Thursday Mar 12, 2026

Thursday Mar 12, 2026

Monday, 18 April 2022 00:00 - - {{hitsCtrl.values.hits}}

|

Economic crisis

Economic crisis

The ongoing severe economic crisis has pushed the country into a major social unrest which has resulted in a political crisis. Amidst mounting pressure from all social groups, the Cabinet of Ministers resigned and the President had to appoint a caretaker Cabinet. Following the resignation of key positions in economic management, Central Bank Governor and the Secretary to the Treasury posts were also made vacant.

The economic policy of the Government is under severe criticism. Due to economic hardships, people from all walks of life are calling for the resignation of the President and the Government. It is not quite unusual for a country to face an economic crisis of this nature if the specific Government opted to follow similar economic policies that Sri Lanka adopted throughout the last two decades. With an unprecedented economic crisis and social unrest, the Government is left with no plan to revive the economy. As a result, the Government was compelled to invite technocrats to accept the key positions in the economic management. The President appointed a retired career central banker and former IMF official as the Governor of the Central Bank and a serving Deputy Governor who had served the IMF in the past as the Secretary to the Treasury.

Immediately after the appointment, now more synchronised fiscal and monetary officials announced their plan to immediately restart discussions with the IMF for an economic rescue package. On the same day, the Monetary Board decided to increase policy interest rates; the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 700 basis points to 13.50% and 14.50% respectively. This is the highest ever policy rate hike in the history of Sri Lanka.

The policy rate hike intends to serve two purposes; to tame the inflation which is stubbornly running above CBSL’s expected corridor and to minimise the speculation of exchange rate by way of reducing demand for imports. Officials expect the aggregate demand to decelerate along with an already depreciated exchange rate and very high interest rates.

High interest rates, being highly growth negative, applies brakes to the aggregate demand. No doubt this will falter the growth of the economy and create further hardships for the citizenry. Though high interest rates are highly growth negative, the central bank had no choice since the crisis has deepened to a more dangerous level. When the economy is in this level of distress, ordinary monetary policy actions are not sufficient to resurrect it.

While the author intends to discuss the short-term policy actions required in detail through another paper, it is timely to discuss the medium to long-term policy reforms required to stabilise the economy along with the IMF arrangement.

About 45 days prior to the Presidential Election, a paper featuring a discussion on ideas for economic policies of the election manifestos was published in the Daily FT (ft.lk/Columnists/Ideas-for-economic-policies-of-the-election-manifestos/14-686803). Though the SLPP manifesto had nothing of significance, the majority voted in favour. In the absence of critical reforms, the economy was expected to slip into this crisis sooner or later. Framework for medium to long terms economic reforms

Addressing twin deficit

Addressing twin deficit

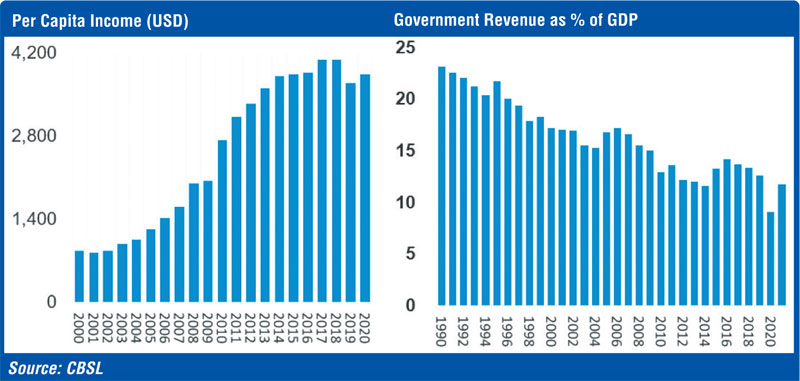

Sri Lanka has been running a large fiscal deficit for generations. Since 2005, the economic policy largely focused on building infrastructure through borrowings. Though a debt funded economic model can lift the short-term economic growth through an increase in the construction expenditure, it significantly decelerates after a few periods. If those infrastructure projects are not economically viable in generating sufficient returns to repay the borrowings, accumulation of debt becomes a burden on the economy.

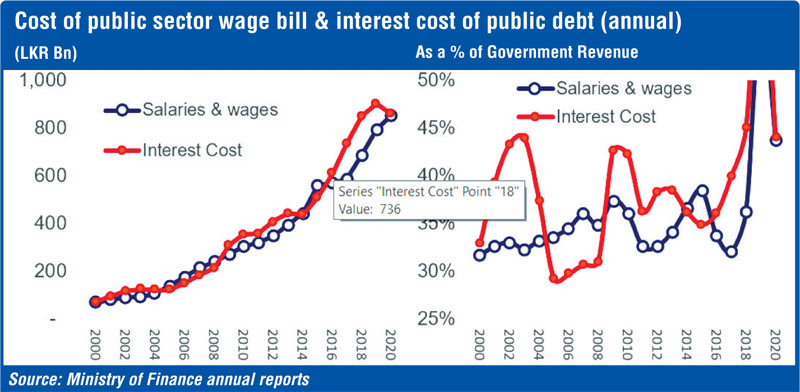

The employment in the public sector has increased by two folds during 2005-2015. Correspondingly, the Government sector salary bill also has grown in nominal terms. Further, public sector productivity remains low while many public sector institutions remain highly overstaffed. The bloated public sector with low productivity, drains a major part of the fiscal revenue. The tax burden is higher, especially on the low- income earning segment of the country due to disproportionately large indirect taxes.

The expenses for providing employment benefits to State sector and paying interest cost for the Government borrowings have grown disproportionally over the decades. The fiscal revenue as percentage of the GDP has declined over the years. As a result of low fiscal revenue and higher expenditure, the Government continues to finance a significant portion of the expenditure through new borrowings. This has resulted in the piling up Government debt.

Economic vulnerability increased with the twin deficit. An economy with a fiscal deficit and a current account deficit is referred to as having ‘twin deficits’. Sri Lanka has been running a budget deficit and current account deficit for many decades (For a more detailed discussion on the reason led to current account deficit, please refer previous article: ft.lk/columns/Time-to-reevaluate-policies-which-led-to-current-economic-crisis/4-732743).

Public sector reforms

Though it is painful and a politically difficult exercise, the Government should adopt policies to trim down public sector employment and increase the productivity in the public sector. There is need for significant reduction in public sector employment to manage ballooning public sector salary ball. Further, the Government should immediately resort for major overhaul in the pension system as the unfunded pension bill is growing disproportionately large. Since the number of retirees are growing at a faster rate due to longevity and high life expectancy in the country with modern healthcare, the pension costs become unsustainable.

If funded pension reforms are not introduced via immediate stoppage of unfunded pension for the public sector employees, a major pension crisis is unavoidable and all retirees will be deprived of sufficient pension in the future.

The pension reforms will facilitate the country to continue with a sustainable pension system guaranteeing the retirees with a suitable pension payment to cover their end life, the development of capital market and prudent fiscal management. Further, moving away from defined benefits plans (DBP) to defined contributory plans (DCP) and funding own pensions should be included in pension reforms

Labour market reforms

The structural labour reforms are an essential part of improving competitiveness. Sri Lanka is largely lagging behind its neighbours, especially India in terms of competitive education. The education reforms should be implemented and fast-tracked to improve number and quality of the young labour force. Sri Lanka should immediately adopt a policy of providing an opportunity of university entrance for all students who pass the G.C.E. A/L and qualify for the university entrance. The Government should formulate policies to expand the private university system to make education more affordable and approachable while enhancing the merit based public university entrance. It is equally necessary to formulate policies to extend the tertiary education to all students who pass G.C.E. O/L exam in order to increase the skilled labour force to find suitable high paying jobs in either domestic or international markets.

The labour shortage in the labour-intensive manufacturing industries are acute, hence labour mobility from the regional countries is required. We should learn from countries with small labour force like GCC and Singapore how effectively we can attract the labour required for unskilled and manual categories.

Tax reforms

While it is necessary to increase the tax rates to immediately boost the tax revenue, we should adopt a balanced tax system to foster long term economic growth. To increase the confidence of private sector tax payers, it is important assure that there is no retrospective taxation in the future. The Government should employ an international tax consultant to reform tax collection process in which leakages are estimated to be nearly 200% of the current tax revenue. The formal sector is highly taxed.

The policies should target to reform Inland Revenue Department (IRD), aiming operational improvement to increase the tax collection though the use of new techniques such as artificial intelligence and data science. The current status of the IRD is a waste of public resources. The Government should engage with IRD trade unions and broader civil society to secure their support for reforms in the tax collection process to save our motherland and stop borrowing from our children’s future.

Minimising wasteful Government expenditure including politically motivated public functions and campaigns with politicians and policy on zero corruption are required to ensure that tax money is not wasted. Such policies will encourage more citizens to voluntarily pay taxes as a national duty.

Improve export competitiveness

As detailed in the previous article, Sri Lanka should adopt a system which ensures that a prudent exchange rate policy is maintained consistently. The exchange rate policy should target to maintain the country’s export competitiveness vis-à-vis our competing countries.

Reforming SOES

The main State-Owned Enterprises (SOEs) are highly inefficient and indebted due to persistent wrong policies. It is of paramount importance that the Government adopt market-based pricing policy to make sure the buyer pays the right price. The IMF has highlighted the need for market-based pricing mechanism for energy pricing. Adoption of market-based pricing formulas are required for key Government services such as provision of electricity, fuel, LP gas and transports services such as trains and buses. Further, the Government should privatise the ownership of SOEs through appropriate privatisation process similar to policies in privatising telecom sector. In order to enhance the eroding capital base of public sector banks, three main public banks, namely Bank of Ceylon, Peoples Bank and National Savings Bank should be privatised while amalgamating small banks with those larger banks. Private sector investments and management should be introduced to Litro Gas, Sri Lanka Insurance, Lanka Hospitals and other hotel properties.

Major reforms in the power and energy sector encouraging more private sector participation and FDI involvement in the generation of electricity are required. In the future, CEB role should restricted to the management of national grid and distribution of electricity nationally. It is also required to obtain technical assistance in the grid management to ensure more renewable energy plants are added to the national grid, significantly enhancing the contribution of the renewable energy sector in the national energy composition. The country should not rule out the possibility of integration of our national grid with India in order to ensure continues energy supply, thereby improving our competitiveness and economic integration with India.

Increasing competitiveness

Sri Lanka should target South Asia’s number one position in “Doing Business Ranking” via major reforms in the way we conduct our businesses. Business approval system should be completely digitalised and fast-tracked. The public institution in the approval process should be incentivised to offer faster and accurate services to businesses. It is also important to offer seamless 365-day services using the excess man power in the Government sector.

PPP for infrastructure

Finally, as the Government cannot continue to fund the infrastructure expenses, appropriate Public Private Partnership (PPP) mechanisms should be introduced to fund future infrastructure projects. Establishing a dedicated institution with sufficient technical expertise to devise a framework for national PPP program to develop critical infrastructure should be prioritised.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)