Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 11 July 2024 00:05 - - {{hitsCtrl.values.hits}}

|

There are two certain things with regard to nature in the world. They are Death and Tax. Taxes are the most important source of revenue of the modern Government. It plays a vital role in fulfilling peoples’ aspirations and their rights. Taxation is not a new concept in the modern world. It is as old as the first attempt of mankind to organise a civilised society.

There are two certain things with regard to nature in the world. They are Death and Tax. Taxes are the most important source of revenue of the modern Government. It plays a vital role in fulfilling peoples’ aspirations and their rights. Taxation is not a new concept in the modern world. It is as old as the first attempt of mankind to organise a civilised society.

The most famous books on Finance in our history is ‘Kautilya Arthashastra, The Wealth of Nation’ by Adam Smith giving classic examples of the world financial system in the ancient era. The taxation comes from the Latin word “taxo” which means censure, charge, compute, rate, appropriate, estimate, etc. According to the Oxford Dictionary, tax is a compulsory contribution to State revenue levied by the Government. Therefore, whether we like it or not we have to pay it to the Government.

Today, the citizens of every country believe that they will be provided goods and services, law and order, healthcare facilities, education, infrastructure, facilities, etc., which will be maintained by the Government. They also think that these are the main components of Government in governing any country whether developed or not. In order to fulfil these things, any Government needs revenue. Revenue comes as a tax, non-tax, charges, levy, loan, etc. Therefore, taxation helps in many ways in making people happiest with wealth in a country. If we use peoples’ revenue for the people in a better way with accountability and transparency, it is the utmost goal of the taxation. If they allocate this revenue in a proper way, with accountability and transparency, the country will become a better place.

Tax system in ancient Sri Lanka

Tax system in ancient Sri Lanka

Historical records, inscriptions and ancient literature provide us with advanced information regarding an organised tax system prevailing from the time Before Christ (BC) up to the introduction of the modern tax system in the country. The Galapatha Vihara inscription of Dambadeniya Era, Gadaladeniya inscription, Saman Devala Sannasa are some of them which show the ancient tax system in Ceylon. Not only inscriptions, but also valuable books written during that period clearly mentioned how they collected taxes at that time. “Buduguna Alankaraya” which was composed during the Kotte Era reminded people of the manner of collecting taxes without harassing the citizens. The following verse gives evidence for how the tax system is convenient for taxpayers: “Ron Aragena Semin, Yana Bigun Lesin kusumin, lowata Duk Nodemin, Ganithi Aya Panduru Pera Niyamin”.

The Kavyashekaraya, Rajawaliya, Pujawaliya and many other historical books have shown the real pictures of tax administration and how kings developed the country by utilising taxes collected from the people on behalf of the citizens and others. During the period of King Nissankamalla of Polonnaruwa, orders were given to cancel some taxes which had been imposed in an arbitrary way. The king also had a clear view on some assessing system of taxes and introduced some fair tax system to the country.

Imposing Coconut Tax which came into operation in September 1896 was purely based on expanding tea industries at that time. Road Tax Act, No. 08 of 1848 was formulated for getting labour from the persons who were aged between 18 and 35 at that time. Land Tax was imposed to get crop from what they harvested. Inheritance Tax, Water Tax, Cinnamon Tax, Balu Badda, Enga Badda, Isthoppu Badda and Payodara Badda are some of them that were imposed during the colonial period.

There was also a tax called ‘Joee Tax’ introduced in 1802. The firearm tax was another tax which was introduced by the British as a protective strategy in order to protect wild animals and set free cultivations from elephants. 2 shillings and 3 pence were to be paid annually as firearm tax. The then British governors had to abolish the firearm tax which was one of the major reasons behind the 1848 rebellion due to a strong protest of the public. This tax was abolished on the recommendations of a commission which consisted of an officer called Beili who enquired reasons for this rebellion.

In the analysis of the tax pattern in the world history, income tax was first introduced in 1799 as a remedy to get rid of the threats of the French Emperor Napoleon in 1804, to uplift the British economy which subjected to degradation in the last decade of 1700 and to gain profits to the Government from the rich who lived during that period and it was gradually spread to other countries as well. Later, British emperors considered increasing their revenue immediately in accordance with the existing expenditure pattern in order to expedite their process of colonialism and to get rid of the other countries which are involved in invasions.

A fair and transparent tax system

The International Monetary Fund (IMF) announced that its Executive Board approved a $ 3 billion financing for Sri Lanka for the next four years while approving an extended fund facility. The IMF also stressed the increasing tax revenue in next decades. Therefore collecting more revenue and strengthening tax administration is the utmost objective of our country. In order to achieve high resources, the tax administration needs public confidence in their duties. The public also needs a fair, equitable, transparent and accountable tax system that aims at implementing good tax principles.

As per the Rajawaliya during the reigns of King Vijayabahu (III) and King Parakramabahu (II) there had been a fair and equal tax system, both kings ordered to levy taxes without distressing peoples’ rights.

The collapse of the 1st world economy during 1914-1920 caused the spread of British imperialism and the British had the necessity of a definite tax system. When Sri Lanka was under ruling of the British during 1815-1848, the Income Tax Department of Sri Lanka was established. During the period of the First World War, there was a multi tax system in Sri Lanka. Trade License Fee, Export Tax were prevailing during that period and Income Tax, Excise Tax and Stamp Duty were also effective as minor taxes during that period. Britain made arrangements to levy Income Tax in 1915.

As a result of the effort of founding an incorporated body by the United Kingdom with the view of establishing a formal income tax system in all the colonised countries, WOOD Taxation Commission was appointed on 8 March 1928. After the appointment of that commission, J.K. Huxum was appointed as the Tax Consultant for examining taxation in Sri Lanka. Based on the concurrence of the content of the studies, interviews and special meetings he conducted a report was presented. The report he presented to the Constitutional Council on 24 November 1931 was adopted as per an Act dated 2 January 1932 and the Income Tax Department was established on 2 April 1932 and H.J. Huxum assumed duties as the First Commissioner.

First, the Income Tax Department was established at the Echlin Barack Lane with the composition of 24 staff officers and 77 clerks. The Income Tax Department established in 1932, changed name as Inland Revenue Department. Today, as per the hierarchy and approved cadre IRD consists of Commissioner General, 9 Deputy Commissioner Generals, 22 Senior Commissioners, 90 Commissioners and 925 Senior Deputy Commissioners, Deputy commissioners and Assistant Commissioners and 1450 officers of the other services.

Some tax policy changes during the past periods

Aims of introducing tax policy should be based on increasing revenue and protecting revenue while keeping the stability of an economy in any country. After gaining independence in 1948, an independent new tax namely profit Tax Act, No. 5 of 1948 introduced in 1949. Act, No. 44 of 1949 covering Industrial and Agricultural Reliefs was also introduced in the same year. The historical landmark of our tax system was marked in 1955. The Tax Commission appointed in 1955 recommended some important tax changes. As a result of their recommendations, the Act, No. 3 of 1956 was introduced. Another landmark event of our Department came into power in 1958. An eminent Economics Professor Nicolus Caldor visited Sri Lanka and he recommended three important tax changes into our system. They were Wealth Tax, Expenditure Tax and Gift Tax. With the occurrence of above changes, the Department changed its name to Department of Inland Revenue.

In 1961, the Department introduced another important Taxes Act, No. 65 of 1961 of the Inland Revenue Act. They were surcharge on Income Tax, National Development Tax, Rice subsidy Tax, A Sur Tax on registration of Business and Sales Tax. In 1963, after legislation of Finance Act No II of 1963 the Business Turnover Tax was introduced.

The next important landmark in the history of taxation was the appointment of the Taxation Commission in 1966 in 1971. Compulsory savings levy was imposed. The Pay As You Earn scheme now called Advance Personal Income Tax came into operation in 1971. The next step is to introduce the self-assessment scheme in 1972 which is still the foundation of our tax system in collecting high revenue every year.

During and after 1978, Inland Revenue Act, No. 28 of 1979, The Estate Duty Act, No. 13 of 1980 and the Turnover Tax Act, No. 69 of 1981 were formulated. In 1982 Stamp Duty Act, No. 43 of 1982 was also enacted.

The year of 1985 was a year of abolishing some taxes that had been contributed for many periods. The estate duty (abolishing) Act, No. 53 of 1985 and the Gift Tax abolishing Act, No. 56 of 1985 of the major amendments done in that period.

For the first time in history, a tax which has no cascading effect called Good and Services Tax was introduced by formulating Act, No. 10 of 1996 later in 2002 this tax was renamed as Value Added Tax in 2004.

The Economic Service charge was introduced under the Finance Act, No. 04 of 2006 in 2006.

Inland Revenue Act, No. 10 of 2006 was enacted in 2006. A tax called Nation Building Tax was introduced in 2009. After that many changes occurred are in process to date. The Inland Revenue Act, No. 24 of 2017 enacted aiming at high revenue and compliance. Later a tax called Capital Gain Tax which was imposed prior to April in 2002 was reintroduced. Under the provision of the Inland Revenue Act, No. 24 of 2017 and tax called Social Security Contribution Levy was also imposed aiming at widening tax bases.

Challenge of today for a better tomorrow

It is accepted that until the Government Revenue improves from the present 10% of GDP to a sustainable level of 15 at least, we have to face a series of challenges reinforcing the revenue based fiscal consolidation supported by revenue.

Administration reforms are critical to recover our economy. Challenge of widening tax base for direct taxes and need for self-assessment and voluntary compliance, to improve our economy. I believe that this could be achieved if the regulation and policymakers were able to follow a sustainable policy on a consistent basis.

Every year the Inland Revenue Department organises an awareness program for taxpayers and tax professionals and these programs mainly focus on delivering knowledge about change of tax law and return filing compliance.

Today one of our targets for the country is to offer TIN certificates for those who have completed 18 years old. The aim of this system is to collect more information and widening tax base for the success of our country.

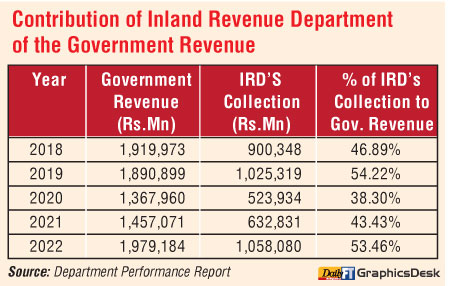

The given comparative figures show the performance in increasing revenue for the past period.

Contribution of Inland Revenue Department of the Government Revenue

Contribution of Inland Revenue Department of the Government Revenue

The Inland Revenue Department has achieved significant challenges in collecting its revenue target in 2023. As of December 2023, the IRD cumulatively collected 103% of the revenue amounting 1,550 billion out of estimated revenue target 1,492 billion.

In 2024, the Government has set a target of achieving Rs. 4.2 trillion in Government revenue.

The Department is assigned to collect 2.1 trillion for the Government purpose. The Inland Revenue Department has made significant and long lasting contributions to the country for 92 years in the developing Sri Lankan economy.

While achieving the sufficient revenue for Government activities, we are committed to enhance the tax base and narrow tax gaps that are major problems faced. Today, in order to achieve Government aspiration with a positive approach, all officers in Inland Revenue are engaging in their activities with firm determination for a better tomorrow. As a main revenue collector of the Government, we have understood our responsibility, obligation for society. The Department is not only filling the Government coffer but also providing valuable services to the taxpayers and others for their day-to-day work.

(The writer, an Attorney-at-Law, is Senior Commissioner, Inland Revenue Department and the article is written to mark the 92nd anniversary of the Inland Revenue Department in 2024.)