Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 11 January 2024 00:00 - - {{hitsCtrl.values.hits}}

Ringing in the new year for Sri Lankans was an increase in the value-added tax (VAT) rate to 18% and a withdrawal of tax exemptions on several goods and services. The last day of 2023 witnessed long queues as people rushed to stock up on essentials such as fuel and gas. Although queues are a familiar sight following the onset of the economic crisis, this time around, it was to avoid being hit with the VAT hike.

Ringing in the new year for Sri Lankans was an increase in the value-added tax (VAT) rate to 18% and a withdrawal of tax exemptions on several goods and services. The last day of 2023 witnessed long queues as people rushed to stock up on essentials such as fuel and gas. Although queues are a familiar sight following the onset of the economic crisis, this time around, it was to avoid being hit with the VAT hike.

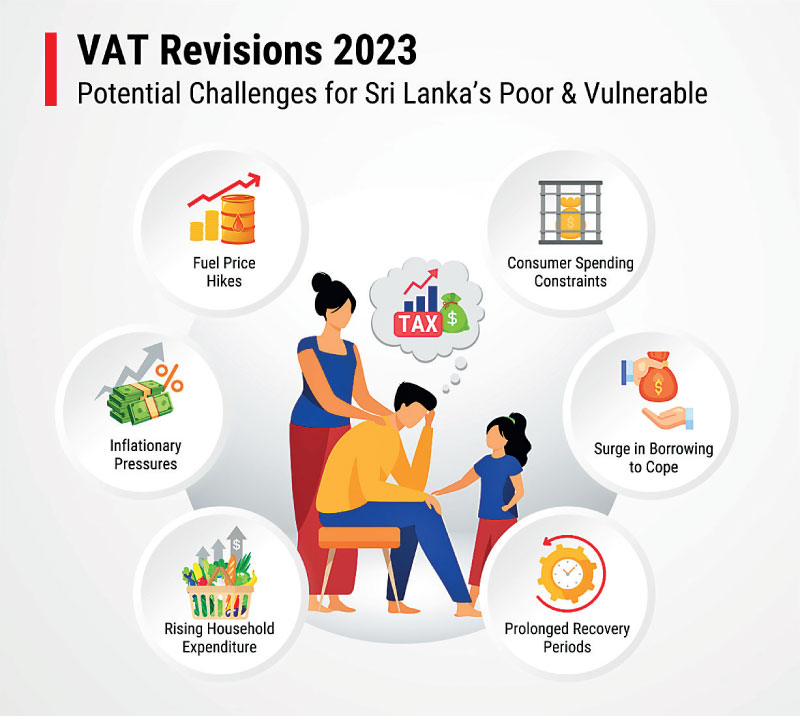

In light of these developments, this blog aims to shed light on VAT, offering a brief overview and delving into the potential implications of the increase, particularly on the poor and vulnerable.

There are both pros and cons to VAT. While VAT offers a means for governments to generate revenue without overcharging the wealthy, its downside lies in imposing a substantial economic burden on lower-income groups, as consumers ultimately bear the tax burden.

Amendments to VAT

In an attempt to raise government revenue, the VAT rate on applicable goods and services increased from 15% to 18% starting 1 January 2024. This amendment brought 97 previously VAT-exempt goods and services including, fuel, gas, telecommunication services, as well as several food products manufactured using locally cultivated grains, locally manufactured coconut milk, and certain dairy products (locally produced), under the tax umbrella. Items that continue to be VAT-exempt include medicines, educational services, public passenger transport services, and food products such as infant milk powder, locally manufactured rice, bread, etc.

Along with the change in tax rates, the VAT threshold for businesses was also reduced to an annual turnover of Rs. 60 million (from Rs. 80 million) and Rs. 15 million per taxable period (from Rs. 20 million). These changes to VAT are expected to generate revenues of around Rs. 1,400 billion in 2024.

Implications for the poor and vulnerable

Implications for the poor and vulnerable

The tax rate increase and the threshold reduction for businesses liable for VAT signals that more items are applicable for VAT at a higher percentage than before. Although this affects all households, it adds an excessive burden on the already struggling poor and vulnerable groups grappling with the concurrent crises from COVID-19 in 2020 to the ongoing economic crisis.

Impact on household expenditure and coping mechanisms

The fuel price hikes, a direct consequence of the new VAT rates, are expected to trigger a domino effect on the prices of various consumer goods and services, potentially leading to inflation. Although inflation has been low since mid-2023 compared to the beginning of the year, the latter part of 2023 (October to December) witnessed a relative increase in inflation. As per the Colombo Consumer Price Index, inflation between September to December 2023 was recorded as 1.3%, 1.5%, 3.4% and 4.0% respectively. The VAT reforms are likely to add to inflationary pressures in 2024. This, in turn, will further reduce the purchasing power of already constrained households.

A survey conducted by the Department of Census and Statistics (DCS) in 2023 on the impacts of the economic crisis revealed that over 60% of households in the country experienced a decrease in income since March 2022. The survey also finds that over 90% of households experienced an increase in their monthly household expenditure due to the economic crisis. The findings further reveal that 99% of households that experienced a rise in expenditure witnessed an increase in food expenditure. The combination of reduced income and rising expenses is poised to constrain consumer spending, particularly affecting goods and services subject to VAT. For example, the survey results reveal that 83% of households whose expenditure increased due to the economic crisis experienced a rise in transport costs. Following the imposition of VAT on petrol and diesel (previously VAT exempt), the price hike in these commodities will further escalate household expenditure on transport. This will compel some households to self-impose restrictions on the use of certain modes of transport or find alternate solutions due to unaffordability concerns.

Financial constraints and indebtedness

Purchasing power constraints force households to adopt various coping strategies to minimise the impacts of these adverse shocks. Around 74% of households that experienced a decline in income did not employ any coping strategies to mitigate the impact while around 7% resorted to a secondary job or additional source of income. Conversely, to cope with the impact of rising expenditure, households employed multiple mechanisms such as limiting/controlling expenses (75%), dietary changes (75%) and reducing/withdrawing savings (46.4%), etc. It is interesting to note that most households chose to adopt coping mechanisms only with respect to mitigating the impact on expenditure although a majority experienced income loss as well.

In the absence of savings – particularly among the poor and vulnerable due to the consecutive adverse shocks –households are likely to borrow to cover their essential expenses. As per survey findings, 55% of households in the country are currently indebted with 22% of such households in debt to meet daily food requirements. Interestingly, 22% of households have accumulated outstanding debt due to the economic crisis while the majority (78%) have not. However, it is concerning that over half of Sri Lankan households are presently indebted, and a considerable share face financial constraints to satisfy essential needs. The VAT reforms are likely to impact these households further through amplified indebtedness due to increased borrowings from both official and unofficial channels. This limits the possibility of timely recovery from shocks as concerns such as repayment challenges will arise in the future. Hence, in addition to struggling at present, the poor and vulnerable are also at risk of facing more prolonged periods of struggle even as the country’s economic crisis subsides.

Coping with the tax burden

It is important to support the poor to cope with the VAT hike at least through targeted initiatives that cater to the most vulnerable groups. Using existing social protection programmes to identify the most vulnerable households and providing them with some form of concessions such as reduced prices on certain VAT-liable goods and services that are frequently used by these groups is one such option.

Targeted transfers are another option. While cash transfers are already provided to eligible poor and vulnerable groups in the country it is important to assess if the amounts received by these groups are sufficient to cope with the ongoing crisis and the burden of indirect taxes. Another option worth considering is to provide needy households with dry rations/nutritious food commodities since low-income households spend a large portion of their total expenditure on food and this share may increase further due to the VAT reforms. Further, although it was mentioned that essential items such as fruits and vegetables will not be taxed, these items too are likely to go up in prices due to the indirect nature of the tax.

Although it is too early to assess the true impacts of the VAT amendments on the poor and vulnerable’s ability to survive, they are certainly at elevated risk of facing unaffordability which in turn triggers countless other obstacles. While the degree of the abovementioned risks can vary by household, they can only be measured upon the availability of sufficient consumption data over the upcoming months. Proactive measures, such as timely support in the form of targeted initiatives and concessions, can not only alleviate the immediate challenges but also contribute to the resilience and recovery of the most vulnerable segments of the population.

(The writer is a Research Officer at the IPS with research interests in poverty, social welfare, development, education, and health. She holds an MSc in Economics with a concentration in Development Economics and a BA in Economics with concentrations in International, Financial and Law and Economics from Southern Illinois University Carbondale (SIUC), US. She can be reached at [email protected].)