Saturday Apr 05, 2025

Saturday Apr 05, 2025

Friday, 14 July 2023 01:22 - - {{hitsCtrl.values.hits}}

President speaking at the ICCSL and Daily FT webinar invited foreign investors to favourably consider Sri Lanka based on what the country has achieved to restore stability via resolute actions in a year from its worst crises

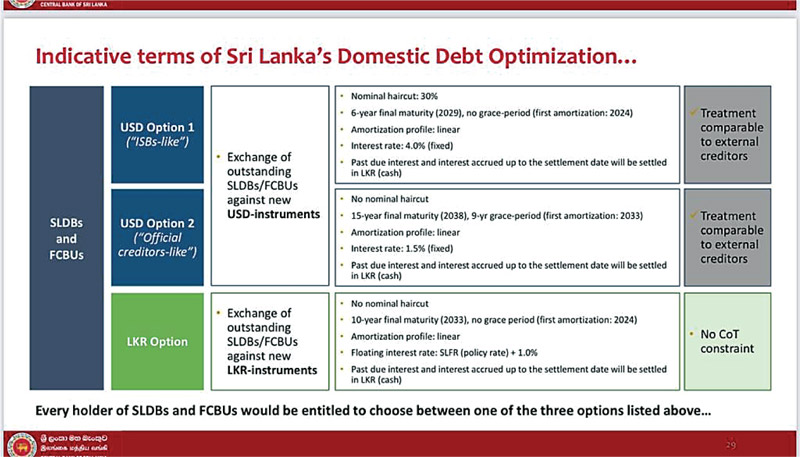

Committee on Public Finance (COPF) Chairman and SJB MP Harsha de Silva raised concerns about the recent DDR, especially the burden falling on superannuation funds- EPF and ETF and also without the consent of members. Whilst some of those concerns are valid some need greater understanding and scrutiny by financial analysts. As a former Chairman of the ETF I will deal with these concerns in a later article. Meanwhile many are grateful the banks were not hit too hard from the DDR -due to existing stress, non-performing loans, extended moratoriums and haircuts on ISBs.

Committee on Public Finance (COPF) Chairman and SJB MP Harsha de Silva raised concerns about the recent DDR, especially the burden falling on superannuation funds- EPF and ETF and also without the consent of members. Whilst some of those concerns are valid some need greater understanding and scrutiny by financial analysts. As a former Chairman of the ETF I will deal with these concerns in a later article. Meanwhile many are grateful the banks were not hit too hard from the DDR -due to existing stress, non-performing loans, extended moratoriums and haircuts on ISBs.

The banks must now bring down interest rates, the central bank must intervene if they don’t. 25% of the SMEs are now in intensive care expecting medication from the President. The FIs can’t be allowed to earn super profits, whilst the SMEs die. On the other hand, given that the EPF/ETF, which carries most of the burden, faces potential opportunity loss, whilst certain others (bonds and bills traders) make a killing at the expense of the tax payers. This is certainly not palatable.

This certainly raises questions about equity and transparency. But what is more important now since the DDR is done, is managing the twin deficits and oversight of future borrowings by government agencies. The terminal illnesses we had; low reserves and ratings slipping over time, distancing the low interest lenders and attracting junk investors with under-the-table sweeteners. Junk ratings, grey list, hot money inflows into equity and bond markets far outstripping FDIs. The signs were always there to those who wanted to see, but ignored, for obvious reasons.

Governance

Some lenders also turned a Nelsonian eye and merrily carried on, hoping they could exit before the music stopped. Now some of them are lamenting about the haircut on the ISBs. The severe conditions and characteristics of predatory lending is generally high interest, hidden lobbying costs, sweeteners to borrowers, opaque approval structures sans parliamentary oversight, low feasibility projects. Even some of the local Financial Institutions and lenders jumped on the bandwagon when the opening was being exploited by foreign institutions. Luckily for them the DDR spared the banks, if not there’ll be hell to pay.

Way forward for Sri Lanka

What can Sri Lanka do to mitigate these effects from now on? And how can we avoid this abuse in the future? Transparent and structured borrowing approvals with parliamentary oversight is the answer. No single person or group or clan can borrow on behalf of GOSL, or commit the nation to years of heavy/unaffordable debt service. An Independent Debt office outside the Treasury and Central Bank with credible and competent professionals who understand the financial markets and who have the well-being of the country must be appointed. Future borrowing of all classes must have the majority agreement. Above all we need to educate our parliamentarians and send better educated people to parliament. When Sri Lanka gained independence in 1948, it was a prosperous country which the British left behind. We did not have forex reserves issues nor did we seek the support of the IMF for emergency financing and we had a good civil service (best in South Asia). Our leaders and super bureaucrats politicised every aspect of the country’s governance, and as a result we did not create a system to hold our bureaucrats and politicians accountable or a meritocracy. Today we need a vehicle to attract the best human capital for decision making, and there must be a process to hold politicians and super bureaucrats accountable for their actions and corrupt decisions even after their tenures.

References

https://economynext.com/sri-lanka-president-says-reduced-interest-rates-development-assistance-to-follow-ddr-124841/

https://www.dailymirror.lk/top_story/DDR-Minimum-impact-on-EPF-ETF-despite-opposition-crying-foul/155-262407

https://youtu.be/rIH0SKLjPw0

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.