Saturday Feb 28, 2026

Saturday Feb 28, 2026

Wednesday, 4 November 2020 00:00 - - {{hitsCtrl.values.hits}}

In today’s context the submission of a CRIB report is even compulsory and an important document prior to the recruitment of any personnel to the banks, as it provides an effective confirmation of the prospective employee’s integrity and credit worthiness. This is an important component in recruiting quality staff

Sumith (not the real name) is an intelligent and hardworking daily wage earner. The recent lockdown forced him to venture into innovations. He succeeded in making innovative wash basins for which there  is a ready demand in view of the corona, towards compliance with the health regulations.

is a ready demand in view of the corona, towards compliance with the health regulations.

He made a few wash basins, supplied to some of the outlets in his vicinity. Consequent to the success of his initial venture, he has received large orders from various clients, due to the acceptability of the product and its affordability, as the cost of production is at a low level. Due to his inability to meet the increased demand, he approaches a financial institution in the vicinity for a basic facility of Rs. 1 million to purchase essential raw materials. He is in possession of confirmed orders from various leading outlets. He has no assets nor security to offer.

However, the bank, in close proximity to his residence, which he approached, in consideration of the current situation, approved the facility of Rs. 1 million as an exception, with reluctance, to purchase essential raw materials against acceptable confirmed orders. The facility was to be repaid from the proceeds of the confirmed orders within a maximum duration of six months. Even though he has no assets to offer as security the bank has approved this facility strictly on an effective follow-up mechanism.

The above case is the reality faced by many of the individuals under the SME sector. There are many such individuals with very valuable possession of innovative ideas. Due to their inability to offer any security, as most of them do not possess acceptable assets, they are not in a position to seek the assistance nor approach any bank or financial institution. This is the reality of the existing situation.

The Small and Medium Entrepreneurs (SME) sector which is considered as the backbone of the economy, is categorised as high risk sector by the financial institutions. Most of these entrepreneurs are dependent on one single personality without any succession plan. The moment the aforesaid personality is out due to death or any unforeseen circumstances, the facility granted will face the risk of non-payment and fall into the default category. This is one of the main reason and reluctance of banks and financial institutions to assist such category of borrowers.

They may feel comfortable to grant facilities to professionals with dependable income, against acceptable security or in some cases on clean basis, i.e., without any security, as the possibility of default is considered remote. This will not only ensure the safety of their exposure it will greatly minimise their follow-up costs on post monitoring towards recovery. Towards achieving this task and boosting their asset portfolio, banks assign targets to their marketing personnel to aggressively canvass such facilities. The borrowers of this category are greatly benefitted and there are no benefits to the country nor to the economy as it only benefits the individual borrower. Target achievers of banks and financial institutions are recognised and rewarded. All such facilities are approved instantly due to less documentation, easy evaluation process, etc., in contrast to the micro finance sector, as granting facilities to this sector is a tedious process.

The existing environment should be utilised to identify the entrepreneurs who could be assisted under the micro finance.

The expertise of the marketing personnel of the banks and financial institutions could be availed to identify such category in need of assistance.

Move away from security-based lending

The time is now opportune for banks and financial institutions to move away from security-based lending and consider such SME sectors under micro finance, against strict supervision and monitoring, depending on the viability of the project of each individual. The case which is stated at the outset of this article is the reality of the situation faced by many of the individuals under the SME sector. However, this doesn’t mean banks don’t consider facilities for SME. They do consider, strictly on supervision and effective monitoring system.

During my own banking career, I have come across many such instances, where the banks have granted facilities on strict monitoring and supervision guidelines. Many such entrepreneurs have today become household names with strong brands and earn valuable foreign exchange to the country. Some of them have even expanded their business operations to several neighbouring countries.

The global pandemic, which thankfully appears to be manageable and under control in Sri Lanka, has deprived many people especially the daily wage earners and individuals involved in small scale entrepreneurships. Owners of three-wheelers, school vans and the daily paid workers, food suppliers are the worst hit, in addition to the travel and hospitality industry all of which are severely affected. It has been revealed a total of five million people inclusive of their families and dependents under the aforesaid category are affected without any income nor purchasing power. It has been further stated 62% of our workforce are unskilled.

Many of them, have utilised the recent lockdown in venturing into several innovations. They had ample time to tap their knowledge and explore various innovations due to the recent lockdown and restrictions of their movements. Innovations should be encouraged with effective mechanism.

The Government has recognised the importance of the SME sector which has received their utmost priority and a special ministry has been created for micro finance, with a view of expediting and assisting this sector. This will not only generate employment, it will also result in saving and bringing in valuable foreign exchange to the country. The decision taken by the Government to prohibit the importation of certain non-essential items which are and could be manufactured locally is a good and timely move which will boost the local economy. There is no necessity to import such items if locally produced items of similar quality is available in the country. One has to visit a supermarket or a departmental store to observe the vast amount of imported consumer durables available at much higher prices than the local products. The affluent category still prefers and desires to purchase such items due to their strong purchasing power.

Recent instructions to the State sector to give priority to the local manufacturers and suppliers in procurement contract is a timely move. This will not only prevent the outflow of valuable foreign reserves at a time when the country is faced with a crisis situation due to the global pandemic; it will boost the local entrepreneurs, which in turn will generate more employment to this sector.

Security-based lending

Banks consider various types of securities prior to the approval of a facility. This is one of the most important criteria in taking a credit decision as they are handling their depositor’s money. If they mishandle they will be out of business. There is a famous saying: ‘Anyone can grant a loan and only an expert can recover’.

This is a true reflection of a banker in appraising a credit facility. A facility could go bad and beyond salvation, due to a variety of reasons. The bankers are conscious of their obligation and responsibility, prior to the disbursement of a facility. Further once a facility is categorised as NPA (Non-performing Advance) considerable management time and legal expenditure have to be incurred by the banks towards the recovery. In certain instances, if the recovery of the interest component is very remote the banks will utilise their optimum resources to recover at least the capital. In a worst case scenario, they will be compelled to ‘write off’ such facilities, if the recovery is considered remote.

Assisting the SME sector

How can the banks and financial institutions assist the individual entrepreneur like Sumith who possess innovative ideas of making wash basins in compliance with the health guidelines? Every shop, business outlets, places of religious worships, etc., are compelled to provide a wash basin to comply with the existing health regulations, hence this is a highly profitable venture. There are many such ventures and entrepreneurs who need assistance under micro finance.

The prevailing environment, it should be noted, has resulted in the change of consumer behaviour and a shift towards e-commerce. This is a major challenge to the brick and mortar retailers, as they find it difficult to survive due to the high operational costs. This will be a boost to the micro finance sector in minimising their operational cost.

The recent introduction of the ‘LankaQR’ (Quick Response), a low cost digital payment mechanism towards expediting digital payments will derive immense benefits to this sector.

Steps towards assisting the micro finance sector

This sector seeking financial assistance could be granted a pledge loan, under which the raw materials and finished goods could be held under pledge for the financial institution in overcoming the difficulty faced by this sector in providing acceptable security.

Furnished below are a set of guidelines which could be adopted by the financial sector to assist the individuals under the micro finance category.

Step 1

The prospective entrepreneur should satisfy the bank or financial institution of their ability to make such washbasins or any other innovations, most importantly its acceptability in the market.

Step 2

Once this aspect is considered to the satisfaction of the financial institution, documentary evidence of the prospective buyers should be submitted to the financier by the entrepreneur. This aspect will confirm the marketability of the product which is to be made. This is considered as an important criteria on any credit evaluation.

Step 3

List of raw materials to be purchased and the details of such vendors should be provided to the banks/financial institution.

Once the above factors 1, 2 and 3 are compiled to the satisfaction of the financier, they could consider the facility favourably. However, it will be subject to a strict follow-up mechanism, few of which are stated below:

The proceeds of the facility should be effected direct to the supplier of the raw materials. This is important due to the vulnerability of this sector to handle large amount of cash,

On compliance of the above, the financier will have to carry out an inspection to ensure the listed raw materials have been delivered to the entrepreneur. Such inspection will ensure there is no manipulation.

Once this is confirmed and the production commences periodical inspections have to be carried out to ascertain the work in progress; on completion of which the items have to be delivered to the prospective buyers as per the confirmed orders.

On compliance of the aforesaid steps, the banker/financier should follow-up and ensure the sale proceeds are received direct as per the undertaking towards the recovery of the advance.

The above is a simple guideline towards assisting this sector depending on the acceptability of each category. It should be noted effective follow-up mechanism and inspections are an essential component in micro finance and its success and the recovery depends mainly on such follow-up mechanism. If this mechanism is effectively adhered to, the prospect of any failure or the facility going bad or default could be considered as remote.

Major risk

However, it should be emphasised, all of us are aware, the major risk, which is beyond the control of the financier in micro finance, is the lack of succession plan of these entrepreneurs and the risk faced by the financiers due to the absence of the borrower as a result of an unforeseen circumstance arising due to the death of the entrepreneur. Such risks could be mitigated, by linking the facility with a life insurance policy covering the life of the individual entrepreneur, as this sector appears to be a neglected category.

This will not only ensure the safety of the bank’s exposure; it will be beneficial to the borrower as a compulsory saving for his future and relieve the dependents in case of an unforeseen eventuality.

Effective insurance cover to minimise the risk

Some time ago I had the opportunity of conducting a workshop for officials involved in micro finance. This workshop was organised by a leading organisation to enhance the knowledge of the officials involved in micro finance. The above guidelines were explained to them in detail. The audience was impressed of the guideline explained by me towards obtaining a life insurance cover to be linked to the facility to overcome the risk which could result in the death of the entrepreneur. Insurance cover will give adequate comfort to the banks and financial institutions in case of an eventuality. Most of the officials involved in micro finance (non-bankers) do not appear to be aware of the benefits available in linking the facility with an insurance cover.

The insurance industry should explore the possibility of introducing special life insurance covers, with disability benefits, to this sector at affordable cost and the term could be extended to the maximum. What matters is the comfort it will provide in case of an eventuality to the financiers and the dependents of the entrepreneurs. This is the concern faced by many financiers involved in micro finance.

This life insurance cover should not be equated to the mortgage reducing policy, which is obtained by banks to secure housing loan facilities. Such policies protect only the loan in the eventuality of death and if the borrower survives after the settlement of the facility the amount expended by way of premium, which in most cases is a one single substantial premium goes waste.

The opportunity has arisen for the insurance sector to introduce innovative life insurance covers with wider benefits exclusively designed for this sector. This will mitigate the risks faced by banks and financial institutions in assisting the entrepreneurs under micro finance.

If such policies are available and linked to SME, it will be a major boost to the SME sector.

Facilities against movable assets

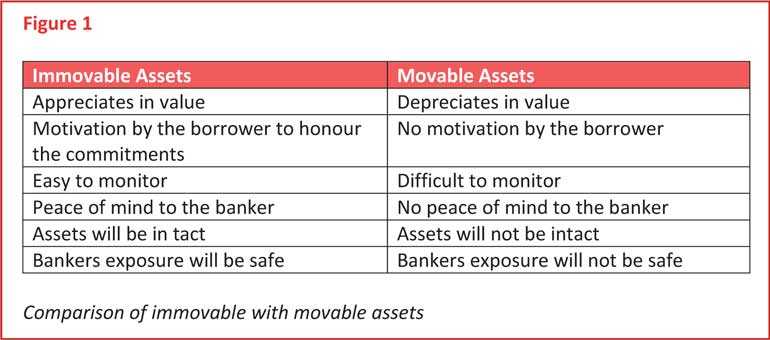

There is some misconception, that banks do not accept movable assets as security. The reality is, banks do accept such assets as security even though the risk is very high apart from the post management costs which compels effective follow-up to ensure such assets obtained as security are intact during the tenure of the facility. Such compulsion does not exist in immovable asset as such assets will always remain intact. Banks prefer immovable assets to movable assets due to a variety of reasons which is stated in Figure 1.

CRIB

There have been some write-ups of the effectiveness of CRIB. The Credit Information Bureau (CRIB) maintains the data of all facilities granted by the banks and financial institutions. This does not debar the banks from entertaining any facilities. This is a very valuable tool for the banker to ascertain the integrity of the prospective borrowers.

Prior to the establishment of CRIB, banks used to call for status reports from the prospective borrower’s banks if they had any banking relationship and such reports in most of the cases were not dependable and didn’t reflect the true position of the prospective borrowers.

In today’s context the submission of a CRIB report is even compulsory and an important document prior to the recruitment of any personnel to the banks, as it provides an effective confirmation of the prospective employee’s integrity and credit worthiness. This is an important component in recruiting quality staff.

However, this tool will not be available for the micro finance sector, as most of them will be new to the banking relations, without having any previous records of banking.

The decision towards the introduction of a points system for borrowers, instead of the existing system of branding borrowers as bad borrowers is a welcome move. This facilitates the approval process for banks and financial institutions expeditiously with a clear understanding of their borrowers. In addition, prospective borrowers will be able to negotiate with their banks for better terms with good scores.

It is reported, that CRIB will be switching to a new system, which will also include the data of telecommunication and utility services. This will identify the customers’ creditworthiness, even though they have not had any prior banking relationships. This will also target the sectors under micro finance, all of whom would have availed telecommunication and utility services.

However, it should be emphasised the decision to grant or reject a facility is the responsibility of the banker/financial institution.

Personal guarantee

Personal guarantee is considered as a very weak security although it gives some comfort to the banker. In case of default, utilising the personal guarantee to realise the exposure is always remote and ends up in litigation, hence this will not be of any assistance to the micro finance sector.

Major contributory factors towards NPA

Facilities granted by banks could go bad and move into NPA due to a variety of reasons. Furnished below are some of the common factors which contribute towards NPA (Non-performing advance).

Reasons for default

1. Lack of follow-up,

2. Failure of the lending institutions monitoring mechanism,

3. Carelessness of the approving/recommending authority,

4. Strain relationship of the lending institution with the borrower,

5. Lack of professionalism,

6. Excessive lending,

7. Wilful default,

8. Incompetent management,

9. Death of borrower/key personnel,

10. Disagreement among the management personnel,

The above factors are all manageable and will not arise in micro finance if effective machinery is in place.

The way forward

Sri Lanka is reputed to have produced several leading global and local entrepreneurs with strong brands. They have created greater value to their products due to the acceptability of their products and services.

The reported decision to set up a National Entrepreneurship Development Bank to assist the SME sector and new business ventures will be of immense benefit to this sector.

If effective steps are taken, we could assist the micro finance sector, which will boost our economy, while generating employment to many affected people due to the current pandemic.