms to push the country to a series of new waves marked by advanced production techniques.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected] )