Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 3 April 2018 00:00 - - {{hitsCtrl.values.hits}}

Last week I was invited to speak to the senior management team of an eminent bank in Sri Lanka on the topic ‘What Sri Lanka must do’. Rather than getting into the rhetoric of Sri Lanka, I thought of focusing on a sample district and then doing a deep dive on what Sri Lanka must do to make the country achieve 7% plus GDP growth.

SL poverty 4.1%?

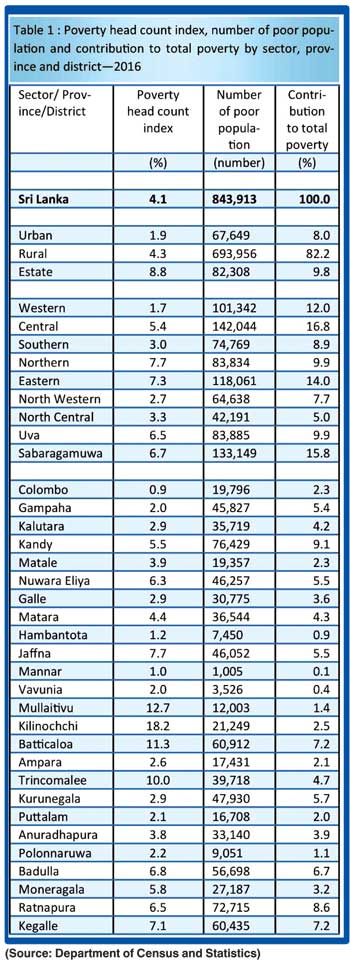

As per the latest data from the department of census and statistics overall poverty stands at 4.1%. In Colombo, poverty has reduced from 2.5% in 2009/10 to 1.1% in 2012/13 whilst by 2016 it had come down to a magical 0.9%. Politically strategic location Hambantota has registered poverty of 5.4% in 2009/10 to 3.8% in 2012/13 whilst by 2016 it had come down to a commanding 1.2%. The gateway to the Northern Province, Vavuniya from 3.4% in 2012/13, in 2016 the poverty number has come down to 2%, a strong performance.

But the issue is what impact development in 2017 has had on this data, the logic being that normally in Sri Lanka there is clustering that happens on the poverty belt. A shock externally like a natural disaster or political instability can swing the poverty level to a negative trajectory overnight.

2017 – Disaster?

For instance 2017 was a disaster year from a consumer income point of view. As per the top research company Nielsen, the overall consumption has dropped in succession quarterly – the first quarter by -3%, the second quarter by -2.5%, the third by 3.5%, and in the final quarter of 2017 by a staggering -8.8%.

In fact the general consensus is that the key reason for the change of voter behaviour on 10 February was the contracting consumption rather than a brand swing. But sadly, there has been no constructive strategy to correct the issue identified even though on the political stance the rhetoric ‘change for the better’ has been continuing for the last three years.

On 1 April, new policy changes on pricing and personal taxation will further put pressure to household income rather than leverage to ease the tension. The reported GDP growth of 3.1% in 2017 by the Central Bank with poor execution to driving policy activation in 2018 means that this year will be rougher at the consumer end. It’s a sad situation for Sri Lanka, to be honest.

In summary, this is not what the country expected on 8 January 2015 when the change of policymakers was done by the Sri Lankan voter.

No-Confidence motion

Whilst the above is unfolding at the consumer end, the focus of the country is on the No-Confidence motion to be debated and voted on 4 April. Given this focus, the policymakers are out of touch of the continuous challenge that is happening at the consumer end and at the village and district level which was seen very clearly on 10 February. In fact, some ministers have voiced that they cannot face their constituency given this reality.

The nail in the coffin if I may put it bluntly happened last week with the announcement of the increasing price of milk powder by Rs. 80, petrol prices by Rs. 9 and diesel by Rs. 5. This will create a spiral impact to the prices of household items which will further contract consumption. This in turn will lead to the poverty indicator changing negatively.

This will be further compounded by the changes to the taxation on the monthly incomes of the working class that includes the public sector.

District development – Vavuniya

It is from this background that I analyse the sample district selected – Vavuniya – and the impact on a consumer. Even though the poverty number is at a commanding 2% as per the graph, the mean income is at a low ebb of Rs. 33,063, which means that the monies spent in Vavuniya on the basket of goods for food and non-food items is very different to the high income districts like Colombo and Gampaha where the poverty levels are at 1% and below.

A point to note is that in that part of the country, many get their basic food from their very own garden such as vegetables, milk and eggs, which I guess skews the number reported.

As I was addressing a cross secretion of senior bankers, I spoke to the Minister in charge of Vavuniya with this information and his insight sure made me think. Apparently during war times, Vavuniya played a central role for trade between the north and south. During the 30 years of war, Vavuniya was the hub of action for logistics and warehousing, which explains the low poverty number. Also, most NGO and the UN agencies set up base in Vavuniya and operated daily to the Northern Province, which had its spin offs to the population of Vavuniya.

This took me back to the time that I was heading Economic Affairs of the Government Peace Secretariat. Most of the issues of transport during war times were reported from Vavuniya. The most frequent complaint was unloading and reloading of goods due to security issues on the Government and LTTE sides happened in Vavuniya – Omanthai to be specific.

Normally in war times a bazaar closes for business after noon, but I remember Vavuniya being a hype of activity even at 4 p.m., which justifies the low 2% poverty number. This means the district development strategy to be actioned must be different in Vavuniya as against the plan in the Northern Province.

Vavuniya – Education

There are two pickups on the education front. Those who have never been to school is at a low 2.9%, which is far below the national average and incidentally close to the urban trend. Some say that the quality of education is what needs further research given the low performance on the O/L and A/L fronts, which needs attention and correction. However, given the high education throughput, Vavuniya will be ideal for setting up BPO ventures. Ideally the IT industry can be linked with the finance community to develop this industry that has set a target of $ 5 billion by 2020.

Vavuniya – Vehicle ownership

The ownership of motorcycles being very high at 32.2% may be reflective of the lifestyle in Vavuniya given the type of work and interests in that part of the country. This can give insights to the type of loans and financing facilities that can be extended to the consumer of Vavuniya.

A point to note is that setting up business in the forgotten Industrial Zone of Vavuniya will have to be priority if the policymakers want to move up motorcar ownership, which is at a low ebb of 2%, below the national average of 5.6%.

It’s also important that the movement from agriculture and trading to setting up of industries takes place more strongly if we are increase the income levels from the current 30,000 range that exists today. This again directs the importance of the SME sector of banks operating in Vavuniya. This is the kind of fine-tuning required to the district strategy by a government that is driven by the political hierarchy.

Vavuniya – Ownership of HH items

The ownership of household items is skewed to sewing machines, which is interesting given that the penetration is as high as 84.3% as against the national average of 42.7%. Maybe the introduction of the handloom industry or a related business linked to fashion schools can be done so that overall income can be increased.

This can be linked to the SME integration and preferential financing in my view. However, for this to happen effectively, the overall value chain needs to be developed so that products can be linked stronger to the consumer of Vavuniya.

Cost of the war

I guess the impact of the war can be seen given the high number of widowed/separated, though not specifically segregated. This amplifies the importance of a specific program for this group of vulnerable people. For this banks can look as linking the financing with the NGO community.

It’s strange that in Vavuniya the ‘never married category’ is as high as 7.9%, which is incidentally double that of the national average. This needs to be researched and addressed from a socioeconomic perspective linked to the private sector.

The female-headed households of less than 25 years being way above the national average must also be focused by the private sector linked to the financial community and driven with specific solution-based strategies. The 25% female representation of the urban councils can help build the strategy and drive passionate execution at the ground end.

District – Way forward

1.A similar analysis must be done on all 24 districts so that ground realities can be understood and shared with the private sector.

2.A master plan must be architectured so that a three to five year developmental program can be done just like what we see in Gampaha and Hambantota Districts.

3.The overall developmental agenda must be done with a clear mission.

4.This bottom-up game plan must be linked to the National Budget.

5.GDP growth must be tracked at the district level if possible so that national level planning can be made targeted.

Conclusion

Whilst the country has been focusing on the bond scam and the rest of the governance issues for the last three years, what the country requires is a focused and sharp district development strategy like the above. However, we will have no option but wait for the 4 April result at 9:30 p.m. to see what trajectory Sri Lanka moves to.

[The writer was the Head

of National Portfolio Development for the United Nations (UNOPS) who architectured the development of the Atchchuveli Industrial Zone in Jaffna and went on to be a Board Director of the Industrial Development Board (IDB) and

Sri Lanka Export Development Board (EDB).]