Thursday Feb 12, 2026

Thursday Feb 12, 2026

Thursday, 14 October 2021 00:00 - - {{hitsCtrl.values.hits}}

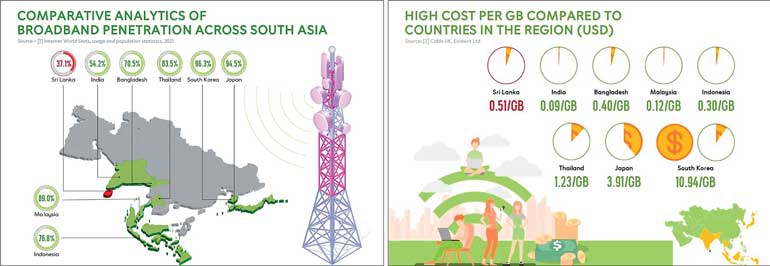

An overview of the comparison for further understanding. It also depicts the possibilities in comparison to developed nations such as Japan, Thailand, Malaysia and South Korea while India, Bangladesh and Indonesia are seen marginally greater in performance

With connectivity now considered a ‘basic human need,’ the recent move by the Telecommunications Regulatory Commission of Sri Lanka (TRCSL) to seek public views on the telecommunications licensing framework in the country is both timely and laudable. In line with the TRCSL’s objectives to promote effective competition as well as efficiency and economisation towards creating a level playing field for telecommunication service providers, this move is expected to ensure equal connectivity to all citizens in the country.

the country is both timely and laudable. In line with the TRCSL’s objectives to promote effective competition as well as efficiency and economisation towards creating a level playing field for telecommunication service providers, this move is expected to ensure equal connectivity to all citizens in the country.

Sri Lanka’s mobile penetration has seen a phenomenal increase in the past 20 years. Mobile telephone subscriptions which stood at 430,202 in the year 2000 have risen to 28,739,277 in 2020. With the COVID-19 pandemic, the country has seen an exponential increase with the number now standing at 29,048,708 as at June 2021.

In spite of this, there continues to be a call to improve the country’s connectivity. With both urban and rural communities continuing to face issues, the question remains as to why Mobile Network Operators (MNO) are unable to stabilise the country’s bandwidth? More importantly, what can we do to address the public’s need for seamless connectivity and bridge this connectivity gap?

Today, Sri Lanka’s broadband penetration stands at approximately 37.1% compared to countries in the region which record 50-96% penetration. The country’s Digital Economy (DE) is approximately 3% of the national economy (GDP) currently lagging behind other Asian and South Asian countries which stand at 20-50% (example: Malaysia 20% and South Korea/Japan 50%). With digital economies growing in Sri Lanka, the country shows so much potential for improvement setting the perfect opportunity for a ‘digital revolution’.

What hinders broadband growth in Sri Lanka?

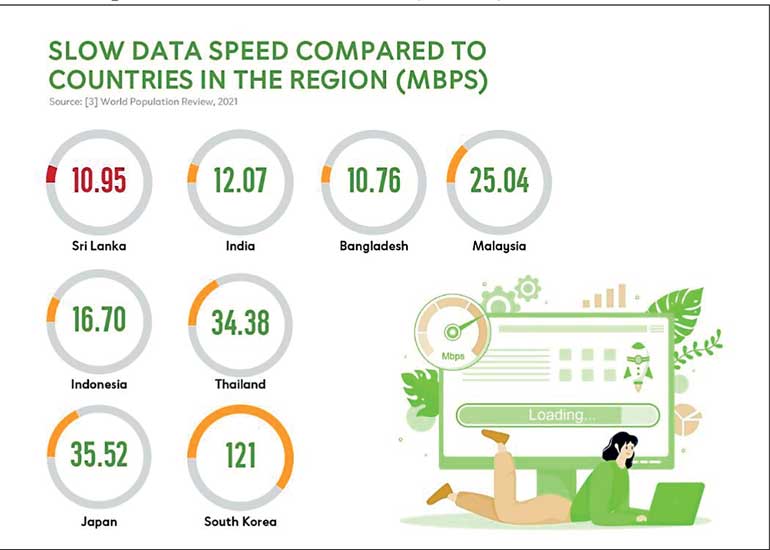

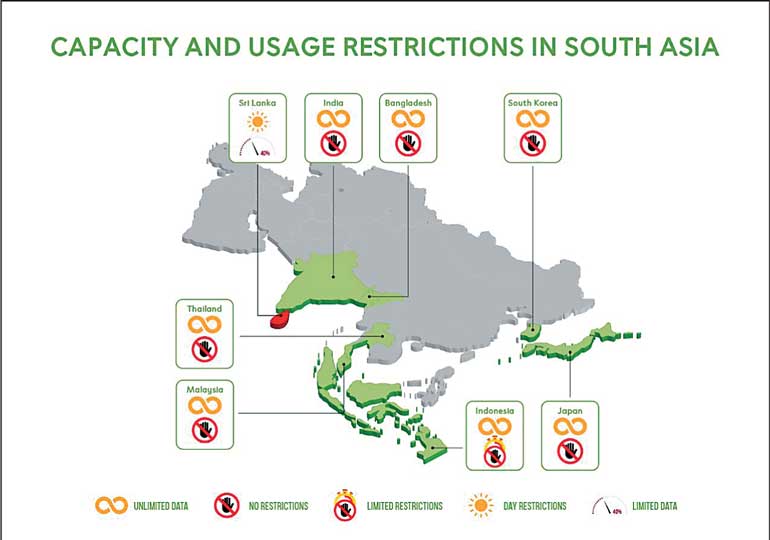

Three issues in the Sri Lankan mobile data network hinder getting broadband penetration from the current 37.1% to the target 80%; the high cost per GB incurred by mobile operators, the slow data speed and the lack of capacity and usage restrictions imposed, such as the non-availability of unlimited data and the cap on daily usage.

The high cost per GB puts pressure on consumer affordability affecting broadband penetration. Currently priced at $ 0.51 (Rs. 100), way above neighbouring countries this cost serves as a bottleneck in increasing broadband penetration, coupled with the fact that, Sri Lanka’s data speed stands at 10.95 Mbps, which is below average and leaves room for development.

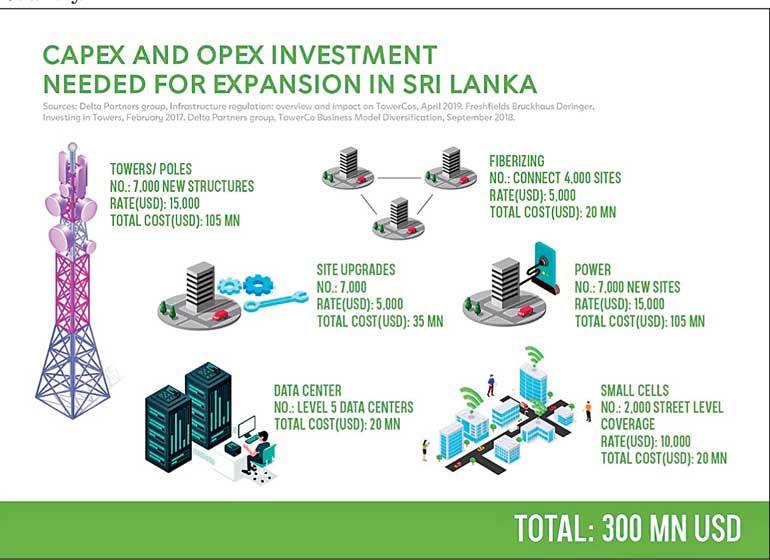

The answer is simple, new infrastructure is required. While MNOs have been investing substantial Capex and Opex in the past, the rapidly falling Average Revenue Per User and multi-fold growth in traffic disincentivises them from increasing investment appetite.

Opex in the past, the rapidly falling Average Revenue Per User and multi-fold growth in traffic disincentivises them from increasing investment appetite.

‘Neutral party host’ – the better telecom model for Sri Lanka

According to the current licensing system, each operator has to invest in infrastructure and the entire spectrum of services.

Neutral party hosting provides the opportunity to broad-base operations and encourages more private sector investment. A model that is not dependent on the operator, where independent parties build and lease specialised network elements to multiple mobile operators it allows for cost to be shared and optimised.

Neutral parties could be in the form of tower companies, data centres, small cells, last mile fibre, edge computing or even energy solutions. It offers a deeper sharing of digital infrastructure ultimately bringing network costs down while simultaneously promoting a level playing field where both tier-1 and tier-2 operators have fair access to network elements.

Neutral Party Hosting could be the answer we have been looking for to connect the unconnected in Sri Lanka as it opens the doors for Investments of new fiberised towers and in last mile fibre, will be able to solve the urban capacity issue with an increase in 4G towers in densely populated areas and allows for operators to share small cells.

In addition to this while Sri Lanka is yet to commence Level 5 Data Centres, the neutral party host model could resolve this issue by giving way to more technically advanced data centres and increase the foreign direct investments brought into the country.

The country’s licensing framework plays a key role in ensuring the right kind of technology allows for narrowing the connectivity gap and unlocking the nation’s digital economy potential. A regulatory framework with the right structures and incentives will enhance the telecommunications industry, create more opportunities for foreign investments into the country and elevate Sri Lanka to a competitive position among its peers in the region.

(The writer is one of the pioneering members of the edotco Group. He speaks and writes frequently in the mobile industry space covering key topics of 5G, network disruption, digital economy, digital transformation and inter-generation opportunities in the 2020 decade across South Asia. Gayan currently serves as Director, edotco Group Strategy & Acting Country Managing Director of edotco Sri Lanka. He spearheaded the formation and growth of the edotco Group since 2013.)