Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 10 August 2020 00:10 - - {{hitsCtrl.values.hits}}

Has CBSL done a study on leadership traits on well-managed financial institutes before bringing the ownership restriction proposal to limelight?

It was proposed to introduce ownership restrictions to the Licensed Finance Companies (LFCs) in the Non-Banking Financial Industry (NBFI) similar to the banking industry of the country. The proposal came into limelight in May last year and since then the consultation paper has been in circulation among the stakeholders. The intention behind the proposal has been to stabilise the industry by mainly decentralising decision making elements towards policy-making of respective LFCs.

The Central Bank of Sri Lanka (CBSL) is of the view since this model has worked in many countries globally, the same would work here effectively. As this was faintly discussed in a recently televised discussion during the lockdown period, it popped up in my mind once again and this article was articulated as a result. It will expose the unseen side of the proposal.

Present scenario

The key indicators are not favourable in the NBFI at present. The credit quality of the NBFI is deteriorating considerably during the last few years. The Non-Performing Advance (NPA) ratio which is one of the main indicators of ascertaining the quality of credit stands at 11.37%** (11.56%** – LFCs) as of March 2020, the end of fiscal year 2019/20 (** Provisional). However, it is not a surprising occurrence as the same has been gradually building over the last four years in the following manner: 2019 – 7.71% (LFCs - 7.8%), 2018 – 5.82% (LFCs - 5.9%), and 2017 – 4.89% (LFCs - 5.2%).

To make matters worse COVID-19 pandemic has impacted the industry further. It is evident the coronavirus outbreak and the subsequent business disruptions have applied additional pressure on asset quality and earnings of Licensed Finance Companies (LFCs) and Specialised Leasing Companies (SLCs), the main players of the NBFI. It is expected NBFI of the country to face multiple challenges, including muted loan growth, the diluted margin in interest rates, and loan-impairment charges in the coming months and also years. This will certainly decline the quality of assets and deteriorate the return of investment for investors.

The concessions offered by CBSL to COVID-19-affected businesses and individual customers will have mixed implications on NBFI. As usual, no level playing field is drafted between the banking industry and the NBFI in these offered concessions. A disparity is being built again between these two industries due to loans granted at 4% by the banking industry under the CBSL introduced re-finance scheme. Also, the loan guarantee scheme recently introduced by the CBSL diverts some of the NBFI clients to banks. The banks may also be willing to lend to these high-risk borrowers as the CBSL underwrites the default risk up to a limit of 50-80%. These anomalies boil down to poor ROE in the NBFI, finally.

The NPA which stood at 7.66% at the end of December 2018 has gradually increased to 7.71% (LFCs - 7.8%) in the last quarter of 2018/19, 9.09% (LFCs - 9.23%) in the first quarter of 2019/20, and 9.69% (LFCs - 9.86%) in the second quarter and reached 10.59% (LFCs - 10.78%) in the third quarter. Finally as stated it ended up at 11.37%** (LFCs - 11.56 %**) at the end of the fiscal year 2019/20. As mentioned, the Gross Non-Performing Advances to Total Advances which is commonly known as NPA is one of the main indicators of measuring the quality of assets in the financial industry.

Impact on ROE

The Return on Equity (ROE) which is the indicator to measure the harvest on the invested money is another sensitive indicator in the financial industry. This indicator is also showing negative signs since 2018. ROE is a very effective metric to evaluate and compare earnings. As a general assessment, most analysts consider an ROE in the range of 15% to 20% to be favourable for purposes of investment. A higher return on equity indicates that a company is effectively using the contribution of investor to generate profits and return the profits to investor at an attractive level.

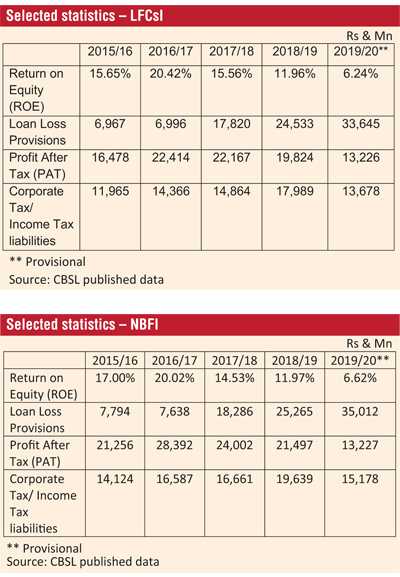

In the NBFI, it has been fluctuating in the following manner in the last five years: 17% (LFCs - 15.65%) – March 2016, 20.02% (LFCs - 20.41%) – March 2017, 14.53% (LFCs - 15.56%) – March 2018, 11.96% (LFCs - 11.96%) – March 2019, and started to decline in the last fiscal year 2019/20 drastically, June 2019 – 3.67% (LFCs - 3.23%), September 2019 – 5.02% (LFCs - 4.57%), December 2019 – 5.56% (LFCs -5.16%), and March 2020 - 6.62%** (LFCs - 6.24%**). Correspondingly, Profit after Tax (PAT) too declined and Loan Loss Provisions have increased significantly.

No one wants to be in an industry that gives negative results or marginal results. The investors will look for getaway plans and start investing in lucrative other industries. If this trend continues, the government should look for alternative plans for the NBFI as the Non-Banking Financial Industry (NBFI) of a country that plays a critical role in the economy.

Though the Sri Lankan NBFI is approximately nine times smaller than the banking industry assets wise, the contribution it makes is priceless towards the economy of the country. It enables the financial intermediation process that facilitates the flow of funds between savers with high returns and borrowers who are not welcome by banks. It customarily enables the intermediation process of elevating non-bankable customers to bankable customers of the country. To stabilise this process the NBFI should be assisted by the regulator and the government with appropriate policies.

Homogeneity of the Sri Lankan NBFI model

I wonder whether the proposed model which CBSL is talking of, restricting ownership limits has been mapped and compared with the homogeneity of the Sri Lankan NBFI model. The master plan of the CBSL is intended to bring down the ownership limits to 25% within a timeframe of five years, by 2032 limits to bring down to 15% and finally by 2037 the same to fix at 5%. This proposal has taken major shareholders of NBFIs by surprise. Some of them are currently planning their exit plans from the industry as they see the future is uncertain in the industry.

The strategic investors who were planning to invest in the NBFI have held back their decisions. As per the published records currently, more than 50% of the shareholding of 30 LFCs is held by the main shareholder. Further in eight LFCs, the main shareholder and related parties hold more than 50% of the shareholding. In two LFCs, ownership is limited to two shareholders. Only three LFCs have diversified ownership. Under the given circumstances, we have to admit the fact that the NBFI which mainly consists of LFCs is driven by a few individuals in the country.

Then the question arises whether they have been contributing anything worthwhile to the industry, to the country and or its people, or have they been just enjoying dividends for their personal glory. Before going further, the writer assumes that they are honest in their dealings with their respective company and have disclosed all their credentials as per the Finance Companies direction No. 3 of 2011 (Assessment of Fitness and Propriety of Directors and Officers Performing Executive Functions).

Research data indicates NBFI has a customer base of seven million in-forms of four million Borrowers and three million Depositors. It has accommodated 32,000 employees. It has had a payable Corporate Tax/Income Tax liability totalling to Rs. 82.19 billion (LFCs – Rs. 57.99 billion) during the last five years apart from the paid VAT, NBT, Stamp Duty, Debt Repayment levy, VAT on financial services, etc. Average Corporate Tax/Income Tax liability stands at Rs. 16.44 billion (LFCs – Rs. 11.6 billion) per year during the last five years.

These indicators show to some degree the contributions made by these individuals through their respective institutes to the country. Further, it is noted that 97% of total assets of NBFI are made of total assets of LFCs. (NBFI – Rs. 1.434 trillion**, LFCs Rs. 1.393 trillion**).

The given table proves, regardless of the declining ROE, the industry has contributed its share towards the development of the country considerably through levies. Also, irrespective of ownership concerns NBFI has directly supported seven million people (half of the active population of 14 million people between ages of 18 to 70) of this country while paying a substantial amount of taxes to the government for the betterment of the country and its people. Apart from the same, as mentioned earlier it gives high returns to savers and accommodates borderline borrowers who are not welcome by banks. This contribution has been made by the NBFI using only average assets of Rs. 1.3 trillion during the period discussed above (March 2016-2020).

Influence on policies by main shareholder – Leadership traits

CBSL is of the view that the Non-Banking Financial Institutes (NBFIs) have issues concerning management, largely due to the main shareholder’s influence towards its policies. However, CBSL has introduced many regulatory measures in the areas of board composition, capital requirement, liquidity measures, corporate governance; operational functions, and business conduct in the recent past to discipline the industry. One would wonder as to why with all these directions around, still CBSL is unable to control the main shareholder.

It appears CBSL doesn’t want to bell the cat. Instead, they are creating the system to confine the movements and territory of the cat as it makes their (CBSL) task easy to control the main shareholder. Is it another situation where the decisions are influenced by powerful politically influenced people? CBSL should have the courage to impose strict action against non- compliance financial institutes and their main shareholders by exercising existing powers entrusted to them (CBSL) without complicating the progress of this 80-year-old industry.

Further, why does CBSL want to impose ownership restrictions based on undue influence made by the main shareholder of fully compliance finance companies? In management, leadership has different faces. Democratic leadership may not be the most effective leadership style all the time. Under critical conditions, autocratic leadership is highly effective if applied appropriately.

Has CBSL done a study on leadership traits on well-managed financial institutes before bringing the ownership restriction proposal to limelight? It is known that some companies are operating with zero compliance issues or with negligible compliance issues. It appears that no due consideration is given to such companies during the decision-making process which the writer feels is unfair.

New strategies Vs. Best practices

Instead of new strategies such as ownership restrictions, CBSL can use their existing practices more effectively. A proper monitoring process of month-end returns is one good mechanism for detecting non-compliance issues of individual companies. Timely action on such issues will align problematic companies on track. Alerting the public on such companies within a reasonable time frame will safeguard the interest of less informed people of the country which is a fundamental obligation of CBSL and a fundamental right of the people of this country.

Lessons learned

Do we have genuine professionals to man NBFIs like the banks in the country without the controlling main shareholder’s presence at the board level? We have seen how companies like The Finance Co (TFC) suffered further setbacks in the hands of incompetent officials who have been entrusted to drive such companies out of trouble. Do we have a mechanism to introduce confidence, highly trained and skilled non-banking financial industry professionals to the industry at board level? We have not seen any happy endings in the stories of re-structured failed finance companies. Once gone, it is gone for sure.

TFC episode from 2008 to 2018 is one such incident. TFC has had a Deposits base of Rs. 30.4 billion as of March 2018. Who is responsible for the present dilemma of TFC? Who managed the company in the last 10 years? As a last precautionary measure, in January 2019, when TFC called for an Expressions of Interest (EOI) program for a minimum equity investment of Rs. 25 billion no investor came forward to bail out the company due to its poor management style and desperate financial footing.

Unlike the banking industry, the NBFI runs on micro-characteristics. The adaptation to the dynamics of the NBFI is questionable when boards are manned by members from other industries. The ability to understand the dynamics of the industry and the speed at which it is being acquired by the new board members are the key factors for the effectiveness of such tryouts. The effectiveness is the key to success. Considering the effectiveness of the business model is important before implementing it in any business.

The model which CBSL tried with TFC has failed. Finally, the CBSL brought in the last contingency option of deposit insurance and liquidity support scheme to safeguard the interest of depositors which said to be covering 93% of the TFC depositors to a maximum of Rs. 600,000 per depositor. The patient dies allowing next of kin to have the benefit of the insurance. The professionalism of the system is highly debatable under such circumstances in any industry. However, that was some concession to the TFC depositors.

Conclusion

CBSL has introduced many directions to safeguard the interest of NBFI, since 2008. These directions have been implemented by CBSL to address the issues faced by the industry from time to time. Most of the directions are highly effective as far as the stability of the industry is concerned. However, directions such as Direction of Loan to Value Ratio for Loans and Advances in Respect of Motor Vehicles – 2015 have pushed the NBFI to a desperate situation.

As there was no level playing field between the NBFI and Banking Financial Industry, banks used their low-cost funds to penetrate the leasing market of NBFI. As a result, NBFI unknowingly pushed into dangerous terrain. One of the main reasons for the present high NPA ratio in the NBFI is the equal application of LTV direction to the banking industry and NBFI. As disclosed before during 2018 and 2019 the investor friendliness of the NBFI has declined.

The Loan Loss Provisions increased from Rs. 25.2 billion (LFCs – Rs. 24.5 billion) in March 2019 to 35 billion (LFCs – 33.6 billion) in March 2020**, which is around a 38.9% (LFCs – 37%) increase. Return on Equity declined by 5.35% (LFCs – 5.72%) between the fiscal years 2018/19 and 2019/20, a decrease of 44.7% (LFCs – 47.8%). Hence, CBSL should give a serious thought to the proposed ownership restrictions strategy as it might have negative consequences on the industry at this juncture.

Finance Companies collectively (Finance House Association – FHA) should voice their concerns over the proposed plan to CBSL to safeguard the interest of the industry and its stakeholders. However, if still, CBSL wants to go ahead with the proposed plan of ownership diversification to restrict the main shareholder’s stake and undue influence, they should first build-up a team of top NBFI professionals through appropriate remedies to defend and manage the importance of NBFI of the country which lasted over 80 years and helped millions of the beginners of the business community and the general public.

(The writer is the founder of Infornets, a non-profit oriented organisation formed to share credit-related information and financial knowledge to less informed people, locally and internationally. He counts 36 years of experience in the non-banking financial industry of Sri Lanka. He is a former CEO/General Manager of a non-bank financial institution and a Commission member of the National Science and Technology Commission (NASTEC). He holds a Master’s Degree in Business Administration from the UK. He is a Fellow of the Institute of Chartered Professional Managers of Sri Lanka and a Member of the Institute of Management of Sri Lanka. He can be reached via [email protected], [email protected] or www.infornets.com.)