Monday Mar 02, 2026

Monday Mar 02, 2026

Thursday, 15 August 2019 00:00 - - {{hitsCtrl.values.hits}}

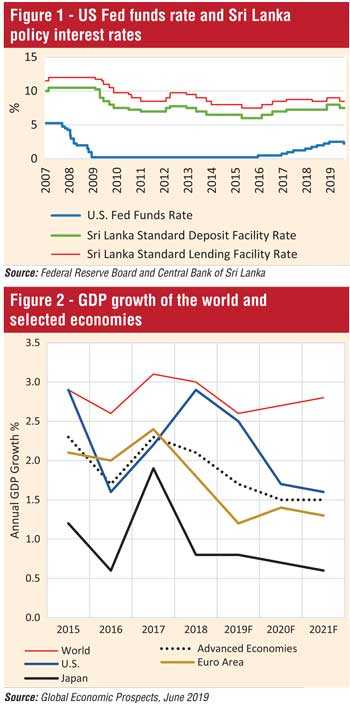

On 31 July 2019, the US Federal Reserve Bank (Fed) lowered interest rates by a quarter-percentage point for the first time since the Great Recession in 2008. What this means is that the Fed reduced its target range for the federal funds rate from 2.25%-2.50% to 2.00%-2.25%. The federal funds rate is the interest rate at which depository institutions such as banks and credit unions lend reserve balances to other depository institutions on an overnight basis.

The Fed achieves its target federal funds rates through open market operations which involve the purchase and sale of government securities by the Central Bank in the open market. As announced, in order to achieve a lower federal funds rate, the Fed will purchase government securities through open market operations. The Fed’s purchase of securities injects money into the banking system, thereby expanding the amount of reserve funds available for banks to lend. This increase in money supply puts downward pressure on the federal funds rate. The purchase of government securities by the Central Bank is called expansionary monetary policy.

The Fed achieves its target federal funds rates through open market operations which involve the purchase and sale of government securities by the Central Bank in the open market. As announced, in order to achieve a lower federal funds rate, the Fed will purchase government securities through open market operations. The Fed’s purchase of securities injects money into the banking system, thereby expanding the amount of reserve funds available for banks to lend. This increase in money supply puts downward pressure on the federal funds rate. The purchase of government securities by the Central Bank is called expansionary monetary policy.

Expansionary monetary policy causes borrowing costs to decline. In fact, when the federal funds rate declines, other interest rates in the economy such as prime lending rate, home loan rates, and car loan rates also tend to decline. It is hoped that lower cost of borrowing will lead to more economic activity and investments on the part of consumers and businesses. This expected boost to the economy is the main objective of such expansionary monetary policy. In addition, when inflation is running very low, monetary easing is used to try to ignite inflation.

Slower growth and subdued inflation are concerns

What are the reasons behind the Fed’s move to reduce the interest rate at this time? The two main factors driving the Fed’s decision are the expected economic slowdown and lower inflation. Over the past five years from 2014-2018, the US economy grew at an average rate of 2.5%. Since the start of the year, there has been increasing evidence of a slowdown in global and US growth.

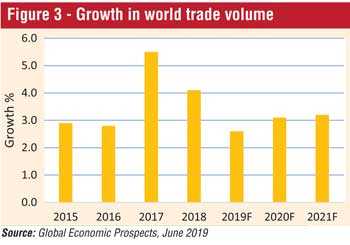

World economic growth is expected to decline from 3% in 2018 to 2.6% in 2019. Growth in advanced economies is forecasted to slow down from 2.1% last year to 1.7% this year. Growth is expected to be 1.2% in the Euro-area and 0.8% in Japan. China’s growth is also likely to slow down to 6.2% in 2019. In fact, Chinese economic growth in the second quarter of 2019 was 6.2%, the weakest rate in at least 27 years. The US growth is also expected to slow down to 2.5% in 2019 in comparison to 2.9% last year.

So far in 2019, the US GDP growth has slowed down from 3.1% in the first quarter to 2.1% in the second quarter. Slowdown in trade due to ongoing US-China trade disputes has been a key factor affecting economic slowdown. Business investment has slowed as well. Under the current scenario, the growth in world trade volume is forecasted to decline from 4.1% in 2018 to 2.6% next year. The Fed is concerned that trade uncertainties and slowdown in other economies could lead to a slowdown in the US economy and undermine its longest economic expansion in the history.

The Fed hopes that lower interest rates will boost economic activity

The US inflation has been running below the Fed’s 2% target as well. For the 12 months ended in June 2019, the inflation rate is 1.6% compared to 1.8% in May. In this environment of slower growth and low inflation, the Fed hopes that monetary easing will provide a boost to the economy and help sustain the expansion through increasing aggregate demand for goods and services which might lead companies to invest more. Personal consumption accounts for 69% of the US economy and increase in borrowing-led consumption could provide a boost to economic activity.

Monetary easing continues to gain pace worldwide

The world is now entering a period of extraordinary monetary easing. Following the US rate cut, India, Philippines, and New Zealand also cut their policy rates citing growth concerns. Central banks in a number of other countries including Malaysia, Russia, Ukraine, Nigeria, South Africa, Egypt, Brazil and Paraguay also lowered interest rates recently.

The Central Bank of Sri Lanka also reduced its policy interest rates in May 2019. It lowered standard deposit facility rate (SDFR) and standard lending facility rate (SLFR) by 0.5% to 8.5% and 9.0% respectively to support the slowing economy in the wake of bomb attacks last April. SDFR is the interest rate paid for overnight deposits by commercial banks with the Central Bank while SLFR is the interest rate paid by commercial banks for overnight borrowings from the Central Bank. These actions by central banks to follow more accommodative monetary policy clearly reflect worries about slowing economic growth and the need to boost aggregate demand and business investments.

However, critics argue that lower interest rates leads people to invest more in financial assets such as stocks. Further, lower rates will motivate more people to buy homes giving rise to higher home prices. Thus, lower rates could ultimately cause asset price bubbles in stock and housing markets which could ultimately burst like what happened in 2008.

What could happen next?

If the US-China trade war escalates and economic data weaken further, the Fed might cut rates again this year. In fact, the markets are expecting another rate cut in September this year. On the other hand, if the US-China trade negotiations lead to some positive resolutions and inflation picks up in the coming months, then the Fed might pause for the rest of the year. Overall, the current evidence suggests that the economic outlook is tilted to the downside.

Implications for Sri Lanka

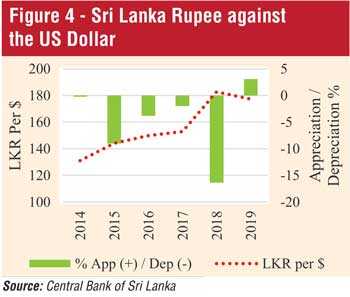

A cut in interest rates could lead the dollar to fall. The US dollar Index has declined by 1.5% from its peak on 31 July. The dollar is already at a multi-year high. The path of the dollar will be influenced by interest rate cuts by other central banks and growth differences between the US and the rest of the world. In the current environment, interest rate and growth differentials are unlikely to move much.

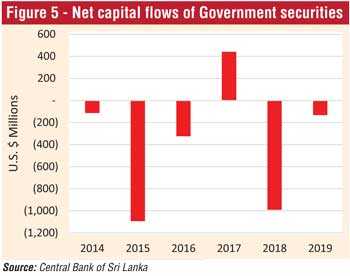

However, most analysts believe that the dollar is unlikely to strengthen in a significant way. This is good news for Sri Lanka. The Sri Lankan rupee came under tremendous pressure in 2018. With net selling of government securities by foreign investors of $ 990 million, the rupee depreciated by 16.4% against the dollar last year. In contrast, the Sri Lankan Rupee has appreciated by about 3% against the dollar so far this year. The net capital outflows from government securities have been only $ 133 million in 2019. The lower US rates might at least help stabilise capital outflows.

Lower US rates and easy monetary conditions worldwide will also help Sri Lanka to borrow at relatively lower rates in international markets. Of course, this assumes that the prevailing country risk premium will not increase. Currently, Sri Lanka’s 10-year sovereign bonds yield is about 7.7% whereas the 10-year US Treasury yield is 1.7% resulting in a country risk premium of about 6%. However, a number of factors may lead to a higher risk premium. They include slower growth and heightened political uncertainties due to the upcoming elections cycle which could lead investors to demand a higher risk premium for investing in Sri Lankan government bonds.

Persistent slower growth and continuation of trade uncertainties could force the US Fed to cut interest rates further in the coming months and years. In such a scenario, foreign investors could once again look to invest in emerging market bonds in search of relatively higher yields. Sri Lanka could also see more capital inflows into government securities which will help to stabilise the rupee and build foreign currency reserves.

One should not ignore possible reversal of the subdued world economic outlook. While the dollar could weaken somewhat with slow economic growth and competitive rate cuts by central banks around the world, a resolution of trade uncertainties could tilt the balance in favour of renewed expectations of growth. Such a scenario could result in the dollar strengthening. A China trade deal and expectations of higher global growth will be positive for export-oriented emerging markets and Sri Lanka. Particularly, higher growth in advanced economies such as the US and the European Union will create more demand for exports.

Central Bank must be pragmatic and flexible

The world is facing an increasingly challenging and complicated macroeconomic and geo-political environment. Slower economic growth and benign inflation will pose greater monetary policy challenges for central banks. In such a scenario, the Central Bank of Sri Lanka should have its entire toolbox of monetary policy at its disposal to deal with future macroeconomic uncertainties in a flexible and pragmatic way. It should not be dogmatic. The bank should not narrow or restrict its monetary policy regimes nor its ability to support the government when needed given the fiscal perils and significant macroeconomic imbalances faced by the country.

(Lalith Samarakoon is a Professor of Finance and a Financial Economist. He serves as the Secretary-General and Chief Economist of the National Economic Council of Sri Lanka. Follow Perspective at www.lalithsamarakoon.com and Twitter @LSamarakoon. Email at [email protected].)